Yo Network Review: Uncovering the Truth Behind This Blockchain Platform

In this Yo Network review, Scams Radar dives deep into the platform’s claims as a decentralized blockchain. From Yo Network staking to its native token and ecosystem, questions arise about legitimacy. Investors seek clarity on Yo Network blockchain technology, security, and investment opportunities. Our analysis reveals key insights for potential users.

Table of Contents

Part 1: Understanding Yo Network Blockchain Basics

Yo Network positions itself as an enterprise-grade EVM-compatible blockchain. It claims to use Cosmos SDK, CometBFT, and EVMOS for fast transaction finality. The platform promises low transaction fees and scalability for dApps. However, checks show no public explorer or verifiable nodes. This raises doubts about its decentralized platform status.

The site once highlighted validator staking and governance. Users could supposedly participate in decisions via token voting. But without open-source code or API docs, these features lack proof. Yo Network developer tools, like claimed SDKs, remain untraceable. As of November 2025, the main domain shows no content, suggesting a shutdown.

1.1 Ownership and Team Profiles: What We Know

Ownership stays hidden. Domain records use privacy shields, with no public names or company filings. Claims of Russian origins lack regulatory proof from bodies like the Federal Tax Service. No founders or CEOs are listed, unlike transparent projects like Ethereum.

Team backgrounds are absent. No bios, LinkedIn profiles, or past work in crypto. This contrasts with legitimate networks where leaders share expertise. Hidden admins on social channels add to the opacity. Without clear governance or partnerships, trust erodes. Yo Network’s compliance and regulatory status appear non-existent, violating norms in many countries.

Part 2: Complete Compensation Plan Breakdown

The plan mixes staking with a 25-level referral system. This MLM structure focuses on recruitment over utility. Here’s a clear table of staking options:

Plan Name | Duration (Days) | Daily ROI | Monthly ROI (Approx.) | Annual ROI (Approx.) | Minimum Deposit |

Basic | 90 | 0.6% | 18% | 216% | $50 USDT |

Pro | 180 | 0.8% | 24% | 288% | $100 USDT |

Elite | 365 | 1.0% | 30% | 365% | $250 USDT |

Referrals unlock commissions across 25 levels. Level 1 offers up to 10%, dropping to 0.5% by level 16-25. Ranks are tied to team volume, pushing constant sign-ups. Yo Network staking rewards and ROI sound appealing, but fixed rates ignore market fluctuations.

How to participate in Yo Network staking programs? Users deposited USDT on BSC, with principal locked until maturity. Harvests happened daily, but reports note delays. This setup favors early joiners, funded by new deposits.

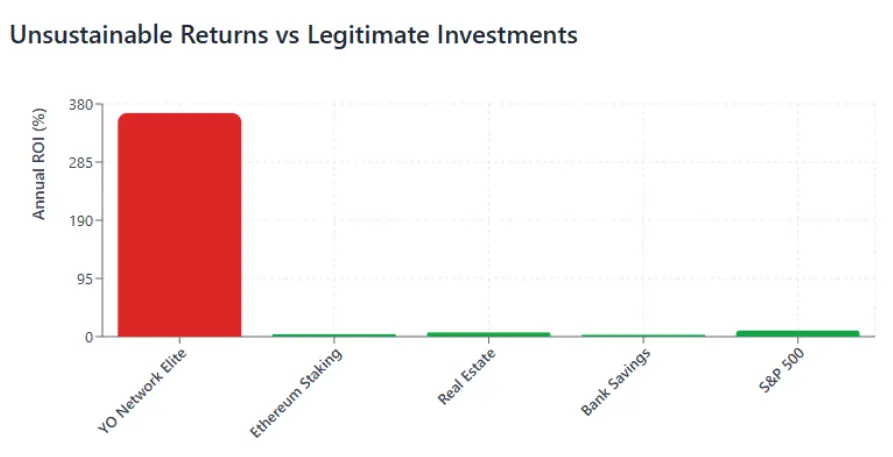

2.1 Mathematical Proof: Why Returns Are Unsustainable

Promised yields far exceed norms. For Elite: Invest $1,000 at 1% daily.

Formula: Future Value = $1,000 × (1.01)^365 ≈ $37,783.

This demands massive external revenue, impossible via true staking. Real sources like fees or inflation yield 3-18% yearly.

Compare in this bar chart representation (values in annual %):

- YO Network Elite: ||||||||||||||||||||||||| (365%)

- Ethereum Staking: ||| (4%)

- Real Estate: ||||| (7%)

- Bank Savings: || (3%)

- S&P 500: ||||||| (10%)

A line graph of compound growth shows exponential rise: At 90 days, ~$2,450; 180 days, ~$6,000; 365 days, $37,783. Without endless inflows, it collapses.

2.2 Comparisons to Legitimate Investments

Benefits of using Yo Network for decentralized finance? None verified. Real options:

- Bank APY: 0.5-5%.

- Real Estate: 5-10%.

- Crypto Staking (Aave): 2-8%.

Yo Network native token value and utility: Unlisted, unverified.

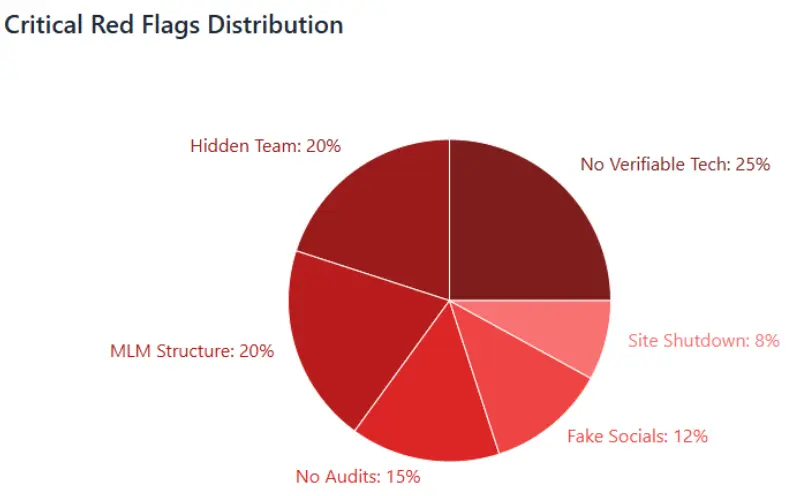

Part 3: Yo Network Security Features and Red Flags

Yo Network security claims include dynamic fees and multithreaded execution. But no audits from Certik or PeckShield exist. Wallet setup via yoclub.net lacked 2FA details. Payments were crypto-only, irreversible.

Red flags include:

- No verifiable smart contracts or chain activity.

- Bot-driven socials with low real engagement.

- Absent developer community or ecosystem partners.

- Traffic under 1,000 monthly, per estimates.

- Not listed on DeFiLlama or CoinGecko.

Yo Network vs other blockchain networks: Unlike Polygon (4-9% APY), it offers fixed high returns, signaling Ponzi traits

3.1 Public Perception and Social Media Insights

Perception leans negative. Reddit and forums flag similar MLMs as scams. X posts warn of bundled scams in “YO” tokens, though not directly. Official @yonetwork25 has minimal likes, no cross-promos.

Promoters’ past: Some accounts shilled HyperFund or NovatechFX, now collapsed. Yo Network ecosystem lacks organic buzz. No dApps or collaborations beyond vague claims.

3.2 Payment Methods, Support, and Technical Performance

Deposits used USDT/BSC, with no fiat options. Support via Telegram with hidden admins. No live chat or tickets.

Technical claims untestable: No TPS stats or uptime. Yo Network’s transaction speed and scalability remain unproven. User experience: Generic interface, now inaccessible.

Future Predictions and Roadmap Concerns

Roadmap promised mainnet, but site downtime suggests failure. Predicted lifecycle: Hype, stagnation, exit. With tightening regs like EU MiCA, shutdowns accelerate. Yo Network’s roadmap and future development plans appear abandoned.

Recommendations for Investors

Avoid Yo Network investment opportunities. If involved, withdraw fast. Focus on blue-chips. How to set up a Yo Network wallet? Irrelevant now—site down.

Building dApps on the Yo Network platform? Impossible without tools.

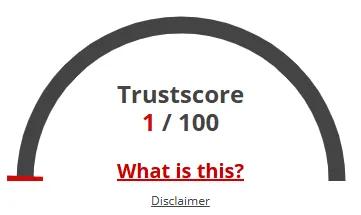

Yo Network Review Trust Score

A website’s trust score is an important indicator of its reliability. Yo Network currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Yo Network or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- This website has existed for quite some years

- DNSFilter considers this website safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- A risk/high return financial services are offered

- This website does not have many visitors

- The age of this site is (very) young.

Frequently Asked Questions About Yo Network Review

This section answers key questions about the Yo Network, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. There is no public team, audited code, or verified blockchain activity.

Returns are fixed and unsupported by real revenue, making them unsustainable.

No. It is not listed on major exchanges or price trackers.

Unlike vetted projects, Yo Network lacks transparency, proof of operations, and regulatory clarity.

If withdrawals are still possible, exit immediately and avoid reinvesting.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.