AI Pip Masters Review: Legitimacy Check for 2025

This AI Pip Masters review: Scams Radar examines the platform’s claims as an AI forex trading bot. Launched early last year, it promises automated forex trading via MT5 integration. Yet, questions arise about its setup. We look at ownership, compensation details, risks, and more. Is AI Pip Masters legit or a scam? Read on for facts.

Table of Contents

Part 1: What Is AI Pip Masters?

AI Pip Masters offers an AI trading platform for forex. It uses bots compatible with MetaTrader 5 EA. Users connect wallets to join. The site highlights AI algorithms for copy trading and auto trading. Deposit levels set user ranks. But transparency is lacking. No team bios show up. Public info stays vague.

The forex robot claims to cut risks and boost gains. Promoter posts tout daily returns. Yet, no backtests or results prove this. For beginners, the guide to the AI Pip Masters platform seems simple. Install a wallet, link it, and deposit USDT. But safety checks matter.

1.1 Ownership and Transparency Concerns

Who runs AI Pip Masters? The site hides details. No company name, address, or leaders listed. Domain data shows creation in January 2025. Privacy tools mask owners. This raises flags for a forex investment platform.

Promoters step in as faces. Fitri Hamdan on Threads shares links. Mohd Rafi Othman posts on Facebook. Their backgrounds? No clear ties to finance. Past posts link to other offers like Starlight TV or Maxximaxx. No crimes found, but patterns suggest short-term hustles. An anonymous setup means no accountability. Investors can’t trace funds if issues hit.

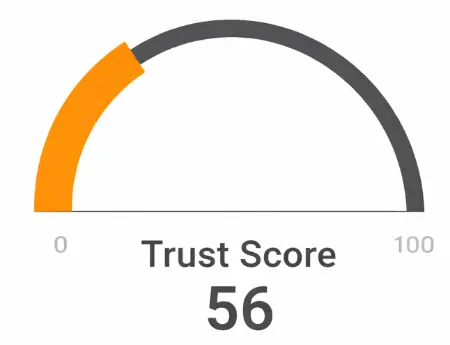

Risk tools agree. ScamAdviser gives low trust due to the youth. Scam Detector scores 30/100. Gridinsoft notes tech safety but urges checks. For AI forex trading scams, hidden owners top red flags.

Part 2: Complete Compensation Plan Breakdown

AI Pip Masters uses a tiered system. Packages range from $10 to over $10,000. These “Star” levels tie to deposits:

- 1 Star: $10–$499

- 2 Star: $500–$999

- 3 Star: $1,000–$2,999

- 4 Star: $3,000–$5,999

- 5 Star: $6,000–$9,999

- 6 Star: $10,000+

Higher deposits unlock ranks. Referral program adds layers. Level 1 pays 8%. Level 2 gives 4%. Deeper levels drop. Total commissions hit 41%. Rank bonuses stack on: Bronze at 5%, Silver 6%, up to Elite 10%.

Compression shifts inactive spots. This hybrid unilevel-matrix pushes recruitment. Daily ROI claims vary: 0.11% to 0.22%, or 0.8% in posts. Free USDT10 hooks new users. Affiliate program drives growth, not trades.

2.1 ROI Claims: Why They're Unsustainable

Promised returns sound great. But math proves otherwise. Take $1 million deposits. 41% commissions take $410,000. Add 5% bonuses: $50,000 more. Left: $540,000.

For 0.11% daily ROI, pay $1,100 daily. Needs 0.204% return on $540,000. Annual: 74%. For 0.22%, $2,200 daily needs 0.407%. Annual: 149%.

0.8% daily? That’s 1,730% yearly. Forex pros average 10-30%. No bot sustains this without new funds. It’s a Ponzi scheme warning.

Part 3: Public Perception and Support

Views mix. Some praise the easy setup. Others warn of scams. Honest user reviews scarce. Telegram shares alerts, but unproven. Instagram and X push bonuses. Support via social or WhatsApp. No email or phone. Responsiveness varies.

aipipmasters.com’s trust score stays low. Traffic trends show spikes then drops.

Key Red Flags and Risks

Watch these signs:

- No KYC; wallet-only join.

- Unverified performance; no audits.

- Low traffic; young site.

- Crypto deposits: USDT on Polygon.

- Promoter focuses on lifestyle, not strategy.

AI Pip Masters withdrawal problems may emerge. Risk management? Claims exist, but no stop loss details. Compared to the safest AI forex trading bots, it lacks proof.

Investment Type | Typical ROI | Risk Level | Regulation |

AI Pip Masters | 97-289% | High | None |

Real Estate | 8-12% | Medium | Varies |

Bank | 4-5% | Low | Yes |

Crypto Staking | 5-10% | Medium | Some |

Future Outlook

Short-term: Growth via referrals. Long-term: Likely fail in 12-24 months. Payouts may be delayed. Regulations tighten on AI bots. Pyramid risks peak.

Final Thoughts on AI Pip Masters Review

AI Pip Masters tempts with easy gains. But anonymous owners, wild ROIs, and MLM focus spell trouble. Compare to real options. Demand proofs. For 2025, steer clear unless verified. Do your own research. Consult experts. Investments carry risks. Stay informed to protect funds.

AI Pip Masters Review Trust Score

A website’s trust score is an important indicator of its reliability. AI Pip Masters currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the AI Pip Masters or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About AI Pip Masters Review

This section answers key questions about AI Pip Masters, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

The platform claims advanced AI and MT5 automation, but no verified trading data or independent audits are publicly available.

The company provides no registered owners, executives, or business address, making accountability nearly impossible.

The advertised returns are far above industry norms and mathematically unsustainable without continuous new deposits.

So far, withdrawals rely on platform-controlled rules, with no long-term proof of consistent payouts.

Most earnings appear tied to referrals and commissions rather than verified trading performance.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.