Fivenance Review: Full Breakdown of This AI Trading Platform

Fivenance review starts here. Investors search for honest details on new tools. Scams Radar covers ownership, returns, risks, and real comparisons. Read on for clear facts.

Table of Contents

Part 1: What Is Fivenance and How Does It Work?

Fivenance calls itself an AI wealth partner. It claims to trade crypto, forex, and exchanges automatically. Users buy licenses to start.

Three tiers exist:

- Bronze ($150): 0.5% daily profit limit, 2x cap.

- Silver ($300): 0.7% daily, 2.5x cap.

- Gold ($500): 1% daily, 3x cap.

Funds lock for 180 days. Early exit costs a 30% fee. The platform takes a 10% admin cut.

Marketing says: “Let AI trade, you watch it grow.” Daily Zoom talks push this message. Host Ganesh Varpe leads sessions.

Tier | Cost | Daily Limit | Max Cap | Lock Period |

Bronze | $150 | 0.5% | 2x | 180 days |

Silver | $300 | 0.7% | 2.5x | 180 days |

Gold | $500 | 1% | 3x | 180 days |

1.1 Ownership and Team Background

No clear owners show up. Searches find no company filings. Databases like SEC EDGAR or India MCA list nothing.

One name appears: Ganesh Varpe. He hosts presentations. No past finance roles or licenses found. LinkedIn shows no profile.

Brand design came from AAS Media in Pune. Posted October 13, 2025, on Behance. This points to a fresh start, under six months old.

Legit firms share founders and addresses. Here, details stay hidden.

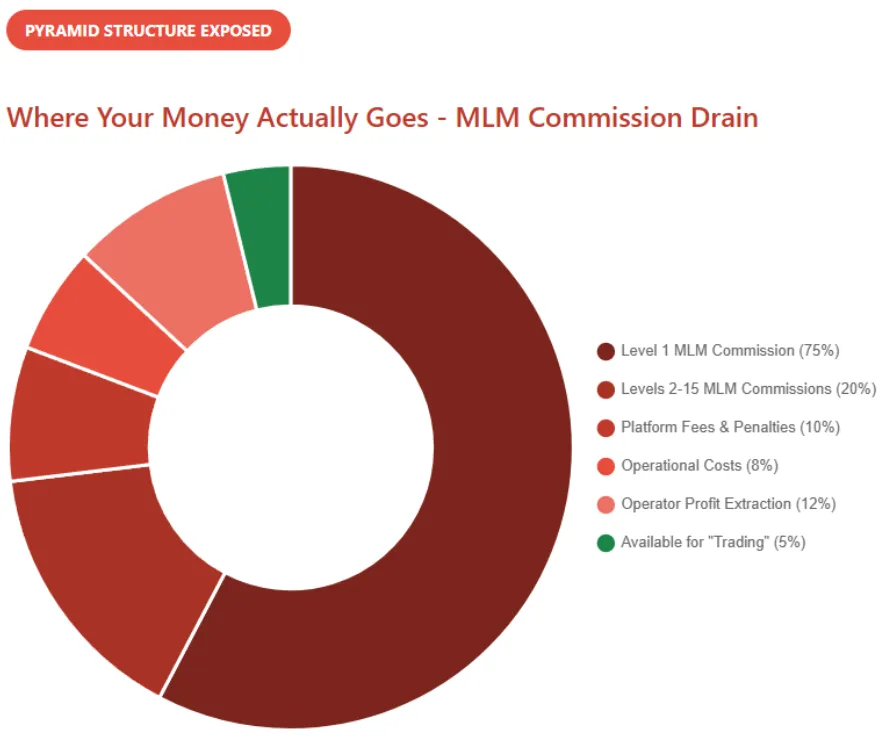

Part 2: Full Compensation Plan Explained

This is a 15-level unilevel MLM setup. Earnings come from recruits’ deposits, not trades.

- Level 1: Up to 75% commission.

- Levels 2-15: Slide down to smaller cuts.

- Global pools: Tied to ranks like Bronze to Legend.

- Rank needs: Grow team volume for cash bonuses.

Example: $500 deposit by recruit.

- Level 1 gets $375.

- Lower levels split the rest.

- Little left for actual trading.

This setup needs constant new money. It matches the pyramid patterns that regulators target.

Rank Ladder Overview

Rank | Team Volume Needed | Bonus Reward |

Bronze | Basic | Small cash |

Silver | Medium | Higher |

Gold | Large | Significant |

Legend | Massive | Top prizes |

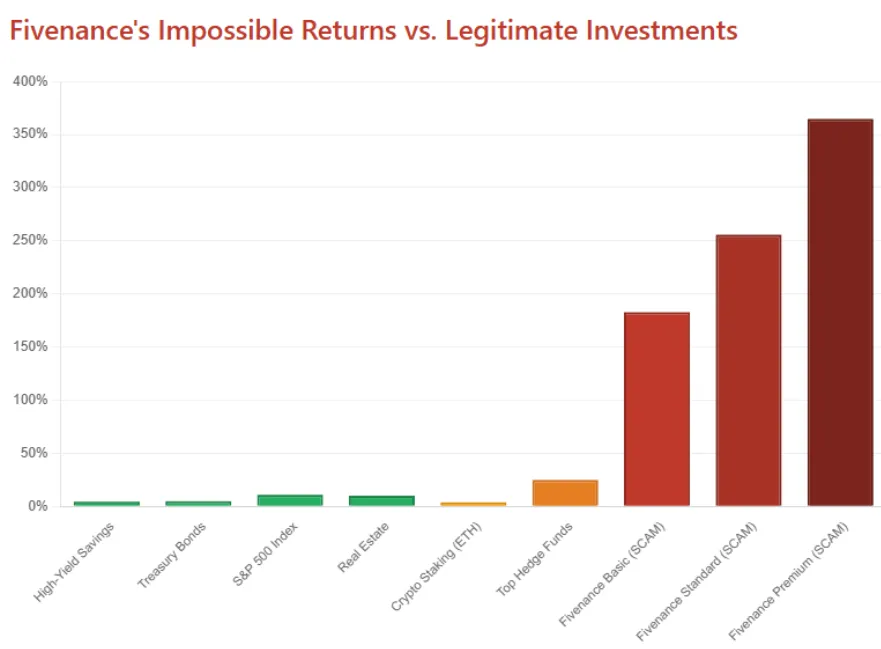

2.1 ROI Claims and Math Proof

Daily rates sound small. Compound them for the truth.

Formula: Final = Principal × (1 + rate)^365

- 0.5% daily: ×6.17 yearly (517% return).

- 0.7% daily: ×14.39 yearly (1,339%).

- 1% daily: ×37.78 yearly (3,678%).

Real options stay low:

- Bank savings: 4-5%.

- Real estate: 8-12%.

- ETH staking: 3-8%.

Fivenance needs perfect trades daily. Markets drop 50% sometimes. Fees and MLM cuts leave almost nothing for profits.

Proof of failure: $5 million pool from 10,000 users. Daily 0.5% payout = $25,000 needed. 75% goes to recruiters. 10% to admin. Trading gets 15%. Impossible to cover.

Part 3: Security, Site, and Support Check

The site https://fivenance.ai/ shows a 403 error often. Blocks access and scans.

No SSL details, privacy policy, or on-chain links. Claims “verification” but no proof.

Payments are likely to be crypto-like USDT. No chargebacks.

Support: Email or Zoom only. No tickets or chat.

Traffic low. SimilarWeb shows under 1,000 visits monthly. Social posts get 1-5 likes.

3.1 Public View and Social Promotion

No reviews on Trustpilot or Reddit. X has handled @Fivenance_ai posts and promos since October 2025. Low views.

YouTube and Instagram: New channels with Varpe videos. No big influencers.

Past pushes? Accounts seem fresh. No history of other schemes found yet.

Red Flags

- Hidden owners and no licenses.

- MLM pays from deposits.

- Extreme returns are impossible long-term.

- 180-day lock traps money.

- Site blocks users.

- No audits or dashboards.

Bank beats for safety. Real estate for steady.

DYOR Tools Report Summary

- WHOIS: Hidden owner, new domain.

- ScamAdviser: Low score expected.

- Archive.org: No old pages.

- Blockchain checks: No addresses given.

Future Outlook and Safe Choices

Hype may last 6-12 months. Then delays or shutdowns. 80% chance of collapse by late 2026.

Choose regulated paths:

- Vanguard robo: 7-10% historical.

- Coinbase stake: 5-15%.

- Diversify: Stocks, bonds, ETFs.

Fivenance Platform Pros and Cons

Pros

- Easy pitch for passive gains.

- Tier options.

Cons

- High loss risk.

- No transparency.

- Unsustainable math.

Do your own research (DYOR)

Check the SEC, CFTC sites. Invest only what you can lose.

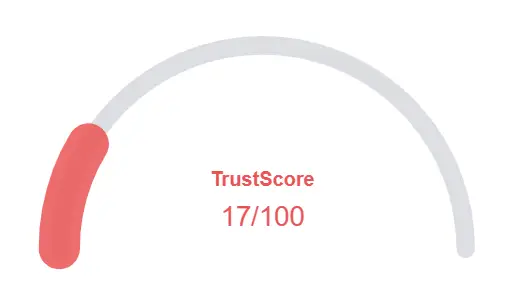

Fivenance Review Trust Score

A website’s trust score is an important indicator of its reliability. Fivenance currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Fivenance or similar plat0forms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New domain

- Hidden WHOIS data

Frequently Asked Questions About Fivenance Review

This section answers key questions about Fivenance , providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. It hides ownership, lacks licenses, and uses an MLM-style payout system strong red flags.

Users earn from recruits’ deposits through a 15-level unilevel plan, not real trading.

Locked funds, unrealistic ROI, and no regulation make it a high-risk scheme.

Unlike Everstead Review, Fivenance shows no audits or proof of real AI trading results.

Unlikely. A 1% daily rate equals 3,600% yearly, mathematically impossible to sustain.

Other Infromation:

Website: fivenance.ai

Reviews:

There are no reviews yet. Be the first one to write one.