Matronix 2.0 Review: Is This Blockchain Platform a Legit Opportunity or a Risky Scheme?

Investing in cryptocurrency platforms like Matronix 2.0 can seem exciting, but is it safe? This Matronix 2.0 review dives deep into its legitimacy, risks, and sustainability for investors.

Scams Radar will analyze ownership, compensation plans, traffic, public perception, security, and ROI claims. Backed by data, charts, and clear comparisons, this guide helps you decide if Matronix is worth your time and money. Always do your own research (DYOR) before investing

Table of Contents

Part 1: What Is Matronix 2.0?

Matronix 2.0 markets itself as a decentralized blockchain platform promising “unlimited USDT earnings” through a 2×2 matrix referral system. It claims to offer smart contract automation, secure transactions, and passive income via USDT-based rewards. But flashy promises often hide risks. Let’s break it down.

1.1 Ownership: Who’s Behind Matronix 2.0?

Transparency builds trust, but Matronix 2.0 lacks it.

- Anonymous Owners: No company name, founder profiles, or legal entity is disclosed on the site. Legitimate platforms like Binance list their leadership and licenses clearly.

- Domain Details: Registered on September 4, 2025, via NameCheap with privacy protection (Withheld for Privacy ehf, Iceland). The DNS SOA email is tgigroup36@gmail.com—a free Gmail account, not a corporate one.

- Hosting: Runs on a Hetzner VPS (Finland, IP: 135.181.226.253) alongside other questionable sites like finixiocapital.com and bigdaddypro.live. Shared hosting with “get-rich” schemes is a red flag.

Why It Matters: Hidden ownership and informal infrastructure suggest potential for unaccountability. Investors deserve to know who controls their funds.

Part 2: Compensation Plan: How Does It Work?

Matronix 2.0 uses a 2×2 matrix system, a classic multi-level marketing (MLM) structure. Here’s how it breaks down:

- Entry: Users pay ~$20 in USDT (BEP-20) to join via a crypto wallet (e.g., MetaMask).

- Earnings:

- Direct Referrals: Earn 35% ($7 per $20) for each person you recruit.

- Indirect Referrals: Earn from recruits of your recruits across matrix levels.

- Sponsor Bonuses: Extra payouts for building a team.

- Level Upgrades: Pay more USDT to unlock higher reward tiers.

- Royalty & Booster Pools: Passive income for high-level users with active teams.

- Direct Referrals: Earn 35% ($7 per $20) for each person you recruit.

- Withdrawals: Funds go directly to your wallet, but no minimums or fees are specified.

Example (simplified):

- You invest $100 and recruit 2 people ($100 each).

- They recruit 4 more ($100 each).

- You earn $20 per recruit across levels:

- Level 1: 2 × $20 = $40

- Level 2: 4 × $20 = $80

- Total: $120 profit (120% ROI)

- Level 1: 2 × $20 = $40

This depends on constant recruitment, not real-world revenue like trading or staking.

2.1 Chart: Matrix Growth (2x2 Structure)

Level | Recruits | Earnings ($20 per recruit) | Total Users |

1 | 2 | $40 | 2 |

2 | 4 | $80 | 6 |

3 | 8 | $160 | 14 |

Total | 14 | $280 | 14 |

2.2 Why the Compensation Plan Is Unsustainable

he matrix relies on exponential growth. Let’s do the math:

- Scenario: 1 user recruits 4 per level (2 direct, 4 indirect). Each pays $20; you earn $20 per recruit.

- After 10 Levels:

- Total users: ~1,048,575

- Total inflows: $20 × 1,048,575 = $20,971,500

- Total payouts: $20 × 1,048,575 = $20,971,500

- Deficit: New users must cover payouts, requiring ~1.85x more recruits per cycle.

- Total users: ~1,048,575

By Level 15, you’d need ~4 billion users, half the world’s population! This is Ponzi arithmetic: payouts depend on new money, not profits from assets or services.

Part 3: Traffic and Popularity: A Quiet Launch

- Traffic Data: HypeStat reports negligible traffic (<1,000 monthly visits), with no Tranco rank. Legit platforms like Coinbase see millions of visits monthly.

- Trend: No organic buzz. New platforms often spike via promotions, but Matronix 2.0 is a ghost town.

Why It Matters: Low visibility suggests reliance on paid promotions, not genuine interest.

3.1 Public Perception: What Are People Saying?

- Scamadviser: Scores 66/100 (medium risk). Flags include young domain and shared hosting with risky sites.

- Trustpilot/Sitejabber: No reviews. Established platforms have hundreds within weeks.

- Social Media: No official X, Telegram, or YouTube accounts. Promoters like “MLM Gkp” and “TRP MARKETING” (YouTube) push referral links, also hyping schemes like “TRP Olymp Trade” and “rainbnb.” This pattern of serial promotion is a red flag.

Takeaway: Lack of organic chatter and reliance on MLM-style YouTubers raises doubts.

3.2 Security: Promises Without Proof

- SSL: Valid Let’s Encrypt certificate (Sep 4–Dec 3, 2025), but it’s a free, short-term cert, not an Extended Validation (EV) one used by reputable platforms.

- Smart Contracts: Claims “tamper-proof” automation, but no audits (e.g., Certik) or code transparency.

- Site Tech: Built with Bootstrap and jQuery—basic, not robust. Page load times are slow (FCP ~3.6s, LCP ~8.2s).

Risk: Unaudited contracts and budget hosting increase hack or exit-scam potential.

3.3 Content Authenticity: Buzzwords, Not Substance

- Site Content: Heavy on jargon (“decentralized,” “trustless”) but light on specifics. No whitepaper, roadmap, or team bios.

- Repetition: Identical blockchain text blocks appear four times, suggesting a rushed, template-based site.

- No Testimonials: Legit platforms showcase user success or audits; Matronix has neither.

Part 4: Payment Methods: USDT-Only Risks

Only USDT (BEP-20) is accepted, limiting accessibility and reversibility. “Fast” withdrawals are promised, but no details on fees or delays. Crypto-only payments mean no chargeback protection.

4.1 Customer Support: Missing in Action

- Contact: No email, phone, or live chat. Promoters use WhatsApp/Telegram, a common tactic for unregulated schemes.

- Social Media: No official channels for updates or support.

Issue: Without support, resolving issues like locked funds becomes impossible.

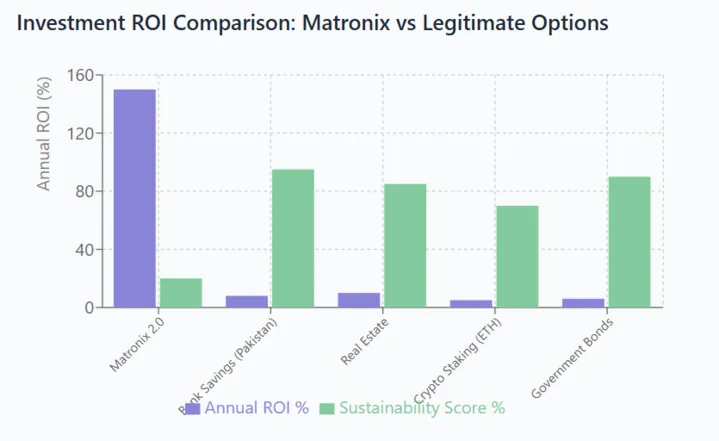

4.2 ROI Comparison: Matronix vs. Legitimate Options

Investment Type | Annual ROI | Risk Level | Sustainability |

Matronix 2.0 (Implied) | 100–180%+ | Extreme | Unsustainable |

Bank Savings (Pakistan) | 5–11% | Low | High (SBP-backed) |

Real Estate | 8–12% | Medium | High (tangible asset) |

Crypto Staking (ETH) | 4–6% | High | Moderate (audited) |

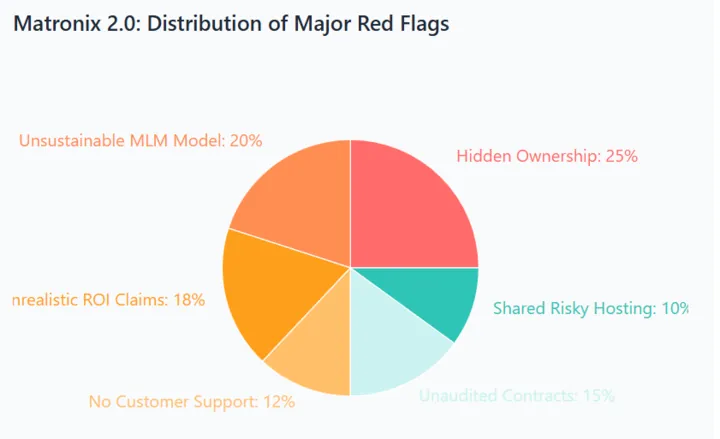

Part 5: Red Flags: Why Be Cautious?

- No transparent ownership or licensing.

- MLM-style matrix reliant on recruitment.

- Unrealistic ROI claims (100–180% short-term).

- No customer support or official social media.

- Shared hosting with suspicious sites.

- Unaudited smart contracts.

- USDT-only payments with no refunds.

5.1 Promoters: Who’s Pushing Matronix?

YouTube channels like “MLM Gkp,” “TRP MARKETING,” and “Trade with Siddharth” promote Matronix with referral links, claiming “$20 in, $50 out.” These accounts also hype other high-risk schemes (e.g., rainbnb, Olymp Trade), suggesting a pattern of chasing trending MLMs. No official Matronix profiles exist, amplifying reliance on unverified influencers.

Future Predictions

- Short-Term (1–3 Months): Possible hype via Telegram/YouTube, attracting 1,000–5,000 users. Early payouts may create FOMO.

- Medium-Term (3–6 Months): Recruitment slows, leading to withdrawal delays or freezes.

- Long-Term (6+ Months): Likely collapse or rebrand, as seen in MLMs like Forsage. Regulatory scrutiny could follow user losses.

Recommendations: Stay Safe

- Avoid Investing: Matronix 2.0’s red flags outweigh its promises. Stick to regulated platforms like Binance or Kraken.

- Use DYOR Tools:

- Scamadviser: Check trust scores.

- HypeStat: Analyze traffic and hosting.

- URLVoid/VirusTotal: Scan for malware or phishing.

- Scamadviser: Check trust scores.

- Protect Yourself: Use throwaway wallets, avoid KYC with unverified sites, and test with $0.

Conclusion: Proceed with Extreme Caution

This Matronix 2.0 review highlights serious concerns: no ownership transparency, an unsustainable MLM model, and no verifiable audits. Its promised 100–180% ROI is mathematically impossible without endless recruitment, unlike stable options like banks or real estate.

For crypto enthusiasts, regulated platforms offer safer returns. Always verify claims with tools like Scamadviser and HypeStat, and never invest more than you can lose. Your money deserves better. Now Visit GlobelPay Review.

DYOR Disclaimer: This analysis uses public data (WHOIS, Scamadviser, HypeStat, YouTube) as of September 20, 2025. Crypto investments carry high risks. Consult a financial advisor and verify all claims independently.

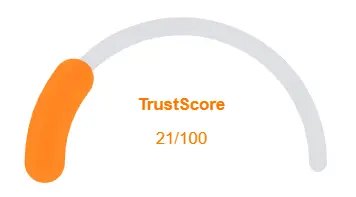

Matronix 2.0 Review: Trust Score

A website’s trust score is a critical indicator of its reliability. Matronix 2.0 currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Matronix 2.0 similar platforms.

Positive Highlights

- Website content is fully accessible.

- he site contains no spelling or grammatical mistakes.

Negative Highlights

- AI shows a low review score.

- The archive is recently created.

- Whois details are concealed.

- The domain is not listed in Tranco’s top 1M.

Frequently Asked Questions About Matronix 2.0 Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No definitive proof, but its MLM structure, hidden ownership, and unrealistic ROI suggest high risk.

Only through recruitment, which is unsustainable. Legit passive income comes from audited staking or assets.

Demand third-party audits (e.g., Certik). Without them, assume risk.

Try bank savings (5–11% in Pakistan), real estate (8–12%), or audited crypto staking (4–6%).

Other Infromation:

Website: matronix.world

Reviews:

There are no reviews yet. Be the first one to write one.