Aixa Miner Review: Is This Cloud Mining Platform Legit?

In this Aixa Miner review, Scams Radar examines whether the platform offers real value for cloud mining enthusiasts. Aixa Miner claims to provide easy passive income through Bitcoin mining and altcoin options. Yet, questions about Aixa Miner’s legitimacy persist amid user feedback and expert analysis. We cover ownership, compensation plans, ROI claims, and more to help you decide.

Table of Contents

Part 1: Understanding Aixa Miner Ownership and Background

Aixa Miner operates under AIXAMINER CLOUD MINING INVESTMENT LTD, a Colorado-registered LLC since 2020. The entity holds the number 20201094901 and lists an address in Greenwood Village. Public records confirm its good standing, but this is basic incorporation, not full financial oversight. No leadership profiles or founder backgrounds appear on the site or LinkedIn. Domain whois data hides ownership via a Dutch privacy service, raising transparency concerns. The platform mentions a FinCEN MSB number 31000300350248, but searches on official sites yield no verification. Without clear executive details, accountability remains limited for users seeking Aixa Miner security.

Part 2: Aixa Miner Compensation Plan and Mining Contracts

Aixa Miner mining plans cater to beginners and pros with short-term contracts. Users rent hash power for coins like BTC, ETH, DOGE, and LTC. The setup includes a multi-level referral program for extra earnings.

Here’s a breakdown of key Aixa Miner mining contract types and returns:

Plan Name | Minimum Deposit | Duration | Daily Rewards | Total Profit | Claimed ROI |

Free Experience | $20 | 1 day | $0.80 | $0.80 | 4% |

DOGE Beginner | $100 | 2 days | $4.00 | $8.00 | 8% |

WhatsMiner M60S++ | $500 | 7 days | $6.80 | $47.60 | 9.52% |

ETC Miner V2 | $1,500 | 12 days | $20.85 | $250.20 | 16.68% |

BTC Antminer S21 | $3,500 | 15 days | $53.55 | $803.25 | 22.95% |

BTC Miner A1566HA | $8,000 | 17 days | $132.00 | $2,244 | 28.05% |

The Aixa Miner referral and affiliate program offers additional benefits: 5% on direct invites, 2% on second-level referrals, and 1% on third-level purchases. VIP tiers reward larger deposits with bonuses of up to thousands in USDT. Aixa Miner multi-currency mining allows auto-switch to profitable coins, but actual yields depend on market conditions. Aixa Miner’s minimum deposit and withdrawal limits start low, with payouts in USDT or crypto. However, some report Aixa Miner withdrawal issues and customer complaints about extra fees.

2.1 Analyzing Aixa Miner ROI Claims and Profitability

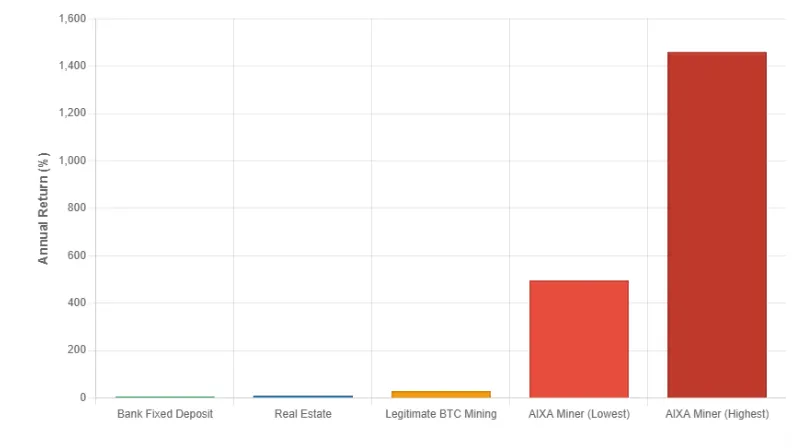

Aixa Miner promises high daily mining rewards, but math shows challenges. For instance, a 4% daily rate compounds to over 1.6 million percent APY annually. Mid-range plans at 1.5% daily hit 25,000% APY. These figures ignore mining costs like electricity and hardware wear.

Compare to benchmarks:

- Bank savings: 4-5% APY, safe but low.

- Real estate: 8-12% yearly, steady with property value growth.

- Crypto staking on exchanges: 3-10% APY, volatile but regulated.

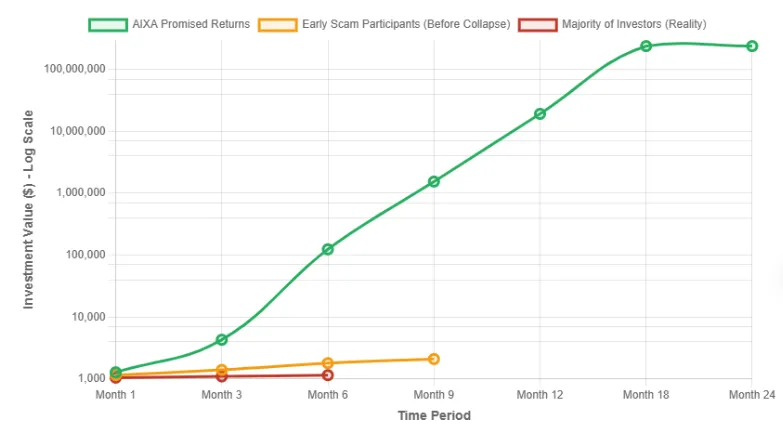

Aixa Miner’s mining profitability analysis reveals gaps. Real Bitcoin mining yields 0.1-0.3% daily after expenses, far below claimed rates. Aixa Miner renewable energy mining claims green benefits, but no audits confirm efficiency. Unsustainable promises suggest reliance on new funds, a common risk in high-yield setups.

Part 3: Aixa Miner User Reviews and Public Perception

Aixa Miner user experience and feedback in 2025 vary. Trustpilot scores it 2.5/5 from 37 reviews. Positive notes include easy sign-up and initial payouts. Negatives dominate: frozen accounts, demands for more deposits to unlock funds, and losses up to $11,000. YouTube channels question if it’s a scam, citing blocked withdrawals after small successes.

Forums like Reddit flag similar patterns in Aixa Miner user reviews. Some praise the Aixa Miner mobile app for mining management, but others cite poor support. Aixa Miner’s customer support responsiveness gets mixed marks, email only, no phone.

3.1 Aixa Miner Security Features and Technical Performance

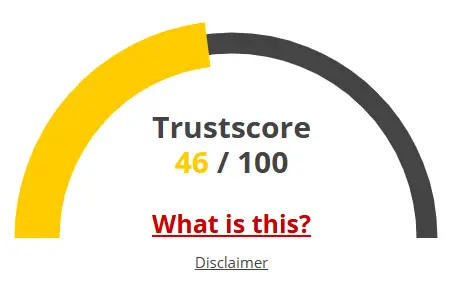

Aixa Miner security includes HTTPS and Cloudflare protection. It claims FCA-style compliance, but no major regulator lists it. Aixa Miner’s KYC and account verification process is basic, with no 2FA details shared. Scamadviser gives a very low trust score, citing hidden owners and scam-like traits.

The technical side shows fast site speed, but traffic data indicates low popularity. Aixa Miner’s fraud prevention lacks proof-of-reserves or audits. Payments use crypto like BTC and ETH, which are irreversible and risky if issues arise.

Key Red Flags and Comparisons

Red flags include mismatched ROI labels (e.g., 74.66% claimed vs. 8% actual) and Russia’s central bank warning for pyramid signs. Comparing Aixa Miner with other cloud miners like Binance shows it lacks transparency. Aixa Miner auto-switch coin mining is explained as AI-driven, but unverified.

Social promoters on X include @AIXAmining, pushing contracts. Some influencers link it to past high-risk sites.

Future Outlook for Aixa Miner

In 2025, Aixa Miner Bitcoin mining and renewable energy usage may attract users, but scrutiny grows. If complaints rise, regulatory actions could follow. Short-term payouts might continue, but long-term sustainability questions persist.

Recommendations for Potential Users

Test with small amounts if curious. How to start cloud mining with Aixa Miner: Sign up, pick a plan, and deposit. But weigh risks, explore regulated options for passive income. Troubleshooting Aixa Miner mining plan problems often involves support, yet delays occur.

In conclusion, this Aixa Miner review highlights strengths in easy access but major concerns on legitimacy and returns. Proceed with caution; research thoroughly to avoid pitfalls in cloud mining.

Aixa Miner Review Trust Score

A website’s trust score is an important indicator of its reliability. Aixa Miner currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Aixa Miner or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About Aixa Miner Review

This section answers key questions about Aixa Miner, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Most signs point to a high-risk platform due to unrealistic ROI and no verified mining.

It gives no real proof of mining activity, making its returns doubtful.

Anonymous owners, unverifiable operations, and possible withdrawal issues.

It shows similar red flags, like exaggerated returns and unclear revenue sources.

No credible third-party reviews or verified customer experiences exist.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.