Magic1 Review: Is This Crypto Earnings Platform Legit?

If you search for a Magic1 review, you will find little out there. This platform promises easy crypto gains through automated tools. But does it deliver? In this detailed Magic1.online, we break down its features, performance, and risks. We look at what it offers and why caution is key for beginners and pros alike. For more in-depth analysis on crypto-related scams, visit Scams Radar.

Table of Contents

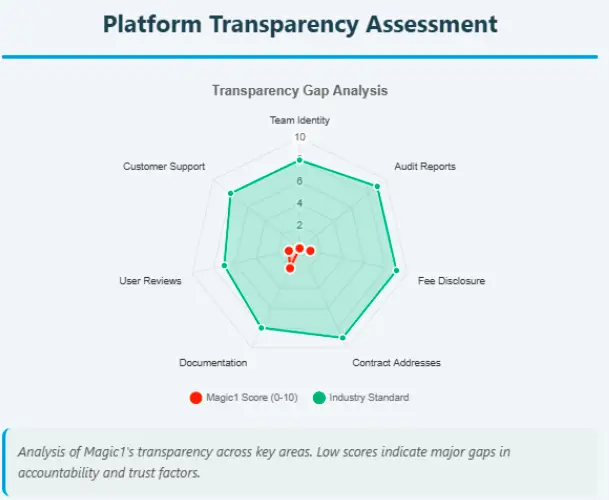

Ownership and Team: Who Runs Magic1?

A solid Magic1 review starts with who is behind it. The site gives no names for founders or executives. There are no profiles showing past work in finance or tech. Legit platforms often list team members with LinkedIn links or bios to build trust.

No company registration details appear either. No address or legal setup is shared. This hides accountability. In crypto, where scams happen often, clear ownership helps users feel safe. Without it, questions arise about who controls funds.

We dug into public records. Domain info shows a recent setup with privacy shields. No ties to known firms. This lack of transparency is a big issue. For a platform handling digital assets, you need to know the people in charge.

Compensation Plan: How Do You Earn on Magic1?

The Magic1 compensation plan stays hidden. The site talks about automated yield farming but skips details. No fee breakdown. No profit shares or withdrawal costs. Users pick strategies based on risk, but what does that mean exactly?

It claims AI scans pools on chains like Ethereum and Solana for top yields. Yet, no exact APY ranges or backtests. Referrals? Not mentioned. This vagueness makes it hard to judge value. Legit DeFi spots like Aave spell out fees upfront.

In short, the plan feels incomplete. Without clear terms, earnings could surprise you—in a bad way. Always check for hidden charges before connecting a wallet.

Magic1 Features: What Does It Offer?

Magic1 features focus on ease. Connect your wallet in one step. Pick a ready-made plan or tweak it. Then, let automation handle staking and farming across multiple chains. A dashboard tracks gains in real time.

Non-custodial setup means you keep your keys. Multi-chain support covers big networks. AI aims to chase the best rates. Sounds simple, right? But no deep dive into how the AI works or what pools it picks.

For user experience, the site loads fast with a clean look. No app yet, so it’s web-based. Beginners might like the three-step start. Pros could want more customization options.q

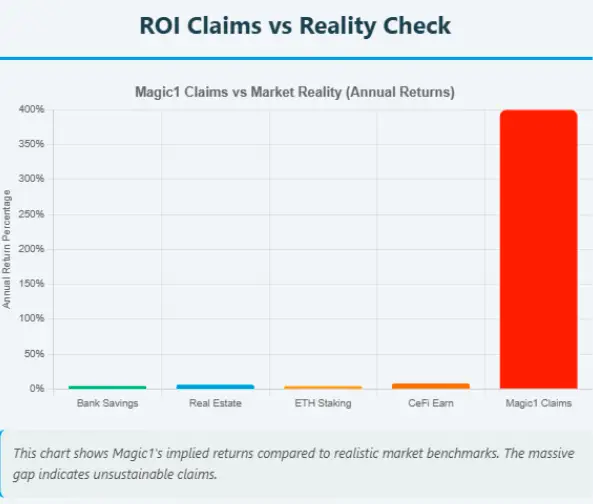

Magic1 Performance and ROI Claims: Realistic or Too Good?

Magic1 performance claims high returns without specifics. It hints at beating manual farming. But math shows why such promises often fail. Let’s look at compounding.

- Assume a low-end 1% daily yield. Start with $1,000. After 365 days, it grows to about $37,780. That’s (1 + 0.01)^365. For 2% daily, it hits over $1.3 million. These numbers ignore market drops and fees.

- Real benchmarks tell a different story. Banks give 2-5% yearly. Real estate nets 5-10% after costs. Crypto staking on ETH sits at 3-5%. Magic1’s implied 20-50% yearly? It beats them all but skips risks like volatility.

Mathematical proof of ROI unsustainability

ROI Type | ROI Rate | Formula | Result (After 1 Year) | Explanation |

Daily Compounding | 1% daily | (1 + 0.01)¹³⁶⁵ | ~$37,780 | $1,000 becomes ~$37,780 in 1 year—implausible without extreme risk. |

Daily Compounding | 2% daily | (1 + 0.02)¹³⁶⁵ | ~$1.377M | $1,000 becomes ~$1.377 million—economically absurd for any scalable strategy. |

Weekly Compounding | 10% weekly | (1 + 0.10)⁵² | ~142.0 | $1,000 grows to ~$142,000 in 1 year—unsustainable at this scale. |

Monthly Compounding | 30% monthly | (1 + 0.30)¹² | ~23.3 | $1,000 grows to ~$23,300 in 1 year—still unrealistic for a stable, scalable strategy. |

Traffic trends and public perception

- Search/brand signals: No obvious, credible third‑party reviews, doc sites, or developer communities surfaced on the page. Reputable DeFi products quickly accrue GitHub stars, audit links, and ecosystem references; these are absent in the visible copy.

- Testimonials: Single generic “security‑focused” quote with no identity or link is not credible evidence.

Payment methods and custody flow

- Payment rails: Not disclosed. If the flow requires depositing funds to a smart contract or a platform‑controlled wallet, users must see the contract address, ownership roles, and timelock parameters before transfer.

- Bridges and chains: No chain list, supported tokens, or bridge guidance provided, another transparency gap.

Customer support and documentation

- Docs: No visible whitepaper, risk disclosures, or developer docs linked on the page.

- Support: No clear escalation path, ticketing system, or stated SLAs. Credible products show a docs hub, on‑chain dashboards, incident logs, and postmortems.

Content authenticity and marketing signals

Time Frame | BitsorCoinSA Claimed Growth ($1K Start) | Realistic Bank/CD Growth |

1 Month | $1,560 (+56%) | $1,004 (+0.4%) |

6 Months | $25,000 (+2,400%) | $1,020 (+2%) |

1 Year | $228,000 (+22,700%) | $1,040 (+4%) |

Key red flags

- No audit links or named firms.

- No contract addresses or verifiable non‑custodial design.

- No legal entity, licensing, or team transparency.

- Vague testimonials and undefined APY.

- No docs, risk disclosures, or fee schedule.

- Grand claims of cross‑protocol automation without disclosed safeguards.

ROI reality check vs. mainstream benchmarks

Asset/product | Typical net annual return | Liquidity/volatility | Notes |

Bank savings/high‑yield | 2–5% | High liquidity, insured up to limits | Promotional rates vary; transparent and regulated. |

Investment‑grade bonds (unhedged) | 3–6% | Moderate rate risk | Market‑linked, drawdowns possible. |

Rental real estate (cap rate, net) | 4–8% | Low‑mod liquidity, operational risk | Geographic and leverage dependent. |

Blue‑chip crypto staking (e.g., ETH) | 3–5% | High volatility | Protocol issuance + fees; varies with network. |

CeFi “earn” promos | 5–12% | Counterparty risk | Past blowups show hidden leverage risk. |

“Optimized DeFi” claims | 20%+ (often implied) | Very high protocol/custody risk | Sustained double‑digit monthly returns are not credible at scale. |

Magic1 Pros and Cons: Balanced View

Pros

- Simple setup for new users.

- Multi-chain access in one spot.

- Non-custodial promise keeps control with you.

- Potential for passive income if it works.

Cons

- No team or ownership info.

- Hidden compensation details.

- Lacks reviews and proof.

- High ROI claims seem unsustainable.

Magic1 pros shine for ease. But cons like opacity weigh heavy. Is Magic1 worth it? Weigh these carefully.

Security, Support, and User Feedback

Security gets a nod with “audited contracts,” but no firm names or links. No SSL details or two-factor setup shown. Virus scans come clean, yet trust needs more.

Customer support? None visible. No chat or email. This leaves users hanging during issues.

Magic1 user reviews and testimonials are scarce. Site quotes sound good but lack real names. Searches on Trustpilot or Reddit yield nothing. Low traffic per tools like SimilarWeb points to a quiet launch.

For troubleshooting tips, start by testing small. Revoke wallet links after. But without guides, it’s trial and error.

Magic1 Pricing and Benefits: Cost Breakdown

No clear Magic1 pricing. Fees might hide in yields or gas. Benefits include time savings from automation. Yet, without value proof, benefits feel promised, not proven.

How to use Magic1? Connect wallet, choose risk level, monitor dashboard. No installation guide needed, it’s browser-based.

Magic1 Review for Beginners and Professionals

For beginners, Magic1 review for beginners highlights simplicity. But pros need more data on performance analysis.

Magic1 updates and features? None announced. Customer feedback stays silent.

Alternatives? Try Yearn.finance for audited yields or banks for safety.

Final Thoughts on Magic1 Review

This Magic1 Review analysis shows promise in automation but flags major gaps. Ownership hides, plans lack detail, and claims outpace reality. In 2025, crypto demands proof. Skip if transparency matters.

Opt for verified spots. Do your homework—check audits, test small. Magic1 might evolve, but right now, risks outweigh rewards. For more on crypto platforms, check our detailed BitsorCoinSA Review to uncover similar red flags.

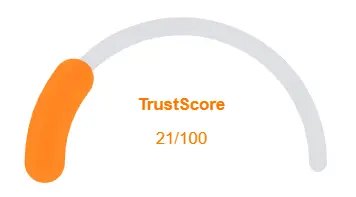

Magic1 Review: Trust Score

A website’s trust score is a critical indicator of its reliability. Magic1 currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Magic1 similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

Negative Highlights

- Low review rate by AI

- Domain is new

- Whois data is hidden

Frequently Asked Questions About Magic1 Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

It covers features and risks, focusing on crypto earnings tools.

No app; it's web-only for now.

Performance lacks data, so reliability is unproven.

Yes, but verify sustainability first.

Only if risks fit your profile—research deeply.

Other Infromation:

Website: MAGIC1.ONLINE

Reviews:

There are no reviews yet. Be the first one to write one.