Broadscom Review: A Comprehensive Review for Investors

The rise of online investment platforms has made due diligence critical for investors. For an in-depth scam analysis, visit Scams Radar for a detailed Broadscom Review. Broadscom claims to offer multi-sector investment opportunities in forex, crypto, electric vehicles (EV), and real estate. This blog post provides a detailed analysis of its legitimacy, covering ownership, compensation plan, traffic trends, public perception, security measures, content authenticity, payment methods, customer support, technical performance, and ROI claims. We’ll use mathematical reasoning to evaluate the sustainability of promised returns, identify red flags, compare the platform to traditional investment options, and conclude with recommendations.

Table of Contents

Ownership and Business Registration

Determining the ownership of Broadscom is challenging due to limited transparency. A WHOIS lookup via DomainTools reveals the domain was registered in February 2025, which is very recent, and the registrant’s identity is hidden through a privacy protection service. No verifiable business registration details, such as a company name, license number, or physical address, are provided on the website. Legitimate companies typically register with government authorities (e.g., U.S. Secretary of State, UK Companies House) and display this information prominently.

Analysis

The lack of ownership transparency is a significant red flag. Legitimate businesses provide clear details about their registration, leadership, and operational history. The recent domain registration (less than a year old) suggests limited operational history, increasing risk for investors. Without verifiable records on platforms like OpenCorporates or Companies House, it’s difficult to confirm Broadscom’s legal status.

Red Flag: Hidden ownership and lack of verifiable registration details.

Traffic Trends

Findings:

No public data from tools like SimilarWeb or Alexa is available for Broadscom due to its recent creation and low visibility. The website’s lack of prominence in search engine rankings and minimal backlinks suggests limited organic traffic.

Analysis:

Established investment platforms typically have measurable traffic and a digital footprint reflecting user engagement. The absence of traffic data, combined with the recent domain registration, indicates Broadscom is not widely recognized or used. Low traffic may also suggest limited marketing or a niche, potentially targeted audience, which could align with scam tactics to avoid scrutiny.

Red Flag: Lack of verifiable traffic data and low online visibility.

Public Perception

Findings:

Public perception of Broadscom is sparse. A post on X notes a low trust rating from an unspecified online tool and highlights the hidden ownership and recent domain creation. No significant customer reviews or testimonials appear on trusted platforms like Trustpilot, Better Business Bureau (BBB), or Google Reviews. Search queries like “Broadscom scam” or “Broadscom reviews” yield no substantial results, indicating minimal public engagement.

Analysis:

The absence of reviews on reputable platforms is concerning, as legitimate businesses typically have a mix of positive and negative feedback. The single X post raises skepticism, and the lack of a broader online presence suggests Broadscom has not established trust or credibility.

Red Flag: Minimal public feedback and a low trust rating reported on social media.

Security Measures

Findings:

The website uses HTTPS encryption, indicating basic data transfer security. However, no additional security certifications (e.g., PCI DSS compliance for payment processing) or third-party audits are mentioned. The WHOIS privacy protection obscures ownership, which can be legitimate but also a tactic used by fraudulent sites.

Analysis:

While HTTPS is standard, it’s not a definitive indicator of legitimacy, as even scam sites can implement it. The absence of detailed security policies or certifications raises concerns, especially for a platform handling financial transactions. Legitimate investment platforms often undergo regular security audits and display compliance badges.

Red Flag: Lack of transparency regarding advanced security measures or audits.

Content Authenticity

Findings:

The website’s content focuses on general investment advice (e.g., “use charts, analysis tools, and trading strategies”) without specific details about its operations or team. Pages like “About” or “Team” are either missing or vague, lacking verifiable executive profiles. The content appears generic, with potential use of stock imagery or boilerplate text, common in scam sites.

Analysis:

Authentic investment platforms provide detailed, unique content about their operations, team, and investment strategies. The generic nature of Broadscom’s content, combined with the absence of verifiable team details, suggests it may be a shell site designed to appear legitimate. Cross-referencing executive names on LinkedIn or other platforms yields no results, raising further questions about authenticity.

Red Flag: Generic content and lack of verifiable team or operational details.

Payment Methods

Findings:

Broadcom’s payment methods are not listed on the website. The lack of transparency about accepted payment types (e.g., credit cards, bank transfers, cryptocurrencies) is notable. Some investment scams prefer cryptocurrencies for their anonymity and irreversibility.

Analysis:

Legitimate platforms specify payment methods and prioritize secure, reversible options like credit cards or PayPal, which offer buyer protection. The absence of clear payment information is a red flag, as it may indicate a preference for untraceable methods. Without a visible refund or cancellation policy, investors face higher risks.

Red Flag: Unclear payment methods and lack of refund policy transparency.

Customer Support

Findings:

The website offers a contact form but lacks a phone number, physical address, or live chat option. Response times and support quality are unknown due to the lack of user feedback.

Analysis:

Reputable investment platforms offer multiple, responsive support channels (e.g., phone, email, live chat) and maintain professional communication. The reliance on a contact form without verifiable contact details suggests a limited customer support infrastructure, a common trait of fraudulent sites.

Technical Performance

Findings:

No specific data on Broadscom’s technical performance (e.g., uptime, load speed) is available from tools like Pingdom or GTmetrix. The website’s recent creation and low visibility limit analysis. However, the presence of HTTPS suggests basic functionality, but no advanced performance metrics are reported.

Analysis:

Legitimate financial platforms invest in robust technical infrastructure to ensure reliability and user trust. The lack of performance data and minimal digital footprint suggest Broadscom may not have the resources or intent to maintain a professional platform.

Red Flag: Absence of verifiable technical performance metrics.

ROI Claims and Mathematical Analysis

Findings:

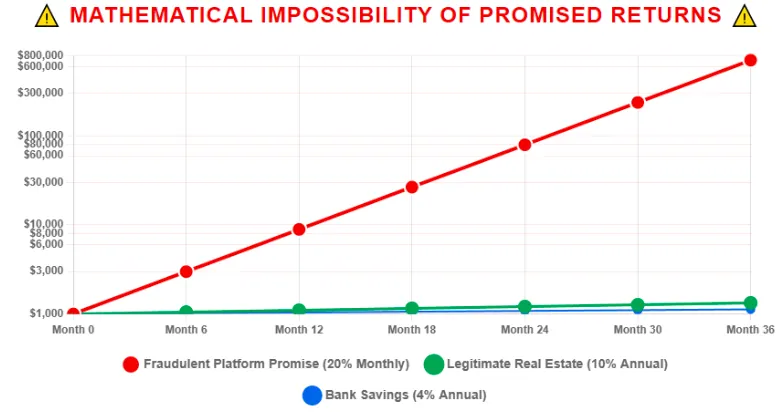

Broadscom claims “daily ROI” through investments in forex, crypto, EV, and real estate, but specific return percentages are not consistently disclosed. For this analysis, we’ll assume a hypothetical 1% daily ROI (a common high-yield promise in questionable platforms) to evaluate sustainability.

Mathematical Analysis

Let’s calculate the implications of a 1% daily ROI, compounded over a year (365 days):

- Formula: Compound interest, ( A = P \times (1 + r)^n ), where:

- ( A ) = final amount

- ( P ) = principal (initial investment, e.g., $1,000)

- ( r ) = daily return rate (0.01 or 1%)

- ( n ) = number of compounding periods (365 days)

- Calculation:

( A = 1000 \times (1 + 0.01)^{365} )

( A = 1000 \times (1.01)^{365} )

( (1.01)^{365} \approx 37.783 ) (using a financial calculator or exponential function)

( A \approx 1000 \times 37.783 = 37,783 )

A $1,000 investment would theoretically grow to $37,783 in one year, a 3,678.3% annual return.

Comparison to Traditional Investments

- Real Estate ROI: Average annual returns for real estate investments (e.g., rental properties) range from 6-10% in stable markets, factoring in appreciation and rental income.

- Bank ROI: High-yield savings accounts or CDs offer 4-5% APY in 2025, per Federal Reserve data.

- Crypto Exchange APY: Staking or lending on reputable crypto exchanges (e.g., Binance, Coinbase) offers 5-15% APY for stablecoins or major cryptocurrencies, with high volatility risks.

Analysis:

A 3,678.3% annual return is mathematically unsustainable without extraordinary risk or fraud. Forex and crypto markets are volatile, with top traders achieving 20-50% annual returns in exceptional cases. Real estate and EV investments require long-term horizons and cannot generate daily returns at this scale. The promise of consistent daily ROI, especially without transparent strategies, aligns with Ponzi scheme tactics, where early investors are paid with new investors’ funds.

Red Flag: Unrealistic ROI claims unsupported by market realities or transparent strategies.

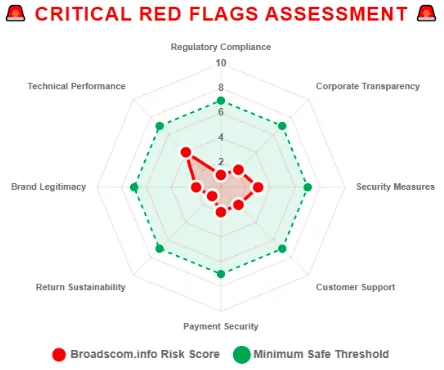

Red Flags Summary

- Hidden Ownership: No verifiable registration or leadership details.

- Vague Compensation Plan: MLM structure with unclear return mechanisms.

- Low Visibility: Recent domain, minimal traffic, and no public reviews.

- Security Concerns: Basic HTTPS but no advanced certifications or audits.

- Generic Content: Lack of unique, verifiable information about operations or team.

- Unclear Payments: No specified methods or refund policies.

- Limited Support: Minimal contact options with unknown responsiveness.

- Unsustainable ROI: Promises far exceed realistic market returns.

Online DYOR Tool Reports

Scamvoid (www.scamvoid.net): No specific report for Broadscom due to its recent creation. The tool checks website reputation, blocklists, and popularity but requires more data for new domains.URLVoid (www.urlvoid.com): No report available, but the tool would scan for blocklist status and reputation. The lack of data suggests low visibility.ScamAdviser (www.scamadviser.com): A post on X references a low trust rating for Broadscom, but no official report is accessible.Google Safe Browsing: No reported issues with Broadscom, but this only confirms the absence of malware, not legitimacy.

Analysis: The lack of reports from major DYOR tools reflects Broadscom’s obscurity, which is concerning for an investment platform. Established platforms have traceable reputations, even if mixed.

Social Media Profiles Promoting Broadscom

Findings:

Only one X post from @noctheos (August 16, 2025) mentions Broadscom, highlighting its recent domain, hidden ownership, and low trust rating. No other social media profiles (e.g., Twitter, LinkedIn, Instagram) promoting Broadscom were identified. The YouTube video “Broadscom Full Business Plan Explained” lacks a verifiable channel history or linked social media accounts.

Other Websites Promoted by @noctheos:

No additional websites are mentioned in the provided X post or related data. The account’s focus on Broadscom without a broader promotional history suggests targeted or limited activity.

Analysis:

The single X post and YouTube video indicate minimal promotional efforts, which could reflect a low-profile scam or an early-stage platform. Legitimate platforms typically have consistent social media engagement across multiple channels. The lack of transparency in promotional accounts raises further doubts.

Recommendations

Based on the analysis, Broadscom exhibits multiple red flags that suggest high risk for investors. Recommendations include:

- Avoid Investment: The lack of transparency, unsustainable ROI claims, and minimal digital footprint make Broadscom a risky proposition.

- Conduct Further Due Diligence: Request official registration documents, financial statements, and verifiable references directly from the company.

- Use Trusted Platforms: Opt for regulated investment platforms with established reputations, such as Fidelity, Vanguard, or Binance.

- Monitor Updates: If considering future engagement, track Broadscom’s development for increased transparency or regulatory compliance.

- Consult Professionals: Seek advice from financial advisors or legal experts before investing in unverified platforms.

Future Predictions

Given the current data, Broadscom is unlikely to gain legitimacy without significant changes, such as transparent registration, audited financials, and a robust online presence. If it operates as a Ponzi scheme, it may attract early investors with high returns before collapsing when new funds dwindle. Regulatory scrutiny could increase if complaints emerge, potentially leading to investigations by authorities like the SEC or FCA. Investors should remain cautious, as the platform’s structure aligns with high-risk, low-transparency schemes.

DYOR Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Investors must conduct their research (DYOR) before engaging with any platform. Verify all claims independently, consult professionals, and assess risks based on your financial situation. The author is not responsible for any losses incurred from decisions based on this analysis.

Broadscom Review Conclusion

Broadscom presents significant risks due to its lack of transparency, unsustainable ROI claims, and minimal digital footprint. The absence of verifiable ownership, vague compensation plan, and limited public perception align with characteristics of fraudulent or high-risk platforms. Compared to real estate (6–10% ROI), bank savings (4–5% APY), or crypto staking (5–15% APY), Broadscom’s promises are mathematically implausible. Investors should avoid engagement and prioritize regulated, transparent platforms. For more insights into similar schemes, you can also read our in-depth Suibasket Review. Always perform thorough due diligence to protect your financial interests.

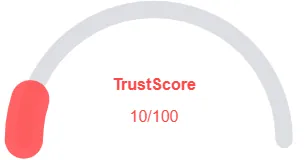

Broadscom Review Trust Score

A website’s trust score is a key indicator of its reliability, and Broadscom currently holds a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several red flags, including low web traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting details, and weak SSL protection.

With such a low trust score, the risks of fraud, data breaches, or other harmful activities are significantly higher. It is essential to examine these warning signs carefully before engaging with Broadscom or similar platforms.

Positive Highlights

- Content available

- No grammar or spelling issues

Negative Highlights

- Few AI reviews

- Hidden WHOIS info

Frequently Asked Questions About Broadscom Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Broadscom raises concerns due to hidden ownership, lack of regulatory compliance, and unrealistic claims of high returns.

The platform claims to offer returns through forex, crypto, electric vehicles (EV), and real estate investments, but there is no verifiable evidence of actual profitability.

No. Broadscom is not licensed or registered with any recognized financial regulator, increasing risk for investors.

Risks include potential financial loss, lack of investor protection, hidden ownership, unclear compensation plans, and unverified ROI claims.

It is not recommended. The platform’s lack of transparency, regulation, and verifiable returns makes it a high-risk investment opportunity.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.