Blofinext Review: Key Facts on Legitimacy and Risks

In this Blofinext review, Scams Radar examines the platform’s claims as a trading site for forex, stocks, crypto, and more. Launched in late 2025, it promises easy copy trading and high returns. But our analysis uncovers major issues. We combine verified data from regulators and tools to help you make informed decisions. Read on for details on ownership, fees, security, and why experts warn against it.

Table of Contents

Part 1: What Is Blofinext Trading Platform?

Blofinext positions itself as a cryptocurrency exchange and CFD broker. It offers over 70 forex pairs, stocks, indices, commodities, and crypto assets. Users can engage in leverage trading, futures contracts, and derivatives. The site highlights automated tools, API support, and contests with bonuses. Account types range from basic to advanced, with varying leverage of up to 1:500. The minimum deposit starts at $250, and it supports both fiat and cryptocurrency options.

Yet, this setup raises questions. The platform lacks clear order execution speed details. Margin call rules and stop-out levels are vague. For beginners, it claims simple features, but real feedback points to problems. Advanced traders might seek better risk management tools elsewhere. How does Blofinext compare to other crypto exchanges? It falls short in transparency.

1.1 Ownership and Background in Blofinext Review

Ownership remains hidden. Domain records show registration in September 2025, with privacy protection via Shield Whois in Sweden. No public names for founders or managers appear. The site mentions “100+ experts” but provides no profiles or backgrounds. This lack of detail is common in risky sites.

Claimed offices include London at 1 Canada Square, New York, Zurich, and Singapore. But checks reveal the London address as HSBC’s headquarters’ fake listing. Company numbers like Seychelles FSA 709718501 and Cyprus HE 19818009 recycle across unrelated brokers. Sites such as goldcapitalinvestments.com and envisionfxmarkets.com use the same details. This suggests a template operation, not a real firm with a verifiable history.

1.2 Regulatory Status Examined

Regulation forms a core part of any Blofinext review. The platform claims global oversight, including CySEC compliance and MiFID II standards. It boasts segregated funds and audits. But facts contradict this.

The UK FCA listed “Blofin Ext / Blofinext” as unauthorized on October 23, 2025. This means no permission to target UK users. CySEC’s register shows no match for HE 19818009. The Seychelles FSA portal lacks a valid entry for 709718501 linked to the site. These are red flags. Legitimate platforms pass such checks easily.

Part 2: Compensation Plan and ROI Promises

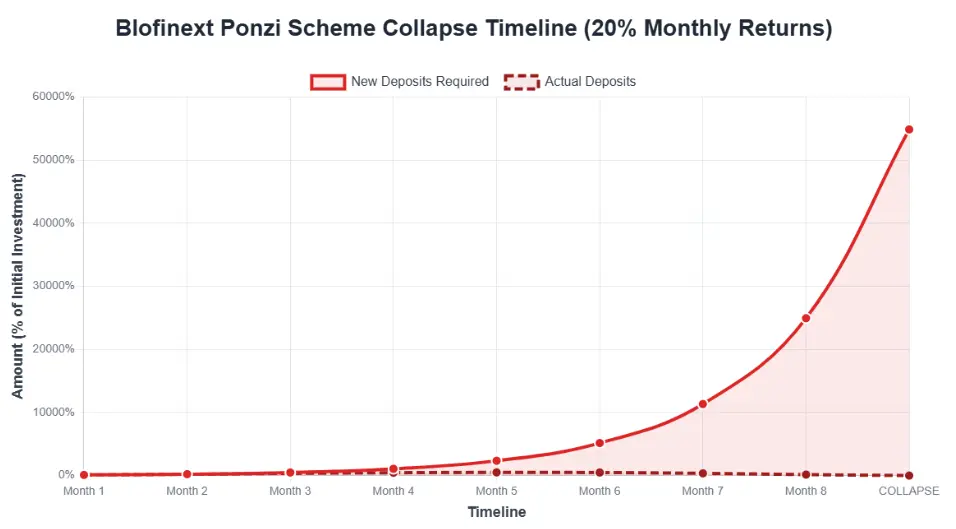

The compensation plan centers on copy trading and affiliates. Users follow “leaders” with 400+ strategies, sharing profits via fees. Affiliates earn from referrals, creating a multi-level structure. Contests offer bonuses for top performers. But this depends on new inflows, like a Ponzi setup.

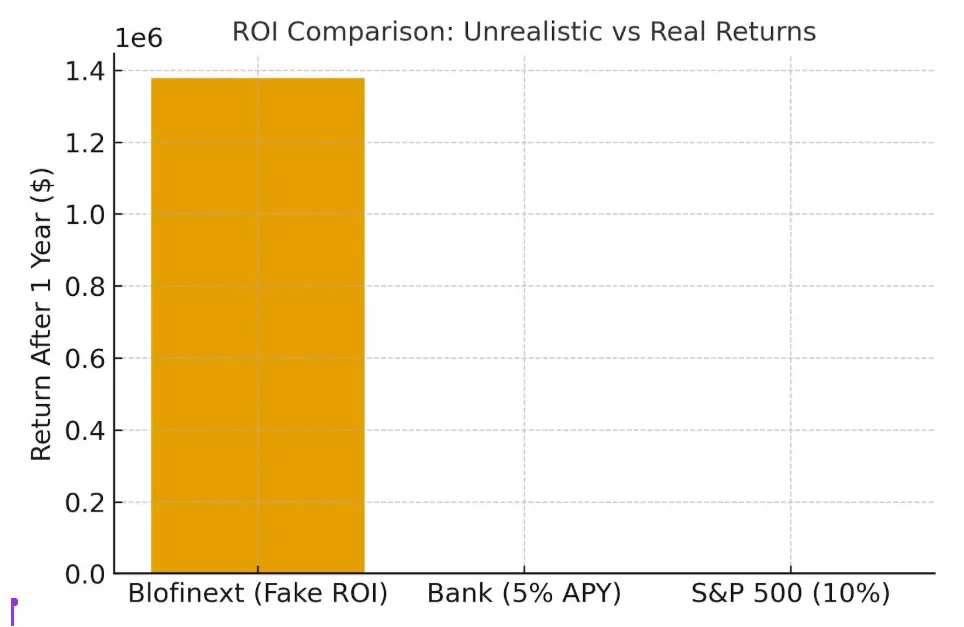

ROI claims imply 20-50% monthly gains from leaderboards. No fixed APY, but dashboards show high “wins.” Is Blofinext safe for cryptocurrency trading? Math says no. Consider a 2% daily return on $1,000.

Formula: A = P(1 + r)^n

- P = $1,000

- r = 0.02 (daily)

- n = days

Period | Scam 2% Daily ($) | Bank 5% APY ($) | S&P 500 10% ($) |

Day 0 | 1,000 | 1,000 | 1,000 |

Month 1 | 1,811 | 1,004 | 1,008 |

Month 3 | 5,943 | 1,012 | 1,025 |

Month 6 | 37,483 | 1,025 | 1,051 |

Year 1 | 1,377,408 | 1,051 | 1,105 |

This graph (log scale) shows scam growth exploding unrealistically. Banks offer 4-5% yearly. Real estate yields 7-10%. Crypto staking hits 5-15%. Blofinext’s model collapses when withdrawals rise.

Part 3: Security Features and Technical Performance

Blofinext security features include SSL encryption. But it’s a basic domain-validated type from Let’s Encrypt. No mention of 2FA or advanced measures. The server shares with suspicious sites via CentrioHost in the US. Traffic ranks low, under 1,000 visits monthly per estimates.

Platform accessibility on mobile devices exists via an app, but reviews note glitches. Trading tools feel generic. For futures trading, contract specs are unclear. Overall, technical performance lags behind established exchanges.

3.1 Payment Methods and Customer Support

Deposit methods cover cards, e-wallets, and crypto over 20 options. Withdrawal process claims speed, but limits and times vary. Fees and commissions apply, with breakdowns hidden until signup.

Customer support promises 24/5 multi-language chat. Yet, reports describe unresponsiveness. No phone or email reliability. In the Blofinext customer service review, this scores low.

3.2 Public Perception and User Reviews

Blofinext user reviews are scarce and negative. YouTube and Reddit mention scams, frozen funds, and withdrawal issues. No Trustpilot page exists. Social media shows zero official promoters. Some confuse it with BloFin at https://www.blofinext.com/, a legit exchange with mixed feedback.

Instagram and X have alerts, not praise. Blofinext user experience and feedback highlight risks. Supported cryptocurrencies and tokens seem broad, but authenticity doubts persist.

Red Flags in Blofinext Review

- FCA blacklist as unauthorized.

- Fake licenses reused from scams.

- Hidden owners, no backgrounds.

- New domain, shared scam server.

- Name similarity to BloFin for confusion.

- Unverifiable $1M insurance.

- Unsustainable returns via math.

- Ghost support, withdrawal blocks.

- No API trading proof.

- Aggressive affiliate program pushes.

Comparisons to Legitimate Options

Platform | Annual ROI | Regulation | Security |

eToro | 5-15% | FCA/CySEC | High |

Binance | 5-20% | Multiple | Strong |

Interactive Brokers | 7-12% | SEC/FCA | Top |

Recommendations

Avoid deposits. If invested, withdraw now. Report to FCA or local authorities. Use DYOR tools like Scamadviser for checks. Opt for regulated sites.

Conclusion: Stay Informed in Your Blofinext Review

This Blofinext review reveals a high-risk site with fake credentials and impossible promises. Ownership hides, regulation fails, and returns defy math. For safe trading, choose verified exchanges. Always research independently. Protect your funds DYOR before any move. This analysis draws from official sources for your benefit. Now visit Atlas Funded Review.

Blofinext Review Trust Score

A website’s trust score is an important indicator of its reliability. Blofinext currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Blofinext or similar plat0forms.

Positive Highlights

- Valid SSL certificate

- Marked safe by DNSFilter

Negative Highlights

- Owner identity hidden via WHOIS privacy

- Low Tranco website ranking

- Server hosts many suspicious sites

Frequently Asked Questions About Blofinext Review

This section answers key questions about Blofinext , providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No, Blofinext is not legit. The FCA lists it as unauthorized, and its claimed licenses are fake.

Hidden owners, fake registration, unrealistic returns, and blocked withdrawals expose major risks.

Unlike regulated brokers, Blofinext lacks oversight and user trust. Safer options include eToro and Binance.

No. Such profits are mathematically impossible and typical of Ponzi-style platforms.

The Everstead Review notes partial legitimacy, but Blofinext shows fake data and a higher risk.

Other Infromation:

Website: blofinext.com

Reviews:

There are no reviews yet. Be the first one to write one.