Aarman Review: All You Need to Know About This Tech and Investment Platform

If you’re searching for an Aarman review, you’ve landed in the right place. This platform promises custom software development and high-yield staking opportunities. But does it deliver? Let’s break it down step by step. Scams Radar will look at ownership details, the full compensation plan, and real risks for everyday users.

Table of Contents

Part 1: Aarman Review: Ownership and Corporate Background

Owership: Clear ownership builds trust in any tech firm. Aarman Technologies Pvt. Ltd. keeps things vague. The domain dates back to November 2000. Yet the current setup, focused on staking and IT services, started in late 2024. Privacy shields hide the registrant’s name.

The company lists a Hong Kong address. Checks show it points to a plain factory building. No signs of real operations there. A marketing office in Kuala Lumpur fares no better. It ties to a generic tower, far from active business.

Public records fall short. No filings on Crunchbase or company registries link to staking leads. Glassdoor mentions a small hardware group with 1-50 staff. That seems unrelated to Aarman’s claims in AI solutions or Arman custom software.

Who runs it? No executive profiles surface on LinkedIn. Searches yield mismatched names like Armaan Bindra in unrelated tech roles. This lack of transparency raises questions. For a firm pushing Arman IT solutions and Arman digital transformation, you’d expect named leaders with track records.

- Key Concern: Hidden details make accountability hard.

- What It Means for You: Without clear backgrounds, spotting issues early gets tough.

Part 2: Aarman Review: The Full Compensation Plan Explained

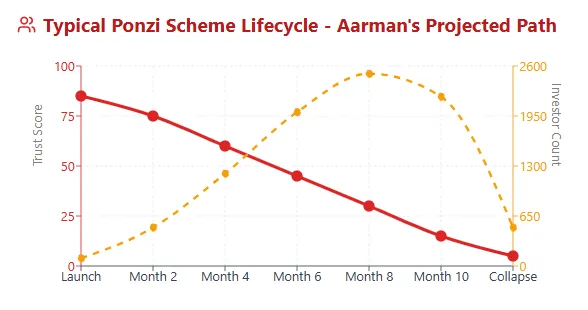

Aarman’s draw lies in its staking model using Beldex (BDX) tokens. It blends passive returns with recruitment rewards. No retail products exist. Earnings come from deposits and team building.

The plan splits into fixed and regular options. Plus, a multi-level marketing (MLM) layer with 40 ranks. Let’s unpack it simply.

2.1 Fixed Investment Plans

Lock in your BDX for a lump sum later. Higher stakes mean better multipliers.

Plan Type | Investment (BDX) | Return Structure | Annualized ROI (%) |

Fixed 3-Year (5k-50k BDX) | 5,000 – 50,000 | 250% lump sum | ~35.7 |

Fixed 5-Year (5k-50k BDX) | 5,000 – 50,000 | 400% lump sum | ~38.2 |

Fixed 3-Year (Higher Tiers) | 100,000+ | 265-320% lump sum | ~35-40 |

Fixed 5-Year (Higher Tiers) | 100,000+ | 425-500% lump sum | ~38-45 |

2.2 Regular Investment Plans

Get steady payouts on half your stake. The rest grows to maturity.

For a 10,000 BDX stake in a 3-year regular plan: Earn 2.4% monthly on 5,000 BDX (120 BDX/month). That’s 4,320 BDX over three years. Plus, the other 5,000 doubles to 10,000 at the end. Total: About 19,320 BDX from 10,000. Simple math shows 23.7% yearly return.

To calculate: Use (final amount / start amount)^(1/years) – 1. Here, (1.932)^(1/3) – 1 = 0.237 or 23.7%.

Higher tiers push to 3% monthly or more. But daily rates like 3.25%? That sounds off—likely a pitch error.

2.3 MLM Recruitment Side

Build a binary team. Earn residuals on the weaker leg: 6-12% of new deposits daily. Half must reinvest. Ranks start at “Deciders” (1,000 BDX downline) and climb to “Titan Elite” (80 million BDX split). Bonuses hit big: 50 million BDX for top spots.

Caps limit earnings to your stake. Reinvest to keep going. This setup favors recruiters over stakers.

Promoters pitch Arman software development as a side perk. Yet focus stays on BDX yields.

Part 3: How Aarman Positions Itself in IT Services

Aarman claims expertise in Arman IT services like Arman custom software and Arman web application development. They highlight Arman AI solutions, Arman data analytics, and Arman Salesforce integration. For startups, Arman MVP development shines. Businesses eye Arman process automation and Arman cloud services.

The site touts Arman chatbot development and Arman e-commerce software tools. Benefits include Arman solutions for operational efficiency and Arman impact on business growth. How does Arman Solutions work? It promises end-to-end from idea to launch.

Arman software review notes praise scalability. Arman technology stack covers modern tools. Arman software customization options fit needs. Plus, Arman API development services boost connectivity.

Support comes via Arman software user support. Costs? Arman software cost benefits aim low. Reliability? Arman software reliability gets nods in pitches.

But ties to staking blur lines. Is this a true Arman innovative IT solutions provider? Or a front?

3.1 Aarman Review: Traffic, Perception, and User Views

Traffic hits 112,000 visits monthly. Almost all from India. Not Hong Kong or Malaysia. This gap flags marketing tricks.

Trustpilot scores 4.8/5 from 149 reviews. Most from India, gushing over returns. Yet critics spot fakes. Scam Detector gives 50.9/100: Questionable.

Users on YouTube warn: “Aarman Review: THIS IS A SCAM!” Facebook pages push “Aarman Community: Beldex Staking.”

Arman customer reviews mix praise for Arman IT consulting services with complaints on delays.

3.2 Security and Technical Check in Aarman Review

The site uses HTTPS and Cloudflare for protection. No malware flags. Gridinsoft rates it 100/100 for basics.

Yet proximity to risky sites hurts trust. No proof-of-reserves audit. Withdrawals? BDX-only, with potential locks.

For Arman performance monitoring, claims sound solid. But real tests are lacking.

Part 4: Red Flags and ROI Comparisons

Watch these:

- No owner bios or audits.

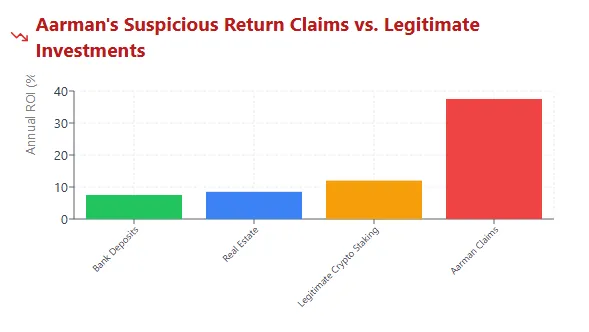

- Returns beat norms: 30%+ vs. banks at 5-10%.

- Recruitment push screams pyramid.

- India-heavy traffic vs. global claims.

Compare ROIs visually. Imagine a bar chart: Banks at 7.5%, real estate 8.5%, legit staking 10%, Aarman 35%. The red bar towers—too good, too risky.

Type | Avg. Annual ROI | Backed By |

Bank Deposits | 5-10% | Insurance |

Real Estate | 7-10% | Assets |

Crypto Staking | 3-15% | Network Fees |

Aarman Claimed | 25-45% | New Deposits? |

4.1 Promoter Profiles in Aarman Review

Promotion runs via socials. Facebook’s “Aarman – Creating crypto” shares plans. WhatsApp groups recruit.

Mikivcard.com lists GBR Associates as promoters. Tamil Nadu base, Hong Kong tie. Past pushes? Similar staking gigs.

X and YouTube tutorials guide “How to stake Beldex in Aarman.” No deep histories found. Early joiners cash out; late ones wait.

Final Thoughts on Aarman Review

Aarman blends Arman tech solutions with bold staking. Ownership opacity and wild returns signal caution. For Arman digital transformation seekers, demand proofs. Skip big bets, test small. Also check out our latest article of VIM Review on Scams Radar.

Seek Arman software project management details. Weigh Arman AI-driven alerts against risks. True growth needs solid ground.

DYOR Disclaimer: Research independently. This isn’t advice. Consult pros.

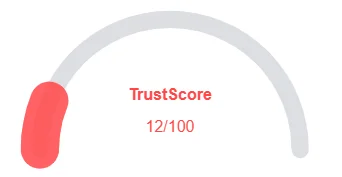

Aarman Review Trust Score

A website’s trust score is an important indicator of its reliability. Aarman currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Aarman or similar platforms.

Positive Highlights

- The SSL certificate is valid

- This website is (very) old

- This website is safe according to DNSFilter

Negative Highlights

- Whois details are concealed.

- The registrar has a high % of spammers and fraud sites

Frequently Asked Questions About Aarman Review

This section answers key questions about Aarman, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Arman Solutions stresses custom software and AI-driven tools for efficiency.

VIM was co-founded by Brent Payne and Linda Baer. Payne has a long history with personal development ventures such as Liberty League International, Avant Global, and Real Estate Worldwide — many of which ended amid scrutiny or decline.

Yes, with flexible Arman technology stack options.

It cuts costs and boosts Arman solutions for operational efficiency.

Reviews highlight Arman MVP development strengths, but verify support.

Other Infromation:

Website: aarman.com

Reviews:

There are no reviews yet. Be the first one to write one.