SaxAi Review: Is This AI Mining Platform Legitimate or a Scam?

In this SaxAi review, Scams Radar examines the platform closely. Launched in 2025, SaxAi claims to offer easy crypto earnings through AI mining. But questions arise about its validity. Many see it as a SaxAi scam. We look at ownership, compensation, and risks. This helps readers decide wisely.

Table of Contents

Part 1: Ownership and Background: Hidden Details Raise Concerns

SaxAi positions itself as a U.S. blockchain firm. It lists a Colorado LLC and a FinCEN certificate. Yet these hold little weight. FinCEN does not regulate finances. Shell companies form easily with false information.

No real owners show up. Domains like saxai. Cloud hides behind privacy services. Registered on April 21, 2025, they obscure true control. Site code includes Chinese text. This points to Southeast Asian fraud groups, such as those in Myanmar and Cambodia host such operations. U.S. sanctions hit these networks in 2024-2025.

Executives appear fake. The site borrows bios from Crypto.com staff. Kris Marszalek, Crypto.com’s CEO, gets listed wrongly as a co-founder. Photos match exactly. This SaxAi fake executives tactic builds false trust. No LinkedIn or filings confirm the team. Anonymity helps evade laws. It fits over 100 similar schemes since 2021.

Ogodo Saxton claims the CEO role in some profiles. But details stay thin. No history or ties verify him. Founders remain unknown. This lack screams caution in any SaxAi review.

Part 2: Compensation Plan Breakdown: How It Draws People In

SaxAi uses a mix of mining returns and referrals. Joining costs nothing. But earnings need a deposit. Minimum starts at 30 USDT. Users pick levels for higher yields.

Investment (USDT) | Daily ROI (%) | Monthly ROI (%) | Example Earnings on Min. |

30-300 | 1.0-1.2 | 30-36 | $0.30-$0.36 daily |

200-1,500 | 1.5-1.8 | 45-54 | $3.00-$3.60 daily |

800-3,500 | 2.0-2.3 | 60-69 | $16.00-$18.40 daily |

2,000-8,000 | 2.5-2.6 | 75-78 | $50.00-$52.00 daily |

10,000+ | Up to 6.0 | Up to 200 | Varies |

Users click daily to claim SXX tokens. Convert to USDT later. But no real mining happens. Funds are recycled from new joins.

Referrals form a unilevel setup. Unlimited width, three levels deep.

- Level 1: 20% of the recruit’s deposit

- Level 2: 5%

- Level 3: 3%

Bonuses add appeal:

- Deposit: +10-25 USDT

- Invites: +7-50 USDT for 1-5 recruits

- Upgrades: +20-600 USDT

- Reactivation: +6 USDT

- Team goals: +20 USDT

This SaxAi referral bonuses system pushes recruitment. No products sell. It acts like a pyramid. Commissions take 28% off deposits. Only 72% funds the pot. This drains resources fast.

Compared to MLMs:

- Unilevel: Wide growth, but needs constant recruits.

- Binary: Two legs, balances teams.

- Matrix: Fixed spots, slower pace.

SaxAi’s plan relies on endless inflows. It fits Ponzi utility flaws.

2.1 ROI Claims: Why They Can't Last

Promised 60-200% monthly defies logic. No external income exists. Returns come from deposits.

Math shows the issue. Assume 60% ROI, 30 USDT average, 100 starters.

Payouts need to grow by 60% monthly. Add commissions, and it hits 80%.

Simulation table:

Month | Total Users | Total In (USDT) | Total Out (USDT) |

1 | 160 | 4,800 | 1,800 |

2 | 256 | 7,680 | 4,680 |

3 | 410 | 12,288 | 9,288 |

12 | 28,147 | 844,425 | 841,425 |

Growth explodes. By year two, millions needed. Impossible.

See the curve:

Grok can make mistakes. Always check sources.

This graph highlights exponential demand. Real investments differ.

- Real estate: 7-10% yearly, asset-backed.

- Banks: 1-5% yearly, insured.

- Crypto APY: 5-20% yearly, from fees.

SaxAi’s rates scream SaxAi Ponzi.

Red Flags and Security Issues

Many warnings exist. Anonymous owners top the list. Fake partnerships like SaxAi x Binance lack proof.

Security stays vague. No audits or KYC. USDT payments hide tracks. Withdrawals freeze often. Users report that SaxAi withdrawals are denied.

App drains battery, lags. No real function. SXX token holds no value outside.

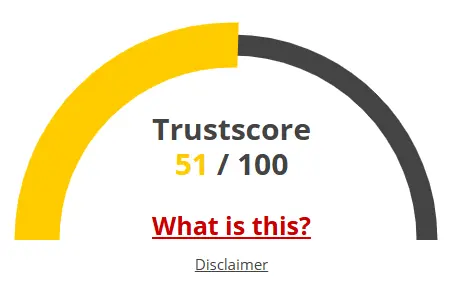

SaxAi low trust score on Scamadviser: 47/100. Hidden WHOIS details add risk.

Ties to SaxAi Chinese scam networks worry. Myanmar compounds run similar ops.

Public Perception: Complaints Mount

Trustpilot shows 4/5, but reviews seem fake. BehindMLM calls it a Ponzi. User complaints about SaxAi payout freezes grow in 2025.

Reddit mixes shills with warnings. YouTube exposes SaxAi’s stolen Crypto.com photos as red flags.

SaxAi app battery drain and lag warnings appear. Many label it the SaxAi cloud mining app scam exposed in 2025.

Social Media and Promoters

Official @SaxAi_io hypes events. Followers low at 1,051.

Promoters like @Carinatsupko push referrals. Past: TronSoy, CNB Mining.

They use urgency, fake proofs. Links to Telegram guide victims.

This fits the SaxAi Myanmar scam compound playbook.

Future Risks and Predictions

The scheme peaks soon. By Q1 2026, strains show. Withdrawal delay. Collapse follows in months.

Losses hit millions. Like Bitconnect, 99% lose.

Avoiding SaxAi AI buzzword investment fraud saves money.

Recommendations: Stay Safe

Skip SaxAi. Report to FTC or IC3 if involved. Recovering funds from SaxAi Ponzi button clicks proves hard. Avoid recovery scams.

Choose real options: NiceHash, Binance staking.

SaxAi vs real mobile mining platforms? Legit ones verify hash rates.

DYOR always. Check audits, teams.

Conclusion: Proceed with Caution

This SaxAi review uncovers major flaws. From hidden owners to impossible ROIs, risks dominate. SaxAi SXX token worthless pyramid utility confirms issues. Is saxai. Is Cloud a legitimate or fake AI platform? Evidence says scam. Protect your funds. Research deeply before any crypto move.

SaxAi Review Trust Score

A website’s trust score is an important indicator of its reliability.SaxAi currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the SaxAi or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About SaxAi Review

This section answers key questions about SaxAi, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

SaxAi appears to be a scam due to fake ownership and unrealistic returns.

SaxAi's mining claims are fake; no actual mining occurs, only user deposits.

Major risks include fake executives, unsustainable returns, and withdrawal issues.

The Everstead Review warns about scams like SaxAi, which lack transparency and real returns.

Recovering funds is tough; report to authorities and avoid recovery scams.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.