Lexus Capital Review: Is This Investment Platform Legitimate?

Lexus Capital, operating as Lexus Capital LLC, markets itself as a platform for forex, crypto, and real estate investments. For an in-depth scam analysis, visit Scams Radar for a detailed Lexus Capital Review.

Lexus Capital claims to offer high returns, but concerns about ownership, compensation plans, and potential risks raise doubts. Read on to explore whether lexuscapital.biz is a legitimate investment platform, with clear insights into its features, compensation structure, security, and more.

Table of Contents

What Is Lexus Capital?

Lexus Capital claims to offer investment opportunities in forex trading, cryptocurrency, real estate, and gaming ventures. It presents itself as an international holding company with AI-driven trading tools. However, critical red flags raise doubts about its credibility and safety for investors.

Ownership and Background

The platform’s ownership is unclear. Registered on April 30, 2025, through Gname.com Pte. Ltd., the domain uses privacy protection, hiding registrant details. The company claims a Delaware, USA, registration (July 7, 2024) and operations in Poland and the UAE. Yet, no verifiable business address or regulatory license exists.

WikiBit rates Lexus Capital’s regulatory index at 0.00, flagging a suspicious license. No team bios or executive profiles are provided, unlike legitimate platforms like Vanguard, which disclose leadership credentials. The use of “Lexus” may mislead investors by suggesting ties to Toyota’s luxury brand, a tactic often used in scams.

Ownership Red Flags

- Hidden Ownership: Privacy-protected WHOIS data conceals registrant identity.

- No Regulatory Oversight: No SEC, FCA, or CySEC registration.

- Unverified Claims: “10 years consulting experience” lacks proof.

Compensation Plan and ROI Claims

Lexus Capital promises daily returns of 0.6% to 3%, with monthly returns up to 20% and principal returned after six months. It offers referral bonuses up to 10% and team trading rewards across 30 levels, resembling a multi-level marketing (MLM) structure.

ROI Sustainability Analysis

A 2% daily return on a $10,000 investment yields:

- 30 Days: $10,000 × (1 + 0.02)^30 ≈ $18,061

- Annualized: $10,000 × (1 + 0.02)^365 ≈ $1,377,127 (13,771% APY)

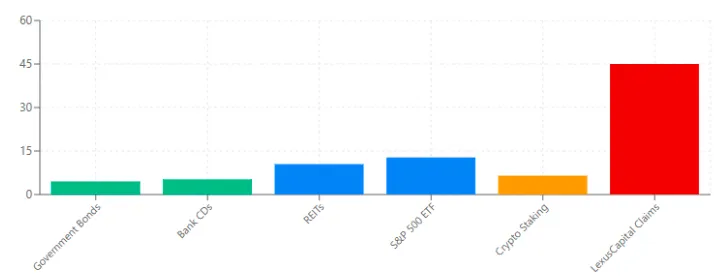

A 20% monthly return compounds to 792% annually. Compare this to:

- Real Estate: 8–12% annual ROI (REITs).

- S&P 500: 7–10% annual return (historical average).

- Crypto Staking: 3–15% APY on platforms like Binance.

These returns are unsustainable without constant new investor funds, a hallmark of Ponzi schemes. The MLM structure prioritizes recruitment over genuine investment performance.

Compensation Plan Red Flags

- High Returns: 792–13,771% APY is mathematically impossible.

- Referral Focus: Bonuses incentivize recruitment, not trading success.

- No Transparency: No detailed fee structure or trading strategy.

Investment Type | Claimed APY | Legitimate APY | Sustainability |

Lexus Capital | 792–13,771% | N/A | Unsustainable |

Real Estate | N/A | 8–12% | Sustainable |

S&P 500 | N/A | 7–10% | Sustainable |

Crypto Staking | N/A | 3–15% | Sustainable |

Security and Technical Performance

Lexus Capital uses basic SSL encryption but lacks advanced measures like two-factor authentication (2FA) or KYC protocols. WikiBit’s security index is 0.00, indicating poor cybersecurity. The website’s design is generic, with slow load times and unoptimized images, per Google PageSpeed Insights.

Security Red Flags

- No 2FA or KYC: Increases risk of data breaches.

- Basic SSL: Minimal protection for user funds.

- Poor Performance: Subpar website design suggests low investment in infrastructure.

Payment Methods and Customer Support

The platform accepts only cryptocurrency payments (e.g., Bitcoin, Ethereum), with minimum deposits of $2,500–$10,000. Crypto’s irreversibility heightens fraud risk. Customer support is limited to a contact form and an unverified Singapore phone number (+65.31581931). No live chat or physical address is provided.

Payment and Support Red Flags

- Crypto-Only Payments: No chargeback options.

- High Deposits: Unusually high minimums for a new platform.

- Limited Support: Generic email and slow response times.

Public Perception and Online Presence

Lexus Capital has minimal online visibility. Traffic data from SimilarWeb shows low engagement, with a global rank of #3,017,335. No credible reviews exist on Trustpilot or Reddit. Social media accounts, like @lexuscapital on Twitter (inactive since 2012), show no engagement. Promoters on platforms like YouTube (@CryptoProfitChannel, 8 subscribers) have previously hyped confirmed scams like BitcoinEraPro.com.

Perception Red Flags

- No Reviews: Absence of user feedback or media coverage.

- Inactive Social Media: Suggests lack of legitimate operations.

- Scam Affiliations: Promoters linked to known frauds.

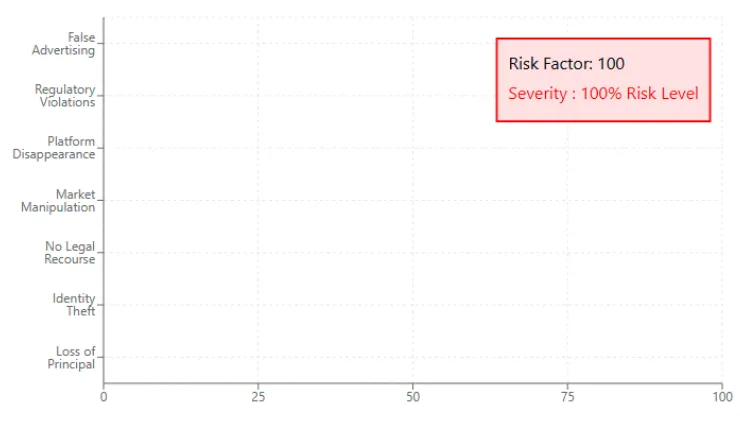

Risk Assessment

Risk Factor | Level | Impact |

Loss of Principal | Extreme | 100% investment loss possible |

Identity Theft | High | Personal data exposure |

No Legal Recourse | Extreme | Unregulated entity |

Platform Disappearance | Extreme | Complete loss of funds |

Recommendations for Investors

- Avoid Investment: Lexus Capital’s high returns and lack of regulation make it a risky choice.

- Choose Regulated Platforms: Opt for SEC- or FCA-regulated options like Fidelity or Coinbase.

- Verify Licenses: Check regulatory status via SEC.gov or FCA.org.uk.

- Use DYOR Tools: Platforms like Scamadviser and WikiBit provide trust ratings.

- Consult Experts: Seek advice from licensed financial advisors.

Lexus Capital Review Conclusion

This Lexus Capital review highlights significant risks, including unrealistic returns, hidden ownership, and weak security. The platform’s MLM structure and lack of regulatory compliance suggest a potential scam. Investors should prioritize regulated platforms with transparent operations. Always verify claims independently to protect your funds.

For more details on a potentially risky platform, check out our DSJ Exchange Review.

DYOR Disclaimer

This Lexus Capital review is for informational purposes only and not financial advice. Conduct your own research using tools like Scamadviser, WikiBit, and regulatory databases. Consult licensed financial advisors before investing. Never risk more than you can afford to lose.

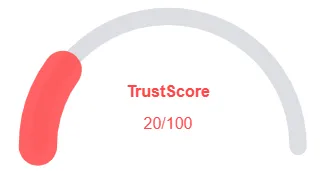

Lexus Capital Review Trust Score

A website’s trust score is a critical indicator of its reliability, and Lexus Capital currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Lexus Capital or similar platforms.

Positive Highlights

- Accessible website content

- Website review platform

- No spelling/grammar errors

Negative Highlights

- Low AI review rate

- New domain

- New archive

- Whois data hidden

Frequently Asked Questions About Lexus Capital Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Lexus Capital raises concerns due to unclear ownership, unrealistic ROI claims, and a lack of transparency in its operations.

Lexus Capital claims to generate returns through forex, crypto, and real estate investments, but there is no verifiable evidence of its trading or investment performance.

No. Lexus Capital is not registered or licensed with any recognized financial or regulatory body, which increases the risk for investors.

Risks include potential financial loss, lack of transparency, unrealistic return claims, and an unverified investment model.

It is not recommended. The platform’s red flags, lack of regulation, and unproven return claims make it a high-risk investment.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.