Legacy Group Review: In-Depth Look at This Crypto Investment Platform

Scams Radar review on Legacy Group: (legacy-group.io) launched in August 2025. It promises access to exclusive alternative assets starting at just $100. Many people now search for an honest Legacy Group review to understand if the high returns are real. This detailed analysis examines the ownership, compensation plan, math behind the promises, and real risks.

Table of Contents

Part 1: Who Really Runs Legacy Group?

The official website shows no team members or founders. It keeps everything hidden on purpose.

The company behind it is Legacy Quantum LTD (UK number 16564667). It registered in July 2025 at a virtual office address in London (71-75 Shelton Street). Thousands of shell companies use this same address.

→ Official director and 75%+ owner: Josue Gabriel, French national living in Martinique. He has almost no online history in finance or crypto. Experts believe he is just a nominee.

→ Real public face: Rémy Nurdin (known online as Remy Capital). This 26-year-old French marketer lives in Dubai. He appears in all webinars and created Vantis Labs – the supposed tech part of the ecosystem.

Nurdin’s past raises serious concerns:

- Top earner in the BE Club → regulators in New Zealand, Colombia, Austria, and others warned against its SageMaster product for securities fraud.

- Launched Prime Academy Global → an unlicensed forex education scheme that quietly disappeared.

- French anti-scam sites list him and reference a video where he reportedly talks about running pyramid-style operations.

No criminal convictions exist against either person. However, the pattern of involvement in high-risk or flagged schemes is clear.

Part 2: Legacy Group Compensation Plan Explained Simply

Legacy Group sells no real products to outsiders. Members only buy investment packages. This makes it a pure recruitment-driven system.

Main Investment Options

- ALX Token Staking Deposit USDT → get ALX tokens → stake them → promised up to 12% monthly. Paid 60% in USDT + 40% in ALX (locked 12 months).

- Node Packages 11 tiers from Bronze ($100) to Legend ($50,000). Same 12% monthly promise with the 60/40 split.

Commission Type | Rate/Details | Paid How Often |

Direct Referral | 20% of new deposit | Immediate |

Unilevel (reinvestments) | Level 1: 15%, Level 2: 2.5%, Level 3: 1.5%, Level 4: 1% | On reinvestments |

Binary Residual | 14-24% of weaker leg volume | Every 12 hours |

Rank Bonuses | $100 → $100,000 one-time | When rank achieved |

Founder Pool | 5% of all company deposits quarterly | Only for ≥$50k investors |

2.1 The Math: Why 12% Monthly Returns Are Impossible

A 12% monthly return equals 144% simple annual or about 290% compounded.

Here is exactly what happens to $1,000 invested and compounded:

Month | Balance |

0 | $1,000 |

1 | $1,120 |

3 | $1,405 |

6 | $1,974 |

9 | $2,773 |

12 | $3,896 |

After one year, your money nearly quadruples. After three years, the same $1,000 would exceed $59,000 if compounding continued.

Now compare to real investments (2025 averages):

Investment Type | Typical Annual Return |

Bank savings/CDs | 4-5% |

Real estate (net) | 8-12% |

S&P 500 long-term | 8-10% |

Top hedge funds | 15-25% |

Legitimate crypto staking | 4-12% |

Legacy Group claim | 144-290% |

Current Technical & Trust Checks

- Domain age → registered August 18, 2025 (4 months old)

- WHOIS → hidden via paid privacy service (St. Kitts & Nevis)

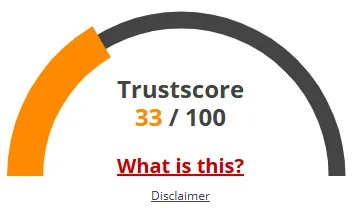

- ScamAdviser trust score → 61/100 (medium risk – hidden owner, very low traffic, brand new)

- Traffic → extremely low, no SimilarWeb ranking

- ALX token (contract 0x49b127bc33ce7e1586ec28cec6a65b112596c822) → 33,892 holders but almost zero real liquidity or trading volume

- No smart-contract audits published

- Site disclaimer → openly states they are NOT a licensed investment company, broker, or advisor. No guarantees, no deposit protection.

Public Perception & Warnings

BehindMLM labeled it a “Dubai MLM crypto Ponzi” in their November 2025 review. Reddit threads and French scam-warning groups already report withdrawal problems. Instagram scam-alert accounts tag it next to collapsed schemes. No Trustpilot page exists yet (too new), but the pattern matches dozens of similar 2024-2025 Dubai failures.

Main promoters remain Rémy Nurdin (@iamremynurdin / Remy Capital on Instagram & TikTok) plus French/African influencers who previously pushed BE Club, OmegaPro, etc.

Final Verdict & Recommendation

Legacy Group shows every red flag of an unsustainable Ponzi/pyramid scheme: anonymous real leadership, serial promoter with controversial history, no retail product, mathematically impossible returns, recruitment-focused pay plan, worthless locked token, and zero regulatory licensing.

The 12% monthly promise cannot be funded by real investments. It relies entirely on new deposits. When recruitment slows – and it always does – withdrawals will freeze, and most members will lose everything.

Do not invest any amount. Even $100 is too much.

If you have already joined, try to withdraw everything in USDT immediately, document everything, and report to your local financial authority.

Always verify claims yourself. Never invest money you cannot afford to lose. Consult a licensed financial advisor before any high-yield opportunity.

Legacy Group Review Trust Score

A website’s trust score is an important indicator of its reliability. Legacy Group currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Legacy Group or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About Legacy Group Review

This section answers key questions about Legacy Group, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No, hidden owners and impossible ROI make it extremely high risk.

Red flags include no licensing, no products, and Ponzi-style payouts.

It mentions staking and nodes, but shows zero real external revenue.

No, the binary and unilevel system collapses once recruitment slows.

Both rely on unrealistic returns, hidden management, and new deposits.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.