Omniwinai Review: AI Income System a Smart Path to Passive Earnings

If you search for an Omniwinai review, you likely want clear facts on its AI income automation claims. This platform pitches itself as an automated income platform using artificial intelligence for crypto earnings. But does it deliver on passive income AI promises?

We dug deep into ownership details, the full compensation plan, user feedback, and math behind the returns. Our take draws from site data, third-party checks, and market benchmarks. Scams Radar will break it down step by step.

Table of Contents

Part 1: Who Owns Omniwinai? A Look at Leadership and Background

Transparency builds trust in any AI investment system. Yet Omniwinai falls short here. The site lists no founders, executives, or company address. It claims to be “created by AI, not biased humans,” but that’s vague marketing speak.

1.1 Anonymous Domain Registration & Zero Executive Transparency

Domain records show omniwinai.com registered on May 24, 2025, through NameCheap. Privacy tools hide the registrant’s name, a common move for untraceable ops. No corporate filings appear in public databases like ICANN or SEC searches. This setup echoes past MLM crypto ventures, where anonymous teams vanish after issues arise.

Background checks reveal no linked pros in AI or finance. Without named leaders or audits, accountability is zero. For an AI-driven earnings tool, this opacity raises doubts about long-term stability.

Part 2: The Omniwinai Compensation Plan: How It Works for Everyday Users

Omniwinai’s core is a 3×6 forced matrix, an automated investing system focused on crypto positions. You start with a $1 entry fee, paid in TRX or similar coins. The plan allows unlimited positions, with AI spillover to fill spots fairly.

2.1 Key mechanics include:

- Entry and Referrals: $1 per position. Earn $0.20 per direct referral.

- Matrix Structure: 3 wide, 6 deep. Payouts flow upline as downlines fill.

- Redistribution: 95% of platform margins to the bottom 50% of earners; 5% for admin.

- Daily Rewards: Shared pool from fees, auto-distributed.

2.2 Payout table

Level | Positions | Payout per Position | Total Earnings |

1 | 3 | $0.10 | $0.30 |

2 | 9 | $0.08 | $0.72 |

3 | 27 | $0.07 | $1.89 |

4 | 81 | $0.05 | $4.05 |

5 | 243 | $0.04 | $9.72 |

6 | 729 | $0.03 | $21.87 |

Total | 1,092 | – | $38.55 |

Part 3: Why Omniwinai's ROI Claims Fail Basic Math Tests

Omniwinai promises up to 3,855% returns on a $1 spot via AI financial management. Sounds great for AI money earning. But let’s check the numbers.

A full matrix needs 1,092 downline positions. Only $0.37 of each $1 entry pays upline, the rest funds admin or pools. To break even on one spot, you need about $2.70 in downline buys.

Exponential math means the system requires endless new users. In a world with 420 million crypto holders, saturation hits fast. Historical pyramids like Bitconnect collapsed at similar scales.

3.1 Comparison:

Compare to real options:

- Bank APY: 4-5% yearly, insured.

- Real Estate: 5-8% net, asset-backed.

- Crypto Staking: 4-10% on ETH via Binance,

from network fees.

Omniwinai’s model redistributes entries, not generates yield. For passive earning with Omniwinai AI, early joiners may cash out small. Late ones face stalls.

Part 4: Traffic Trends and Omniwinai User Feedback

Site counters claim growing visits, but tools like SimilarWeb show under 5,000 monthly it’s mostly referral-driven. No big ad spend or SEO rank

4.1 What Real People Say

Public perception is largely unfavorable, with early reviews pointing to blocked withdrawals, a structure resembling a pyramid scheme, and trust ratings dragged down by the platform’s newly registered domain.

Omniwinai user feedback highlights hype vs. reality. Some share success stories on socials, but patterns suggest affiliates. Real experiences often mention locked funds after $10 thresholds.

4.2 Security, Payments, and Support in Omniwinai

Basic HTTPS protects data, but no 2FA or audits. Payments stick to crypto like TRX, USDT, irreversible, heightening risks.

Support is email-only, with slow replies per feedback. No phone or address for disputes. For AI income generator seekers, this limits recourse.

4.3 Key Red Flags from Our Omniwinai Review

- Anonymous owners and fresh domain.

- Recruitment over real value.

- Inconsistent stats: $6,800+ paid vs. zero daily activity shown.

- Crypto-only, no fiat safety nets.

- Buzzword-heavy content without proof.

These signal caution for any automated income platform.

Social Promoters and Their Track Records

X posts show sparse promo from handles like:

@jorsell – Racing fan turned matrix promoter; history in generic earning schemes.

@brinbit – IT professional, but activity shifted into MLM-style promos; previously focused on security tech.

@JohnThomps84605 – Promotes variants like OmniWinAIGold; pattern shows serial involvement in Ponzi-style projects.

@Erfolg2010 – Targets German audiences; timeline filled with 3–5 figure earning scheme promotions.

@realjessesingh – Shares critical reviews, but bio indicates affiliate training background.

DYOR Tools for Omniwinai Checks

- Scamadviser: Low trust, spam flags.

- Trustpilot: Scam complaints.

- WHOIS: Hidden details.

- Wayback: Minimal history.

Run these for AI-based automated earning solutions.

Final Thoughts: Proceed with Eyes Wide Open

This Omniwinai review uncovers a flashy AI income generator with solid entry appeal but shaky foundations. The compensation plan shines on paper, yet ownership voids and math gaps dim its passive income AI shine. For 2025 automated passive income systems, stick to proven paths like high-yield savings or vetted crypto yields they offer steady gains without recruitment chases. For broader context, you can also read our WeFi review article.

DYOR Disclaimer: This is informational only, not advice. Markets shift; research thoroughly and consult experts before any move. Invest wisely that what you can lose stays lost.

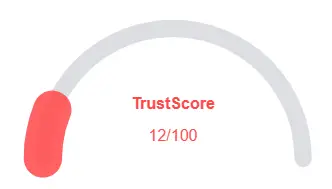

Omniwinai Review Trust Score

A website’s trust score is a critical indicator of its reliability. Omniwinai currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Omniwinai similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

- Domain age: Old

- Archive age: Old

Negative Highlights

- Low AI review rating

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About Omniwinai Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. It shows signs of a pyramid model with no real product or transparency.

Users buy $1 spots in a 3x6 matrix. Earnings depend on recruiting others.

No. Only $0.37 of each $1 is paid out. Returns need endless new recruits.

Blocked withdrawals, anonymous owners, crypto-only payments, and likely collapse.

High-yield savings, real estate, or regulated crypto staking with steady single-digit returns.

Other Infromation:

Website: OMNIWINAI.COM

Reviews:

There are no reviews yet. Be the first one to write one.