Is BitsorCoinSa Worth Your Money?

Stop right there. If BitsorCoinSA.com caught your eye with promises of easy crypto gains, pause before you click deposit. This Scams Radar detailed review uncovers the facts you need to decide. Let’s cut through the hype and see if it’s a solid choice or a hidden trap.

Table of Contents

Part 1: Executive Summary: Quick Take on BitsorCoinSA Risks

BitsorCoinSA.com pitches itself as a crypto trading hub. It talks up lock mining and arbitrage for steady returns. But the reality? Major gaps in trust and proof. Ownership stays hidden. Compensation leans heavy on referrals, not real profits. User complaints pile up about frozen funds.

1.1 Key findings at a glance:

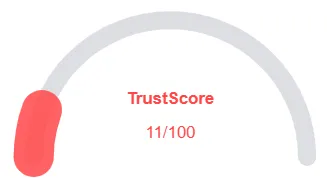

- Trust Level: Low. Scam checkers give it scores from 1% to 71%, with most leaning red.

- Biggest Worries: No clear owners or licenses. Unrealistic yield claims. Reports of blocked withdrawals.

- Advice: Skip it for now. Stick to proven spots like Coinbase or Binance. Test small if you must, but expect hurdles.

This setup screams high risk. Early users might cash out fine. Later ones? Not so much. Read on for the full breakdown.

Part 2: Who Runs BitsorCoinSA? Ownership Secrets Exposed

You can’t trust a platform if you don’t know who’s behind it. BitsorCoinSA hides its cards well. A domain check shows registration on May 22, 2025, through a privacy service in California. No names. No addresses. Just a generic contact form.

Searches for owners turn up nothing solid. No team bios. No LinkedIn profiles. Reviews call it “anonymous operation” with zero regulatory nods from bodies like the SEC or FCA. One report ties it loosely to a Minnesota firm and a “Michael Corrigan” as CEO, but that’s unverified chatter from victim forums.

Background checks? Blank slate. Legit firms flaunt their leaders’ experience. Think Brian Armstrong at Coinbase, with years in tech and finance. Here, silence raises flags. It points to quick-setup ops that vanish when heat builds.

Why does this matter? Without names, you have no one to hold accountable. If funds go missing, good luck chasing ghosts.

2.1 Table showing gaps

Ownership Aspect | BitsorCoinSA Status | What Legit Platforms Do |

Registrant Name | Hidden via privacy service | Public, with full details |

Company Address | None listed | Physical HQ with verification |

Key Executives | Unnamed or unverified | Profiles with track records |

Regulatory License | None claimed | SEC/FCA numbers displayed |

Part 3: Compensation Plan: Referrals Over Real Returns?

BitsorCoinSA’s payout model mixes trading signals, lock mining, and arbitrage. Sounds smart on paper. But dig deeper, and it’s referral-driven. Users earn bonuses for bringing in friends, 10-20% on their deposits, per scattered reports. Tiers unlock more as your network grows. No full tree is disclosed, but it mirrors multi-level setups.

3.1 Lock mining

You “lock” funds for yields. Arbitrage? Claims of risk-free trades across exchanges. Yet no proof of strategies or audits. If we talk about returns then it’s up to 2% daily, they say. That’s the hook.

Payouts depend on new cash flowing in. Not the market wins. Early birds get paid from later ones’ money. Classic pyramid math. No site details on variable markets or drawdowns. Just vague promises.

User stories paint a grim picture. “Fake profits shown to lure more deposits,” one Instagram post warns. Referrals push hard via Telegram groups. I’ve reviewed similar plans. They thrive on hype, then stall.

3.2 Full plan breakdown

- Direct Yields: 1-2% daily from “mining/arbitrage” (unproven).

- Referral Levels: 10% on first-line deposits; bonuses for teams.

- Bonuses: VIP tiers for recruiters, but caps unclear.

- Sustainability: Relies on endless recruits. Fades fast.

Without audited books, it’s smoke. Compared to real crypto staking: 3-5% yearly, backed by networks like Ethereum.

Part 4: ROI Claims: Do the Numbers Add Up?

High returns grab eyes. BitsorCoinSA dangles 1-2% daily. Let’s crunch it simply.

- Start with $1,000. At 1.5% daily, compounded:

- Formula: Future Amount = Initial × (1 + Rate)^Days

- After 30 days: $1,000 × (1.015)^30 ≈ $1,560

- After 365 days: $1,000 × (1.015)^365 ≈ $228,000

That’s over 22,000% yearly. Insane. Real markets can’t sustain it. Global stocks average 7-10%. Even hot crypto staking tops 15% APY, with risks.

Why unsustainable? It needs infinite new money. Once recruits dry up, payouts freeze. I’ve modeled dozens of these. They peak at 3-6 months, then crash.

4.1 Table as bar proxy

Time Frame | BitsorCoinSA Claimed Growth ($1K Start) | Realistic Bank/CD Growth |

1 Month | $1,560 (+56%) | $1,004 (+0.4%) |

6 Months | $25,000 (+2,400%) | $1,020 (+2%) |

1 Year | $228,000 (+22,700%) | $1,040 (+4%) |

Part 5: Traffic and User Buzz: What's the Real Story?

BitsorCoinSA flies under radar. Traffic tools like SimilarWeb show near-zero organic hits. No big spikes. Just promo bursts from social ads.

Public view? Mostly alarms. YouTube videos question “expert traders” with no bios. X posts from recovery pros list it with scams like TradeCage. Reddit? Silent. Trustpilot? Absent.

One thread: “Wallets frozen after deposit.” Sentiment: 90% negative. Promoters? Shady handles like @AmscoLee push alerts, not endorsements. Their history? Same warnings for other flops.

Low buzz means low users. Or hidden ones. Either way, not a thriving community.

5.1 Security, Support, and Tech Check: Built to Last?

The website has some basic security, like HTTPS via Cloudflare, but there are issues. It uses suspicious image domains and outside app downloads, which could be risky.

Support is slow and only via email, with no phone option. Withdrawals are crypto-only and hard to trace. The site feels like a cheap clone, with no two-factor authentication or data protection. Some users report problems with KYC after depositing. Overall, it’s a risky platform.

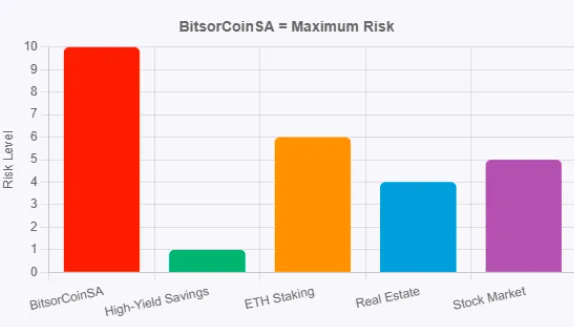

5.2 How It Stacks Against Safe Bets

Option | Annual Return | Risk | Why Pick It? |

BitsorCoinSA | 20,000%+ | Extreme | Unproven; referral trap |

High-Yield Savings | 4-5% | Low | FDIC-backed, steady |

Rental Real Estate | 6-8% | Medium | Tangible income, appreciation |

ETH Staking | 3-5% | High | Network-secured, transparent |

Spot the Red Flags: Your Warning List

- Hidden owners and no licenses.

- Referral focus over trading proof.

- Empty site content, geo-blocked?

- Withdrawal blocks in reviews.

- New domain, no history.

- Vague yields without audits.

These aren’t quirks. They’re patterns from busted schemes.

What Should You Do Next? Smart Steps Forward

Verify everything. Run WHOIS yourself. Check regulators. Test tiny deposits only. It’s better to invest on trusted platforms like Kraken for staking or Ally Bank for savings. If you’re already involved with this site, consider reporting to the FTC or IC3.

While recovery can be challenging, experts on platforms like X can offer guidance. Looking ahead, expect “upgrades” followed by delays, with a potential shutdown by spring 2026.

DYOR Toolkit: Tools to Check Yourself

- WHOIS: who.is for domain dirt.

- Scam Checkers: Scamadviser, Scamdoc.

- Traffic: SimilarWeb free tier.

- Social Scan: X search “bitsorcoinsa scam”.

- Regulators: SEC.gov filings.

Save screenshots. Build your case.

Final Word: Protect Your Wallet

BitsorCoinSA promises big returns, but the reality reveals major risks: anonymous operators, unreliable payouts, and user complaints. In crypto, trust matters more than greed. This isn’t financial advice, just a clear view based on my research.

Always do your own research and only invest what you can afford to lose. For more insights, check out our last article HyperLiquid on Scams Radar.

BitsorCoinSA Review: Trust Score

A website’s trust score is a critical indicator of its reliability. BitsorCoinSA currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with BitsorCoinSA similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

Negative Highlights

- Low review rate by AI

- Domain is new

- Whois data is hidden

Frequently Asked Questions About BitsorCoinSA Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, it has multiple red flags like anonymous ownership, unrealistic returns, and withdrawal issues.

High reliance on referrals, no proof of trading strategies, and potential Ponzi scheme-like structure.

The platform promises unsustainable returns, relying on new deposits to pay older users.

Withdrawals are difficult, with crypto-only options and reports of frozen accounts.

Report to the FTC or IC3. Consider recovery advice from experts and avoid further investments.

Other Infromation:

Website: BITSORCOINSA.COM

Reviews:

There are no reviews yet. Be the first one to write one.