Auto Link Review: A Close Look at the Platform's Promises and Pitfalls

In this Auto Link review, Scams Radar examines the key features of autolink.work. Many people search for details on its setup and risks. We cover ownership, pay plans, and more. Our goal is to help you decide if it fits your needs.

Table of Contents

Part 1: What Is Auto Link and How Does It Work?

Auto Link positions itself as a volunteer-based system in New Delhi, India. It claims to link donors with those in need. No fees or middlemen, they say. Users sign up, verify, match, and deal directly. The site stresses that they handle no funds. Donations are voluntary. No returns expected.

Yet internal docs show a different side. They describe a structured flow. Users provide help (PH) and get help (GH). This involves packages, fees, and timed payouts. It uses USDT for transfers. An internal principal fund appears after deposits. This contradicts the public’s no-funds claim.

The process starts with registration. Add a crypto wallet. Pay an activation PIN. Then PH to assigned recipients. Matches happen daily at midnight. Withdrawals go via USDT or UPI/cash. Min is ₹5,000. Support is 24/7 via email or helpline.

1. 1 Ownership and Transparency Issues

Who runs Auto Link? Details stay hidden. The domain was registered on August 5, 2025. WHOIS data uses a privacy service from Iceland. Registrar is NameCheap. Servers on AWS in India. No team names or bios listed. Just “New Delhi-based” founders as philanthropists.

In India, real charities register as societies or trusts. None here. No office address beyond the city. This lack raises concerns. If issues arise, accountability is hard. Hidden owners often signal risks in financial setups.

We searched for founders. No clear profiles found. Backgrounds unknown. This opacity fits patterns in questionable programs.

Part 2: The Compensation Plan Explained

Auto Link’s plan centers on packages and affiliates. Three levels exist.

Package Name | PH Amount | PIN Fee | Total Cost | Promised GH Total |

Foundation | ₹10,000 | ₹1,000 | ₹11,000 | ₹25,000 |

Advance | ₹50,000 | ₹5,000 | ₹55,000 | ₹125,000 |

Elite | ₹100,000 | ₹10,000 | ₹110,000 | ₹250,000 |

GH payouts every 10 days. Four match the PH amount. Fifth needs 8 direct recruits. Total 150% gross in 50 days. Net around 140% after fees.

Affiliate structure: 15 levels. 8% on directs. Then 3%, 2%, down to 1%. Levels unlock with recruits. One direct gives 2 levels. Eight unlocks all.

This ties earnings to recruitment. Not donations. It mimics referral programs in other systems.

2.1 ROI Claims and Why They Fall Short

Promised returns sound high. Foundation: 127% net in 50 days. About 2.55% daily. But math shows issues.

Sustainability needs endless new joins. Each user recruits 8 for full access. Model: Start with 1. Level 1: 8. Level 2: 64. Level 3: 512. Level 4: 4,096. Level 5: 32,768. By level 10, billions needed. Impossible.

If growth slows, payouts stop. No real revenue source. Just inflows from new users.

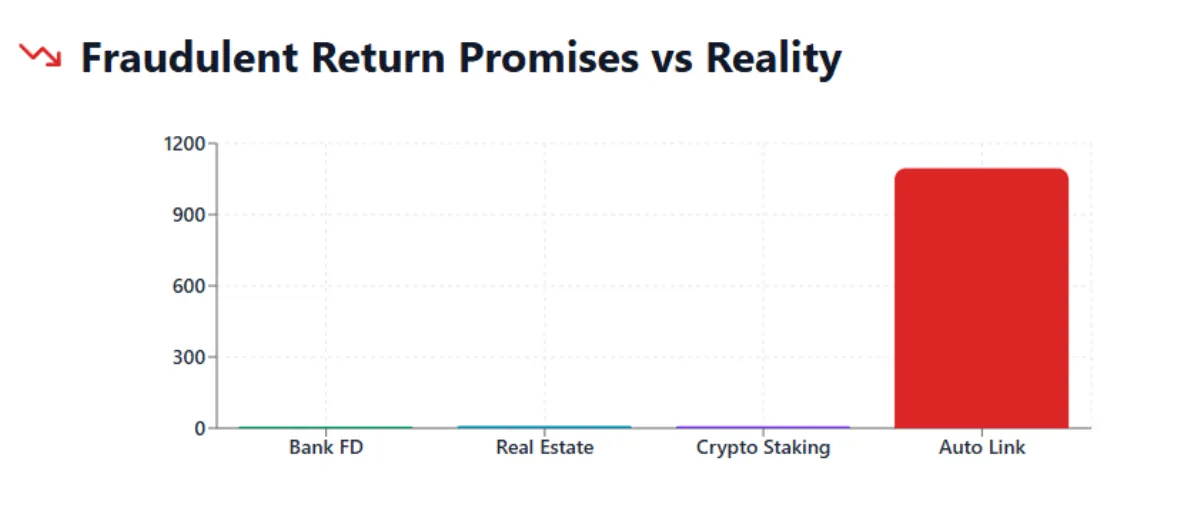

2.2 Comparisons to Real Investments

Auto Link’s yields beat safe options. See below.

Investment Type | Annual ROI | Daily ROI | Risk Level |

Bank FD (India) | 6-7% | 0.016-0.019% | Low |

Real Estate (India) | 8-12% | 0.022-0.033% | Medium |

Crypto APY (Stablecoins) | 5-10% | 0.014-0.027% | High |

Auto Link claims 3% daily. Over 1,000% yearly. No match in regulated spaces. Banks offer security. Real estate gives steady growth. Crypto staking on Binance or Coinbase yields audits. Nothing near Auto Link without huge risks.

Red Flags to Watch

Several signs point to problems.

- Legal bans: India’s 1978 Act outlaws money circulation schemes. This fits with recruitment for payouts.

- Contradictions: Site says no funds handled. Docs show USDT deposits and internal balances.

- Recruitment focus: Final GH locked behind 8 directs pay-to-play feel.

- Hidden owners: No transparency on team or registrations.

- High returns: Unsustainable without constant new money.

- Crypto use: USDT allows anonymity. Hard to trace.

- Low traffic: New domain, minimal visitors. Relies on word-of-mouth.

- No audits: Zero financial proofs or charity status.

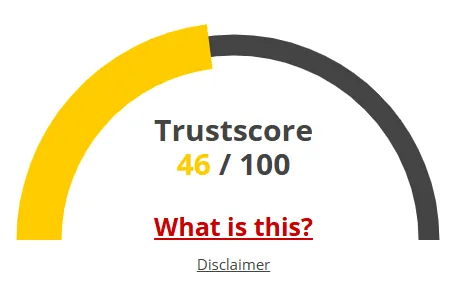

Public views? ScamAdviser gives low trust. Hidden owner, young site, slow load. Similar schemes face probes.

DYOR Tool Reports

Check these for verification.

- ScamAdviser: Low score. Hidden data, new domain, negative refs.

- URLVoid: No major flags, but limited info.

- Sucuri: No malware. Monitor changes.

- WHOIS: Privacy shielded. Registered 2025.

- SSL Labs: Basic SSL. No org validation.

Run your own scans. Save reports.

Social Media and Promotions

No official handles found. Promotions are likely in private groups like WhatsApp. X searches show unrelated referrals. For example, Tesla incentives or crypto projects like NATIX. No direct Auto Link promoters identified. Past schemes by similar networks include gifting clubs.

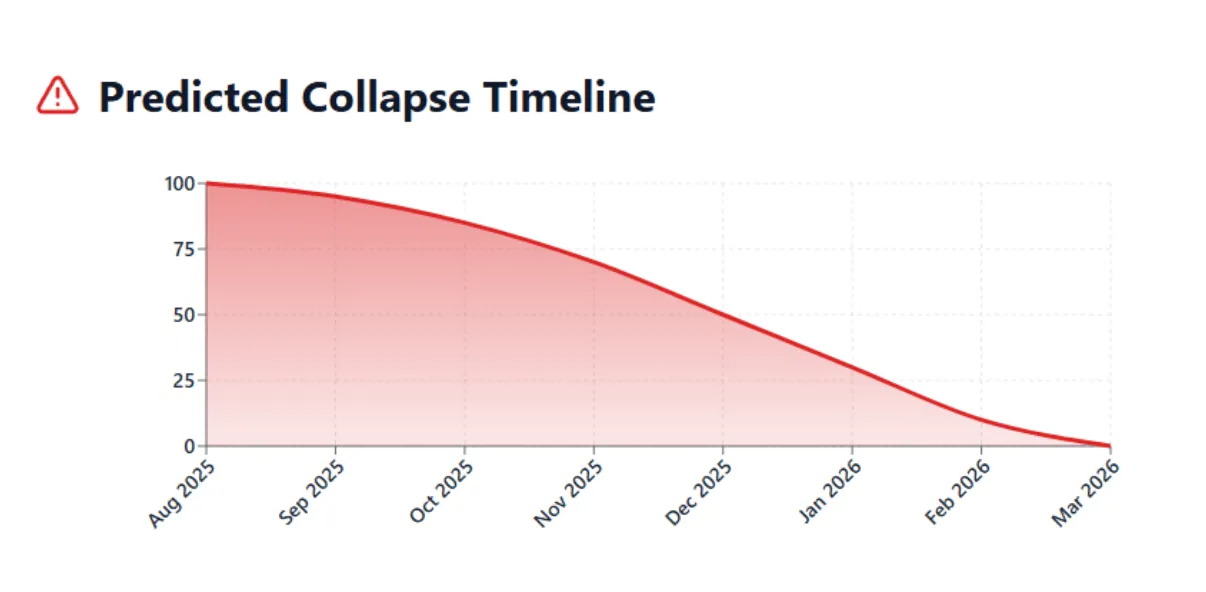

Future Outlook

Early joiners may see payouts. But by 2026, the slowdown hits. Delays, then collapse. India cracks down on MLMs. The site may vanish.

Final Thoughts

This Auto Link review highlights major concerns. High returns tempt, but math and laws warn against them. Stick to proven options like banks or real estate. Always check facts yourself. Consult experts before any move. Stay informed to protect your funds.

Auto Link Review Trust Score

A website’s trust score is an important indicator of its reliability. Auto Link currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Auto Link or similar platforms.

Positive Highlights

- DNSFilter labels this site as safe

- We found a valid SSL certificate

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- The registrar of this website is popular amongst scammers

- The references on Social Media were negative

- The age of this site is (very) young.

Frequently Asked Questions About Auto Link Review

This section answers key questions about Auto Link Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Auto Link shows red flags like hidden owners, unrealistic ROIs, and referral-based payouts, signs of a likely scam.

It relies on new user deposits to pay earlier members, not from real business income, a classic Ponzi pattern.

High risk of losing funds due to lack of transparency, fake charity claims, and possible legal violations in India.

Real options like banks or real estate have audited returns; Auto Link offers none, just promises of quick profits.

Like the Everstead Review, Auto Link shows false ROI claims, secret management, and unsustainable payout plans.

Other Infromation:

Website: autolink.work

Reviews:

There are no reviews yet. Be the first one to write one.