In-Out Review: Is This Investment Platform Legitimate or a Risky Scheme?

Investing online can be tempting, especially with platforms like in-out (example: in-out.live) promising high returns. This in-out review on Scams Radar examines the platform’s claims of offering substantial profits through a decentralized system. We analyze ownership, compensation plans, security, and potential risks using clear language, charts, and visual data to guide everyday investors. Our goal is to provide a professional, unbiased assessment to help you make informed decisions before investing. Always conduct your own research (DYOR) before committing any funds.

Table of Contents

Understanding the Platform

The platform markets itself as a decentralized financial system using blockchain technology, specifically the Polygon blockchain with DAI stablecoin. It claims to deliver up to 2x returns through smart contracts and a referral-based model. With a minimum entry of $10, it promises daily returns of 0.5–1% over 15-day cycles. However, several concerns arise when digging deeper.

Ownership and Transparency

No identifiable owners or team members are listed on the site. The domain, registered on June 12, 2023, via Namecheap, uses privacy protection to hide registrant details. No company registration or regulatory compliance (e.g., SEC, FCA) is disclosed, which is unusual for legitimate investment platforms. The smart contract address (0xFc6d1717F6173508FA97549C13B4bF58FDBCfC39) is provided, but no audit or team credentials are available. This lack of transparency is a major red flag, as trustworthy platforms typically share verifiable corporate information.

Compensation Plan Breakdown

The compensation plan is complex, relying heavily on multi-level marketing (MLM). It includes:

- Direct Referral Income: Rewards for recruiting new investors.

- Level Income: Earnings from referrals up to 150 levels deep.

- Self Growth Income: Up to 2x returns on personal investments.

- Team Growth Income: Bonuses for team performance.

- Leader and Team Development Income: Additional rewards for top recruiters.

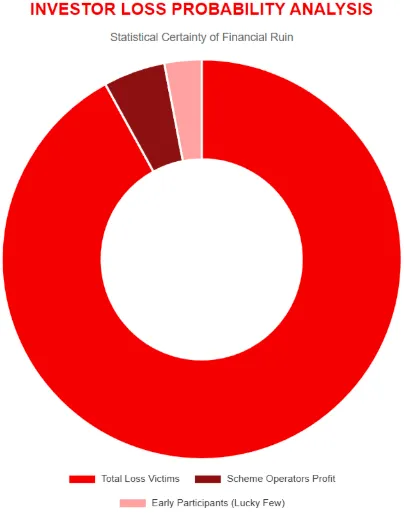

Investors deposit funds in the platform’s INOUT token, while profits are paid in DAI. A 10% withdrawal fee applies, and funds are locked for 10 days, requiring a new order to unlock after this period. This structure incentivizes continuous recruitment over genuine profit generation, resembling a Ponzi scheme.

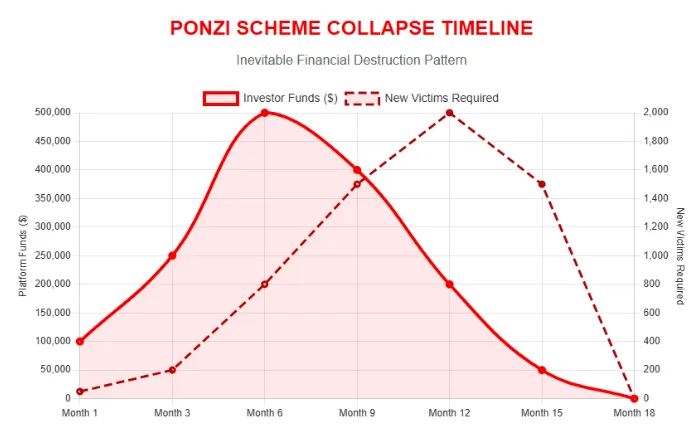

Mathematical Analysis of ROI Sustainability

The platform promises 0.5–1% daily returns for 15 days, equating to 7.77–16.1% per cycle. If cycled annually, this implies:

- 0.5% daily: ~517% APY

- 1% daily: ~3,678% APY

To illustrate, a $100 investment at 1% daily could theoretically grow to $3,778 in a year. However, sustaining such returns requires exponential growth in new investors. For example:

- Month 1: 10 investors recruit 30 more (40 total).

- Month 6: 40,960 investors needed.

- Month 10: 10.5 million investors required.

This growth is unsustainable, as it would exceed the global crypto investor base within months. Without a verifiable revenue source (e.g., arbitrage or trading), payouts rely on new deposits, a hallmark of Ponzi schemes.

Comparing Returns to Legitimate Investments

Investment Type | Annual ROI | Risk Level | Regulatory Oversight |

Platform Claims | 517–3,678% | Extremely High | None |

Real Estate | 6–10% | Medium | High |

Bank Savings (PKR) | 15–20% | Low | Very High |

Crypto Staking | 5–12% | Medium | High |

Security and Technical Concerns

The platform uses the Polygon blockchain with a verified INOUT_STAKING contract, but admin functions (e.g., setPrams, releaseContract) suggest centralized control, contradicting “decentralized” claims. No security audits or bug bounty programs are disclosed. The Telegram channel (@in_out_Official, ~585 subscribers) admits to contract migrations due to logic flaws, adding risk. The site uses HTTPS but lacks advanced security like 2FA or KYC/AML compliance.

Public Perception and Traffic

Traffic is low (10,000–50,000 monthly visits), mostly from regions with lax regulations. ScamAdviser rates it a “very low trust score,” and ScamDetector gives a 58/100 “dubious” score. Public feedback on forums and X is mixed, with early payouts praised but complaints about delayed withdrawals and poor support growing. Promotional activity is Telegram-centric, with anonymous accounts on YouTube and Instagram pushing similar schemes like Forsage.

Red Flags

- Unrealistic Returns: 517–3,678% APY is unsustainable.

- Anonymous Ownership: No team or legal entity disclosed.

- MLM Structure: Relies on recruitment, not profits.

- Crypto-Only Payments: No fiat options, increasing fraud risk.

- Poor Support: Limited to Telegram, with slow responses.

- Contract Risks: Admin controls and migration issues.

Recommendations for Investors

- Avoid Investment: The platform’s Ponzi-like structure and lack of transparency make it high-risk.

- Choose Safer Options: Consider regulated platforms like Coinbase (5–12% APY) or real estate (6–10% ROI).

- Use DYOR Tools: Check ScamAdviser, Polygonscan, and SEC databases.

- Diversify: Spread investments across low-risk assets like bonds or index funds.

In-Out Review Conclusion

This in-out review reveals a platform with unsustainable promises and significant risks. Its anonymous ownership, MLM structure, and lack of regulatory oversight suggest a Ponzi scheme. Compared to real estate, bank savings, or crypto staking, its returns are implausible. Investors should avoid this platform and prioritize regulated alternatives. Conduct thorough research to protect your finances.

For another detailed analysis of a similar high-risk DeFi project, you can also read our ArkDeFAI Review, which highlights comparable red flags, including unrealistic ROI claims and lack of transparency.

DYOR Disclaimer: This review is for informational purposes only and not financial advice. Always verify platform legitimacy using tools like ScamAdviser and Polygonscan, and consult a financial advisor before investing.

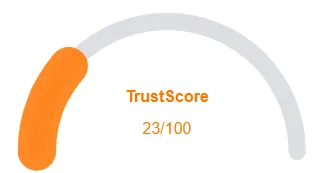

In-Out Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 In-Out currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with In-Out similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New domain

- Hidden WHOIS

- New archive

- Not in Tranco top 1M

Frequently Asked Questions About In-Out Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

In-Out (in-out.live) claims to offer high returns via a decentralized system. Our Scams Radar review investigates whether these promises are realistic or risky.

While In-Out advertises big profits, our analysis reveals ownership opacity, security concerns, and unsustainable ROI, signaling caution.

The platform claims decentralized or AI-driven trading methods. Our review examines whether these methods can actually deliver the advertised returns.

Potential risks include unclear ownership, unrealistic profit claims, limited transparency, and possible exposure to high-risk or scam operations.

Our Scams Radar review recommends verifying all claims and conducting your own research (DYOR). Consider safer alternatives before engaging with In-Out.

Other Infromation:

Website: in-out.live

Reviews:

There are no reviews yet. Be the first one to write one.