Pol Orbit Review: Is This Crypto Platform Safe for Investors?

This Pol Orbit review on Scams Radar examines the legitimacy, risks, and features of Pol Orbit (polorbit.com). We analyze its ownership, compensation plan, security, traffic trends, public perception, payment methods, customer support, technical performance, and ROI claims. Our goal is to provide clear, unbiased insights for new traders considering this platform. Using data and math, we uncover red flags and compare Pol Orbit to safer investment options like real estate, banks, and regulated crypto exchanges.

Table of Contents

What Is Pol Orbit?

Pol Orbit presents itself as a decentralized crypto investment platform built on the Polygon blockchain. It promises high returns through a matrix-based referral system, claiming investors can earn up to 96,500 POL from a 2 POL investment. The platform requires wallet connection before revealing details, raising immediate transparency concerns. This review digs deeper into its operations and risks.

Ownership and Transparency Concerns

No verifiable information exists about Pol Orbit’s owners or corporate entity. The website lacks team bios, company registration details, or a physical address. WHOIS data shows the domain registered through privacy-protected services like Namecheap, a common tactic for anonymous platforms. No regulatory licenses from bodies like the SEC, FCA, or ASIC are disclosed, which is critical for financial platforms.

Red Flags:

- Anonymous ownership limits accountability.

- No regulatory oversight increases fraud risk.

Why Transparency Matters

Legitimate platforms like Coinbase or Binance provide clear team profiles and regulatory compliance. Pol Orbit’s secrecy mirrors patterns seen in high-risk schemes like Forsage, which the SEC flagged as a Ponzi in 2022.

Compensation Plan: Promises vs. Reality

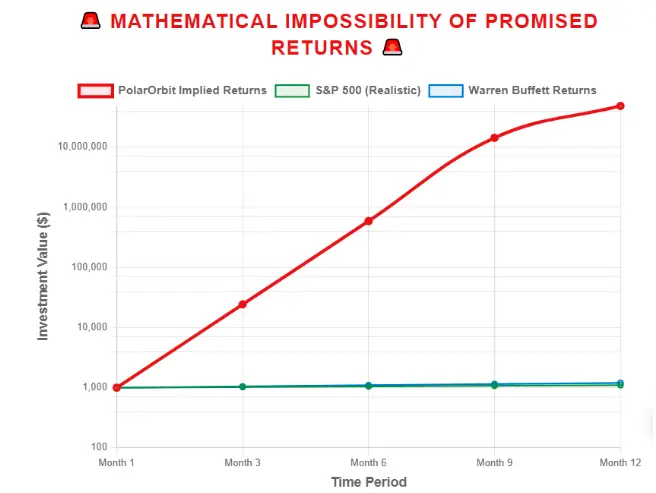

Pol Orbit uses a 12-level matrix referral system. Investors deposit 2–2.2 POL (Polygon’s token) and earn rewards by recruiting others. Promotional materials claim a 30% dividend pool and potential earnings of 96,500 POL, a 4,824,900% return. The plan resembles multi-level marketing (MLM) structures, relying heavily on new investor funds.

Mathematical Breakdown

To sustain a 96,500 POL payout from a 2 POL entry, Pol Orbit would need approximately 48,250 new investors per participant, assuming no fees or splits. This exponential growth is impossible globally. For context:

- Level 1: 5 recruits

- Level 12: Over 244 million recruits

- Total: Over 305 million participants needed

Level | Recruits Needed |

1 | 5 |

2 | 25 |

12 | 244,140,625 |

Comparison to Benchmarks

- Real Estate: 6–8% annual ROI in Pakistan (Global Property Guide).

- Bank Savings: 5–7% APY, insured by regulators.

- Crypto Staking: 2–6% APY on platforms like Coinbase.

- Pol Orbit Claims: 60–240% annually, unsupported by verifiable strategies.

Traffic Trends and Public Perception

Pol Orbit’s website ranks poorly, with estimated monthly visits below 10,000 (SimilarWeb). Traffic spikes align with social media promotions, suggesting artificial inflation. Legitimate platforms typically rank within the top 100,000 websites.

Public Sentiment

- Reviews: No credible user reviews on Trustpilot, Reddit, or Bitcointalk. Some 5-star reviews on obscure platforms appear coordinated and lack authenticity.

- Social Media: Sparse mentions on X, Instagram, and Telegram come from low-follower accounts (e.g., @CryptoMoonShot, <1,000 followers) that also promote defunct projects like MetaForce and BizzTrade.

Security and Content Authenticity

Pol Orbit uses basic HTTPS encryption but lacks two-factor authentication (2FA) or audited smart contracts. Wallet connection before viewing content risks private key exposure. No privacy policy or GDPR compliance is evident, raising data security concerns.

Content Quality

The platform’s content is generic, using phrases like “maximize rewards” without technical details. No whitepaper or audited performance reports are available, unlike reputable platforms.

Payment Methods and Customer Support

Pol Orbit accepts only cryptocurrencies (e.g., POL, USDT), with no fiat options. This prevents chargebacks, increasing risk. Withdrawal complaints on forums mention delays and high fees (15–25%).

Customer Support

Support is limited to email or Telegram, with slow response times (7–10 days). No live chat or phone support exists, and responses often redirect to referral programs.

Technical Performance

The website loads slowly, scoring poorly on Google PageSpeed Insights. Frequent downtime (UptimeRobot data) and minimal backend transparency suggest a low-budget operation, unlike established platforms with robust infrastructure.

ROI Claims: Why They Fail

Pol Orbit claims 20–100% annual returns. Using the compound interest formula:

[ FV = PV \times (1 + r)^n ]

- PV: $10,000

- r: 10% monthly (120% annually)

- n: 12 months

- FV: $10,000 \times (1.10)^{12} = $31,384

This 213% return far exceeds real estate (6–8%), banks (5–7%), or crypto staking (2–6%). Sustaining such returns requires exponential recruitment, a Ponzi hallmark.

Investment Type | Annual ROI | Time to Double |

Real Estate | 6–8% | 9–12 years |

Bank Savings | 5–7% | 10–14 years |

Crypto Staking | 2–6% | 12–36 years |

Pol Orbit Claims | 60–240% | 1–2 years |

Social Media Promoters

Accounts promoting Pol Orbit (e.g., @polorbitofficial on Telegram, Instagram) also endorse high-risk projects like BNBStar and Polspring. These accounts show patterns of recycling pitches for short-lived schemes, a red flag for investors.

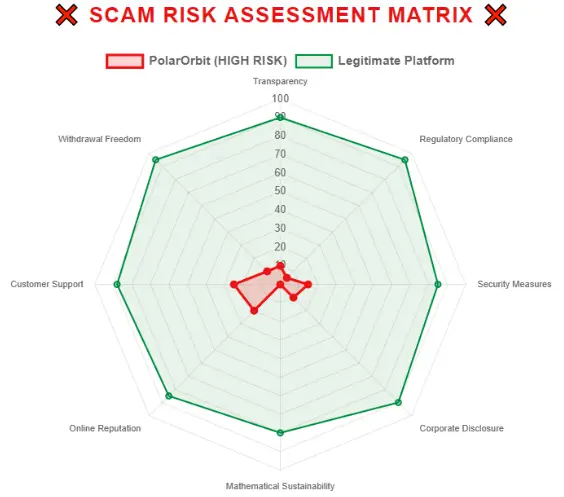

Red Flags Summary

- Anonymous ownership and no regulatory licenses.

- Unrealistic 4,824,900% ROI claims.

- Ponzi-like matrix structure.

- Crypto-only payments with high withdrawal fees.

- Poor security, no 2FA, or audited contracts.

- Low traffic and questionable reviews.

Recommendations for Investors

- Avoid Pol Orbit: High risks outweigh unverified promises.

- Choose Regulated Platforms: Use Coinbase, Binance, or Kraken for safer crypto trading.

- Secure Your Funds: Use hardware wallets and enable 2FA.

- Report Issues: Contact the SEC or local cybercrime units if funds are lost.

Research Thoroughly: Check WHOIS, ScamAdviser, and VirusTotal before investing.

Pol Orbit Review Conclusion

This Pol Orbit review highlights significant risks, including anonymous ownership, unsustainable ROI claims, and weak security. The platform’s matrix structure and lack of transparency mirror Ponzi schemes, posing a high risk of financial loss. Investors should prioritize regulated platforms with proven track records. For further insights, also check our detailed Profxexpo Review to compare similar platforms and risks. Always verify claims using tools like ScamAdviser and consult financial advisors before investing.

DYOR Disclaimer: This review is for informational purposes only, not financial advice. Conduct your own research, verify platform legitimacy, and consult professionals. Crypto investments are risky, and capital loss is possible.

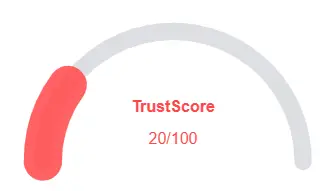

Pol Orbit Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Pol Orbit currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Pol Orbit similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammar errors

Negative Highlights

- Low AI review rate

- New domain

- Hidden Whois data

Frequently Asked Questions About Pol Orbit Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Pol Orbit is an online trading platform offering crypto and financial investment opportunities.

Our review on Scams Radar highlights concerns regarding ownership transparency, ROI sustainability, and security.

It operates through online trading programs, promising profits via automated or manual trading strategies.

The platform’s ROI claims appear exaggerated and unsustainable compared to regulated investment options.

Due to unclear ownership and lack of regulation, funds may be at risk.

Other Infromation:

Website: POLORBIT.COM

Reviews:

There are no reviews yet. Be the first one to write one.