ESVcap Review: Is This Crypto Platform Legitimate or Risky?

This ESVCAP review on Scams Radar examines the legitimacy and risks of ESV Capital (esvcap.com), a platform claiming to be “Africa’s 1st & Largest Bitcoin Treasury Company.” Launched in 2025, it promises 20% annual returns paid daily in USDC through staking, AI trading bots, and startup funding. Our analysis explores ownership, compensation plans, security, traffic, public perception, and ROI sustainability. Using clear data, charts, and comparisons, we provide a professional, easy-to-read guide to help investors make informed decisions before engaging with the platform.

Table of Contents

Ownership and Background

ESV Capital’s ownership raises concerns due to limited transparency. The domain, registered on July 4, 2025, via GoDaddy, uses WhoisGuard to hide details. No verifiable company registration, physical address, or executive team is disclosed. Gaius Chibueze, known as “Bitcoin Chief,” is linked to the platform through social media posts on X (@gaiuschibueze), Instagram (@bitcoin_chief), and Facebook. He promotes ESV Capital as a Bitcoin treasury but lacks a verifiable professional background in finance or blockchain. Past promotions by Chibueze include ABiT Network and Tatcoin, which have faced scrutiny for high-risk claims, raising doubts about credibility.

Red Flags:

- No legal entity or regulatory registration.

- Anonymous team with no professional profiles.

- Promoter linked to questionable past projects.

Compensation Plan Details

ESV Capital’s compensation plan centers on staking, trading bots, and referrals. Investors stake ESVC tokens for 6 or 12 months, with a minimum $50 investment in Solana (SOL) or USDC, earning 20% annual returns paid daily in USDC. A “Referrals Reward Fund” offers bonuses for recruiting new investors, resembling a multi-level marketing (MLM) structure. The platform also markets a “$100 to $1M trade challenge” using AI trading bots with a “no stop loss” strategy, costing $100/year for access.

Structure Breakdown:

- Staking: 20% APR, paid daily (0.0548% per day).

- Referral Bonuses: Earn commissions for recruiting.

- Trading Bot: Claims high compounding profits via Binance API.

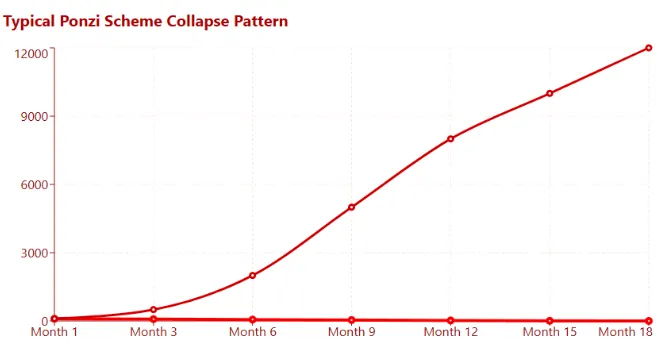

- Concerns: The MLM-style focus on recruitment and unsustainable 20% returns suggest a Ponzi-like model, where new funds pay earlier investors.

ROI Sustainability Analysis

The promised 20% annual return is mathematically unsustainable. For a $10,000 investment, ESV Capital claims $2,000 yearly ($5.48 daily). To sustain this, the platform needs consistent 25–30% returns to cover payouts, operational costs, and profits. Most legitimate investments yield far less:

Investment Type | Typical Annual ROI | Risk Level | Regulation |

ESV Capital Staking | 20% | Very High | None |

High-Yield Savings | 3.5–5% | Low | FDIC Insured |

Real Estate (REITs) | 6–12% | Medium | SEC Regulated |

Crypto Staking (Kraken) | 4–12% | High | Unregulated |

Security and Technical Performance

The platform uses basic SSL encryption (Let’s Encrypt) but lacks advanced security like two-factor authentication (2FA), cold storage, or third-party audits. The website loads quickly (3–5 seconds on desktop) but shows placeholder “$0” values in dashboards, indicating poor technical integration. Customer support is limited to an email (support@esvcap.com) and Telegram, with no live chat or phone options, raising concerns about responsiveness.

- Security Issues:

- No 2FA or cold storage for funds.

- No proof of reserves or audits.

- Basic SSL, no advanced protections.

- No 2FA or cold storage for funds.

Traffic and Public Perception

Traffic data from ScamAdviser shows low engagement (1,000–5,000 monthly visits), mostly from paid ads in regions with lax regulations. Public sentiment on X and Reddit is skeptical, with users calling it “too good to be true.” No Trustpilot or SiteJabber reviews exist, and no reputable media (e.g., Forbes) covers the platform. Promoters like @CryptoGemsUnleashed and @DeFiDreamer22 on X have pushed failed projects like HyperFund, increasing distrust.

Payment Methods

ESV Capital accepts only SOL and USDC, with 6–12 month lock-ups. Crypto-only payments lack chargeback protection, and long lock-ups increase liquidity risks. Legitimate platforms like Coinbase offer diverse payment options with consumer protections.

Red Flags

- Anonymous ownership and no regulatory compliance.

- Unsustainable 20% ROI claims.

- MLM-style referral focus.

- Weak security and limited support.

- Low traffic and questionable social media promotions.

Recommendations

Investors should avoid ESV Capital due to its high-risk profile. Safer options include:

- High-yield savings (3.5–5% APY, FDIC-insured).

- Real estate REITs (6–12% ROI, SEC-regulated).

- Regulated crypto staking (4–12% APY, e.g., Kraken).

Verify platforms through SEC/FCA databases and demand audited financials. Report suspicious activity to financial authorities.

Future Outlook

Without transparency or regulation, ESV Capital may collapse within 12–18 months, as seen in cases like BitConnect. Regulatory crackdowns in crypto markets will likely target such platforms.

DYOR Disclaimer

This esvcap review is for informational purposes only, not financial advice. Conduct your own research, consult licensed advisors, and verify claims before investing. Use tools like ScamAdviser, VirusTotal, and SEC EDGAR for due diligence. Only risk what you can afford to lose.

ESVcap Review Conclusion

This esvcap review highlights critical risks: anonymous ownership, unsustainable 20% returns, and lack of regulation. Compared to real estate (6–12% ROI) or savings (3.5–5% APY), ESV Capital’s promises are unrealistic and resemble Ponzi schemes. Investors should prioritize regulated platforms and avoid this high-risk venture. For more insights on similar platforms, check our detailed GROKRX3WF Review to compare risks and legitimacy. Thorough research is essential for safe investing.

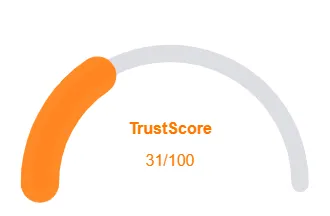

ESVcap Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 ESVcap currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with ESVcap similar platforms.

Positive Highlights

- Content accessible

- No spelling or grammar errors

- Old archive age

Negative Highlights

- Low AI review rate

- New domain

- Hidden WHOIS

Frequently Asked Questions About ESVcap Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

ESVCAP is a platform claiming to be Africa’s 1st Bitcoin Treasury Company. Our ESVCAP Review on Scams Radar examines whether its promises are real or risky.

While ESVCAP promises 20% annual returns paid daily in USDC, our review uncovers ownership and security concerns that raise red flags.

ESVCAP uses AI trading bots, staking, and startup funding to generate returns. Our review questions the sustainability and transparency of these methods.

Risks include unsustainable ROI promises, lack of regulatory clarity, opaque ownership, and potential technical or security issues.

Our ESVCAP Review recommends caution. Verify claims, assess risks, and consider safer alternatives before investing in esvcap.com.

Other Infromation:

Website: ESVCAP.COM

Reviews:

There are no reviews yet. Be the first one to write one.