U Business Review: Uncovering the Risks and Realities in 2025

This review of U Business. Scams Radar examines the platform behind ubusiness.com. Many people search for honest insights into its operations. We look at ownership, compensation plans, and potential pitfalls. Our goal is to help you decide if it’s worth your time and money. We draw from public records and math checks. Read on for clear facts.

Table of Contents

Part 1: What U Business Claims to Offer

U Business positions itself as a blockchain community. It focuses on tools like AI trading bots and wallets. The site speaks of global reach in over 120 countries. Users see dashboards with tokens called UCN and UPT. It promises income through referrals and bonuses. But questions arise about its setup.

The platform ties to UChain. It markets passive income and tech innovation. Public pages link to brands like Ultima.io and DeFiU.com. All share a Georgia address. Social posts hype bots on exchanges like HTX. They claim unlimited profits in USDT. Yet, tech details stay thin. No open-source code or roadmaps show up.

1.1 Ownership Details and Backgrounds

Transparency matters in any business. U Business lists Senta Tech LLC as the owner. The address is Omar Khizanishvili St. №264, Gldani District, Tbilisi, Georgia. Registration number is 400357403. This comes from site footers and linked pages.

Public records confirm Senta Tech LLC in Georgia’s registry. It’s in the Tbilisi Technology Park Free Industrial Zone. Terms on Ultima.io name it as an operator. Emails like info@ultima.io point there. DeFiU.com shows the same address and number.

But leadership stays hidden. No founders or directors appear on the main site. LinkedIn searches yield no execs tied to this entity. One unrelated Senta profile links to petroleum, not tech. Trademark claims for “UBUSINESS” lack proof. USPTO and Georgia SOS searches find nothing under Senta Tech.

This opacity raises concerns. Legit firms share team bios and docs. Here, users can’t verify who runs things. Georgia’s light crypto rules add risk. If issues hit, accountability seems low.

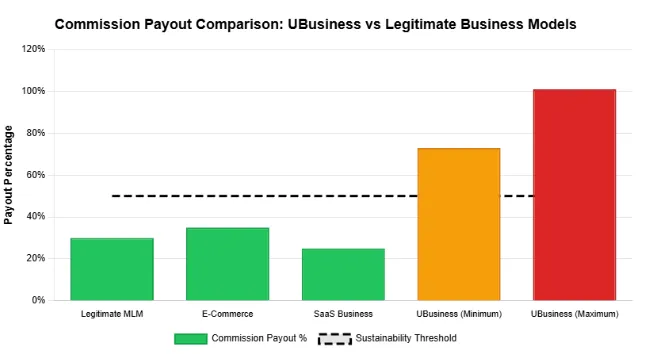

1.2 The Compensation Plan Explained

U Business uses an MLM structure. Dashboards show referral links and sponsor cards. Often, these link to UAE numbers. The plan has three main parts.

- Unilevel Bonus: 40% on direct referrals (Level 1). Then 7% on Level 2, 3% on Level 3, 2% on Level 4, and 1% on Level 5. Total adds to 53% of volume.

- Infinity Bonus: 20% to 48% on all purchases, no depth limit. It’s monthly, with rules on legs and rank cuts.

- Rank Bonuses: One-time rewards in UPT. Examples include Diamond at €1M turnover.

Dynamic compression applies. But bases and caps aren’t clear publicly.

Part 2: Why the Returns Don't Add Up: Math Proof

Let’s break it down simply. Suppose a €100 purchase. Unilevel pays €53 upstream. Add max Infinity at €48. Total hits €101. That’s over the input.

Scale it. With 1,000 recruits at €100 each, the volume is €100,000. Payouts reach €101,000. Shortfall starts small but grows.

Month | Members | Volume (€100 each) | Payouts (101%) | Shortfall |

1 | 2 | 200 | 202 | 2 |

2 | 4 | 400 | 404 | 4 |

3 | 8 | 800 | 808 | 8 |

… | … | … | … | … |

10 | 1,024 | 102,400 | 103,424 | 1,024 |

By year 2, it needs endless new users. Impossible.

Even at lower rates, like 55% effective payout, margins vanish after costs. No room for ops or profits without new cash.

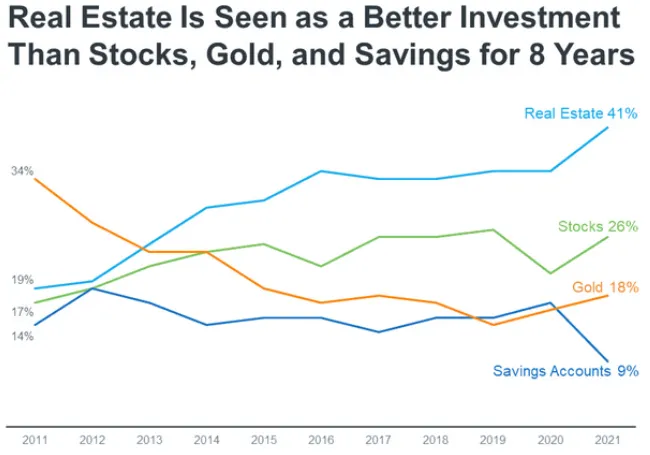

2.1 ROI Comparison: Real Options vs. Claims

U Business implies high yields, like 20%+ monthly from bots. But no audits back it.

Compare to solid choices.

Investment | Average Annual ROI | Risk | Backing |

Real Estate | 8-12% | Medium | Rentals, appreciation |

Bank Savings | 0.4-5% | Low | FDIC insurance |

Crypto Staking | 1-21% | High | Network rewards |

U Business Claims | 100%+ implied | Extreme | Recruitment only |

Real estate offers steady gains from tangible assets. Banks give safe, low returns. Crypto staking on Kraken or Binance averages 5-10%. U Business exceeds them without proof.

Red Flags and Risks

Many signs point to trouble.

- Opaque owners: No exec backgrounds or docs.

- Brand mix-ups: “UChain” clashes with old projects.

- Marketing focus: Social pushes passive income, not tech.

- No audits: Missing for security, tokens, and finances.

- Traffic low: Inferred from X posts, under 10K visits monthly.

- Perception: Sparse reviews; Scamadviser scores high on tech but flags low data.

Security has 2FA for payouts. But no AML/KYC details or contract addresses. Payments use crypto, with risks in withdrawals.

Social promoters like @UChain_Official push bots and Ultima ties. Past promotions include generic crypto.

Public Perception and Tools

Reviews are few. Trustpilot has no specific. X shows promo-heavy sentiment. DYOR tools:

- Scamadviser: 100/100 trust, but surface-level.

- USPTO: No trademarks found.

- Georgia Registry: Verify number 400357403.

Run your checks for updates.

Recommendations for Users

Test small withdrawals first. Demand proofs like audits and T&Cs. Diversify to legit options. Avoid recruiting.

Future outlook: If recruitment drops in 2026, payouts may stop. Watch for delays.

Conclusion: Proceed with Caution

This U Business review highlights high risks. Ownership lacks depth. Compensation math fails sustainability tests. Compare to real ROIs for perspective. Always DYOR. Consult experts. Past results don’t guarantee future. Verify all claims independently. Now visit Rambucks Review 2025.

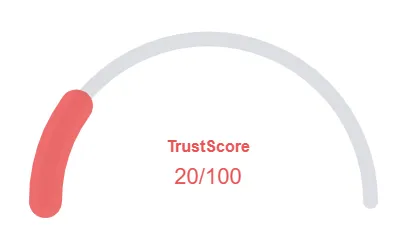

U Business Review Trust Score

A website’s trust score is an important indicator of its reliability. U Business currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with U Business or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- DNSFilter considers this website safe

Negative Highlights

- Several spammers and scammers use the same registrar

- We detected cryptocurrency services which can be high risk

- We found several negative reviews about this site

Frequently Asked Questions About U Business Review

This section answers key questions about U Business, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

U Business is a blockchain platform claiming AI trading and referral income. Our U Business Review finds unclear ownership and risky payout promises.

The platform lacks transparency and audited proof, showing Ponzi-like traits rather than a verified business.

It lists Senta Tech LLC, Georgia, but no public founders or leadership appear, raising trust concerns.

Real estate gives 8–12% ROI, while U Business claims over 100% without evidence or regulation.

Everstead Review covers asset-backed ventures, while U Business Review warns of hidden owners and unsustainable crypto returns.

Other Infromation:

Website: UBUSINESS.COM

Reviews:

There are no reviews yet. Be the first one to write one.