Arc Miner Review: Exploring Legitimacy and Risks

In this Arc Miner review, Scams Radar looks at the cloud mining platform’s features and concerns. Many users seek details on Arc Miner cloud mining contracts and daily returns. We cover ownership, compensation plans, and more. This helps decide if it’s right for you.

Table of Contents

Part 1: Understanding Arc Miner Cloud Mining Basics

Arc Miner offers cloud mining services. Users rent computing power without buying hardware. The platform claims to use renewable energy like solar and wind. It supports cryptocurrencies such as BTC, ETH, XRP, and USDT. Founded in 2019, it says it has over 7 million users worldwide.

The site promotes easy mining through a mobile app. You can start with a free contract. Daily check-ins give small rewards. But questions arise about its true operations.

1.1 Ownership and Background: What We Know

Ownership details stay hidden. Domain records show registration in 2019 via NameBrightPrivacy.com. This shields the real owners. The platform claims UK headquarters and regulation by the old Financial Services Authority. That body ended in 2013. Now, the FCA handles such matters.

No clear founders or team profiles appear. Searches mix it with Arc Minerals, a separate firm in Zambia. That company has leaders like Nick von Schirnding. But arcminer.com differs. It lacks verifiable company numbers or FCA listings. This opacity raises flags for a service handling funds.

Part 2: Complete Compensation Plan Breakdown

The compensation plan centers on mining contracts. These promise fixed daily returns. Here’s a detailed table of key plans based on site data:

Contract Type | Minimum Investment (USDT) | Duration (Days) | Daily Earnings (USDT) | True ROI (%) | Implied Daily ROI (%) |

Free Mining | 15 | 1 | 0.60 | 4.00 | 4.00 |

Experience | 100 | 2 | 3.70 | 7.40 | 3.70 |

Classic #25516 | 2,700 | 25 | 40.50 | 37.50 | 1.50 |

Classic #25817 | 5,000 | 30 | 78.00 | 46.80 | 1.56 |

Advanced #35392 | 15,000 | 45 | 267.00 | 80.10 | 1.78 |

Super #55662 | 230,000 | 45 | 5,313.00 | 103.95 | 2.31 |

These figures come from calculations. Profit equals daily earnings times days. ROI is profit divided by investment times 100. Site-shown earnings often mismatch these numbers.

The Arc Miner referral program adds income. Level 1 gives 3% on referrals’ investments. Level 2 offers 2%. Bonuses reach up to $100,000. This multi-level setup encourages recruiting. Lifetime commissions can hit 5%.

Withdrawal process uses crypto only. Minimum is $100. Users send proof screenshots. Delays appear in some reports. Fees apply, but stay unclear.

2.1 Arc Miner Daily Returns and ROI Claims Analyzed

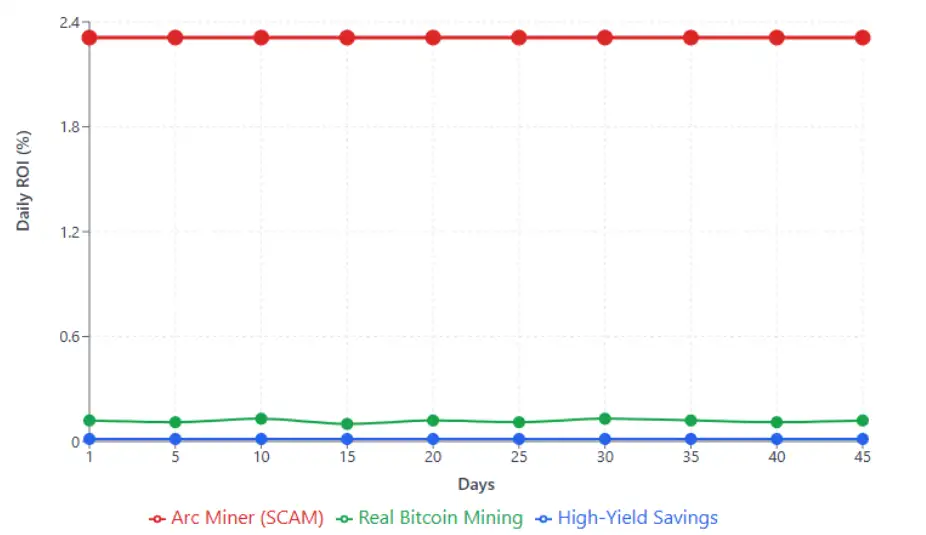

Daily returns look high. Mid-tier plans give 1.5% to 2% per day. To check sustainability, consider annualized yields.

For 2% daily: Annualized ROI = (1 + 0.02)^365 – 1 × 100 ≈ 137,641%.

For 1.5%: ≈ 22,814%.

Real Bitcoin mining yields far less. Network difficulty and costs limit profits to 20-50% yearly. Fixed guarantees ignore market swings.

Compared to others:

- Bank savings: 4-5% APY.

- Real estate: 8-12% yearly.

- Crypto staking on Binance: 3-10% APY.

Arc Miner’s claims exceed these by factors of 100 or more. This gap suggests reliance on new funds, not mining.

Part 3: Arc Miner Security Measures and Content Authenticity

Security includes SSL and cold wallets. It claims AIG insurance. But no proof exists. Scans vary: Gridinsoft rates 80/100 now. Scamadviser warns of low trust due to hidden owners.

Content comes from sponsored posts. Sites like MEXC and BeInCrypto carry ads. No independent audits back claims. PR touts $100M funding in 2025. Yet, no verifier confirms it.

3.1 Payment Methods and Customer Support Details

Payments use USDT, BTC, ETH, and more. No fiat options. This fits crypto but limits recourse. Support via email: info@arcminer.com. App chat helps too. No phone line. Response times get mixed feedback.

3.2 Traffic Trends and Public Perception

Traffic ranks low per the tools. This contrasts with 7 million user claims. Public views are split. Some praise easy use. Others flag delays.

Reddit threads call it risky. Trustpilot for similar sites shows 3/5 averages. YouTube warns of HYIP traits.

3.3 Social Media Profiles Promoting Arc Miner

Promotion happens on X and Facebook. Accounts like @Ze_rith post threads on XRP earnings. @b_evil8606 shares links. @raisingfi notes funding.

These often promote others, too, like OAK Mining or CLS Mining. Patterns show affiliate drives.

Online DYOR Tool Reports

- Scamadviser: Low trust, possible HYIP.

- Gridinsoft: 80/100, legitimate but notes privacy.

- Scam-Detector: Suspicious but known.

- Trustpilot: Few reviews, some scam claims.

- CryptoLegal UK: Fits scam patterns, not listed yet.

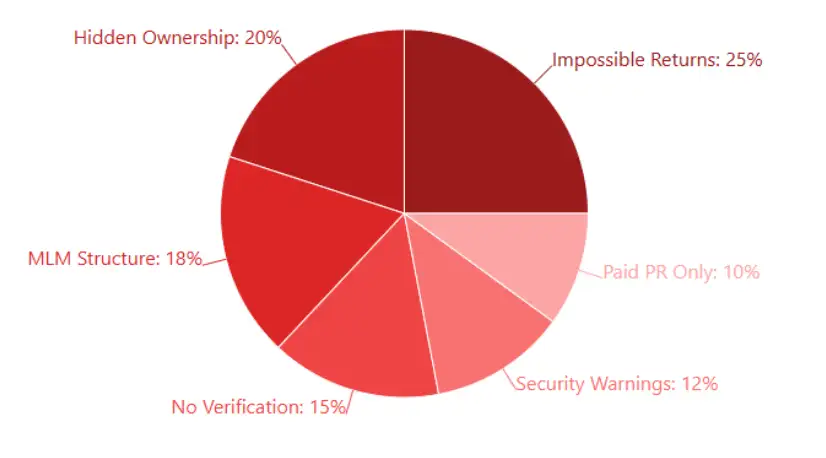

Red Flags and Comparisons

Key issues:

- Hidden ownership.

- Inconsistent ROI math.

- High referral focus.

- Sponsored-only positives.

Versus legit platforms: Genesis Mining offers variable yields. Arc Miner fixes them high.

Future Predictions for Arc Miner

Early payouts may build trust. Growth could stall by mid-2026. Market dips speed issues. Rebrand possible.

Recommendations for Potential Users

Starting cloud mining with Arc Miner requires signing up, choosing a contract, and depositing crypto, but investors should test free plans first, withdraw early, and compare all returns with legit platforms like Coinbase staking while consulting experts for safety. Although the minimum investment starts at $100 with a $100 withdrawal limit and claims of AI-driven mining, green energy usage, and support for BTC, ETH, and XRP, the platform shows unclear fees, mixed user testimonials, email-only customer support, and limited transparency regarding ownership. While Arc Miner promotes mobile app features for monitoring and payouts, and encourages users to maximize earnings through referrals and reinvestment, its high profitability claims remain risky, making it essential to verify SSL security, check forums, and evaluate whether its promised returns are realistic compared to real market standards.

Conclusion: Weigh Risks Carefully

This Arc Miner review shows promise in ease, but big concerns in transparency. High returns tempt, yet math questions sustainability. Do thorough checks. Crypto carries risks. Always research fully. This info aids decisions; it’s not advice. Never risk more than you can lose. Now visit Pioneer Hash Review.

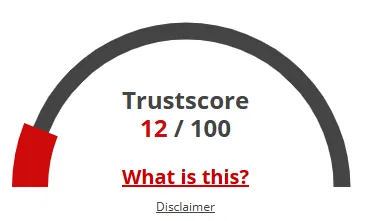

Arc Miner Review Trust Score

A website’s trust score is an important indicator of its reliability. Arc Miner currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Arc Miner or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About Arc Miner Review

This section answers key questions about Arc Miner, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Arc Miner shows high ROI claims and hidden ownership, which raises red flags; users should proceed cautiously and verify all details before investing.

Users rent cloud mining power for fixed durations, but the platform’s guaranteed daily ROI often exceeds real mining profitability.

Key risks include hidden ownership, unclear fees, unsustainable returns, and a heavy referral-driven earning model.

Compared to regulated platforms or those studied in an Everstead Review, Arc Miner lacks transparency and offers returns that appear mathematically unrealistic.

Arc Miner requires a minimum $100 deposit and a $100 withdrawal limit, with crypto-only payment options.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.