Quid Miner Review: Scam Warning and Some Key Facts for Investors

In this Quid Miner review, Scams Radar looks closely at the platform’s promises of easy crypto earnings. Many people search for reliable ways to start cloud mining. Quid Miner claims to offer secure options. Yet, recent reports raise serious doubts. As of November 2025, user experiences and independent checks point to risks. This guide breaks down ownership, plans, and more. It helps you decide if Quid Miner cloud mining fits your needs.

Table of Contents

Part 1: What Quid Miner Claims to Be

Quid Miner presents itself as a trusted name in crypto mining. The site highlights green energy use and AI tools for better results.

1.1 Marketing Promises: Green Mining, Global Farms, and Passive Income

The platform says it runs farms in places like the US and Canada. It talks about operations in over 180 countries. Users can mine BTC, ETH, and others via a mobile app. Quid Miner AI mining tech aims to boost daily returns. It stresses environmental sustainability with renewable power. New users get a free $15 trial for risk-free starts.

1.2 What You See on the Site Today

The layout shows contract cards with fixed costs and payouts. There’s a signup area with claims of strong encryption. Support is listed as 24/7. A UK address appears, but details stay vague. Quid Miner referral program gives bonuses for bringing in friends.

Part 2: Ownership Check: UK Companies House vs Marketing Story

Ownership matters in any Quid Miner review. The platform links to a UK firm, but the facts don’t match.

2.1 QUIDS IN LIMITED vs H & K QUIDS IN LIMITED

Records show H & K QUIDS IN LIMITED was formed in 2019. Marketing says 2010 start. No clear tie to directors or crypto work. Quid Miner’s cryptocurrency list is broad, but company filings lack mining proof.

2.2 Company Size and Filings vs Global Narrative

It’s a small firm with low turnover. Under 10 staff can’t handle huge farms. No regulator licenses found, like FCA. This gaps the “global” story. Owners’ profiles stay hidden, raising trust issues.

Part 3: Domain, Hosting, and Technical Footprint

Tech setup looks basic but hides key info.

3.1 Domain Age, Registrar, WHOIS Privacy

Registered in 2021, not as old as claimed. Owner data redacted. This is common in risky sites.

3.2 Traffic Trends and Backlink Profile

Low visits, around 56 daily. Backlinks come from paid ads, not real buzz. Quid Miner’s global availability seems overstated.

3.3 Security Measures

Uses Cloudflare for protection. SSL encrypts data. But no 2FA or audits mentioned. Quid Miner’s security features feel thin for money handling.

Part 4: Compensation Plan and ROI: The Numbers Behind Quid Miner

This Quid Miner review digs into earnings. Plans promise high yields, but math shows issues.

4.1 Example Contract Returns

LG Mining comparison with other cloud mining platforms, like NiceHash, shows lower, variable yields there. See this ROI table:

Plan Name | Investment ($$ ) | Duration (Days) | Daily Earnings ( $$) | Total Profit ($) | ROI Over Contract (%) |

BTC Free Hash Power | 15 | 1 | 0.60 | 0.60 | 4.00 |

BTC Antminer S19k Pro | 200 | 2 | 8.00 | 16.00 | 8.00 |

BTC Avalon A1366 | 1,000 | 12 | 12.70 | 152.40 | 15.24 |

BTC WhatsMiner M60S | 3,000 | 15 | 41.70 | 625.50 | 20.85 |

BTC Antminer S21 XP | 10,000 | 23 | 177.00 | 4,071.00 | 40.71 |

BTC Bit-RAM MightyPOD | 370,000 | 47 | 8,769.00 | 412,143.00 | 111.39 |

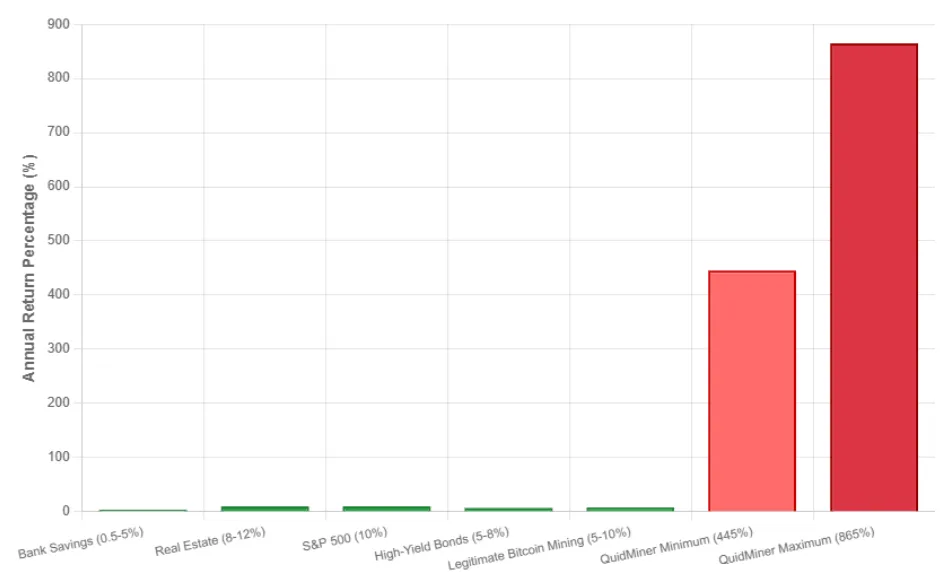

4.2 Annualized ROI Calculations: Why the Model Breaks

Big plans show extreme growth. For $370,000, 111% in 47 days annualizes to 865%. Formula: (1 + ROI)^(365/duration) – 1. This needs endless new cash, like a Ponzi.

Graph idea: Bar chart shows bank ROI at 3%, real estate 7%, staking 10%, vs Quid Miner 865%. The gap proves unsustainability.

4.3 Comparison vs Real-Estate ROI, Bank Deposits, and Real Crypto APY

Real estate gives 5-10% yearly. Banks offer 1-5%. Crypto staking: 4-12%. Quid Miner’s daily returns dwarf these. Quid Miner fees aren’t clear, adding risk.

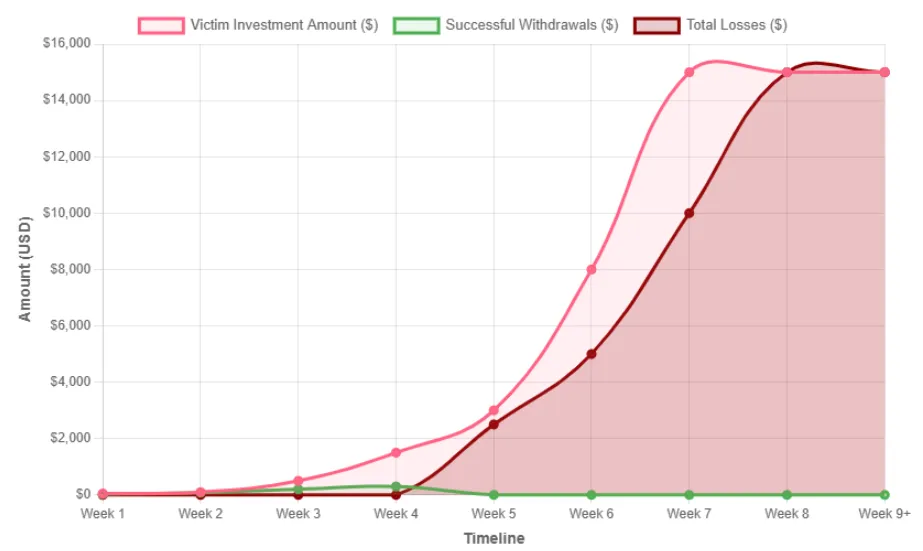

Part 5: User Reports: Withdrawals, VIP Traps, and Frozen Accounts

Real stories shape this Quid Miner review.

5.1 Trustpilot Pattern: Polarized Reviews and Complaints

Score 3.5/5. Many 1-star tales of frozen funds. One lost $16,000. Quid Miner withdrawal process often fails, demanding extra buys.

5.2 Reddit and Community Reports

Forums warn of scams. Users say small pulls work, big ones block. Quid Miner user reviews mix fake positives with real losses.

DYOR Tools:

Use tools for transparency and legitimacy assessment of Quid Miner.

- ScamAdviser, Gridinsoft, IsLegitSite

Low trust: Hidden owner, crypto risks. Gridinsoft: 39/100.

- FraudTracers, CryptoLegal

Listed as a scam. No licenses. Quid Miner risks and scams to watch include withdrawal blocks.

Marketing Footprint: Paid PR and Hype

Ads repeat green claims. Quid Miner AI optimization technology sounds advanced but unproven.

- Press-Release Articles

Paid content on news sites. No real checks.

- Social Media Promotion

Accounts push similar schemes. Past promotions include other miners. Quid Miner’s affiliate system drives this.

Content Authenticity and Inconsistencies

Founding dates mismatch. No proof for farms.

- Dates, Locations, Scale

2019 start, not 2010. Quid Miner’s environmental sustainability lacks evidence.

- Mining Claims No Proof

No hash stats. Quid Miner’s mining profitability potential seems fake.

Payment Methods, Withdrawals, KYC Gaps

Crypto only, no fiat. Quid Miner’s minimum deposit varies. Limits hit hard.

- Fund Flows

Irreversible sends. Quid Miner withdrawal methods often fail.

- No Regulation

No investor shields. Big red flag.

Conclusion & Strong DYOR Disclaimer

This Quid Miner review shows high risks. Unreal ROIs, hidden owners, and complaints signal caution. Real mining needs checks. Diversify safely. Always DYOR. Crypto holds risks; past results don’t predict future. Consult experts before moves.

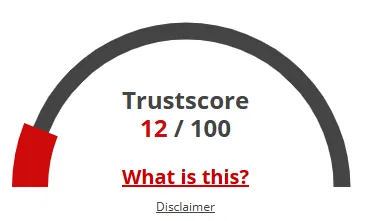

Quid Miner Review Trust Score

A website’s trust score is an important indicator of its reliability. Quid Miner currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Quid Miner or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About Quid Miner Review

This section answers key questions about Quid Miner, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. Hidden owners + unrealistic ROI = major scam indicators.

Fake mining claims, blocked withdrawals, and Ponzi-style returns.

Real mining gives 5–20% yearly; Quid Miner promises up to 100% in days impossible.

Yes. Same pattern: anonymous owners, hype marketing, and unsustainable payouts.

Mostly no. Users report delays, limits, and frozen funds on larger withdrawals.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.