MaoPay Review Risk Audit: Must-Know Facts, Math-Backed Red Flags & Safer ROI

If you’re searching for a Maopay review, you’re likely drawn to its bold claims of AI-driven profits in crypto and assets. Launched in early 2025, the platform promises easy growth through automated tools. But does it deliver?

This deep dive pulls from public records, user reports, and financial math to give you the facts. Scams Radar covers ownership, the full compensation setup, return promises, and real-world checks. By the end, you’ll know if it’s worth your time.

Table of Contents

Part 1: Ownership and Team Background: Who Runs Maopay?

A solid Maopay review starts with leadership. Legit platforms share team details to build trust. Maopay falls short here.

1.1 Incorporation

The company is listed as MaoPay AI Limited, incorporated July 9, 2025, in Hong Kong. Its address: 8/F, Two Exchange Square, Central, Hong Kong. This is a shared office space used by many firms. No unique tie to Maopay shows up.

1.2 Founders and contact info

Searches across LinkedIn, Crunchbase, and business registries turn up zero profiles. No exec bios, no past roles in fintech or AI. Patent checks find nothing linked to Maopay tech. Academic databases? Empty too.

This anonymity raises questions. Real AI trading firms like those behind OpenAI list co-founders with clear histories. Maopay’s setup fits patterns of new, untraceable operations. Contact: info@maopay.ai and +852 5227 3819. But no verified officers or board.

In short, no public background means limited accountability. Investors deserve names and credentials.

Part 2: Maopay Compensation Plan: Full Breakdown

Maopay’s earnings mix includes trading returns with referrals. It uses a unilevel structure where promoters sit at the top, with recruits below. This 20-level system pays on team sales. Here are the details.

2.1 Investment Tiers

Tier | Duration | Daily Rate | Total Return (Simple) | Min. Invest |

Venture | 200 days | 1.5-2.5% | 300-500% | $100 |

Venture Premium | 300 days | 2.0-3.0% | 600-900% | $1,000 |

Elite (implied) | 300+ days | Up to 3.5% | 1,000%+ | $10,000 |

2.2 Referral Structure

Earn on downline buys. 20 levels deep:

- Level 1: 7%

- Level 2: 3%

- Levels 3-4: 2% each

- Levels 5-20: 1% each

Bonuses add layers

- Ambassador: Up to 15% on team volume monthly.

- Leadership: Extra for hitting sales tiers, like 5-10% on group totals.

This MLM focus means income tied to recruiting, not just trading. Affiliates push via links like ?ref=TimurFaust. Past promotions? Same handles hawk other HYIPs, per social scans. For laymen, it rewards building a network. But if few join, earnings stall.

Part 3: ROI Claims: Math Shows Why They're Tough

Maopay promises steady profits using AI trading, with daily returns of 1-3%. It sounds exciting, but let’s break it down simply.

3.1 Their Claim

Maopay says you can earn 2% daily for 300 days. For a $1,000 investment, that’s $20 a day. After 300 days, you’d have $7,000 total, a 600% gain. No daily reinvesting; you get the payout at the end.

3.2 What If You Reinvest?

In real trading, profits often grow by reinvesting daily (compounding). At 2% daily, reinvested, your $1,000 would become:

$1,000 × (1.02)^300 ≈ $380,000.

That’s a 38,000% return! Even at 1% daily, it’s $8,700 after a year.

3.3 Why It’s Unrealistic

No market grows like this every day. Stocks like the S&P 500 earn about 7-10% a year (0.03% daily). Crypto staking on trusted platforms like Binance offers 5-13% yearly (0.01-0.04% daily). Maopay’s numbers are way higher, too good to be true.

Part 4: The Catch

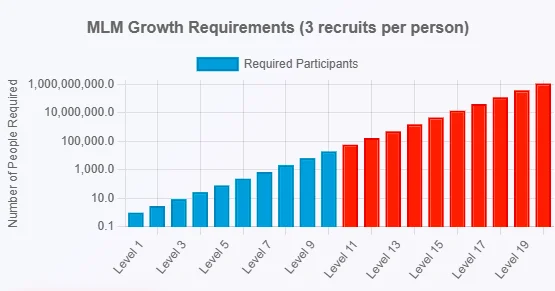

These big payouts need constant new money. Maopay’s plan relies on recruiting others. If each person recruits 3 more, by level 10, you’d need 1 million users. There are only about 500 million crypto users worldwide. When new sign-ups slow, the system collapses.

Benchmark | Annual ROI | Daily Equivalent | Source |

Bank Savings | 4-5% | 0.01% | FDIC 2025 |

Real Estate (REITs) | 8-11% | 0.03% | Historical avg |

Crypto Staking (Binance) | 5-13% | 0.01-0.04% | Exchange data |

Maopay Claim | 600-900% | 2-3% | Platform PDF |

4.1 Key Red Flags in This Maopay Review

- New domain (April 2025), hidden WHOIS.

- Duplicate site text feels like a template.

- Crypto-only payments: Hard to reverse.

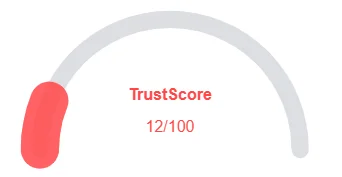

- Low trust scores: Scamadviser flags suspicious (low rank, hidden owner). Scamdoc: 25% trust.

- Withdrawal stories: Early small wins, then fees/delays.

- Promo ties: X posts from @realjessesingh link to “reviews” pushing affiliates. Past: Similar MLM sites.

4.2 Public View and DYOR Tools

Online buzz? Mostly warnings. BehindMLM calls it a “crypto Ponzi.” YouTube: Scam alerts outnumber promos. X: Sparse, with affiliate noise.

DYOR toolkit

- Scamdoc: Domain age/review.

- Wayback Machine: Site history.

- HK Registry: Company status.

- VirusTotal: Malware scan.

Run these yourself. Zero reviews on Trustpilot.

4.4 Safer Paths Forward

Skip Maopay. Opt for regulated spots like Binance Earn (up to 13% APY) or FDIC savings (4-5%). Diversify: 50% stables, 30% stocks, 20% crypto.

MaoPay.ai markets itself with polished language and bold AI-trading promises, but a closer look exposes troubling gaps between anonymous founders, MLM-heavy payouts, unsustainable ROI math, and poor trust scores across independent DYOR tools. The numbers simply don’t add up when compared to real benchmarks like FDIC savings, real estate, or Binance Earn.

Investors should treat MaoPay with extreme caution, test only with amounts they can afford to lose, and prioritize regulated, transparent platforms. In high-risk crypto, skepticism is your best protection. Omnisphere is our latest article from a must-read for anyone exploring AI-driven crypto platforms.

MaoPay Review Trust Score

A website’s trust score is a critical indicator of its reliability. MaoPay currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with MaoPay similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

- Domain age: Old

- Archive age: Old

Negative Highlights

- Low AI review rating

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About MaoPay Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No strong evidence. Start with known exchanges.

Withdraw fast. Document everything. Seek regulatory help.

Math says no, it's too high compared to markets.

Coinbase, eToro: Licensed, transparent.

Proceed with caution, no guarantees beat due diligence.

Other Infromation:

Website: maopay.ai

Reviews:

There are no reviews yet. Be the first one to write one.