Maxim Gain Review: Is This Investment Platform Safe or a Scam?

In the fast-paced world of online investments, Maxim Gain (maximgain.com) has emerged, promising high returns through AI-powered trading. This Maxim Gain review on Scams Radar examines its legitimacy, focusing on ownership, compensation plans, and risks. Our analysis uses data from trusted sources to provide a clear, honest assessment for potential investors.

Table of Contents

What Is Maxim Gain?

Maxim Gain positions itself as a cloud-based trading platform, offering investments in forex, crypto, stocks, and commodities. It claims 28+ years of industry experience and uses buzzwords like “AI-powered trading” and “controlled risk.” However, the platform’s structure raises serious concerns about its sustainability and legitimacy.

Ownership: A Veil of Anonymity

Transparency is vital for trust in financial platforms. Unfortunately, Maxim Gain lacks it. The domain, registered on January 17, 2024, via NameCheap, uses WhoisGuard to hide owner details. A UK entity, MAXIMGAIN LTD, was incorporated on July 15, 2025, at a virtual office (311, 1 Eastbourne Terrace, London). Other addresses, like The Shard (London) and a multi-tenant office in Albuquerque, NM, are also serviced locations, often used to project legitimacy without real presence.

No founders, executives, or bios are listed. Legitimate platforms like Binance or Fidelity disclose ownership and comply with regulations like KYC/AML. This anonymity is a major red flag, signaling potential unaccountability.

Compensation Plan: High Returns, Higher Risks

Maxim Gain’s investment plans promise daily returns, structured as:

- Regular Packages ($20–$100,000+):

- Basic: 1% daily for 200 days (200% profit, 300% total return).

- Premium: 3% daily for 200 days (600% profit, 700% total).

- Basic: 1% daily for 200 days (200% profit, 300% total return).

- Fixed Deposits (365 days):

- Basic: 2% daily (730% profit, 830% total).

- Premium: 6% daily (2,190% profit, 2,290% total).

- Basic: 2% daily (730% profit, 830% total).

The plan includes a 10–11% referral bonus and a binary matching bonus, rewarding recruitment. This multi-level marketing (MLM) structure resembles a pyramid scheme, where new investor funds pay earlier ones.

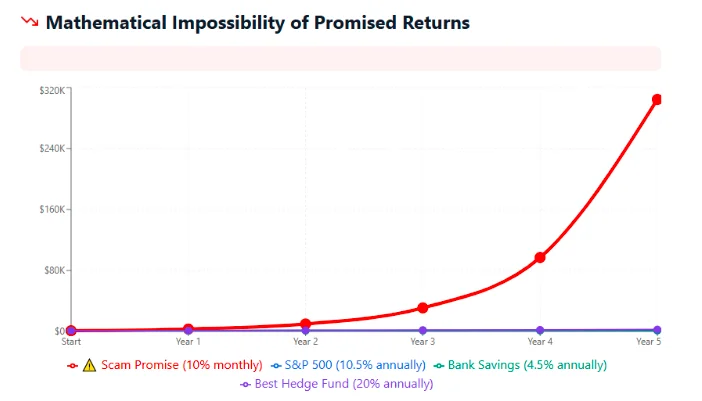

Mathematical Reality Check

Let’s test a $1,000 investment at 6% daily, compounded for 365 days:

- Formula: ( A = P(1 + r)^t ), where ( P = 1000 ), ( r = 0.06 ), ( t = 365 ).

- Calculation: ( A = 1000 \times 1.06^{365} \approx 8.9 \text{ billion} ).

This implies a $1,000 investment becomes $8.9 billion in a year—an impossible 890,000,000% APY. Compare this to:

- S&P 500: ~7–10% annual return.

- Real Estate: 5–10% annually (rentals/appreciation).

- Crypto Staking: 5–20% APY (e.g., Kraken).

- Bank Savings: 3–5% annually (FDIC-insured).

Such returns require infinite new deposits, a hallmark of Ponzi schemes.

Investment Type | Annual ROI | Risk Level |

Maxim Gain (Claimed) | 2,000%+ | Extremely High |

S&P 500 | 7–10% | Medium |

Real Estate | 5–10% | Medium |

Crypto Staking | 5–20% | High |

Bank Savings | 3–5% | Very Low |

Traffic and Public Perception

SimilarWeb shows Maxim Gain has under 10,000 monthly visits, mostly from India, Nigeria, and the US, with a brief spike in July 2025. This low traffic suggests reliance on paid promotions. Trustpilot’s 4-star rating (41 reviews) seems suspicious, with repetitive, unverified praise. Scamadviser gives a 66/100 trust score, citing recent domain age and hidden ownership. Reddit and Sitejabber show no credible endorsements, only scam warnings.

Security and Payments

The site uses basic SSL encryption but lacks two-factor authentication, cold storage, or third-party audits. Payments are crypto-only (e.g., Bitcoin, USDT), which are irreversible and untraceable—ideal for scammers. No fiat options or clear processors are listed. Support is limited to a contact form, with no live chat or phone.

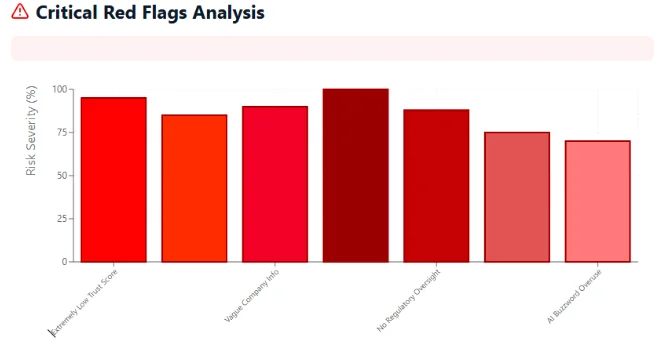

Red Flags Summary

- Anonymous Ownership: Hidden via WhoisGuard; no verifiable team.

- Unrealistic ROI: Up to 2,290% total return, mathematically impossible.

- MLM Structure: Relies on recruitment, not trading.

- Low Transparency: No regulatory licenses or financial audits.

- Suspect Reviews: Likely manipulated; no organic buzz.

Social Media Promotion

Searches on X and Telegram show no major influencers promoting Maxim Gain. Accounts like @ChhabilalSapk19 and @_livingRealLife mention it casually, but also promote other high-risk sites (e.g., primeaxis.world, xrpaibot.com). This pattern suggests coordinated marketing typical of HYIPs.

Future Outlook

Most HYIPs follow a predictable path:

- Attraction: Small payouts build trust.

- Expansion: Aggressive affiliate pushes.

- Collapse: Payout delays, then site shutdown (6–12 months).

Maxim Gain, launched recently, is likely in phase 1. Regulatory crackdowns or declining deposits could hasten its demise.

Recommendations

- Avoid Investing: The platform’s risks are extreme.

- Choose Regulated Options: Use Fidelity, Kraken, or Vanguard.

- Diversify: Combine stocks, real estate, and insured savings.

- Report Issues: Contact the FTC or local authorities if affected.

Maxim Gain Review Conclusion

This MaximGain review reveals a high-risk platform with anonymous ownership, unsustainable returns, and MLM tactics. Its low trust score, lack of regulation, and crypto-only payments scream caution. For safe wealth-building, stick to regulated investments with realistic returns. Always verify claims independently to protect your financial future.

Additionally, if you’re looking for a more reliable alternative, check out our detailed Adscent International Review to gain insights into its operations, trustworthiness, and risks.

DYOR Disclaimer

This analysis, based on public data as of August 26, 2025, is for educational purposes only. Investments carry risks. Conduct your own research and consult licensed advisors before investing. If it sounds too good to be true, it likely is.

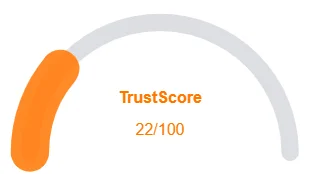

Maxim Gain Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Maxim Gain currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Maxim Gain similar platforms.

Positive Highlights

- Website content is accessible.

- No spelling or grammar errors.

- Archive age is very old.

Negative Highlights

- Low AI review rating.

- Domain is recent.

- Whois data is private.

Frequently Asked Questions About Maxim Gain Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Maxim Gain claims to be an AI-powered trading platform that offers investors high returns through automated strategies. Our Scams Radar review examines whether these claims are realistic and sustainable.

Based on Scams Radar’s investigation, the legitimacy of Maxim Gain is questionable due to hidden ownership details, lack of regulatory approvals, and promises of unusually high ROI that resemble Ponzi-style models.

Maxim Gain offers returns based on investment packages and affiliate recruitment. This structure raises red flags, as the income model depends heavily on bringing in new investors rather than proven external revenue streams.

Risks include loss of funds, withdrawal delays, and the possibility of the platform collapsing once new investments slow down. Investors should compare Maxim Gain’s ROI claims with regulated financial products such as real estate, bank deposits, or licensed exchanges.

Scams Radar advises potential investors to approach Maxim Gain with caution, conduct independent research, and avoid relying on unverified promises. Safer alternatives include regulated platforms with transparent track records.

Other Infromation:

Website: maximgain.com

Reviews:

There are no reviews yet. Be the first one to write one.