Dot Miners Review: Is This Cloud Mining Platform Worth Your Time in 2025?

In this Dot Miners review, Scams Radar examines the site’s features and concerns. Many seek Dot Miners cloud mining for easy crypto earnings. Yet, questions arise about its legitimacy. We cover Dot Miners XRP mining, DOGE mining, investment plans, and more. Read on for a clear look.

Table of Contents

Part 1: What Dot Miners Offers

Dot Miners calls itself a UK-based tech firm. It focuses on cloud mining for Bitcoin and other coins. The goal? Make mining simple without hardware. Claims include over 5 million users in 100 countries. It boasts a global network and green energy use.

The head office sits at a shared UK address. This spot hosts many firms, hinting at a virtual setup. No clear owner profiles or team backgrounds appear. Press mentions Bitmain ties, but no proof backs this. For the transparency and legitimacy of Dot Miners’ operations, details stay thin.

Part 2: Dot Miners Investment Plans and Mining Contracts

Dot Miners’ mining contracts draw interest with fixed returns. How to start cloud mining with Dot Miners? Sign up and pick a plan. Dot Miners’ minimum investment starts low.

Here’s a table of key plans:

Contract Name | Price (USD) | Duration (Days) | Daily Income (USD) | Total Profit (USD) | Daily ROI (%) |

Free Contract | 15 | 1 | 0.60 | 0.60 | 4.0 |

Novice Miner | 100 | 2 | 3.50 | 7.00 | 3.5 |

Starter Miner | 500 | 7 | 6.00 | 42.00 | 1.2 |

Starter Miner | 1,000 | 9 | 12.50 | 112.50 | 1.25 |

Pro Miner | 3,000 | 20 | 40.50 | 810.00 | 1.35 |

Pro Miner | 5,000 | 35 | 72.50 | 2,537.50 | 1.45 |

Prime Miner | 10,000 | 40 | 155.00 | 6,200.00 | 1.55 |

Prime Miner | 28,000 | 45 | 498.40 | 22,428.00 | 1.78 |

Quantum Miner | 150,000 | 48 | 3,000.00 | 144,000.00 | 2.0 |

2.1 Dot Miners Referral Program and VIP System

Dot Miners referral program pays 3% on direct invites. Level two adds 1.5%. Dot Miners referral program commission details help grow earnings. Top earners get bonuses up to $77,777.

The VIP club unlocks more. Higher levels mean better yields. Contact support to claim. This setup boosts Dot Miners’ mining profitability through networks.

2.3 Why Returns May Not Last

Dot Miners claims high yields. But math shows issues. At 1.55% daily on $1,000, a year yields over $274,000. That’s unsustainable.

Real mining hits 10-20% yearly. Dot Miners dwarfs this. How to maximize returns with Dot Miners mining plans? Reinvest, but risks grow.

Compare in this table:

Investment Type | Annual ROI (%) |

Bank Savings | 3 |

Real Estate | 7 |

Stock Market | 9 |

Legit Mining | 15 |

DeFi | 12 |

Dot Miners | 900 |

Part 3: Security Protocols at Dot Miners

Dot Miners security claims bank-level protection. It uses SSL and cold wallets. Yet, no audits show up. The Dot Miners platform usability feels basic. Real-time tracking of mining profits on the Dot Miners dashboard exists. Mobile app features of Dot Miners aid on-the-go checks.

Environmental sustainability of Dot Miners’ facilities gets a nod. It talks about green energy. But proof is lacking. Risks and precautions for Dot Miners investors include crypto volatility.

3.1 Payment Methods, Fees, and Withdrawals

Payments use crypto like BTC, USDT. No fiat options. Dot Miner’s fees stay unclear upfront. Withdrawal process and limits on Dot Miners allow anytime pulls. But reports note extra taxes or fees.

Common problems and troubleshooting Dot Miners involve delays. Customer support quality and responsiveness get mixed views. Email and chat help, but some call it slow.

Part 4: Public Views and Tool Reports

Real user reviews of Dot Miners vary. Trustpilot sits at 2.9/5. Some praise early pulls. Others flag blocks. User testimonials and experience with Dot Miners often cite scam risks.

Gridinsoft gives 1/100 trust. Scamadviser calls it low trust. Reddit warns of fraud.

4.1 Social Media and Promotions

@DOTMiners shares perks on X. Followers are low. Recovery accounts like @GeorgeRevovery warn of #DotMiners as a scam. They link it to #LetMining, #JCBcrypto. No big promoters found.

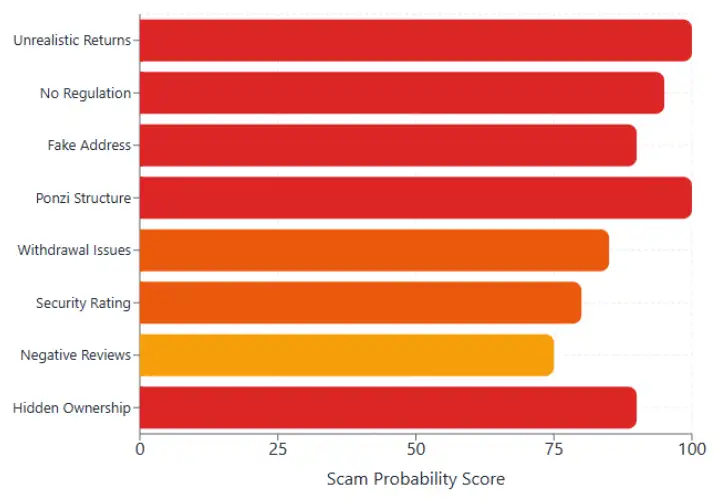

Red Flags to Watch

Hidden owners. High returns. Referral focus. These signals caution.

Final Thoughts

This Dot Miners review shows promise but big risks. For safe plays, check regulated spots. Always DYOR. Crypto holds no guarantees. Consult experts before investing. Stay informed to avoid pitfalls.

Dot Miners Review Trust Score

A website’s trust score is an important indicator of its reliability. Dot Miners currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Dot Miners or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About Dot Miners Review

This section answers key questions about Dot Miners, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Dot Miners shows multiple red flags, making it a high-risk platform.

No. The platform promises returns far above real mining profitability.

It pays 3 percent on level one and 1.5 percent on level two, promoting recruitment.

Hidden owners, unrealistic profits, and low trust scores stand out.

Both show anonymous owners and unsustainable ROI patterns.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.