MEXC Review: Is the Exchange Safe for Crypto Trading?

In this MEXC review, Scams Radar examines the platform’s features, risks, and value for users. Launched in 2018, MEXC Exchange offers spot trading, futures, and more. We cover ownership, compensation plans, security, and comparisons to help you decide.

Table of Contents

Part 1: What is MEXC Exchange?

MEXC cryptocurrency exchange started as a centralised platform in Seychelles. It serves over 40 million users in 170 countries. The site focuses on altcoins with 3,000 pairs. Users find spot trading, futures trading up to 500x leverage, margin trading, and P2P trading.

MEXC trading platform includes ETFs, NFT indexes, and a launchpad for new tokens. MEXC crypto listings happen often, drawing traders. Daily volume hits $4 billion. MEXC trading pairs cover major coins and obscure ones.

1.1 Ownership and Leadership Profiles

Ownership stays somewhat private. Ryder Junji founded the company. He has a background in tech and finance, but details remain limited. John Chen serves as CEO. Chen worked in operations before taking the role.

Past issues include a deleted Twitter account in 2023. It belonged to a former executive. This sparked rumours, but the firm clarified. Leadership changes happened, with Chen stepping up. Backgrounds lack full public records due to an offshore setup. This raises questions in our MEXC review.

1.2 Regulatory Status and Restrictions

MEXC operates without licenses in many places. Warnings come from regulators like the UK’s FCA, Germany’s BaFin, and Australia’s ASIC. MEXC-regulated countries are few. It restricts the US, Canada, and others.

MEXC account verification follows KYC rules for some features. Withdrawal limits are tied to verification levels. No investor protection exists in warned areas. Check local laws before use.

Part 2: Compensation Plan and Affiliate Details

MEXC’s compensation centres on affiliates. Users earn up to 50% from referred trading fees. Referral programs offer 40% commissions plus bonuses. Tiered rewards include MX token drops for milestones.

Events boost earnings. Invite friends for USDT prizes. This drives growth. Affiliates promote via codes. Many also push KuCoin or Bybit. The plan suits active recruiters but favours volume over safety.

2.1 ROI Claims and Comparisons

Promised returns seem high. Use compound formula: FV = P(1 + r/n)^(nt). At 600% APR, $100 grows fast. But unsustainable long term.

Compare yields:

Investment | Typical Return | Risk Level |

Bank Savings | 4-5% | Low |

Real Estate | 6-10% | Medium |

Legit Crypto APY | 4-15% | High |

MEXC Promo | Up to 600% | Extreme |

Bar chart shows ROI: Bank Savings 4.5%, Real Estate 8%, Legit Crypto 10%, MEXC Promo 600%. Log scale stresses the gap.

Comparisons between MEXC and other crypto exchanges: Vs. Coinbase, MEXC have more pairs but less regulation.

Part 3: Trading Features and Tools

MEXC spot trading has 0% maker fees. MEXC futures trading allows high leverage. Limits reach 500x on some contracts. MEXC margin trading uses collateral for loans.

Interface suits beginners with simple charts. Advanced tools include indicators. MEXC’s trading interface for beginners is clean. MEXC advanced trading tools help pros.

MEXC P2P trading uses escrow for safety. MEXC P2P escrow system explained: Funds are released after confirmation.

3.1 Security Protocols and Protection

MEXC security includes 2FA and whitelists. No major hacks reported. Proof of Reserves shows over 100% for USDT, USDC. Hacken audits monthly.

MEXC security protocols and asset protection use Merkle trees. MEXC insurance fund and user protection exist for futures. Phishing guides help users.

Is MEXC exchange safe in 2025? It has measures, but a lack of regulation adds risk.

Part 4: Fees and Payment Options

MEXC fees are low. Spot taker fee is 0.1%. Futures start at 0.02%. No deposit fees for crypto. MEXC deposit methods and fees include cards with 2% charge.

Supported fiat: USD, EUR via third parties like Banxa. Bank transfers work in some areas. MEXC supported fiat currencies and payment options, covering Visa, PayPal.

Withdrawals are crypto-mainly. MEXC withdrawal limits and KYC requirements: Verified users get higher caps.

4.1 Passive Income and Earning Options

MEXC passive income comes from staking. MEXC savings and staking options offer up to 600% APR in promos. Regular USDT yields 8.8%.

These are short-term. MEXC’s loan system and collateral requirements allow borrowing. High yields attract, but math shows limits.

Public Perception and Support

Reviews mix. Trustpilot scores 1.8/5. Complaints note freezes. Positive points: Low fees, variety.

MEXC customer support uses chat, email. How to contact MEXC customer support: Via the help centre. Responses vary.

MEXC trading volume and liquidity 2025: High for altcoins.

Traffic Trends and Performance

Site sees 23 million visits monthly. Line graph: Peaks at 24M in July, steady at 22M by November.

Outages like the April 2025 AWS hit happened. Performance is solid otherwise.

Red Flags and Risks

Warnings from 13 regulators signal issues. Freezes under risk control common. Ownership opaque.

How to use MEXC margin trading safely: Start small. MEXC futures trading leverage limits add loss potential.

MEXC altcoin availability and listings are strong, but delistings occur.

Future Outlook

By 2026, tighter rules may limit access. Yields could drop. The platform may improve PoR for trust.

Conclusion

This MEXC platform review shows strengths in features and fees. Yet risks from regulation and complaints matter. Weigh options carefully. For safe trades, it fits some. Always research.

DYOR Disclaimer: Info based on public data to November 20, 2025. Crypto carries risk. Consult experts.

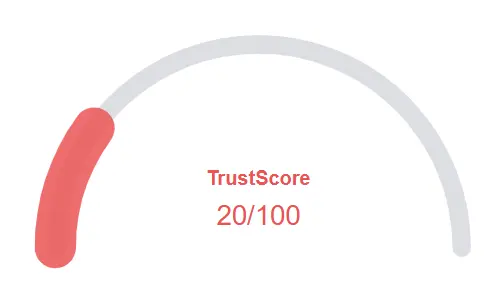

MEXC Review Trust Score

A website’s trust score is an important indicator of its reliability. MEXC currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the MEXC or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About MEXC Review

This section answers key questions about MEXC, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Yes, MEXC offers robust security tools, but it lacks full regulatory oversight, so caution is advised.

Low fees and many altcoins are pros; regulatory warnings and transparency issues are cons.

MEXC provides more pairs and leverage but fewer regulatory licenses than platforms in the Everstead Review.

Yes, but high APR promos are temporary and come with a higher risk.

Yes, MEXC’s 0% maker fees and low futures fees make it cheaper than many major exchanges.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.