Texitcoin Review: Is This Texas Cryptocurrency a Safe Investment?

Texitcoin, a cryptocurrency claiming to empower Texas with financial independence, has attracted both curiosity and skepticism. This Texitcoin review on Scams Radar examines its legitimacy, ownership, compensation plan, and potential risks. The platform, hosted at texitcoin.org, promises financial opportunities through its token system, but limited transparency raises concerns. Using clear data, charts, and comparisons, we help investors decide whether Texitcoin is a safe option or a high-risk venture. Always perform your own research (DYOR) before investing.

Table of Contents

What Is Texitcoin Cryptocurrency?

Texitcoin (TXC) markets itself as a Texas-focused, mineable Layer 1 blockchain using a Scrypt Proof-of-Work (PoW) algorithm, similar to Litecoin. Launched in January 2024, it promises fast transactions, a 3-minute block time, and a vision of decentralized mining in Texas. However, its bold claims, like “inflation-crushing” returns and regional economic sovereignty, raise questions about its legitimacy.

Ownership and Background

Texitcoin is led by Bobby Gray, who claims to have created the original Bitcoin cold storage coin in 2011 and founded the American Open Currency Standard in 2008. Gray also testified as a congressional expert on alternative currencies in 2012. However, his past includes controversies, such as legal issues in Republic Metals Corp. v. Gray et al., which question his credibility. The platform lists Rearden Metals Pte Ltd in Singapore as the data controller, an odd choice for a “Texas-first” project. No other team members are named, and the website lacks a physical address or company registration details.

Key Concerns:

- No verifiable team or company information.

- Bobby Gray’s past legal troubles.

- Singapore-based ownership contradicts Texas branding.

Texitcoin Compensation Plan

Texitcoin’s compensation plan, run through mineTXC.com, offers mining shares starting at $995 for 100 MH/s of hashpower, with packages up to $8,955. Users earn daily TXC payouts and can join a referral program with a $3,000 weekly cap per “tracking center” (up to $9,000/week with the Builder Plan). The plan emphasizes “Rapid Rewards” in USDC and bonuses for recruiting new users, resembling multi-level marketing (MLM).

Mining Discrepancies

Metric | Claimed | Actual | Deficit |

Mining Power Sold | 6,573 GH/s | 30–40 GH/s | ~6,533 GH/s |

Implication | Ponzi-like structure, unsustainable payouts |

ROI Claims and Sustainability

Texitcoin promises high returns, with claims like a $100 investment growing to $1,000,000 if TXC reaches the top 5 cryptocurrencies. Current data shows:

- TXC price: ~$2.83 (September 2025).

- Circulating supply: 52.01M TXC.

- Daily trading volume: $130,000–$330,000.

To reach a top 5 ranking (market cap ~$100 billion), TXC’s price would need to hit $1,922.70, a 67,800% increase. This is mathematically unrealistic given its low liquidity and lack of adoption.

ROI Calculation:

- A $995 share yields ~0.2 TXC/day (based on 1,000 TXC daily for 5,029 miners).

- At $2.83/TXC, that’s $0.566/day or $206.59/year.

- ROI: ($206.59 / $995) × 100 = 20.76%/year.

If TXC drops to $0.06 (its all-time low), ROI falls to 0.44%, far below promises. The reliance on new investor funds to sustain payouts mirrors Ponzi dynamics.

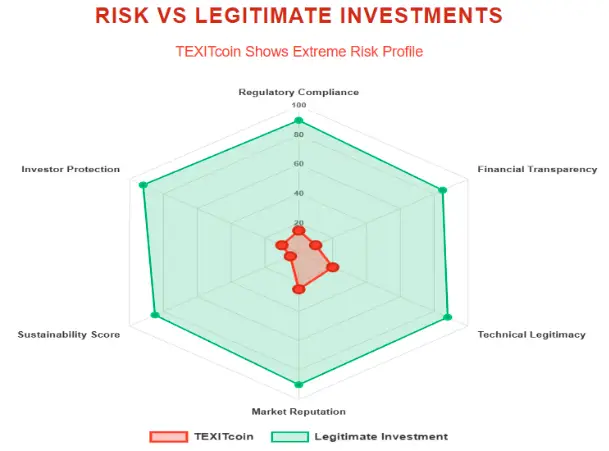

Texitcoin Blockchain and Technical Performance

Texitcoin’s blockchain is a Litecoin fork with no smart contracts or staking. Its 3-minute block time supports fast transactions, but the network’s 30–40 GH/s hashrate is weak compared to Litecoin’s 500+ TH/s. The explorer shows stale data, and mining is restricted to Texas, undermining decentralization.

Key Issues:

- Low hashrate increases vulnerability to 51% attacks.

- Private source code prevents independent audits.

- No technological innovation beyond Litecoin.

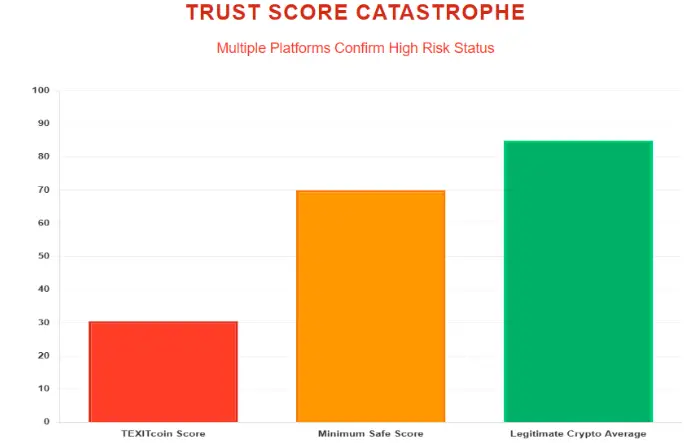

Public Perception and Trust Scores

Texitcoin’s public perception is negative. Reddit threads (e.g., r/CryptoScams) and reviews from BehindMLM and Disruption Banking label it a potential scam. DYOR tools report:

- Scamadviser: 30.5/100 trust score, citing new domain and opacity.

- ScamDoc: 65/100, “needs further investigation.”

- Gridinsoft: 28/100 for mineTXC.com, low visibility.

Tool | Score | Comment |

Scamadviser | 30.5/100 | New domain, low transparency |

ScamDoc | 65/100 | Average, needs investigation |

Gridinsoft | 28/100 | Suspicious, low visibility |

Security and Payment Methods

Texitcoin uses basic HTTPS but lacks two-factor authentication (2FA) or detailed security protocols. Payments are in USDC via Coinbase, with no fiat options or KYC/AML compliance, raising regulatory concerns. Customer support is limited to email and Telegram, with reports of unresponsiveness.

Red Flags of Texitcoin Investment Risk

- No Regulation: Unregistered with SEC, FCA, or ASIC.

- Oversold Mining: 15.4x more mining power sold than available.

- MLM Structure: Referral bonuses incentivize recruitment.

- Low Liquidity: $130,000–$330,000 daily volume limits exits.

- Opaque Ownership: No team details beyond Bobby Gray.

- Unrealistic Claims: Promises of 67,800% growth are fantastical.

Feature | Texitcoin | Litecoin |

Algorithm | Scrypt PoW | Scrypt PoW |

Block Time | 3 minutes | 2.5 minutes |

Hashrate | 30–40 GH/s | 500+ TH/s |

Decentralization | Texas-only mining | Global mining |

Innovation | Litecoin fork | Established blockchain |

Social Media Promotion

Promoters like Mike Healy (@mikebigguns) and Jason (YouTube) push Texitcoin via Zoom calls and social platforms (TikTok: @texitcoins, Facebook groups). These accounts also promote mineTXC.com and other MLM-style ventures, using sponsor links to drive recruitment.

Future Outlook

Texitcoin’s reliance on recruitment and thin liquidity suggests it may collapse within 6–18 months if new funds slow. Regulatory scrutiny, especially in Texas, could lead to shutdowns. Without major exchanges or adoption, TXC’s price is likely to decline.

Recommendations for Investors

- Avoid Investment: High risks outweigh speculative returns.

- Use Trusted Platforms: Choose regulated exchanges like Coinbase.

- Verify Claims: Check CoinGecko or CoinMarketCap for data.

- Report Issues: Contact the FTC or SEC if funds are lost.

- Secure Wallets: Use non-custodial wallets with 2FA.

Texitcoin Review Conclusion

This Texitcoin review reveals a high-risk project with questionable legitimacy. Its MLM-style compensation, oversold mining shares, and lack of regulation signal potential fraud. Compared to real estate (8–12% ROI), bank savings (4–5%), or crypto staking (3–8%), Texitcoin’s promises are unsustainable. Investors should prioritize regulated alternatives and conduct thorough research before committing funds. For further insights, also check our detailed RapidBitex Review.

DYOR Disclaimer: This analysis is for educational purposes only. Cryptocurrency investments are risky, and past performance doesn’t guarantee future results. Always verify claims using trusted sources like CoinMarketCap, regulatory databases, and independent reviews. Consult a financial advisor before investing.

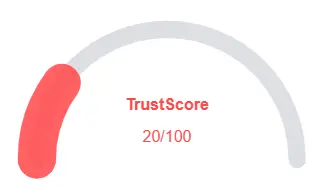

Texitcoin Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Texitcoin currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Texitcoin similar platforms.

Positive Highlights

- Content accessible

- No spelling/grammar errors

Negative Highlights

- Low AI review rate

- New domain

- New archive

- Whois data hidden

- Not in Tranco top 1M

Frequently Asked Questions About Texitcoin Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Texitcoin exists as a blockchain token, but transparency around ownership and operations is limited, raising concerns.

Users may earn through token purchases, trading, or referral programs, depending on the platform’s structure.

High returns are not guaranteed and come with risks typical of crypto investments.

The platform’s security protocols are unclear, making it crucial to exercise caution.

Investment carries risk. Thorough research and understanding of crypto markets are essential before participating.

Other Infromation:

Website: texitcoin.org

Reviews:

There are no reviews yet. Be the first one to write one.