AB Group of Companies Review: A Close Look at Operations and Concerns

In this AB Group of Companies review, Scams Radar examines the platform behind abgoc.com. Many people search for details on its services, returns, and legitimacy. This guide draws from multiple sources to offer a clear picture. We cover ownership, compensation plans, risks, and comparisons. Our goal is to help readers make informed choices.

Table of Contents

Part 1: What Is AB Group of Companies?

AB Group of Companies runs abgoc.com. It calls itself a smart investment platform. Users can put in money starting at $100 up to $100,000. The site says it focuses on real estate, forex trading, and e-commerce. It promises daily earnings for life at 0.14% per day. This adds up to 4% to 6% per month.

The platform stresses easy entry. It targets areas like Pakistan with local payment options. But it lacks clear details on how it works. No team names or office addresses appear on the site. This raises questions about accountability.

1.1 Ownership and Background Details

Ownership stays hidden. Domain checks show abgoc.com started in August 2025. The owner uses privacy protection. No company registration shows up in searches. Regulators like SECP in Pakistan, FCA in the UK, or SEC in the US have no records.

Profiles of leaders are missing. No LinkedIn links or bios exist. This differs from trusted firms that share team info. Without this, users can’t check backgrounds. Past checks on similar sites often link to repeat scheme operators.

Part 2: Compensation Plan Breakdown

The plan has two main parts: investment returns and referrals.

Investment Returns

- Daily rate: 0.14%

- Monthly range: 4% to 6%

- Claim: Earn for life with anytime withdrawals

- Minimum withdrawal: $50

Users invest once and get daily credits. But no proof of trading or projects backing this.

Referral Structure

It’s a 3-level system:

- Level 1: 5% on direct referrals

- Level 2: 3% on their referrals

- Level 3: 1% on the next level

Total commissions per new deposit: 9%. This pushes users to recruit. It shifts focus from real business to growth through networks.

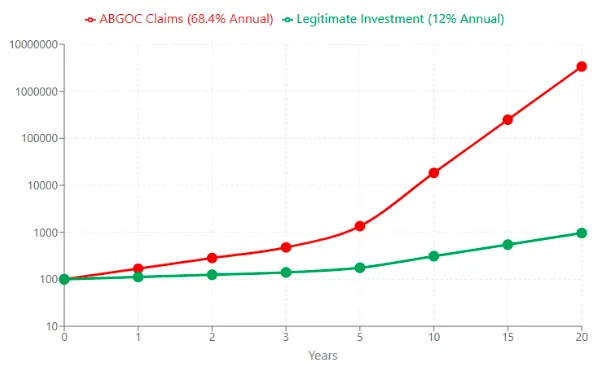

2.1 Why Returns Are Unsustainable: Math Explained

High yields sound great. But numbers show issues. Let’s use simple calculations.

Daily rate is 0.0014. Annual return: (1 + 0.0014)^365 – 1 = 66.64%.

For 4% monthly: (1 + 0.04)^12 – 1 = 60.10% yearly.

For 6% monthly: (1 + 0.06)^12 – 1 = 101.22% yearly.

A $100 investment at 0.14% daily:

- Year 1: $166.64

- Year 5: $1,284.83

- Year 10: $16,507.94

To pay for this for 1,000 users, the platform needs huge inflows. Add 9% referrals and costs. Real profits can’t cover it without new money. This matches Ponzi setups.

Here’s a table of growth:

Year | Amount from $100 |

1 | $166.64 |

5 | $1,284.83 |

10 | $16,507.94 |

No fund beats markets like this forever. Fees and risks eat gains.

2.1 Referral Commissions

Level | Payout % |

1st | 15% |

2nd | 5% |

3rd | 3% |

4th | 2% |

5th-10th | 1%-0.5% |

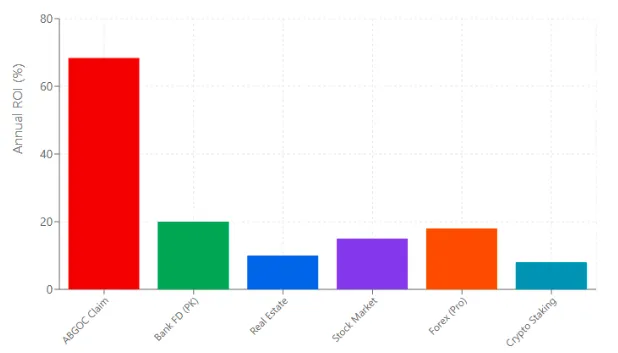

2.3 Comparisons to Real Investments

See how AB Group stacks up.

Real Estate ROI

Average: 4-10% yearly. It comes from rents and the rise. But it’s slow and needs upkeep.

Bank ROI

Savings: 0.5-5% yearly. In Pakistan, up to 10.5% for some accounts. Safe with insurance.

Crypto Exchange APY

Staking: 2-10% yearly. Like ETH at 2.87% or AVAX at 8.94%. Varies with market.

AB Group’s 60-101% dwarfs these. Legit options have no guarantees.

Type | Annual Return | Risk | Notes |

AB Group Claimed | 60-101% | High | No proof |

Real Estate | 4-10% | Medium | Tangible assets |

Bank Savings | 0.5-10.5% | Low | Insured |

Crypto Staking | 2-10% | High | Market swings |

Part 3: Traffic Trends and Public View

Traffic is low. Estimates under 1,000 visits per month. No big spikes.

Perception: Skeptical. Forums call it HYIP. No Trustpilot page. Reddit has warnings. Russia’s central bank flagged it for pyramid signs.

3.1 Red Flags List

- Hidden owners and no registration

- Unreal returns with no proof

- Referral focus is like a pyramid

- New domain, hidden WHOIS

- No audits or trading logs

- Crypto payments for easy exits

- Regulator warnings

Ponzi checklist: All signs present.

3.2 Promoter Profiles on Social Media

Promotion is low-key. X shows a few posts. One from @RichardHowm_ in June 2025 links to ABGOC with referrals. No big influencers. Past: Promoters often push similar HYIPs like Omega Pro or IBS Forex.

Other handles: Sparse. Telegram groups exist, but are unrelated. Grassroots via WhatsApp.

DYOR Tool Reports

- Scamadviser: Low trust. Flags new domain, hidden owner.

- WikiFX: No licenses.

- Bank of Russia: Pyramid warning (Sep 2025).

- Trustpilot: No page, scattered complaints.

- WHOIS: Created Aug 2025, expires 2026.

Search “abgoc.com scam” for updates.

Future Outlook and Risks

Patterns suggest a short life. Launch, growth via referrals, then delays. Exit likely in 6-18 months. Losses could hit $100K+.

Risks: Total fund loss. Legal issues in Pakistan under SECP rules.

Recommendations

Stay away. If invested, withdraw fast. Report to FIA or SECP.

Choose regulated options. Banks offer safe 6-10% yearly. REITs for real estate. Staking on Binance for crypto. Now Visit Capital Spring Review.

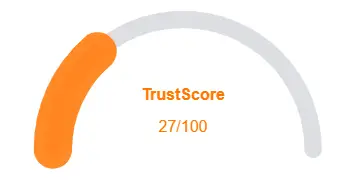

AB Group of Companies Review Trust Score

A website’s trust score is an important indicator of its reliability. AB Group of Companies currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with AB Group of Companies or similar platforms.

Positive Highlights

- Content accessible

- No grammar or spelling errors

- Old archive age

Negative Highlights

- Low AI review rate

- New domain

- Hidden WHOIS data

- Not in Tranco top 1M

Frequently Asked Questions About AB Group of Companies Review

This section answers key questions about Aarman, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No, AB Group of Companies lacks transparency, ownership details, and regulation, making it a high-risk investment option.

It promises 0.14% daily (4%–6% monthly), which equals 60%–100% yearly—unsustainable figures.

It pays 5% on direct recruits, 3% on second-level, and 1% on third-level referrals, encouraging recruitment over real business.

Both show hidden owners, fake ROI claims, and pyramid-style recruitment, signaling strong scam potential.

Withdrawals are uncertain, as reports indicate delays and reliance on new deposits instead of genuine profits.

Other Infromation:

Website: ABGOC.COM

Reviews:

There are no reviews yet. Be the first one to write one.