Evaluating the Legitimacy of Xsynergy Review as a Rewards Platform

In this XSynergy review, we examine the platform at xsynergy.io, a site claiming to offer decentralized rewards through blockchain technology. Launched recently, it promises easy earnings via staking and referrals. Investors should approach with caution due to several concerns. This analysis combines public data, ownership checks, and performance metrics to help you decide. Now Visit Scams Radar.

Table of Contents

Part 1: Understanding the XSynergy Platform

XSynergy positions itself as a trustless reward engine. It converts USDT into daily earnings using a hybrid time-mining and vault staking protocol. Users connect wallets, stake funds, and receive payouts in XSYN tokens. The system emphasizes automation, with no need for middlemen or KYC checks. Key highlights include automated payouts, global access, and on-chain transparency.

The tokenomics feature a fixed supply of 88,888,888 XSYN tokens. The token symbol is XSYN, and its contract address is on the Polygon blockchain. NFTs are mentioned for added utility, like unlocking rewards. However, the site blocks crawlers, limiting public scrutiny.

1.1 Ownership and Background Details

Ownership remains opaque. The domain xsynergy.io uses privacy protection, hiding registrant details through a service like NameCheap. No team bios or company registration tie directly to the platform. A search reveals XSynergy Limited, an Irish entity formed in 1999, with directors Colin Fitzpatrick and Siobhan Hearne-Fitzpatrick. It reports modest assets of about €69,698. But this company focuses on integration services, not crypto rewards. The link to xsynergy.io appears coincidental or misleading. No verifiable profiles match the crypto operation, raising accountability issues.

Part 2: The Complete Compensation Plan Explained

The compensation plan centers on a hybrid matrix model. It blends active referrals and passive staking. Users join via referral links and fill matrix slots for commissions.

2.1 Active Earnings Through Matrices

- XSynergy 1 Matrix: 3-wide structure. Spots 1 and 2 pay 100% to you. Spot 3 spills to upline and cycles.

- XSynergy 2 Matrix: 6-wide. Slots 1-2 go to upline, 3-5 to you, slot 6 reinvests.

- Revenue distribution: 30% to each matrix, 25% to staking, 10% to reserves, 5% burned.

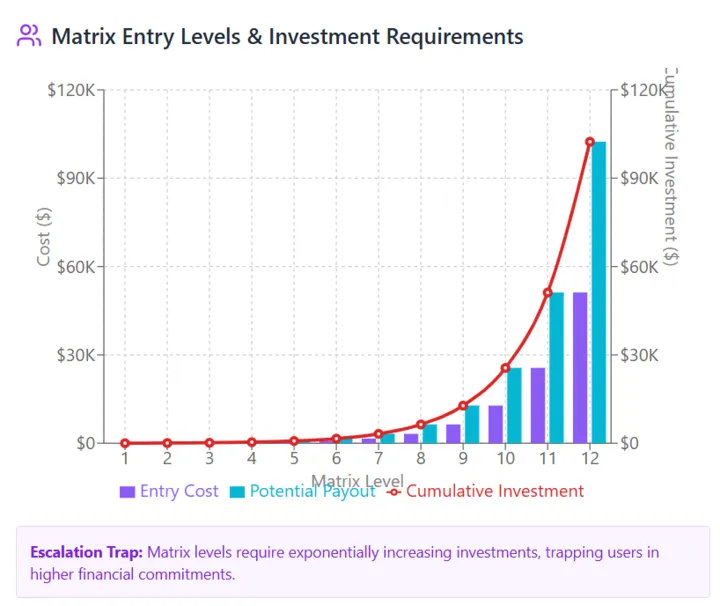

Entry levels start at $25 and climb to $102,400. Referrals boost earnings, with a 10% APY bonus per friend.

2.2 Passive Earnings Via Staking

Stake XSYN in the SynerVault for yields. Tiers offer up to 370% APY over 125 days, claiming 4X returns on high entries. Funds auto-convert and lock, paying instantly to wallets.

This setup relies on recruitment. New inflows fund payouts, typical of MLM systems. No product sales occur beyond tokens.

2.3 ROI Claims and Why They Are Unsustainable

XSynergy touts high yields, like 90-370% APY. Let’s break it down mathematically.

Assume a $1,000 stake at 370% annual APY.

- Daily rate: 370% / 365 ≈ 1.01%.

- Over 125 days: Future value = $1,000 × (1.0101)^125 ≈ $3,710 (near 4X).

For sustainability, consider a 2% daily return (conservative estimate from similar schemes).

- Formula: A = P(1 + r)^t

- After 30 days: $1,000 × (1.02)^30 ≈ $1,811.

- After 365 days: $1,000 × (1.02)^365 ≈ $1,377,408 (1,377% ROI).

- After 365 days: $1,000 × (1.02)^365 ≈ $1,377,408 (1,377% ROI).

Such growth demands endless new users. If recruitment stalls, the vault depletes. Real sources? Only entry fees, not external revenue. This mirrors Ponzi dynamics, where early participants gain at later ones’ expense.

2.4 Traffic Trends and Public Perception

Traffic data is absent due to indexing blocks. Early launch stats show 537 members and $197,975 in rewards in 24 hours. Public sentiment is limited. Scamadviser rates it very low trust, citing anonymity and scam indicators. No reviews on Trustpilot or Reddit for this exact site. Promotions occur in closed groups, echoing high-risk hype.

Part 3: Security Measures and Content Authenticity

Claims include immutable code and on-chain audits by users. Subgraphs on The Graph handle data. But no third-party audits like CertiK appear. Content repeats buzzwords like “trustless” and “automated,” lacking depth. Authenticity suffers from unverified promises.

3.1 Payment Methods and Customer Support

Payments use USDT on Polygon, with MATIC for fees. Instant withdrawals to personal wallets. Support relies on Zoom presentations and WhatsApp groups. No formal helpdesk or phone lines exist.

3.2 Technical Performance

Post-launch, liquidity exceeded $100K on Polygon and Ethereum. Token price rose 400% initially. No downtime reported, but scalability untested.

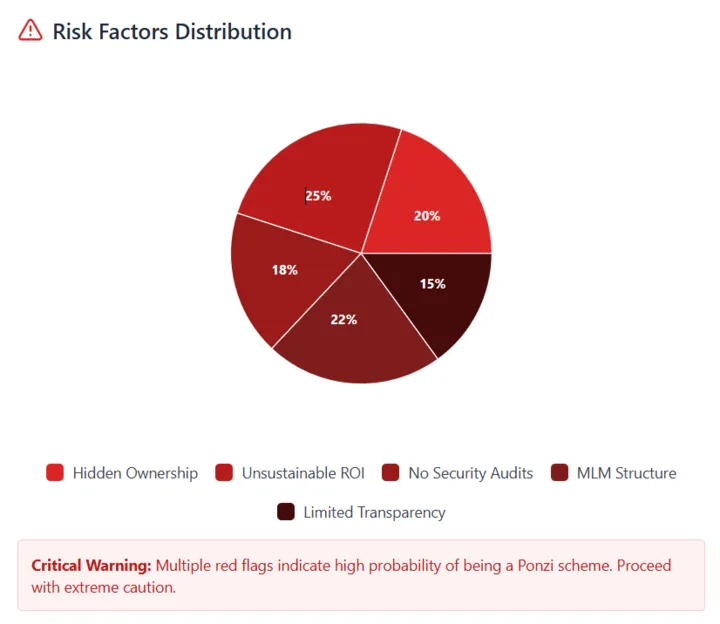

3.3 Red Flags in This XSynergy Review

Category | Issue | Implication |

Ownership | Hidden details | No accountability |

Compensation | Recruitment focus | Pyramid risk |

ROI | Extreme yields | Unsustainable math |

Security | No audits | Exploit potential |

Transparency | Crawler blocks | Hides scrutiny |

Promotion | Referral hype | Echo chamber |

3.4 Comparison to Real Investment Options

Option | Annual ROI | Risk | Notes |

XSynergy (claimed) | 728%+ | Extreme | Recruitment-dependent |

Bank Savings | 3-5% | Low | Insured stability |

Real Estate | 7-10% | Medium | Asset-backed |

Crypto Staking (e.g., Binance) | 3-10% | High | Audited protocols |

Part 4: Clarifying Confusion: This Is Not Synergy Project Management Software

If you searched for XSynergy user review 2025 or Synergy project management, note this xsynergy.io is unrelated. Synergy project management is a cloud-based tool for AEC firms, offering project planning software, task management software, and resource management tools. It includes project tracking software, project collaboration features, budgeting software, project analytics, invoicing software, and project reporting tools.

4.1 Key Features for AEC Project Management

Features like work breakdown structure, KPIs tracking software, and project dashboard make it ideal for project management for AEC firms. Synergy project scheduling features allow resource allocation in XSynergy, XSynergy financial tracking, and project milestone tracking Synergy. Task delegation in XSynergy, Synergy project notifications, Synergy project budgeting tool, and time tracking in XSynergy enhance efficiency.

XSynergy project report examples show Synergy collaboration tools and project cost monitoring with XSynergy. As a Synergy cloud-based project management solution, it offers Synergy integration with Xero, invoicing and billing in XSynergy, and Synergy project performance analysis. Task follow-up reminders Synergy, multi-project dashboard Synergy, Synergy task assignment workflow, and Synergy software customer feedback highlight its usability.

Synergy interface usability, Synergy timesheet management, XSynergy software pros and cons, and Synergy project management automation set it apart. Positive reviews praise its ease for engineering practices. This crypto site shares a similar name but lacks these functions.

4.2 Social Media Profiles Promoting XSynergy

The official handle is @Xsynergy_io, with 38 followers, posting launch updates and Zoom invites. Promoter @AmarinTommy shares referral links and videos. His past promotions include L7DEX, SoulAgain NFTs, and CryptoElitesClub—patterns of short-lived opportunities.

DYOR Tool Reports for XSynergy

- Scamadviser: Very low trust score, possible scam.

- WHOIS: Hidden ownership.

- DEXTools: Tracks liquidity pairs.

- PolygonScan: Verifies contract.

- No Trustpilot reviews; unrelated Synergy entries appear.

Future Predictions for XSynergy

Short-term growth possible via hype, reaching 10,000 users. Medium-term: Recruitment slows, yields drop, 70% rug pull chance. Long-term survival low without audits.

Recommendations for Potential Investors

Verify all claims independently. Avoid deposits without audits. Compare to regulated options. Report suspicions to authorities. If invested, withdraw principals fast.

Conclusion: Proceed with Extreme Caution in This XSynergy Review

XSynergy at xsynergy.io shows classic high-risk traits: anonymous owners, unsustainable math, and MLM reliance. While early stats impress, collapse seems likely. True opportunities build on transparency, not hype. For safe choices, explore audited platforms. Always consult experts before investing. This review underscores the need for diligence in volatile spaces. Matronix 2.0 Review.

XSynergy Review Trust Score

A website’s trust score is a critical indicator of its reliability. XSynergy currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with XSynergy similar platforms.

Positive Highlights

- Content accessible

- Error-free

- Public WHOIS data

Negative Highlights

- AI shows a low review score.

- The archive is recently created.

- Whois details are concealed.

- The domain is not listed in Tranco’s top 1M.

Frequently Asked Questions About XSynergy Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

XSynergy is a blockchain-based platform claiming to offer rewards through hybrid matrix referrals and staking, but it raises major risks.

Ownership is hidden. WHOIS data is private, and no verifiable team details link to the crypto project.

No. Promised returns of 90–370% APY are mathematically unsustainable and rely on constant new recruits.

No third-party audits like CertiK exist, making the system vulnerable to exploits and lacking trust.

High risks, hidden ownership, and MLM-style payouts make it highly unsafe. Experts advise extreme caution.

Other Infromation:

Website: xsynergy.io

Reviews:

There are no reviews yet. Be the first one to write one.