Axiom Trade Review: Is This DeFi Platform Legit in 2025?

In this Axiom Trade review, Scams Radar explores whether the platform stands as a solid choice for traders. Launched in 2024, Axiom Trade offers tools for Solana memecoin trading and Hyperliquid perpetuals. Backed by Y Combinator, it draws attention. Yet questions linger about safety and sustainability. We break down key details for clear insight.

Table of Contents

Part 1: What is Axiom Trade?

Axiom Trade serves as a non-custodial DeFi platform. It focuses on high-speed trading. Users trade memecoins on Solana and perpetuals with up to 50x leverage via Hyperliquid. The setup includes wallet tracking and sniping tools. No funds stay with the platform. You control your keys through Turnkey tech. This reduces risks seen in centralized spots like FTX.

The business started in San Francisco. It joined Y Combinator’s Winter 2025 batch. Daily volume hits over $400M in peaks. Revenue comes from fees between 0.75% and 0.95%. Axiom Trade Solana integration shines for quick executions. It also ties in MarginFi for staking up to 15% APY on idle funds.

Part 2: Owners' Profiles and Backgrounds

Henry Zhang leads as CEO. He graduated from UC San Diego in Computer Science. Before Axiom, he built AI tools at TikTok. He sold a prior startup. No red marks in his record. Public checks show a clean history, no MLM or fraud ties.

Preston Ellis handles tech as CTO. He studied Electrical Engineering at UC Berkeley. He interned at DoorDash. At 22, during launch, he brings fresh skills. Again, no issues found in background scans. Both founders keep active on X, sharing updates.

Advisor Jordan Fish adds weight. Known in crypto, he guides on marketing. The team avoids heavy influencer spending. This setup boosts trust. Y Combinator backs them well. No links to scams like the FCA-flagged AxiomTrade variants.

Part 3: Complete Compensation Plan Explained

Axiom Trade uses a referral setup. It shares fees to draw users. Here’s the breakdown:

- Tier 1 (Direct Referrals): 30% of fees from those you bring in.

- Tier 2: 3% from their referrals.

- Tier 3: 2% from the next level.

Total referrals hit 35%. Add cashback up to 43% based on volume. Ranks from Wood to Champion unlock better rates. The points system rewards trades and quests. Many speculate on a future airdrop.

This totals 78% of fees back to users. It drives growth but raises concerns. Legit exchanges cap at 50%. High shares may rely on VC funds. Wash trading bots farm points, inflating stats.

3.1 ROI Claims and Comparisons

Axiom touts 15% APY staking via MarginFi. No guarantees, but activity-based. Math shows strain. For $1B daily volume at 0.8% fee: $8M revenue. 78% payouts leave $1.76M. Yield on $500M idle costs $205K daily. Gaps grow without subsidies.

Axiom beats banks but risks volatility. Vs. Pump.fun or Raydium, it’s competitive yet unsubsidized long-term.

Part 4: Security Measures and Technical Performance

Non-custodial design keeps funds safe. Turnkey uses biometrics. MEV guards against attacks. No public audits yet, but partners like Hyperliquid are checked.

Tech shines with one-block orders. Deep liquidity aids trades. Issues include load during pumps. Axiom Trade wallet tracker helps with sniping. No KYC appeals to privacy seekers.

4.1 Traffic Trends and Growth

Data from Semrush shows a strong rise. Organic traffic grew 55.8% monthly in October 2025. Global rank sits at 4,594. Most visits come directly at 79%. Referrals flow from Pump.fun and Google. U.S. crypto fans lead the audience. Spikes tie to memecoin trends.

This matches $100M+ revenue claims in months. Yet bots may boost numbers. Axiom Trade’s low fees help high volume. Compared to Raydium, it grabs share fast.

4.2 Public Perception and User Experiences

Views mix but tilt positive. On Reddit’s r/solana, users praise speed and MEV protection. Coin Bureau calls it legit due to the backing. Trustpilot scores 2.4/5 from 15 reviews. Praise note, quick support, and interface. Complaints hit glitches like stop-loss fails.

Axiom Trade Twitter sentiment leans upbeat. Influencers push it, but warn of risks. User experiences highlight fast execution. Some report unauthorized moves, likely from errors or clones.

Red Flags and Potential Risks

High payouts spur wash trading. Name mix-ups with scam clones like axiomtradeapp.com confuse. No regulation heightens issues. Young domain flags on tools. Axiom Trade scam clones fake sites warn users. Technical issues like glitches add caution.

DYOR Tools and Reports

Scamadviser gives 0/100, citing a hidden owner. Gridinsoft flags malicious, but SSL passes. VirusTotal clean. Check Etherscan for wallets. CoinGecko for sentiment.

Social Media Promotion Analysis

Promoters on X include @big_duca, @Redlion35. They share codes. Past pushes: memecoins, Bybit. @ArtCryptoz touts cashback. Many link to risky spots like Pump. fun.

Future Predictions

Bull case: Token launch boosts to $1B value. Bear: Regs cut volume 50%. Watch subsidies end.

Conclusion and Recommendations

This Axiom Trade review shows a legit tool with risks. Strengths in innovation. Weak in sustainability. Use for active trades. Start small. Research alone. Diversify. Not financial advice. DYOR always.

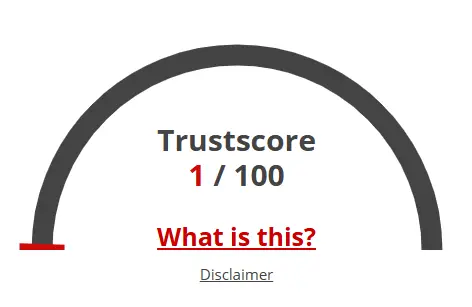

Axiom Trade Review Trust Score

A website’s trust score is an important indicator of its reliability. Axiom Trade currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Axiom Trade or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About Axiom Trade Review

This section answers key questions about Axiom Trade, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

A non-custodial DeFi platform for memecoin and perpetual trading with sniping tools and 50x leverage.

Yes, backed by Y Combinator, but unregulated. Use caution.

Axiom aggregates liquidity, while Pump.fun and Raydium focus on memecoin launches.

Wash trading, unregulated status, and potential technical glitches during high volumes.

Offers 15% APY via MarginFi, but less stable than platforms like Everstead.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.