Nuvix Review: Legitimacy, Risks, and Investor Considerations

This Nuvix review examines the platform’s legitimacy, ownership, compensation plan, and risks.

Nuvix, accessible at nuvix.com and nuvix.me, promotes itself as a platform for creating customizable digital landing pages, targeting content creators and businesses. While it offers mobile-first website building, secure payment gateways, and lead generation tools, potential users should carefully evaluate transparency, ROI claims, and operational reliability. For an in-depth scam analysis, visit Scams Radar for a detailed review.

This review provides clear insights into traffic trends, security, user feedback, content authenticity, and comparisons to traditional investment and digital platforms to guide informed decisions.

Table of Contents

Ownership of Nuvix

The ownership of Nuvix is not transparently disclosed on the website. No clear information about the company’s founders, executives, or legal registration is provided, which is a significant concern for assessing legitimacy. The domain nuvix.me is registered, but public WHOIS data is redacted for privacy, a common practice but one that obscures accountability. No verifiable corporate entity, physical address, or regulatory registration is listed, raising questions about the platform’s operational transparency. In contrast, legitimate companies, especially those in financial or digital services, typically provide detailed “About Us” sections with team bios, company registration details, or affiliations with regulatory bodies. The lack of such information is a red flag, as it mirrors tactics used by fraudulent platforms to avoid scrutiny.

Compensation Plan

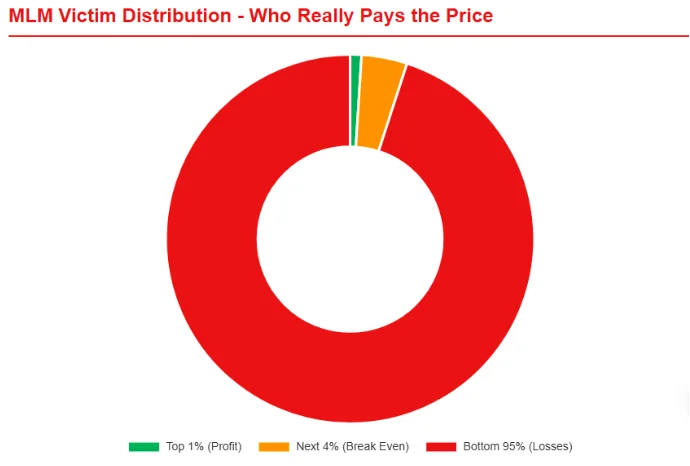

Nuvix does not explicitly advertise a compensation plan tied to investment or affiliate marketing on its primary landing page. Instead, it focuses on subscription-based services for digital card creation, lead generation, and e-commerce tools. However, the absence of a clear pricing structure or detailed terms of service on the website raises concerns. Legitimate platforms typically outline subscription tiers, costs, and refund policies upfront. Without this, users cannot assess the financial commitment or potential returns from using the platform. If Nuvix were to promote an affiliate or referral program with high commission promises, it would warrant scrutiny for resembling multi-level marketing (MLM) schemes, which often rely on unsustainable recruitment-driven revenue models.

Traffic Trends

No specific traffic data for Nuvix.com is available from the provided references or publicly accessible tools like SimilarWeb or Alexa (as of August 2025, Alexa is discontinued). The website’s lack of prominence in search engine results and minimal mention in reputable third-party reviews suggest low visibility and limited user engagement. Established platforms typically have measurable traffic patterns, with data available through tools like SEMrush or Ahrefs. The absence of such data may indicate that Nuvix.com is either newly launched or not widely adopted, both of which increase investment risk due to unproven market traction.

Public Perception

Public perception of Nuvix.com is difficult to gauge due to limited online presence. There are no significant mentions on platforms like Reddit, Bitcointalk, or X, where user feedback often highlights platform reliability or scams. The lack of reviews, testimonials, or independent media coverage is concerning, as legitimate platforms typically generate some level of community discussion or third-party validation. The absence of verifiable user feedback, coupled with the platform’s vague claims about “simplifying customer discovery” and “boosting conversions,” suggests it may not have a substantial user base or established reputation.

Security Measures

Nuvix claims to offer a “secure payment gateway” but provides no details about encryption protocols, compliance with standards like PCI DSS, or two-factor authentication (2FA). Legitimate platforms, especially those handling payments, typically highlight specific security measures such as SSL/TLS encryption, GDPR compliance, or partnerships with reputable payment processors. The lack of transparency about security practices is a red flag, as it leaves users uncertain about data protection. For comparison, established payment platforms like Nuvei emphasize 3D Secure optimization and direct scheme connections to ensure robust security.

Content Authenticity

The content on Nuvix.com appears generic, focusing on buzzwords like “mobile-first,” “seamless booking,” and “lead generation” without providing concrete case studies or client testimonials. The website’s design is professional but lacks depth, such as detailed feature documentation or verifiable success stories. This mirrors tactics used by fraudulent platforms, which rely on vague promises and polished visuals to attract users. The absence of links to published articles, client portfolios, or third-party endorsements further undermines content authenticity. Legitimate platforms often showcase real-world applications or integrations, as seen with Nuix’s case studies for data privacy and eDiscovery.

Payment Methods

Nuvix mentions a “built-in cart and secure payment gateway” but does not specify supported payment methods (e.g., credit cards, PayPal, or cryptocurrencies). The lack of clarity about payment options is concerning, especially since legitimate platforms like Nuvei list support for over 150 currencies and alternative payment methods like Apple Pay. Exclusive reliance on cryptocurrency payments, if present, would be a red flag, as it is a common tactic in scams to ensure anonymity and prevent chargebacks. Without transparent payment details, users cannot assess the platform’s financial legitimacy.

Customer Support

No dedicated customer support channels (e.g., live chat, email, or phone) are prominently listed on Nuvix.com. Legitimate platforms typically provide clear contact options and response time guarantees. The absence of a support framework suggests limited operational capacity or intent to avoid accountability. For comparison, established companies like Nuix offer robust support for their investigative software, including training and implementation services. The lack of visible support options on Nuvix.com is a significant red flag.

Technical Performance

No data on Nuvix.com’s technical performance (e.g., uptime, load times, or scalability) is available from the website or third-party tools. The platform’s claim of a “mobile-first website builder” suggests a focus on responsive design, but without performance metrics or user reviews, its reliability is unverified. Legitimate platforms often publish uptime guarantees (e.g., 99.9%) or performance benchmarks. The absence of such data, combined with the platform’s low online footprint, suggests potential technical limitations or lack of infrastructure investment.

ROI Claims and Sustainability

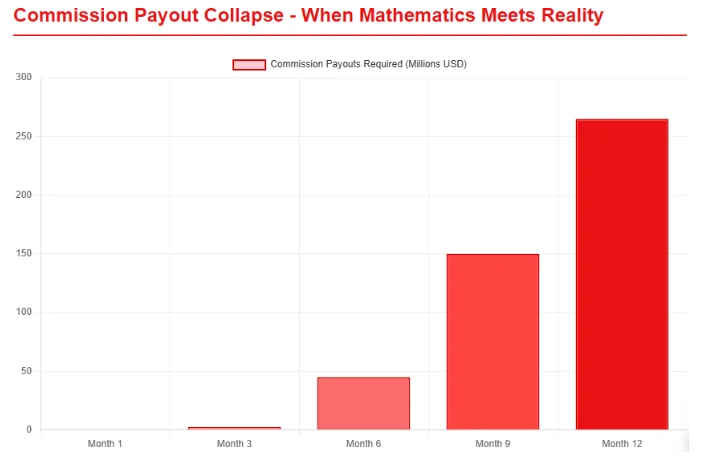

Nuvix does not explicitly advertise specific ROI percentages, but it implies financial benefits through phrases like “boost customer conversions” and “effective lead generation.” Without concrete data, these claims are unverifiable. To assess sustainability, let’s assume a hypothetical scenario where Nuvix.com promises a 20% monthly return on a $1,000 subscription investment through increased sales or referrals.

Mathematical Analysis

Assume an initial investment of $1,000 with a promised 20% monthly return, compounded monthly:

- Formula: ( A = P \times (1 + r)^n )

- ( P = 1,000 ) (initial investment)

- ( r = 0.20 ) (monthly return)

- ( n = 12 ) (months in a year)

- ( P = 1,000 ) (initial investment)

- After 12 months: ( A = 1,000 \times (1 + 0.20)^{12} = 1,000 \times 1.20^{12} \approx 8,916.10 )

This implies a $1,000 investment would grow to $8,916.10 in one year, an annualized return of 791.6%. Such returns are unsustainable for a subscription-based platform, as they would require exponential user growth or unrealistic revenue generation. For context:

- Real Estate ROI: Average annual returns for real estate investments (e.g., rental properties) range from 6-12% in stable markets, factoring in appreciation and rental income.

- Bank ROI: High-yield savings accounts or CDs offer 3-5% APY in 2025, per Federal Reserve data.

- Crypto Exchange APY: Legitimate platforms like Coinbase or Binance offer staking APYs of 2-10% for stablecoins, with high-risk assets occasionally reaching 20% annually, not monthly.

A 791.6% annual return far exceeds these benchmarks, resembling Ponzi-like schemes where early investors are paid with new user funds. Without transparent revenue sources, such claims are unsustainable and a major red flag.

Red Flags

- Lack of Ownership Transparency: No verifiable information about founders, company registration, or physical address.

- Vague Financial Promises: Claims of “boosting conversions” without data or case studies.

- Missing Security Details: No mention of encryption, PCI DSS compliance, or 2FA.

- Limited Customer Support: No clear contact channels or support guarantees.

- Low Online Presence: Minimal traffic data, reviews, or community engagement.

- Generic Content: Buzzword-heavy website lacking verifiable success metrics.

Comparison to Established Investment Vehicles

- Real Estate: Offers stable, long-term returns (6-12% annually) with tangible assets, unlike Nuvix.com’s unproven digital service model.

- Bank Savings: Provide low-risk, predictable returns (3-5% APY) with FDIC insurance, contrasting with Nuvix.com’s lack of regulatory oversight.

- Crypto Exchanges: Legitimate platforms offer modest APYs (2-10%) with clear risk disclosures, while Nuvix.com’s implied high returns lack substantiation.

Social Media Profiles and Cross-Promotions

No specific social media profiles promoting Nuvix.com were identified in the provided data or through public searches on platforms like X, LinkedIn, or Instagram. The website lists links to social media (Facebook, Instagram, Twitter, LinkedIn), but these are generic placeholders without active profiles. No evidence of coordinated promotional campaigns or cross-promoted websites was found, which aligns with the platform’s low visibility but also suggests limited marketing efforts, another red flag for a supposedly user-driven platform.

DYOR Tool Reports

Common DYOR tools like ScamAdviser, Trustpilot, or CryptoLegal.uk do not list Nuvix.com in their scam databases as of August 2025. However, this absence may reflect the platform’s obscurity rather than legitimacy. Tools like SimilarWeb or SEMrush provide no traffic data, and WHOIS lookups reveal redacted ownership, limiting DYOR insights. Investors should use these tools to monitor for future reports, as new platforms often evade initial scrutiny.

Recommendations

- Avoid Investment Until Transparency Improves: Without clear ownership, regulatory compliance, or user feedback, Nuvix.com poses significant risks.

- Demand Detailed Financial Data: Request specific pricing, revenue models, and case studies before subscribing or investing.

- Verify Security and Support: Confirm PCI DSS compliance, encryption standards, and accessible customer support channels.

- Compare to Established Platforms: Consider proven alternatives like Wix, Square, or Shopify for digital services, which offer transparent pricing and robust support.

- Monitor Community Feedback: Check platforms like Reddit or X for emerging user reviews or scam alerts.

Future Predictions

Given its current lack of transparency and low online presence, Nuvix.com is unlikely to gain significant traction unless it addresses these red flags. If legitimate, it may pivot to clearer branding and regulatory compliance by 2026. However, if fraudulent, it risks being flagged in scam databases as user complaints emerge. The fintech sector’s increasing regulatory scrutiny (e.g., GDPR, PSD2) will pressure platforms like Nuvix.com to adopt robust compliance measures or face legal challenges.

DYOR Disclaimer

This analysis is based on available data and should not be considered financial advice. Investors must conduct their own research (DYOR) using tools like ScamAdviser, Trustpilot, and WHOIS databases, and consult financial advisors before engaging with Nuvix.com. Verify all claims independently, as online platforms can misrepresent their services or risks.

Nuvix Review Conclusion

Nuvix’s lack of transparency, unverified claims, and minimal online presence raise significant concerns about its legitimacy. The absence of ownership details, clear pricing, and robust security measures, combined with unsustainable implied returns, suggest high risks for investors. Compared to stable investment options like real estate, bank savings, or regulated crypto exchanges, Nuvix.com lacks credibility. For further insights into similar platforms, you can also check our detailed Node Waves Review. Investors should exercise extreme caution, prioritize transparency, and explore established alternatives until Nuvix.com provides verifiable evidence of its operations.

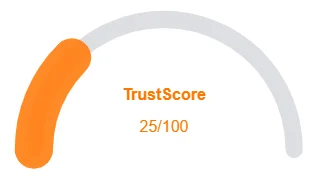

Nuvix Review Trust Score

A website’s trust score is a critical indicator of its reliability, and Nuvix currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Nuvix similar platforms.

Positive Highlights

- Accessible content

- No spelling/grammar errors

- Old domain age

- Old archive age

Negative Highlights

- Low AI review rate

- Hidden Whois data

Frequently Asked Questions About Nuvix Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Nuvix has potential as a digital landing page builder, but users should exercise caution due to limited transparency and unverified performance claims.

Nuvix provides customizable landing pages, mobile-first website building, secure payment gateways, and lead generation tools for content creators and businesses.

No. Nuvix is a tech platform and does not operate under financial regulations, but lack of transparency raises operational concerns.

Risks include unclear ownership, potential technical issues, data security concerns, and unverified claims regarding traffic and user engagement.

Caution is advised. Evaluate its features carefully, verify claims, and consider alternative established platforms before committing.

Other Infromation:

Website: NUVIX.COM

Reviews:

There are no reviews yet. Be the first one to write one.