Veles Finance Review: Legit Trading Bot or Risky Gamble?

Veles Finance review starts with a key question for crypto traders: Can this platform deliver reliable automated crypto trading? Launched in 2021, Veles Finance offers tools for building cryptocurrency trading robots. Users connect via API to exchanges like Binance and Bybit. But concerns about ownership, fees, and returns linger. Scams radar’s guide breaks it down simply.

Table of Contents

Part 1: What Is Veles Finance?

Veles Finance is a cloud-based trading platform. It lets users create bots for spot and futures markets. No coding needed. You pick strategies, indicators, and signals. The site claims over 45,000 users and $79 million in profits. Key features include backtesting, risk tools like stop loss, and 24/7 monitoring.

Supported exchanges include Binance, OKX, Bybit, BingX, Gate.io, and HTX. A recent BingX integration highlights automation for beginners. Funds stay on your exchange account. Veles has no access. This setup appeals to those seeking crypto trading automation without custody risks.

1.1 Ownership and Team Profiles

Transparency matters in crypto. Veles lists a legal entity: VELES MIDDLE EAST – FZCO, LLC, based in Dubai Silicon Oasis, UAE. Founded around 2021, it raised $500,000 in pre-seed funding from Afford Capital and DF101.

Team details appear on the site. CEO Vladislav Kriger handles strategy. CTO Ruslan Molchanov oversees tech. COO Arkadiy Amiryan manages operations. Other roles include marketing and support leads. LinkedIn links exist, but verification is limited. No deep bios or past roles shared. This opacity raises questions. In a space with rug pulls, full profiles build trust. External checks like PitchBook confirm the entity, but independent audits are missing.

1.2 Compensation Plan Explained

Veles uses a performance-based model. No upfront subscriptions. They take 20% of your profits, capped at $50 per month per bot. No fees on losses. This aligns incentives. You pay only when you win.

Top-ups for fees use BEP-20 tokens. Cards are planned. A $5 welcome bonus helps new users test. Minimum deposits start at $30 for bots.

The referral program offers 30% of referred users’ earnings, up to $15 monthly per referral. Influencers get outreach. Details at veles.finance/en/partnership. High payouts encourage sharing, but can skew reviews. Compared to 3Commas’ $29–$99 monthly fees, Veles seems user-friendly. Yet, if bots fail, it feels misleading.

Compensation Element | Details | Pros | Cons |

Core Fee | 20% of profits, $50 cap/month/bot | Pay only on wins | Caps limit big earners |

Referral Payout | 30% of referrals’ earnings, $15 cap/referral | Easy income boost | May attract biased promoters |

Top-Up Method | BEP-20 tokens | Quick crypto transfers | No chargeback protection |

Bonus | $5 for sign-up | Low entry barrier | Tied to challenges |

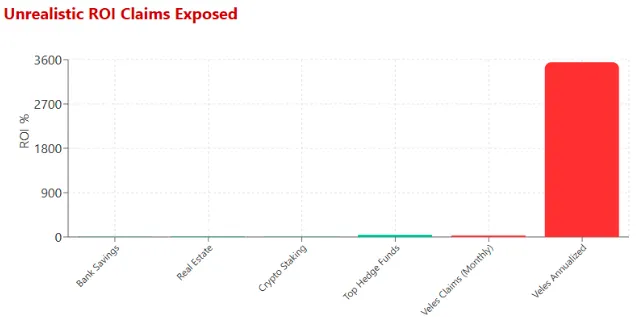

Part 2: ROI Claims and Why They Fall Short

Veles shows ready-made bots with monthly returns like +29.59% for ADA Long or +5.82% for BNB Miner. These look tempting. But math reveals issues.

Use compound interest: A = P(1 + r)^t. For $1,000 at 29.59% monthly (r=0.2959, t=12 months), it grows to about $35,480 yearly. That’s 3,548% annualized. Over two years, over $1 million.

Real crypto averages 5–15% yearly for pros. Martingale strategies in bots have double risks. A 50% dip can wipe most capital.

Proof: Efficient markets limit such gains. Top funds like Renaissance hit 39% yearly with experts. Veles’ backtests may pick up bull runs. Live trades add fees, slippage, and latency.

2.1 Comparisons to Safer Options

Veles claims eclipse basics.

Investment | Annual ROI | Risk | Why Compare? |

Bank Savings | 0.4–5% | Low | Insured, stable |

Real Estate | 4–10% | Medium | Tangible, hedge inflation |

Crypto Staking | 2–7% | Medium-High | Passive, audited |

Part 3: Security Measures and Technical Setup

API connections keep funds safe. No withdrawal permissions needed. The site claims low latency and monitoring. But no Certik audits. Encryption details are vague.

Content feels authentic, with blog posts on blockchain. Yet, much is promotional. Payment via exchanges only. Support through Zoom consults and forms. Responses praised, but delays on issues.

3.1 Public Perception and Traffic Trends

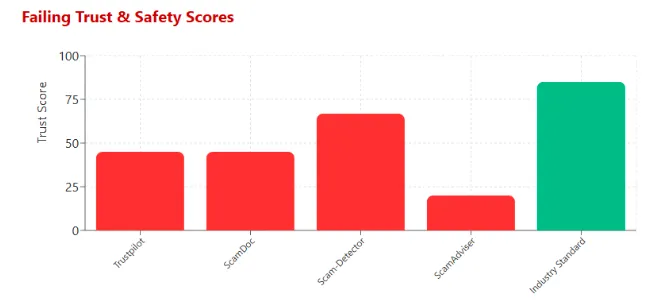

Trustpilot: 4.5/5 from 48 reviews. Positives note easy UI. Negatives cite losses. Polarized, common in crypto.

Traffic: 50,000 monthly visits, mostly Russia. Global rank 35,810. Spikes during promos. Low vs. Bybit’s millions.

Social promoters: @velesfinance official. Affiliates like @canersaltik push Veles bots. Past promotions: WeAlgo, Bybit. Low engagement signals hype over substance.

Red Flags to Watch

- Hidden team depths.

- Unreal ROIs.

- Low trust scores: ScamAdviser low, ScamDoc 45%.

- Paid PR like Chainwire.

- Martingale risks.

- BEP-20 only for fees.

How to Use Veles Finance Safely

For beginners: Start with a demo. Set up Veles both step by step via API. Use signals like RSI, Bollinger. Backtest strategies.

Security: Enable 2FA, monitor keys. No mobile app yet. Account verification basic.

Referral details: Earn via links. But verify users.

Future Outlook

In 2025, tighter regs may force more transparency. Veles could grow with integration. But complaints may rise if returns falter.

Conclusion: Weigh Risks Carefully

This Veles Finance review shows promise in automation but flags on sustainability. For automated cryptocurrency trading, compare options. Always DYOR. Crypto volatility means never risk more than you can lose. Safer paths like staking exist. Stay informed about smart choices.

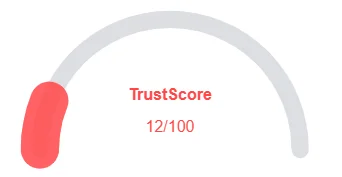

Veles Finance ReviewTrust Score

A website’s trust score is an important indicator of its reliability. Veles Finance currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Veles Finance or similar platforms.

Positive Highlights

- The SSL certificate is valid

- This website is (very) old

- This website is safe according to DNSFilter

Negative Highlights

- Whois details are concealed.

- The registrar has a high % of spammers and fraud sites

Frequently Asked Questions About Veles Finance Review

This section answers key questions about Aarman, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

NodeWaves is a blockchain-based platform that lets users run validator nodes and earn rewards. It simplifies node hosting without needing advanced technical skills.

NodeWaves shows transparency about its technology but offers limited details about its team and audits. Always start with small investments and do your own research (DYOR).

Returns depend on token volatility, network performance, and fees. Promised high ROIs are not guaranteed and carry significant market risks.

Both platforms emphasize passive income, but Everstead Review highlights more regulatory compliance details. NodeWaves needs stronger audits to match that trust level.

Yes, NodeWaves provides email-based support and lets users withdraw staking rewards anytime, though response times may vary.

Other Infromation:

Website: veles.finance

Reviews:

There are no reviews yet. Be the first one to write one.