De Spend Review: Uncovering the Truth Behind This Web3 Platform

In this De Spend Review, Scams Radar examines despend.com, a site claiming to blend e-commerce with crypto rewards. Launched in late 2025, it promises high returns through DSG tokens and referrals. But key issues like opaque ownership and unsustainable models raise concerns. Let’s dive into details on leaders, compensation, and risks.

Table of Contents

Part 1: Understanding De Spend's Ownership and Leadership

De Spend’s leadership lacks clear details. The main name linked to it is Ray V. Lalli. Searches show no prior business records or online profiles for him. No LinkedIn page exists. No corporate filings appear. Variations of his name connect to unrelated people in the UK or Canada, with no crypto ties.

This setup fits patterns in risky ventures. Founders often use pseudonyms to avoid accountability. Press releases from November 2025 name Lalli as the contact, but they seem paid and lack depth. No team bios or addresses show on the site. This opacity signals red flags for investors seeking trust.

Experts note that such “ghost profiles” are common in schemes. Without doxxed leaders, tracking issues becomes hard. De Spend claims U.S. ties, but hints like Chinese text in materials suggest offshore ops, perhaps by anonymous syndicates. This raises questions of legitimacy.

Part 2: Breaking Down the De Spend Compensation Plan

De Spend’s model centers on a “spend-to-invest” system. Users buy packages or shop to earn DSG tokens. It mixes referrals with passive yields from a global dividend pool.

Key parts include:

- Referral Commissions: Earn 40% on direct recruits’ spends. This drives recruitment.

- Unilevel Structure: Unlimited width, with rebates down levels. No binary balancing.

- Roles and Escalation: Start as a Consumer for rebates. Advance to Investor for holdings, Promoter for recruiting, Governor for voting, and bigger shares.

- Consumption Mining: Shop to “mine” tokens, tied to RWA tokenization.

- Global Dividend Pool: Shares merchant profits, but sources seem unclear.

This looks like an MLM pyramid with crypto twists. The 40% payout creates deficits. For a $1,000 input, $400 goes out instantly, leaving $600. To return the principal, it needs 66.7% instant ROI. That’s rare in legit setups.

Real revenue? It relies on new funds, not sales. No merchant listings or demos exist. This matches Ponzi mechanics, where deposits recycle to pay earlier users.

De Spend MLM aspects incentivize endless growth. Assume each recruits three: Level 1 has 3, Level 10 has 59,049, and Level 21 exceeds the world population at over 10 billion. Collapse follows when growth stops.

Payout delays and blocks appear in warnings. Users report issues withdrawing. The model risks failure without real e-commerce.

2.1 Comparing De Spend ROI to Real Investments

De Spend promises high yields, but math doesn’t add up. Implied ROIs exceed norms.

See this table:

Investment Type | Annual ROI | Risk Level |

Bank Savings | 0.5-5% | Low |

Real Estate | 8-12% | Moderate |

Crypto Staking | 5-20% | High |

De Spend Claims | >66% Instant | Extreme |

Part 3: De Spend DSG Token: Analysis and Risks

The DSG token powers De Spend. On BNB Chain, contract 0x3A09…03fc71. Supply: about 334,580 tokens. Price hit $29-$30 in late 2025, up from $4.

But 87% sits in one wallet. This centralizes control, enabling dumps. Liquidity is low, around $1,000 in pools. Volume spikes suggest wash trading.

Utility? Speculative. No real backing or sales drive value. It’s BEP-20, but no audits show. Claims of Web3 e-commerce fall short with no products.

Compared to real platforms: Legit ones have diverse holders, audits, and revenue. De Spend’s setup screams rug pull risk.

3.1 De Spend vs Real Cross-Border Crypto Platforms

Legit ones like established DeFi sites offer audited yields from fees. De Spend recycles deposits in a Ponzi style. Risks of Web3 buzzword investment are high here.

For recovering funds from despend.com investment fraud: Report to authorities fast. But chances are slim due to anonymity.

Public Perception and Red Flags

Searches show sparse chatter. No Trustpilot reviews. X posts are promo-heavy, from accounts like @DeSpend_. Sentiment flags “De Spend scam” and “De Spend Ponzi”.

Warnings include:

- De Spend fake FinCEN: Claims are meaningless without verification.

- De Spend Chinese scam: Text hints at origins, despite U.S. claims.

- De Spend withdrawals: Delays reported.

- De Spend no products: Productless model risks collapse.

- De Spend offshore scam infrastructure signs.

Vs. real cross-border crypto platforms: Those have sales, audits, and diverse teams.

Conclusion: Proceed with Caution in De Spend Review

This De Spend Review reveals a platform with promising ideas but deep flaws. Opaque owners, impossible compensation, and token risks make it high-stakes. For safety, seek audited alternatives with real revenue. Always DYOR before investing. This could help avoid losses in volatile Web3 spaces.

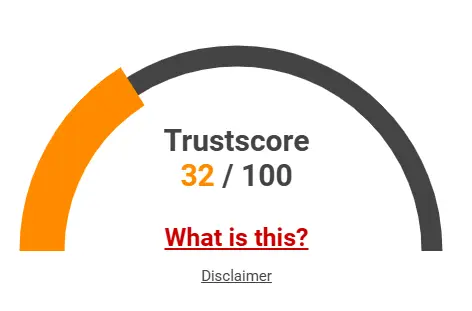

De Spend Review Trust Score

A website’s trust score is an important indicator of its reliability. De Spend currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the De Spend or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About De Spend Review

This section answers key questions about De Spend, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

De Spend is a Web3 platform offering crypto rewards through e-commerce spending and referrals.

De Spend raises red flags with opaque ownership and unsustainable returns, resembling a Ponzi scheme.

High risks include unclear leadership, speculative tokens, and dependency on new funds for payouts.

De Spend’s plan focuses on recruitment, with a unilevel structure and referral-based payouts.

Unlike Everstead, De Spend lacks transparency, real revenue, and products, making it riskier.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.