My Forex Freedom Review: Is This AI Trading Platform Legit or a High-Risk Scheme?

My Forex Freedom launched in mid-2025 as an AI-powered forex trading system that promises passive income through automated bots. Many people search for a reliable My Forex Freedom review to determine whether it delivers real results or poses serious risks. This detailed analysis Scams Radar examines ownership, compensation structure, return claims, broker partnership, and user experiences based on independent sources as of December 2025.

The platform markets itself as educational software with affiliate earnings. However, watchdog sites and investigators highlight patterns common in recruitment-driven schemes. Read on for a clear breakdown.

Table of Contents

Part 1: Who Really Runs My Forex Freedom? Ownership and Background Check

The official website lists no executives or company address. It operates under “The Virtual Dispensary,” a name unrelated to finance. Support chat and webinar materials; however, point directly to one person.

Calvin Harvey II (online name “richoff_pips”) serves as the main operator and presenter. Independent reviews from BehindMLM (November 2025) and others confirm:

- His photo appears on the site support →

- He hosts daily updates and calls himself “Co-Founder” in funnels →

- Other names linked include Lindan Grier and Christopher Purnell as co-founders of “Freedom Ambassadors.”

Harvey’s history raises concerns. Sources document his involvement in:

- RE247365 (2014-2015): Recruitment-focused MLM labelled pyramid-like →

- Reverse Commissions (2016): Cash-gifting cycler scheme with no real product →

- Recent years: HustleOS (AI marketing tool) and scrubbed online presence before rebranding to AI trading.

This pattern – launch scheme, collect fees, disappear, relaunch with new tech buzzwords – appears repeatedly.

The site mentions an affiliate program for “referrals.” Webinars reveal the full multi-level structure.

Membership Tiers (not shown on main site):

Part 2: My Forex Freedom Compensation Plan Explained Simply

Plan

Upfront Fee

Monthly Fee

Main Benefits Claimed

Micro Pip

$50

$50

Basic bot access + tools

Pip

$150

$150

Enhanced tools

Lot

$300

$300

Premium marketing + bot features

Additional requirement: Deposit a minimum $500 (often in USDT crypto) with partner broker Xtreme Markets.

How affiliates earn:

- Recruitment Commissions (Unilevel – 5 levels deep)

- Level 1 (your recruits): 25% of their fees

- Level 2: another 25% → 50% of every new subscription flows upward immediately.

- Trading Volume Commissions

- $9 per lot from Level 1 traders

- $1 per lot from Levels 2–5.

- Performance Fee Company takes 50% of any profits the bot supposedly makes.

No retail product exists outside membership itself. All money comes from participants’ fees and deposits. Independent analysts call this a pyramid structure because revenue depends entirely on bringing in new people.

2.1 The AI Trading Bot and Return Promises – What They Claim

Marketing highlights:

- “Over 137% gains this year” (stated on Trustpilot profile) →

- Turn $500 into $50,000 in 48 months →

- Some pitches even claim $37 into $50,000 →

- Bot trades 24/7 while you sleep.

Reality check: No audited track record, no developer names, no third-party verification. The bot connects only to one offshore broker.

2.2 Why the Promised Returns Are Mathematically Unsustainable

Take the main claim: $500 → $50,000 in 48 months.

Required growth: 100× in 4 years

Monthly compound rate needed: ≈9.9% net every single month

Annualised: ≈210–251% per year after fees.

After deducting:

- 50% performance fee →

- Broker costs →

- MLM overrides →

- Monthly subscription ($50–$300)

The bot would need roughly 20% gross monthly returns consistently – something no legitimate fund achieves long-term.

Real-world comparison table (average annual returns):

Investment Type

Typical Annual Return

Risk Level

48-Month Outcome from $500

High-yield savings / CDs

4–5.5%

Very Low

$600–$650

S&P 500 Index

8–12%

Medium

$700–$800

Rental Real Estate

7–12%

Medium

$700–$800

Legitimate Crypto Staking

5–15%

High

$600–$900

Professional Forex Funds

15–30% (top performers)

Very High

$900–$1,500

My Forex Freedom Claim

210%+

Extreme

$50,000 (impossible without new money inflow)

Promises above 30-40% consistent annual returns almost always rely on new deposits paying earlier members classic Ponzi mathematics.

The Broker: Xtreme Markets Major Red Flags

Users must fund accounts exclusively at Xtreme Markets (BVI shell company claiming Mauritius regulation).

Issues documented in 2025 reviews:

- Mauritius license offers minimal protection →

- Not registered with CFTC, SEC, FCA, or any top-tier regulator →

- Multiple sources (WikiFX, TradersUnion) added it to warning lists →

- Complaints about delayed/suddenly blocked withdrawals when accounts become profitable.

This setup keeps funds offshore and hard to recover.

User Reviews and Current Sentiment

Trustpilot: 11 reviews, 4.3/5 score – mostly early excitement about setup, zero verified large withdrawals.

Independent sources:

- BehindMLM: “Pyramid + commodities + securities fraud.” →

- Reddit & scam forums: Overwhelmingly negative, compared to past Harvey schemes →

- YouTube recovery channels: Already posting warning videos.

No mainstream finance site or legitimate trader endorses the platform.

Final Verdict and Recommendations

My Forex Freedom combines hidden ownership, recruitment-heavy compensation, unrealistic returns, and an offshore, unregulated broker. The structure matches dozens of collapsed forex/MLM schemes.

If you are already involved → withdraw everything possible immediately and document all transactions.

For everyone else → avoid completely. Real wealth builds through proven, regulated investments offering 5–15% annual returns – not 200%+ promises that defy mathematics.

Always verify regulatory registration yourself (SEC EDGAR, CFTC, etc.) and never invest money you cannot afford to lose.

DYOR Disclaimer: This review compiles publicly available data as of December 2025. It is not financial advice. Conduct your own research and consult licensed professionals before any investment decision.

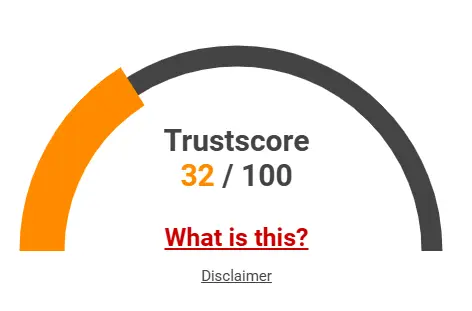

My Forex Freedom Trust Score

A website’s trust score is an important indicator of its reliability. My Forex Freedom currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the My Forex Freedom or similar platforms.

Positive Highlights

- This website offers payment methods which offer a "money back services"

- People are giving this website positive reviews

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- High risk financial services or content seems to be offered

- This website has a lot of reviews while being very young

- The age of this site is (very) young.

Frequently Asked Questions About My Forex Freedom Review

This section answers key questions about My Forex Freedom, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. It hides ownership, uses an offshore broker, and offers unrealistic returns.

Mostly from memberships, referrals, and deposits, not verified trading results.

No transparency, no regulation, forced recruitment, and impossible ROI claims.

No independent proof or audited performance exists for the bot.

Both show unverified returns, offshore brokers, and high-risk structures.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.