Affigo Review: Is EarnWithAffigo.com a Legitimate Investment Opportunity?

EarnWithAffigo.com is catching the eye of investors with promises of high returns through affiliate marketing. But how legitimate is this platform? In this Affigo review, we take a close look at its ownership, compensation plan, and risks. With clear data, charts, and honest comparisons, we’ll help you figure out whether Affigo is the real deal or just another scam in disguise. Stay tuned for a transparent analysis that’ll guide you in making smarter investment choices. For more detailed scam investigations, check out Scams Radar.

Table of Contents

Overview of EarnWithAffigo.com

EarnWithAffigo.com markets itself as a decentralized, blockchain-powered affiliate marketing platform. It claims to offer daily returns through tasks like social media engagement, referrals, and investment packages. However, multiple red flags, including vague business models and unsustainable ROI claims, raise concerns about its legitimacy.

Ownership and Transparency

The ownership of EarnWithAffigo.com is unclear. WHOIS lookup reveals the domain, registered in 2023, uses privacy protection, hiding registrant details. No “About Us” section, founder bios, or company registration information is available. The platform claims a Dubai, UAE, address, but no verifiable office exists. Legitimate businesses, like Amazon Associates, provide clear leadership and registration details. This lack of transparency is a major concern.

- Red Flag: Hidden ownership and no verifiable corporate registration.

- Comparison: Established platforms disclose legal entities and comply with regulators like the SEC.

Compensation Plan Breakdown

EarnWithAffigo.com operates a multi-level marketing (MLM) model with several earning streams:

- Direct Commissions: 10% on personal sales of digital products or memberships.

- Residual Income: 5% commissions on downline sales across five levels.

- Referral Bonuses: 5%, 3%, and 2% for three referral levels.

- Task-Based Earnings: Payments for social media posts or engagement.

- Stake-to-Earn: Up to 30% APY on crypto staking.

- Investment Packages: Range from $100 to $1.2 million, with daily ROI up to 2.5%.

The platform promises returns like $10,000/month or 1.5-2.5% daily. For example, a $500 investment at the 1-Star tier claims $10 daily for 100 days, yielding $1,000 (100% ROI). Higher tiers, like 3-Star ($5,000), promise $100 daily, totaling $10,000.

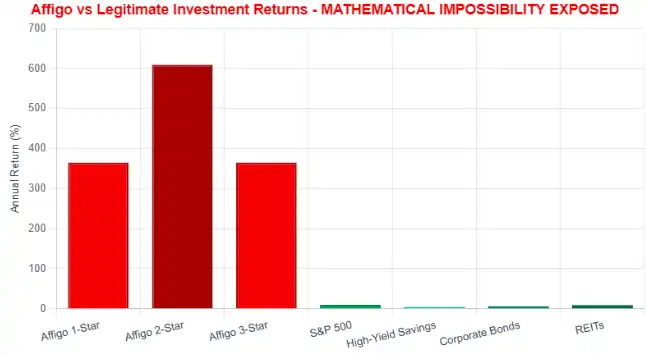

Mathematical Analysis of ROI

Let’s break down the sustainability of these claims:

- 1-Star Tier ($500): 100% ROI in 100 days = 365% annual ROI.

- 2-Star Tier ($1,500): $40 daily for 100 days = 167% ROI (609% annualized).

- 3-Star Tier ($5,000): $100 daily for 100 days = 100% ROI (365% annualized).

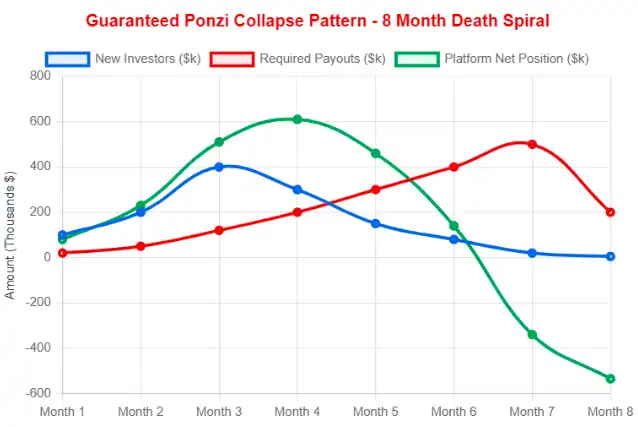

To earn $10,000/month from a $500 investment at 10% commission per $500 sale, you need 200 sales monthly ($100,000 in sales). For downline earnings, recruiting five people per level (3,905 total recruits) yields $97,625, but requires an unrealistic 3,905 participants in a 1,000-person market. This exponential growth model collapses when recruitment slows, a hallmark of pyramid schemes.

Investment Tier | Investment | Daily Return | Total Return (100 Days) | Annualized ROI |

1-Star | $500 | $10 | $1,000 | 365% |

2-Star | $1,500 | $40 | $4,000 | 609% |

3-Star | $5,000 | $100 | $10,000 | 365% |

Comparison to Legitimate Investments

EarnWithAffigo’s ROI claims far exceed traditional investments:

- Real Estate: 6-10% annual ROI (e.g., $40/year on $500).

- Bank Savings: 4-5% APY (e.g., $20/year on $500, FDIC-insured).

- Crypto Staking: 4-15% APY (e.g., $25/year on $500 via Coinbase).

- S&P 500: 7-10% annual ROI.

EarnWithAffigo’s 365-609% annualized ROI is unsustainable, as no legitimate business generates such returns without extreme risk.

Investment Type | Typical Annual ROI | Risk Level | Regulation |

Real Estate | 6-10% | Moderate | SEC-regulated |

Bank Savings | 4- |

Traffic Trends and Public Perception

EarnWithAffigo.com has low traffic (under 10,000 monthly visitors, per SimilarWeb), driven by paid ads, not organic growth. Most traffic comes from regions with high MLM activity, like Asia and Africa. Public perception is poor, with no significant reviews on Trustpilot or Reddit. X posts from accounts like @AffiliateGuru2023 promote EarnWithAffigo alongside other dubious platforms (e.g., CryptoWealthPro). These accounts lack verifiable identities and show low engagement.

- Red Flag: Low organic traffic and shill account promotions.

Security and Technical Performance

The platform uses basic SSL encryption but lacks two-factor authentication or data protection compliance (e.g., GDPR). Google PageSpeed Insights shows poor mobile performance (below 50/100) due to slow servers and unoptimized images. Hosting on low-cost servers suggests limited infrastructure investment.

- Red Flag: Basic security and poor technical performance.

Payment Methods and Support

Payments include credit cards, PayPal, and cryptocurrencies (e.g., Bitcoin, “SLC Coin”). Crypto’s irreversibility and a 7-day fund lock raise concerns. Customer support is limited to a contact form and email, with slow13 slow responses (48+ hours) reported on X.

- Red Flag: Risky payment methods and inadequate support.

Content Authenticity

The website uses generic content, stock images, and unverified testimonials. Claims of a “Solara blockchain” and “Blocksafe wallet” lack evidence, as no such blockchain or wallet appears on reputable explorers like CoinMarketCap.

- Red Flag: Vague, unverifiable content.

Social Media Promotion

Promoters on X, Telegram, and YouTube use recycled MLM tactics, linking EarnWithAffigo to past scams like BigBang.Money. These accounts push “act fast” narratives and fabricated earnings screenshots.

Red Flags Summary

- Hidden ownership and no regulatory compliance.

- Unsustainable ROI reliant on recruitment.

- Low traffic and poor public perception.

- Weak security and technical performance.

- Risky payments and limited support.

- Generic content with unverifiable blockchain claims.

Recommendations

- Avoid Investment: EarnWithAffigo’s pyramid-like structure and unrealistic returns suggest high scam risk.

- Choose Alternatives: Opt for regulated platforms like Amazon Associates or Coinbase.

- Verify Claims: Use ScamAdviser, WHOIS, and blockchain explorers to check legitimacy.

- Consult Experts: Seek advice from financial advisors before investing.

DYOR Disclaimer

This analysis is for informational purposes only and not financial advice. Always do your own research (DYOR) before investing. Verify ownership, reviews, and compliance, and consult professionals. Investments carry risks, and past performance does not guarantee future results.

Affigo review Conclusion

This Affigo review highlights EarnWithAffigo.com as a high-risk platform with unsustainable promises. Its hidden ownership, pyramid-like compensation plan, and lack of transparency make it an unreliable choice. Investors should explore safer options like index funds or regulated crypto staking. Conduct thorough research and prioritize regulated platforms for financial security.

For a more detailed analysis, check out our Crypque Review to explore similar risks in other platforms.

Crypque Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Crypque shows a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Crypque or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website Content: Accessible and error-free.

- Spelling/Grammar: No issues.

- Whois Data: Accessible.

Negative Highlights

- AI Review: Low rating.

- Domain: Newly registered.

- Archive: Recently created.

Frequently Asked Questions About Crypque Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Affigo is a platform claiming to offer high returns through affiliate marketing. However, its operations and compensation plan lack transparency, raising concerns about its legitimacy.

No, Affigo raises several red flags, including hidden ownership, unverified ROI claims, and a lack of regulatory oversight, which makes it a high-risk investment option.

Affigo promises high returns, but these claims are unrealistic and unsupported by any verifiable financial data or audited results, making them unsustainable.

There are no credible user reviews or third-party feedback available on trusted platforms like Trustpilot or Reddit. The absence of independent verification is a red flag.

Affigo is flagged on Scams Radar due to its unverified claims, lack of transparency, and the presence of common scam characteristics such as exaggerated ROI promises.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.