Bluelitty Review: Full Investigation into the Desalination Investment Platform

Bluelitty Review: Here is the complete, no-nonsense breakdown you need before sending a single dollar to this platform. As of December 2025, Bluelitty markets itself as a UK-based water desalination company that pays daily passive returns up to 2.4 percent while claiming to “save the planet.” After digging through company records, compensation documents, promoter histories, and independent investigations, Scams Radar examines the facts and exposes what’s really going on behind the polished marketing.

The conclusion is clear: Bluelitty is a recruitment-driven Ponzi scheme hiding behind an environmental storyline.

Table of Contents

Part 1: Company Background and Ownership Reality

Bluelitty claims it was founded in 2016 by British entrepreneur David Williamson and a group of friends. The truth is very different.

The domain bluelitty.com was registered on 12 January 2025. The UK company BLUELITTY LIMITED (number 16263443) was created only in February 2025. It is a cheap shell company with no filed accounts and no employees listed.

David Williamson does not exist outside Bluelitty’s own marketing materials: no LinkedIn profile, no industry record, no trace in Companies House as a director, nothing. Multiple investigators have confirmed the name is fabricated.

The only real person consistently linked to the operation is Cuban network marketer Arichel Piedra. He wrote the official marketing presentation, announced the launch in January 2025, and is celebrated in official posts as a top leader. Piedra previously promoted EndoTech, Daisy Global, and iGenius; all three received regulatory warnings in Canada, the UK, New Zealand, and Poland for unauthorised securities offerings and pyramid characteristics.

Other visible promoters (Alejandro, Roberto Romero, Federico) follow the same MLM influencer pattern – lifestyle photos, rank celebrations, and recruitment messages – but Piedra is the clearest link to earlier collapsed schemes.

Part 2: Complete Compensation Plan Explained

Plan

Deposit Range

Daily ROI

Duration

Total Return (simple)

Approximate Multiple

Rural

$50 – $15,000

1.5%

165 Days

247.5%

3.48×

Urban

$15,001 – $60,000

1.9%

150 Days

285%

3.85×

Industrial

$60,001 – $150,000

2.4%

140 Days

336%

4.36×

Plan

Rural

Urban

Industrial

Deposit Range

$50 – $15,000

$15,001 – $60,000

$60,001 – $150,000

Daily ROI

1.5%

1.9%

2.4%

Duration

165 Days

150 Days

140 Days

Total Return (simple)

247.5%

285%

336%

Approximate Multiple

3.48×

3.85×

4.36×

Every withdrawal carries an 8 % fee.

Additional earnings come entirely from recruitment:

- Direct referral commission: 9–11 % of the recruit’s deposit (higher tier = higher percentage)

- Binary residual: 12 % daily on the weaker leg volume

- Rank bonuses: $100 up to $100,000 one-time when volume targets are hit

- Franchise upgrades: pay $15,000 or $60,000 extra for higher referral rates, lower fees, higher daily caps, and a mysterious $150 monthly payment

There is also a “zero investment” affiliate option, so anyone can recruit without depositing, turning the entire network into free promoters.

No retail product exists. The only money entering the system comes from new deposits.

2.1 Why the Returns Are Mathematically Impossible

Take the Industrial plan as the clearest example.

$100,000 invested → 2.4 % daily for 140 days = $336,000 ROI owed

Total payout on base ROI alone = $436,000

Money received = $100,000

Shortfall = $336,000 before any referral, binary, or rank bonuses.

When referral (11 %), daily binary (12 %), and rank bonuses are added, the real obligation easily exceeds 400–500 % of incoming funds every cycle.

Annualised, 2.4 % daily equals roughly 856 % per year – more than 50 times a good real estate return and 80 times current bank rates.

No desalination project on earth can deliver that. Real water infrastructure projects cost hundreds of millions and target 8–15 % annual IRR over 15–30 years.

2.2 Realistic Investment Comparison

Investment Type

Typical Annual Return

Time to Double Money

Guaranteed?

Source of Profit

High-yield savings / CDs

4.0 – 5.5 %

13–18 years

Yes

Bank interest

Real estate rental (net)

6 – 10 %

7–12 years

No

Rent + appreciation

S&P 500 long-term average

9 – 11 %

6.5–8 years

No

Company profits & growth

Legitimate crypto staking

4 – 12 %

6–18 years

No

Network rewards

Real desalination

8 – 15 %

5–9 years

No

Water sales/contracts

Bluelitty Industrial Plan

~856 %

~42 days

Yes

New investor deposits only

Major Red Flags Summary

- Fabricated founder and 2016 history

- The domain and company are less than 12 months old

- Stock photos used for “desalination plants.”

- No verifiable projects, clients, or contracts

- Returns funded solely by new deposits

- Key operator previously involved in regulator-warned schemes

- 8 % withdrawal fee and crypto-only payments

- Heavy recruitment focus instead of product sales

- Low traffic and no genuine industry presence

Current Status and Likely Future

Bluelitty is still paying early participants (using new deposits) and running aggressive recruitment campaigns on Facebook, Instagram, WhatsApp, and Pinterest. This is the classic expansion phase. Historical patterns from Daisy Global, iGenius, and similar schemes show that withdrawal problems usually begin 6-18 months after launch. Expect delays, KYC blocks, or sudden “maintenance” in 2026.

Final Recommendation

Do not invest in Bluelitty. The combination of fake ownership, impossible returns, recruitment dependency, and direct ties to previously warned schemes makes it extremely high-risk. If you already have money inside, withdraw immediately while payouts are still working and stop promoting it.

Always do your own research. Check Companies House records, WHOIS data, reverse-image search the photos, and read the independent reviews on BehindMLM and similar sites. If daily 1.5–2.4 % returns with no real product sound sustainable, remember: real businesses do not pay that ever.

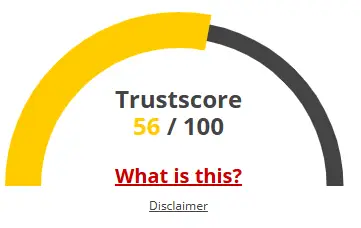

Bluelitty Review Trust Score

A website’s trust score is an important indicator of its reliability. Bluelitty currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Bluelitty or similar platforms.

Positive Highlights

- We found a valid SSL certificate.

- DNSFilter labels this site as safe.

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS.

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About Bluelitty Review

This section answers key questions about Bluelitty, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No, it operates like a Ponzi with no real desalination business.

Using new investor deposits, not real revenue.

Fake founder, new shell company, unrealistic ROI, MLM recruiters.

Both rely on anonymous owners, fake returns, and recruitment-based payouts.

Yes, exit early before withdrawal delays start.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.