AI ETF Review: Exploring Legitimate Artificial Intelligence ETFs for 2025 Investments

In this AI ETF review, Scams Radar examines options for investors seeking exposure to artificial intelligence. From AI-powered ETFs to machine learning funds, we cover performance, risks, and top choices. We also highlight pitfalls, including questionable projects like AiETF Token, to help you make informed decisions.

Table of Contents

Part 1: Understanding Artificial Intelligence ETFs

Artificial intelligence ETFs offer a way to invest in AI technology funds without picking individual stocks. These AI funds are investing in companies behind AI innovation, cloud computing, and robots. For example, the Global X Artificial Intelligence & Technology ETF (AIQ) bets on AI-related stocks that include semiconductors and software.

AI sector ETFs provide diversification, reducing risks tied to single companies. Unlike traditional ETFs, AI growth ETFs emphasize high-potential areas like generative AI and algorithmic trading. Investors often compare AI ETFs vs traditional ETFs for better long-term growth.

1.1 Top AI ETFs for 2025: Performance and Holdings

Looking at the best AI ETFs to invest in 2025, several stand out for low expense ratios and strong returns. The iShares Future AI & Tech ETF (ARTY) offers investors cost-efficient exposure to artificial intelligence innovation with a low expense ratio of just 0.47%. Its top holdings include Nvidia and Microsoft, highlighting a strong focus on AI software and technology leaders driving the future of intelligent computing.

Another option is the Global X Robotics & Artificial Intelligence ETF (BOTZ), with a 0.68% expense ratio. It includes companies like Intuitive Surgical for robotics exposure. For high dividend yield AI ETFs, consider the Roundhill Generative AI & Technology ETF (CHAT), yielding around 0.5% with emphasis on AI cloud computing ETFs.

AI ETFs’ performance analysis shows solid gains in 2025. BOTZ returned over 30% year-to-date, driven by semiconductor exposure. AI ETFs’ top holdings 2025 often include Nvidia, AMD, and Taiwan Semiconductor, providing ethical investing options in AI.

ETF Name | Expense Ratio | 1-Year Return (2025) | Top Holdings |

Global X AIQ | 0.68% | 28% | Nvidia, Amazon, Microsoft |

iShares ARTY | 0.47% | 30% | Broadcom, Oracle, Salesforce |

Vanguard VGT | 0.10% | 35% | Apple, Nvidia, Microsoft |

Roundhill CHAT | 0.75% | 25% | Meta, Alphabet, Adobe |

This table highlights low-expense-ratio AI ETFs with potential for AI ETFs for long-term growth.

Part 2: Risk Factors in AI ETFs

AI ETFs risk factors include market volatility from tech sector swings. High exposure to semiconductors can lead to losses during chip shortages. Diversification in AI ETFs helps, but global AI ETFs vs US-focused AI ETFs face currency risks.

Active vs passive AI ETFs differ in management. Passive funds like AIQ track indexes with lower costs, while active AI stock-picking ETFs aim for outperformance but charge more. AI ETFs’ liquidity and trading volume are strong on US exchanges, aiding retail investors.

AI ETFs and the impact of generative AI boost returns, but overvaluation is a concern. AI ETFs with a machine learning focus may underperform if AI hype fades.

Part 3: Compensation Plans and Ownership in Questionable AI Projects

Some projects claim to be AI portfolio funds but lack transparency. For example, AiETF Token promotes multi-stage sales with bonuses up to 75% in early phases, dropping to 50% in the main ICO. Referral rewards offer 5,000 tokens for direct sign-ups and 2,500 for second-level, plus purchase matches.

Staking yields range from 7.45% for six months to 23.75% for advanced plans, paid in stablecoins and tokens. A branded card requires verification, but no bank partner is named. Tokenomics show a 200 billion supply cap on Solana and Ethereum.

Ownership remains hidden, with domain privacy services masking details. The listed address in Louisiana appears unverified, and no team profiles or backgrounds exist. This opacity contrasts with legitimate AI passive ETFs like VGT, where Vanguard discloses full operations.

3.1 Why High Returns in Some Schemes Are Unsustainable

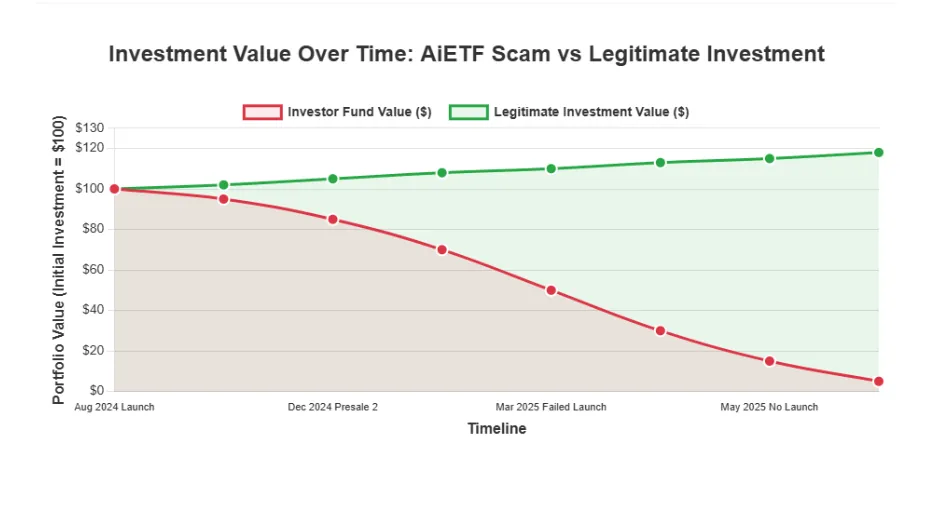

Promised yields in dubious projects often exceed realistic benchmarks. Using compound interest, a $10,000 stake at 23.75% APY grows to about $12,651 in one year. Yet, sustaining this requires constant new funds, resembling unstable models.

Compare to real investments:

- Bank savings: 4.5% APY, FDIC-backed.

- Real estate: 8% average ROI.

- S&P 500 ETFs: 10% historical.

- Legit crypto staking: 5-15%.

AI ETFs for retail investors average 5-15% returns, far below unsustainable promises. AI ETFs vs traditional ETFs show balanced risks.

Part 4: Public Views and Security Concerns

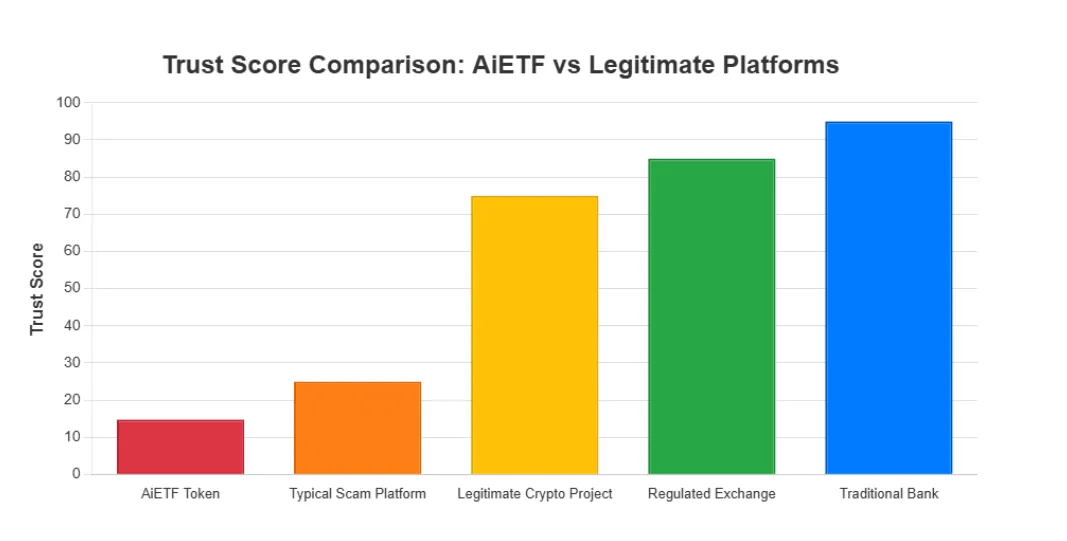

Community feedback on suspect platforms is negative, with reports of delays and access issues. Tools like ScamAdviser give low scores, citing hidden owners and high bonuses as warnings.

Security claims include AI monitoring, but no audits or contract addresses are public. Payment uses wallets, but withdrawal complaints persist. Support via email often goes unanswered.

In contrast, AI technology ETFs like BOTZ have verified audits and clear holdings.

4.1 Social Promotion Patterns

Promoters on platforms like X post repetitive hype, such as free tokens or quick cashouts. Accounts like @jorsell share identical messages with low engagement, suggesting automation. Past activity shows no other projects, indicating focused shilling.

No major influencers back these, unlike established AI market ETFs.

Recommendations for Safe AI Investing

Focus on AI ETFs with high dividend yield or ethical focus. Diversify across AI ETFs investing in robotics and social sentiment analysis. Check AI ETFs’ exposure to cloud computing for growth.

Avoid unverified schemes. Verify listings, audits, and teams.

Conclusion: Choose Verified AI Investment Funds

This AI ETF review emphasizes caution with unproven tokens while highlighting reliable choices, such as AI stock ETFs, for 2025. With proper research, AI-driven investments can enhance portfolios. Always prioritize transparency for sustainable gains in the AI sector.

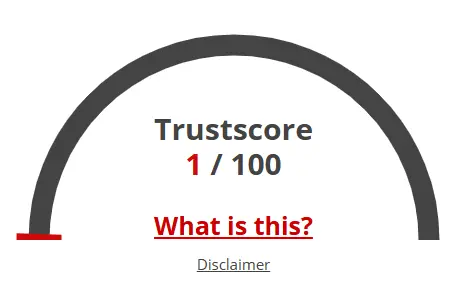

AI ETF Token Review Trust Score

A website’s trust score is an important indicator of its reliability. AI ETF Token currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with AI ETF Token or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- DNSFilter considers this website safe

Negative Highlights

- Several spammers and scammers use the same registrar

- We detected cryptocurrency services which can be high risk

- We found several negative reviews about this site

Frequently Asked Questions About AI ETF Token Review

This section answers key questions about AI ETF Token, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

An AI ETF invests in companies developing artificial intelligence technologies, giving investors diversified exposure to the AI sector.

Leading AI ETFs include Global X AIQ, iShares ARTY, and BOTZ, all featuring holdings in Nvidia, Microsoft, and Amazon.

AI ETFs face market volatility, tech overvaluation, and chip supply issues, though diversification can help reduce risk.

Legit AI ETFs are regulated and transparent, unlike AiETF Token, which hides ownership and makes unrealistic ROI claims.

Like the AI ETF Review, the Everstead Review emphasizes transparency, enabling investors to identify genuine opportunities and avoid scams.

Other Infromation:

Website: aietftoken.com

Reviews:

There are no reviews yet. Be the first one to write one.