Pioneer Hash Review: Uncovering the Facts Behind This Cloud Mining Platform

In this Pioneer Hash review, Scams Radar explores the platform’s cloud mining features, mining contracts, and daily payouts. Launched in 2021, Pioneer Hash offers AI mining and green energy solutions for cryptocurrencies like BTC and ETH. But questions about its legitimacy persist. We examine ownership, transparency, referral program, and risks to help you decide.

Table of Contents

Part 1: What Makes Pioneer Hash Stand Out in Cloud Mining?

Pioneer Hash positions itself as a user-friendly option for cloud mining. It skips the need for hardware or high energy costs. Users buy mining contracts and earn daily. The platform supports multiple cryptocurrencies, including Bitcoin, Ethereum, XRP, and Dogecoin. It highlights AI-driven hash allocation to boost earnings. Green mining with renewable sources like solar and wind adds appeal. New users get a Pioneer Hash signup bonus of $15 to start.

From public data, the site claims over 90 data centers worldwide. It serves users in 150 countries. But verifiable details are scarce. No photos or locations of these centers exist online. This raises concerns about Pioneer Hash transparency.

1.1 Ownership and Background: Who Runs Pioneer Hash?

Ownership details remain hidden. The domain, pioneerhash.com, registered on March 21, 2021, uses privacy services. WHOIS records redact the owner, organization, address, and phone. Hosted via Cloudflare, it adds more layers of anonymity.

No named executives or board members appear on the site. Claims of UK registration and FCA compliance show up in press releases. Yet, searches of the FCA register find no match for Pioneer Hash. EU MiCA alignment also lacks proof. Legit platforms like Binance list clear leadership and filings. Here, the absence signals potential issues. Without background on the owners, trust is hard to build.

Part 2: Pioneer Hash Mining Contracts: A Close Look at the Compensation Plan

The core of Pioneer Hash is its mining contracts. Users deposit crypto to buy hash power. Contracts run for short terms with fixed daily earnings. Principal returns at the end. Here’s a breakdown:

- Daily Sign-in Contract: $15 investment, 1 day, $0.60 daily earnings. ROI: 4%.

- Experience Contract: $100 investment, 2 days, $3 daily earnings. ROI: 6%.

- Weekend Benefits Contract: $2,000 investment, 2 days, $35.60 daily earnings. ROI: 3.56%.

- Primary Hash Rate I: $500 investment, 3 days, $6.10 daily earnings. ROI: 3.66 %.

- Primary Hash Rate II: $1,200 investment, 5 days, $15.84 daily earnings. ROI: 6.60%.

- Primary Hash Rate III: $3,000 investment, 8 days, $40.50 daily earnings. ROI: 10.80%.

- Intermediate Hash Rate I: $5,000 investment, 12 days, $78 daily earnings. ROI: 18.72%.

- Intermediate Hash Rate II: $7,800 investment, 7 days, $148.98 daily earnings. ROI: 13.37%.

Older plans from promotions show similar structures, like $5,000 for 30 days, yielding 45.60%. Note: Site labels often mismatch actual math, showing higher percentages.

The Pioneer Hash referral program adds layers. Earn 3% on direct referrals’ deposits and 1.5% on their referrals. No sales needed, just deposits. This setup drives recruitment over mining value.

Contract Type | Minimum Investment | Duration (Days) | Daily Earnings | Total ROI |

Daily Sign-in | $15 | 1 | $0.60 | 4% |

Experience | $100 | 2 | $3 | 6% |

Primary I | $500 | 3 | $6.10 | 3.66% |

Intermediate II | $7,800 | 7 | $148.98 | 13.37% |

2.1 Why Pioneer Hash Daily Payouts Raise Concerns

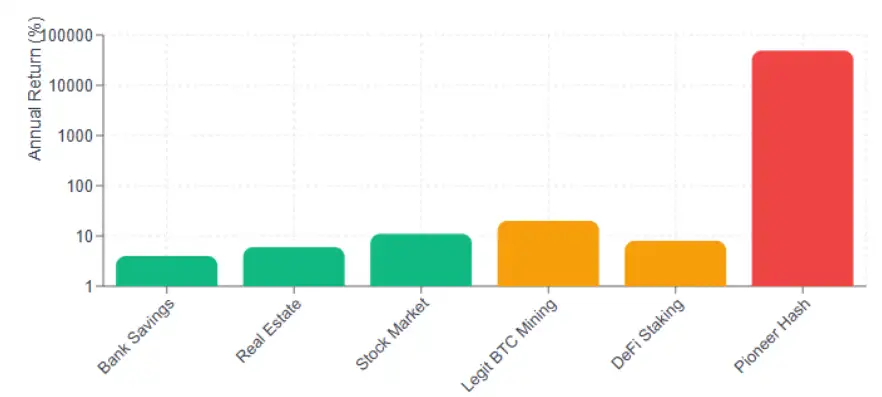

Daily payouts sound great, but math shows issues. A 4% daily ROI compounds to over 164 million percent APY yearly. That’s impossible for real mining. Bitcoin farms face costs like electricity and hardware. Typical yields: 5-15% per year.

Compare to benchmarks:

- Bank savings: 2-5% APY.

- Real estate yields: 3-8% net per year.

- Crypto staking (Aave): 3-10% APY.

Pioneer Hash dwarfs these. No business sustains such returns without new funds covering old ones Ponzi scheme.

Platform/Asset | Annual Yield |

Banks | 2-5% |

Real Estate | 3-8% |

Legit Crypto Staking | 3-10% |

Pioneer Hash (Projected) | 49,000%+ |

Part 3: Pioneer Hash Security and Withdrawal Process

Security claims include multi-encryption and cold wallets. SSL via Cloudflare is valid. Tools like Gridinsoft rate it 80/100 for tech safety. But scores check malware, not business.

Deposits use USDT, BTC, ETH, XRP, and no fiat. Withdrawals are claimed anytime, but reviews note delays. Pioneer Hash’s withdrawal process lacks clear timelines. Complaints mention frozen funds.

3.1 Public Views and Pioneer Hash Customer Support

Trustpilot scores 4.2/5 from 11 reviews. Positive ones praise ease and payouts. Negatives cite no withdrawals. A banner warns of high-risk investments.

Customer support: Email and form only. No live chat or phone. Social pages promote but respond little. Pioneer Hash app for iOS/Android aids monitoring, but issues persist.

Social promoters like @PioneerHash focus on bonuses. Others like @blockchainrptr share news, with no deep history of similar sites.

3.2 Risks and Scam Warnings for Pioneer Hash

Red flags include hidden ownership, unverifiable claims, and high yields. No audits or on-chain proof. Pioneer Hash compares to failed platforms like Paladin Mining, with scam reports.

Mining profitability here ignores real costs. Sustainability is low.

Final Thoughts on Pioneer Hash Review

This Pioneer Hash review highlights strong marketing but weak transparency. Ownership hides behind redactions, and returns seem unsustainable. For those eyeing cloud mining, check regulated options first. Always research deeply. Crypto carries risks; invest wisely. Data as of November 18, 2025. Not advice; consult experts. Now visit Quid Miner Review.

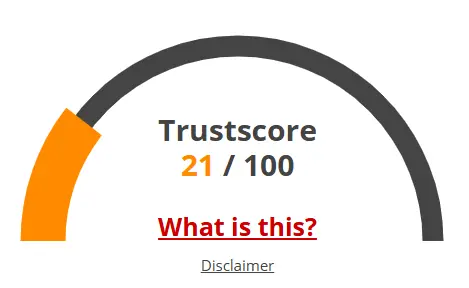

Pioneer Hash Review Trust Score

A website’s trust score is an important indicator of its reliability. Pioneer Hash currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Pioneer Hash or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About Pioneer Hash Review

This section answers key questions about Pioneer Hash, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No clear ownership and unrealistic ROIs make Pioneer Hash a high-risk platform.

Users buy short-term contracts with fixed daily payouts, but returns exceed real mining capabilities.

Anonymity, unverifiable mining data, inflated earnings, and withdrawal complaints.

Like in an Everstead Review, Pioneer Hash shows high returns with low transparency.

Not recommended due to unverified operations and no regulatory oversight.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.