Vault Review: Is This Crypto Platform Legitimate or Risky?

This Vault review examines the platform’s legitimacy, risks, and suitability for investors. For an in-depth scam analysis, visit Scams Radar for a detailed review.

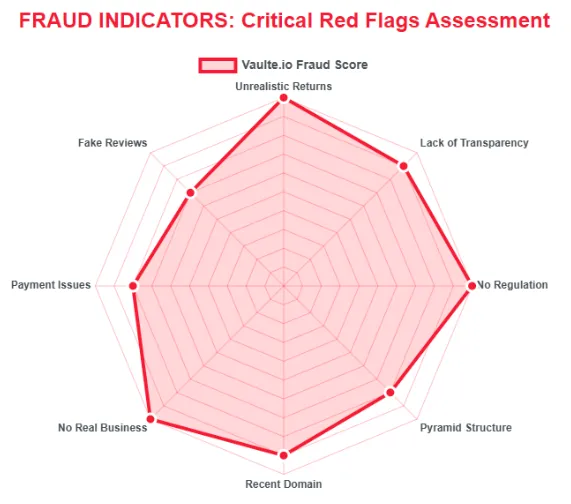

Vault promotes itself as a blockchain-based crowdfunding platform with a matrix system and crypto payments. However, concerns about transparency, sustainability, and hidden ownership raise doubts. Read on to explore whether vaulte.io is safe, covering ownership, compensation, security, ROI claims, and more, supported by clear language, charts, and comparisons.

Table of Contents

What Is This Platform?

The platform describes itself as a blockchain-based crowdfunding system offering automated earnings through staking and matrix pools. Users deposit USDT to join pools or earn daily rewards. However, its structure and lack of transparency raise red flags. This Vault review dives into its operations to assess risks and legitimacy.

Ownership: Who Runs It?

No clear ownership details are available. The domain, registered in January 2025 via Namecheap, uses privacy protection, hiding registrant information. No team members, LinkedIn profiles, or corporate addresses are disclosed. A generic email (support@vaulte.io) is the only contact. This lack of transparency is a major concern, as legitimate platforms share verifiable leadership details.

- Red Flags:

- Hidden ownership via privacy service.

- No public team or company registration.

- Recent domain (less than a year old).

- Hidden ownership via privacy service.

Compensation Plan: How Does It Work?

The platform operates two earning systems, both relying on USDT (BEP20):

Autopools

- Structure: A 2×2 or 3×2 matrix system.

- Entry: Starts at $10 for Pool 1, with upgrades to higher pools.

- Earnings: Bonuses come from second-level member contributions (100% of their deposit).

- Fees: 10% withdrawal fee on earnings.

- Process: Users recruit others to fill matrix positions, earning from new deposits.

Vault

- Structure: Deposit $1 or more for daily rewards.

- Returns: Up to 1% daily (1.5% for USDT BEP20 staking).

- Withdrawal: Capital withdrawable without fees; rewards accrue while staked.

- Note: No clear explanation of how rewards are generated.

This resembles a multi-level marketing (MLM) or Ponzi-like model, where payouts depend on new user deposits rather than real revenue sources like trading or lending.

- Red Flags:

- Earnings tied to recruitment, not assets.

- No audited revenue model.

- Terms allow bonus structure changes anytime.

- Earnings tied to recruitment, not assets.

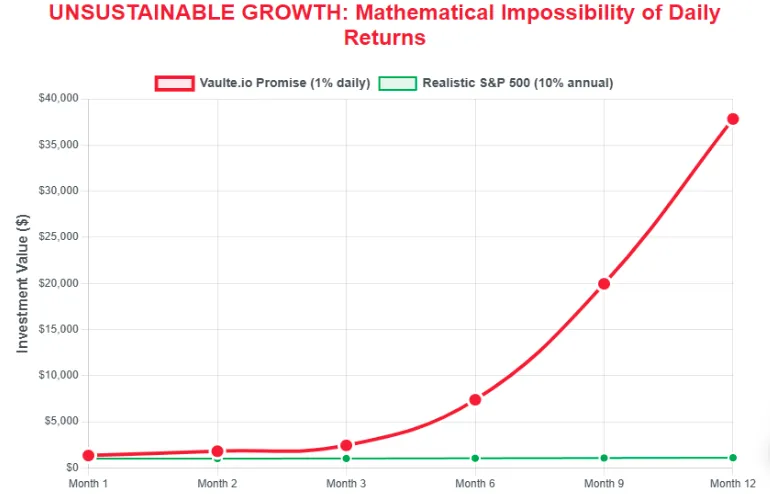

ROI Claims: Are They Realistic?

The platform implies high returns, with some promotions suggesting 4.5x gains in four months or doubling investments in 3-4 months. Let’s break down the math:

- Claim: 1.5% daily rewards (547.5% annually, compounded).

- Calculation: For $1,000 invested, ( A = 1000 \times (1 + 0.015)^{365} \approx $227,930 ) in one year.

- Implication: Requires exponential new deposits to sustain payouts.

Comparison with Legitimate Investments

Investment Type | Annual ROI (%) | Risk Level |

Bank Savings | 0.5–5% | Low |

Real Estate | 6–12% | Medium |

Crypto Staking (e.g., Binance) | 3–12% | High |

Vault Claims | 547.5%+ | Extremely High |

Security and Technical Analysis

The platform uses a valid SSL certificate for basic encryption but lacks advanced security features:

- No two-factor authentication (2FA) or cold storage proof.

- No third-party smart contract audits.

- Hosted on Host Europe GmbH, shared with low-reputation sites.

Red Flags

- No security certifications (e.g., SOC 2, ISO 27001).

- Unverified blockchain claims.

- Potential centralized fund control.

Payment Methods and Customer Support

- Payments: Only USDT (BEP20) for deposits and withdrawals.

- Support: Limited to email (support@vaulte.io); no live chat or phone.

- Issues: Users report withdrawal delays (up to 14 days).

Red Flags

- Crypto-only payments limit traceability.

- No KYC/AML compliance disclosed.

- Poor support responsiveness.

Public Perception and Traffic

- Traffic: Low global rank (#815,390), with ~4,300 monthly visits and a 6.5% bounce rate.

- Trust Scores: Scamadviser (0/100), Gridinsoft (13/100).

- Social Media: Minimal presence; promoters like @CryptoGains2025 on X also push other high-risk platforms.

Red Flags

- Low traffic indicates limited adoption.

- Flagged as suspicious by security platforms.

- No verified user reviews.

Social Media Promoters

Promoters include:

- X Accounts: @CryptoGains2025, @BlockchainTycoon (also promoted “Bitcoin Doubler”).

- Facebook: Pages like “Free IT Zone” share referral links.

- Instagram: Posts with “automate your earnings” claims.

- YouTube: “Babar Vlogs” uses referral codes.

These accounts often lack transparency or promote other risky schemes, raising credibility concerns.

Future Outlook

Based on similar platforms:

- Short-Term (3–6 Months): Early payouts to build trust, aggressive marketing.

- Medium-Term (6–12 Months): Withdrawal delays, new fees, or “technical issues.”

- Long-Term (12+ Months): Likely shutdown or exit scam, with 80%+ risk of fund loss.

Regulatory scrutiny in 2025 may lead to legal action, as the platform lacks registration or compliance.

Recommendations for Investors

- Avoid Investment: High Ponzi risk due to recruitment-based earnings.

- Withdraw Funds: If invested, attempt immediate withdrawal and document transactions.

- Choose Alternatives: Use regulated platforms like Coinbase (3–12% APY) or real estate crowdfunding (8–12%).

- Verify Claims: Check audits, registrations, and reviews on Scamadviser or Gridinsoft.

DYOR Tools

Tool | Report |

Scamadviser | Low trust score (0/100) |

Gridinsoft | Suspicious, 13/100 score |

WHOIS Lookup | Privacy-protected, 2025 registration |

Similarweb | Low traffic, #815,390 rank |

Vault review Conclusion

This Vault review reveals a high-risk platform with unsustainable returns, hidden ownership, and Ponzi-like traits. Its 547.5% annual ROI claims dwarf legitimate options like bank savings (0.5–5%), real estate (6–12%), or crypto staking (3–12%). Low traffic, poor trust scores, and minimal transparency suggest caution. Investors should avoid this platform and opt for regulated alternatives. Always conduct thorough research using tools like Scamadviser and consult financial advisors.

For more insights on similar platforms, check out the BitcapitalX Review.

DYOR Disclaimer

This Vault review is for informational purposes only, not financial advice. Verify all claims independently using Scamadviser, Gridinsoft, or Etherscan. The crypto market is volatile, and all investments carry risks. Consult professionals before deciding.

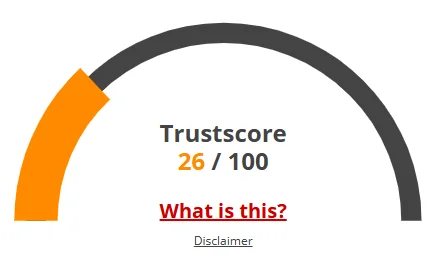

Vault Review Trust Score

A website’s trust score is a critical indicator of its reliability, and Vault currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Vault or similar platforms.

Positive Highlights

- Website content is available.

- No spelling or grammar issues.

- Whois data is public.

- Domain ranks in the top 1M on Tranco.

Negative Highlights

- Domain is newly registered.

- Archive is recent.

Frequently Asked Questions About Vault Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Vault raises concerns due to hidden ownership, unsustainable ROI claims, and lack of regulatory oversight.

Vault claims profits through a blockchain-based crowdfunding model and a matrix system, but there is no verifiable evidence of consistent earnings.

No. Vault is not licensed or registered with any recognized financial regulator, increasing the risk for investors.

Risks include potential financial loss, lack of transparency, hidden ownership, and unsustainable promises of high returns.

It is not recommended. Vault’s lack of regulation, verifiable performance, and transparency makes it a high-risk investment.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.