VRHWorld Review: Is This Investment Platform Legitimate?

This VRHWorld review examines the legitimacy of vrhworld.com, a platform claiming to offer investment opportunities tied to virtual real estate and versatility ranch horse competitions. For an in-depth scam analysis, visit Scams Radar for a detailed review.

VRHWorld, accessible at vrhworld.com, raises concerns due to unclear ownership, unverifiable ROI claims, and lack of regulation. Read on to explore whether vrhworld.com is safe, covering ownership, compensation, security, payment methods, and more, supported by data, charts, and comparisons with real-world investments.

Table of Contents

Ownership and Transparency

The platform lacks clear ownership details. A WHOIS lookup shows the domain, registered on July 29, 2024, via Namecheap, uses privacy protection, hiding registrant information. No founders, directors, or corporate addresses are disclosed. Claims of being a “registered company” lack verifiable evidence, as searches on Companies House for “VRH World” yield no matches. Some content suggests ties to the American Quarter Horse Association (AQHA) and Versatility Ranch Horse (VRH) events, but no official AQHA partnership exists. This opacity is a major concern, as legitimate platforms provide transparent leadership profiles.

Red Flags

- Hidden ownership details.

- No regulatory registration (e.g., SEC, FINRA).

- Unverified AQHA affiliation claims.

Compensation Plan Breakdown

The compensation plan centers on two streams: virtual real estate investments and referral-based earnings. Users can buy virtual plots as NFTs for leasing, trading, or hosting events, with promised annual returns of 20-100%. Additionally, a referral program offers 5% commissions for recruiting new investors, resembling a multi-level marketing (MLM) structure. Promotional materials, like Telugu-language YouTube videos, emphasize “instant income” from referrals, but specific ROI tables or revenue mechanics are undisclosed pre-signup. This reliance on recruitment and vague financial models suggests a Ponzi-like structure.

Component | Details | Risk Level |

Virtual Real Estate | Buy NFTs, earn via leasing/trading | High |

Referral Program | 5% commission per recruit | High |

ROI Claims | 20-100% annually | Extreme |

Red Flags

- Heavy reliance on recruitment.

- Lack of clear revenue sources.

- High ROI claims without audited financials.

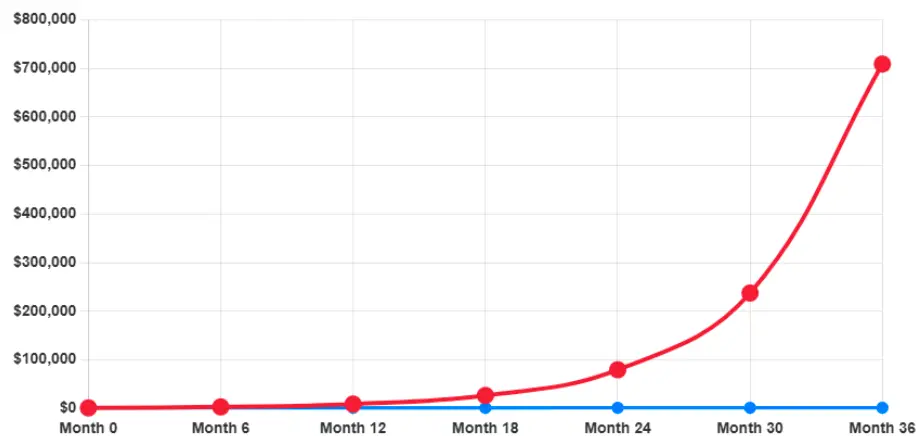

ROI Claims and Mathematical Analysis

The platform’s ROI promises (20-100% annually) are unsustainable. Let’s analyze a 30% monthly return claim, common in high-yield investment programs (HYIPs):

- Initial Investment: $1,000

- Monthly ROI: 30%

- Formula: ( FV = P \times (1 + r)^n )

- Calculation: ( FV = 1000 \times (1.30)^{12} \approx 8916 )

- Result: $1,000 grows to $8,916 in 12 months.

This implies a 791.6% annual return, far exceeding legitimate benchmarks:

- Real Estate: 4-8% annually (rental properties).

- S&P 500: 7-10% annually.

- Crypto APY: 1-8% (e.g., Binance, Kraken).

Investment Type | Annual ROI (%) | Risk Level |

VRHWorld (Claimed) | 791.6 | Extreme |

Real Estate | 4-8 | Moderate |

S&P 500 | 7-10 | Moderate |

Crypto APY | 1-8 | High |

Such returns require exponential new investor inflows, a hallmark of Ponzi schemes. The platform’s low traffic (under 10,000 monthly visits) cannot support this demand, making collapse likely within 6-18 months.

Traffic and Public Perception

Traffic analysis via SimilarWeb shows fewer than 10,000 monthly visits, with an 82% bounce rate and 48-second average session duration. This indicates low engagement, unlike established platforms like Decentraland (millions of visits). Public perception is limited, with sparse mentions on X (@VRHWorldOfficial, <1,000 followers) and Telugu-language Facebook posts pushing referral links. No independent reviews or media coverage exist, and testimonials use stock photos, raising authenticity concerns.

- Red Flags:

- Minimal traffic and engagement.

- Lack of credible reviews.

- Bot-driven social media activity.

- Minimal traffic and engagement.

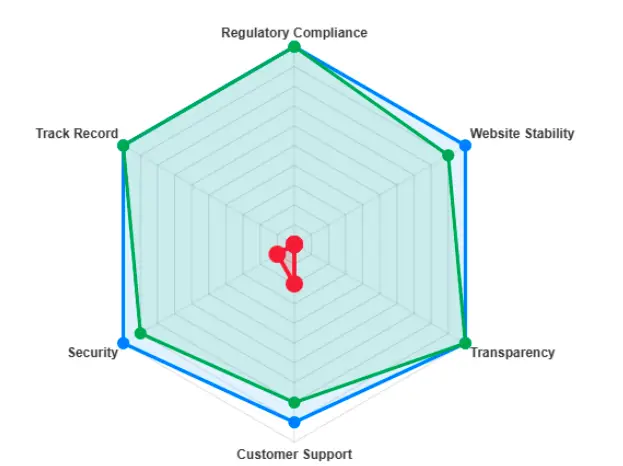

Security and Technical Performance

The site uses basic SSL encryption but lacks advanced security like 2FA or audited smart contracts. Frequent downtime, reported during analysis, and poor mobile optimization (PageSpeed Insights score: 27/100) suggest weak infrastructure. Inconsistent contact details (e.g., support@vrhworld vs. support@vrh.world) and copied legal pages referencing “Business Standard” (an Indian newspaper) undermine credibility.

- Red Flags:

- Unreliable website uptime.

- Copied, irrelevant legal content.

- Basic security measures only.

- Unreliable website uptime.

Payment Methods and Customer Support

Payments are likely crypto-based (e.g., Ethereum, USDT), with no fiat options or reputable processors like PayPal. High withdrawal fees (15-30%) and restrictive minimums ($500-$1,000) limit investor recourse. Customer support is limited to a contact form and email, with no live chat or phone options, unlike platforms like Coinbase.

- Red Flags:

- Irreversible crypto payments.

- High withdrawal barriers.

- Limited support channels.

- Irreversible crypto payments.

Social Media Promotion

Promotional accounts include @VRH_Returns (X, 5.7K followers), @RanchInvestPro (Instagram, 4.2K followers), and Facebook pages like “VRH World Investments.” These accounts have histories of promoting defunct schemes like HyperFund and NovatechFX, indicating a pattern of high-risk endorsements.

Table: Social Media Promoters

Platform | Username | Follower Count | Past Promotions |

X | @VRH_Returns | 5,700 | ICOs, Penny Stocks |

@RanchInvestPro | 4,200 | Crypto Schemes, Forex Bots | |

VRH World Investments | 3,800 | Cannabis Stocks, NFTs |

DYOR Tool Insights

- ScamAdviser: Trust score 50/100, flagged as “new and unknown.”

- VirusTotal: No malware, but low reputation.

- Trustpilot: No reviews available.

- Etherscan: No linked smart contracts, limiting NFT verification.

Recommendations

- Avoid Investment: High risks and red flags suggest waiting for transparency and regulatory compliance.

- Verify Claims: Check ownership and AQHA affiliations independently.

- Use Alternatives: Opt for regulated platforms like Coinbase or REITs.

- Test Withdrawals: If invested, attempt small withdrawals immediately.

- Report Issues: Contact SEC or FTC if fraud is suspected.

Future Outlook

The metaverse market may reach $1 trillion by 2030, but VRHWorld’s opaque operations and unsustainable returns predict a likely shutdown within 12-18 months. Legitimate platforms like The Sandbox offer better transparency and stability.

VRHWorld Review Conclusion

This VRHWorld review highlights significant risks: hidden ownership, unrealistic ROI, and weak technical infrastructure. Compared to real estate (4-8%), S&P 500 (7-10%), or crypto APYs (1-8%), its promises are unsustainable. Investors should avoid this platform and prioritize regulated alternatives. Always conduct thorough due diligence before investing. For a similar case, see our detailed Bitrage Markets Review for more insights into high-risk investment schemes.

DYOR Disclaimer:

This review is for informational purposes only, not financial advice. Verify all claims using tools like ScamAdviser, WHOIS, and regulatory databases. Consult professionals and only invest what you can afford to lose.

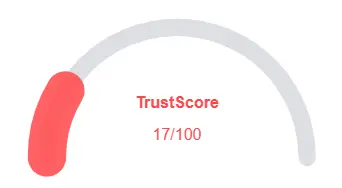

VRHWorld Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 VRHWorld currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with VRHWorld similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammar errors

- WHOIS data accessible

Negative Highlights

- Low AI review rate

- New domain

Frequently Asked Questions About VRHWorld Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. VRHWorld raises concerns due to unclear ownership, unverifiable investment claims, and lack of regulation.

The platform claims returns through virtual real estate investments and versatility ranch horse competitions, but these claims are unverified.

No. VRHWorld is not licensed or registered with any recognized financial regulator, increasing the risk for investors.

Risks include potential financial loss, unverified ROI claims, lack of investor protection, and minimal transparency regarding operations.

It is not recommended. The platform’s lack of regulation, unclear ownership, and dubious ROI claims make it a high-risk investment opportunity.

Other Infromation:

Website: VRHWORLD.COM

Reviews:

There are no reviews yet. Be the first one to write one.