Kivo Trade Review: Is This Platform Legit?

In this Kivo Trade review, Scams Radar examines the platform’s claims for 2025. Many people search for details on the Kivo Trade platform. We look at its features, risks, and user feedback. This helps decide if it’s safe for trading.

Table of Contents

Part 1: What Is Kivo Trade?

Kivo Trade offers automated trading tools. It focuses on cryptocurrency, forex, stocks, and CFDs. Users start with a minimum investment. The site promises easy earnings through plans. But public checks show issues.

The homepage has basic content. It mentions AI for business automation. Yet, it lacks clear ties to trading. No team details appear. The footer only shows a copyright year.

1.1 Ownership and Background Check

Public records show no clear owners. Materials name Scott Williams from the Philippines as the founder. Searches find no links to him in business files. No SEC records in the Philippines exist for this name with Kivo Trade.

LinkedIn and other sites have no profile for him in this role. This raises questions. Legit platforms list leaders with proven backgrounds. Here, details stay hidden.

Part 2: Complete Compensation Plan Explained

The plan mixes returns and referrals. It aims at quick gains. Here’s the breakdown.

Core Earnings Structure

- Hourly Returns: Users get 0.1% per hour on deposits. This equals 2.4% daily.

- Minimum Deposit: Starts at $10 in USDT.

- Reinvestment Bonus: Add 5% extra for putting earnings back in.

- Implied Multiplier: Some materials suggest up to 3X growth.

Referral and Team Rewards

- Direct Sponsor Commission: Earn 5% on deposits from people you bring in.

- Binary Matching: Get 6% on matched pairs in your team. Ratios include 1:2, 2:1, and 1:1. Closes daily with no carryover.

- Deposit Bonuses: Larger sums unlock fixed payouts.

- $2,500: $250 over 7 days.

- $5,000: $750 over 30 days.

- $10,000: $2,000 over 90 days.

- $25,000: $7,500 over 180 days.

- $50,000: $20,000 over 365 days.

- $100,000: $50,000 over 365 days.

- Team Volume Rewards: Percentages based on group activity over 10 to 365 days.

Withdrawal Rules

- Fees: 10% service charge plus 5% tax on INR pulls.

- Timing: Open 24/7, multiple times allowed.

- Limits: No forward on matching earnings.

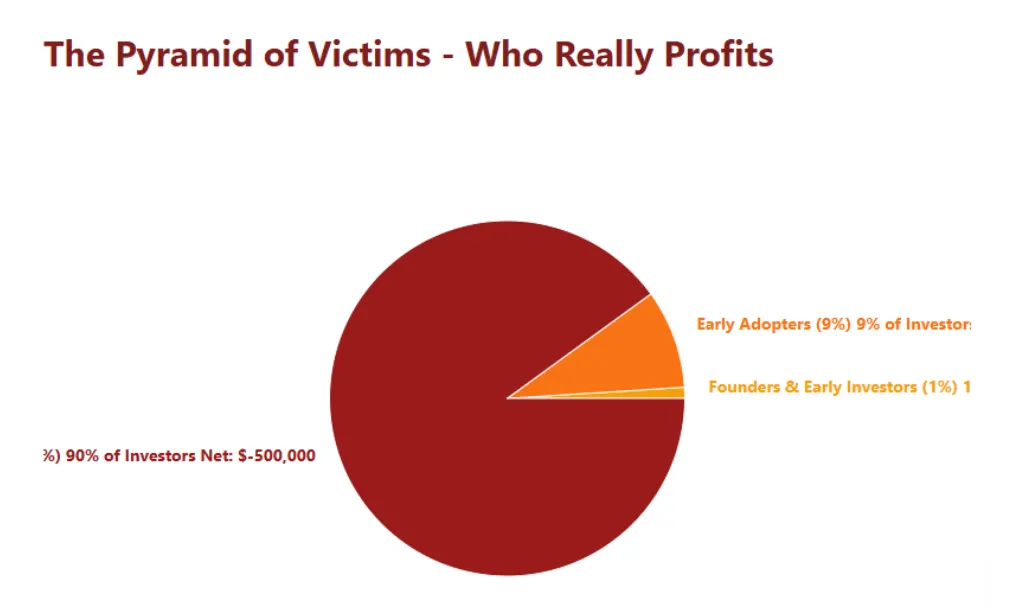

This setup pushes recruitment. Earnings tie more to new joins than market wins.

2.1 Why Returns Raise Concerns

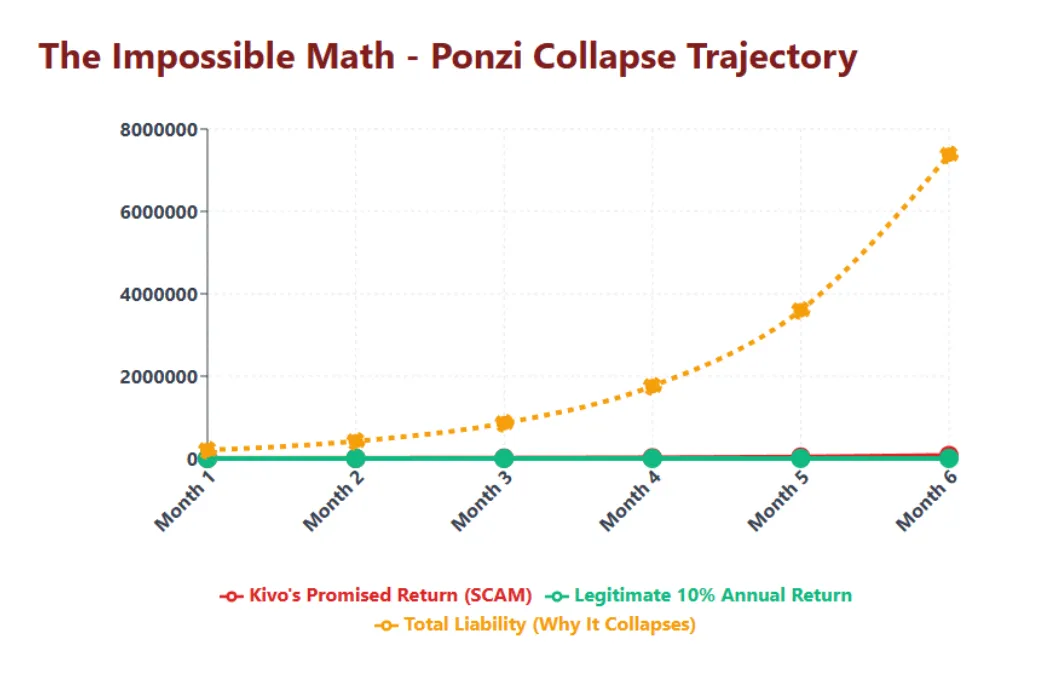

Promised yields sound high. We ran numbers to check. A $1,000 starts at 2.4% daily compound interest fast.

Days | Amount ($) |

0 | 1,000 |

30 | 2,037 |

60 | 4,150 |

90 | 8,453 |

120 | 17,218 |

150 | 35,075 |

180 | 71,448 |

210 | 145,543 |

240 | 296,476 |

270 | 603,932 |

300 | 1,230,232 |

330 | 2,506,027 |

360 | 5,104,867 |

This table shows growth. In one year, it hits over $5 million. Real markets can’t sustain this. Banks offer 4-6% yearly. Crypto staking gives 4-8%. This gap signals risk.

Part 3: Security and Support Features

Kivo Trade uses HTTPS. But no 2FA or cold storage details show. Payment methods include USDT. Withdrawals face high fees.

Customer support lacks clear channels. No email or phone on site. Queries often go unanswered. For beginners, this hurts.

The mobile app claims compatibility. Yet, no store links appear. Demo account benefits remain unproven. Users report no access.

3.1 Public Views and Red Flags

Reviews mix. Some call it a scam. Watchdogs list it as a suspect. Clones like investirekivo.com confuse users.

No regulation shows. FCA warns on similar names. Traffic stays low. This fits new schemes.

Social promoters push via YouTube. They link referrals. Past promotions include failed plans.

Part 4: Comparisons to Other Platforms

Kivo Trade vs others differs. Legit sites like Binance offer 4-8% staking. They have licenses. Kivo lacks this.

For crypto trading, Coinbase provides tools with security. Kivo’s automated trading Kivo claims no audits.

Future Outlook

Schemes like this often fail in months. Early users may gain. Later ones lose. Watch for delays in pulls.

Recommendations

Check all claims. Use regulated options. Consult experts before investing.

This Kivo Trade review 2025 stresses caution. Verify everything.

Conclusion

This Kivo Trade review highlights key issues. Weigh options carefully. Safe choices exist elsewhere. Always research fully.

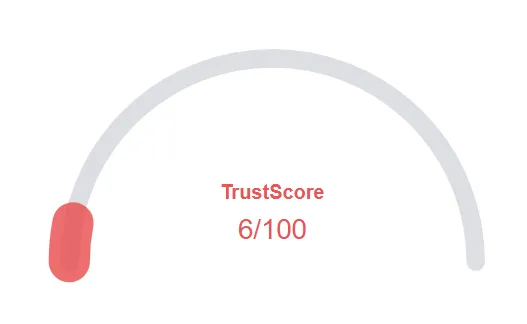

Kivo Trade Review Trust Score

A website’s trust score is an important indicator of its reliability. Kivo Trade currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Kivo Trade or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- DNSFilter considers this website safe

Negative Highlights

- This website does not have many visitors

- This website has only been registered recently.

Frequently Asked Questions About Kivo Trade Review

This section answers key questions about Kivo Trade, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Coinsize is an online trading and investment platform that claims to use AI tools for cryptocurrency and forex profits. However, its Coinsize Review shows limited transparency and no proof of real trading activity.

According to public findings, Coinsize shows no verifiable registration or license, which raises legitimacy concerns. Many Coinsize Review reports suggest it operates like a high-risk investment or Ponzi-style plan.

Coinsize claims daily profits and referral bonuses of up to 5%. But such high ROI promises are not sustainable in real markets. Always verify before investing, as these rates exceed industry averages.

Both Coinsize Review and Everstead Review reveal similar issues — unverified founders, unrealistic earnings, and a lack of regulation. These similarities suggest a need for caution before investing in any such platform.

Everstead Review covers asset-backed ventures, while U Business Review warns of hidden owners and unsustainable crypto returns.

Other Infromation:

Website: kivotrade.com

Reviews:

There are no reviews yet. Be the first one to write one.