Qutom Review: Is This Platform Safe for Investors in 2025?

This Qutom review examines the platform’s legitimacy, risks, and suitability for investors. For an in-depth scam analysis, visit Scams Radar for a detailed review.

Qutom promotes itself as an AI-driven solution for renewable energy trading and hydrogen staking. However, concerns about transparency, unrealistic returns, and technical issues raise doubts. Read on to explore whether qutom.ai is safe, covering ownership, compensation, security, user feedback, and more, supported by clear language and visuals for easy understanding.

Table of Contents

What Is the Qutom Platform?

Qutom claims to offer AI-powered trading in renewable energy markets and hydrogen staking on the Solana blockchain. It promises high returns through sophisticated algorithms. However, the platform’s lack of transparency and questionable claims demand scrutiny. This Qutom product review analyzes key aspects to help you decide: is Qutom worth it?

Ownership and Transparency

Qutom’s ownership is unclear. The domain, registered on November 4, 2024, through Namecheap Inc., uses WHOIS privacy protection, hiding registrant details. Some sources mention Qutom Private Limited, incorporated in Delhi, India, on November 25, 2022, with directors Kamalpreet Singh and Alka Chaudhary. However, no public profiles or professional backgrounds for these individuals are available on LinkedIn or credible platforms. Legitimate investment firms typically disclose leadership teams and regulatory licenses (e.g., SEC, FCA). The absence of such details is a red flag, suggesting limited accountability.

Qutom Features and Compensation Plan

Qutom’s compensation plan centers on “Hydro AI staking” and renewable energy trading. It claims high returns, with some promotions citing 2–5% daily or up to 30% monthly. For example, one claim suggests a €250 deposit could yield €5,000 weekly. Specifics on tiered plans or referral commissions are vague, and no audited performance data exists.

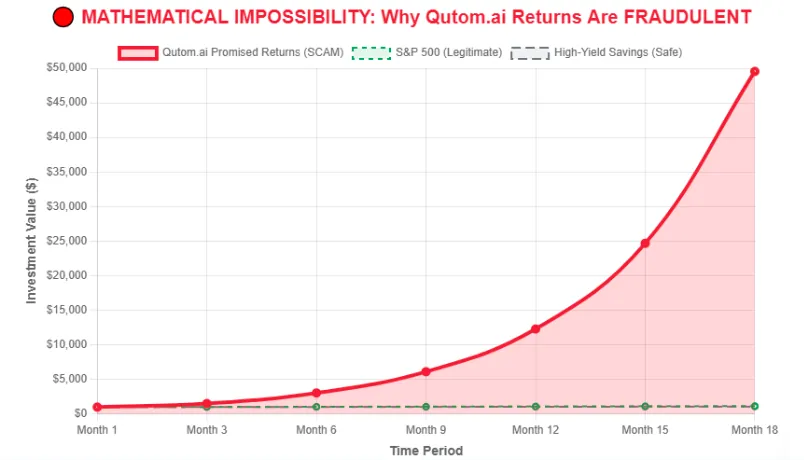

Mathematical Analysis of ROI Claims

To assess Qutom’s ROI claims, consider a 3% daily return:

- Initial Investment: $1,000

- After 1 Year (compounded daily): $1,000 × (1.03)^365 ≈ $48.48 million

- After 2 Years: $1,000 × (1.03)^730 ≈ $2.35 trillion

Investment Type | Annual Return | Monthly Equivalent | Risk Level |

Qutom (claimed) | 2–5% daily | 60–150% | Extreme |

Real Estate | 3–7% | 0.25–0.58% | Moderate |

Bank Savings | 4–5% | 0.33–0.42% | Low |

Crypto Staking | 2–6% | 0.17–0.5% | Medium |

Qutom Security Concerns

Qutom uses basic security measures:

- SSL Certificate: Issued by Google Trust Services.

- DDoS Protection: Provided by Cloudflare.

- Blockchain: Claims Solana integration for staking.

However, no third-party security audits (e.g., SOC 2, ISO 27001) or two-factor authentication details are disclosed. The platform’s “mandatory DPC purchase” for accounts exceeding $600,000 is unusual and resembles upselling tactics seen in scams. Legitimate platforms like Binance offer transparent security protocols and regulatory compliance.

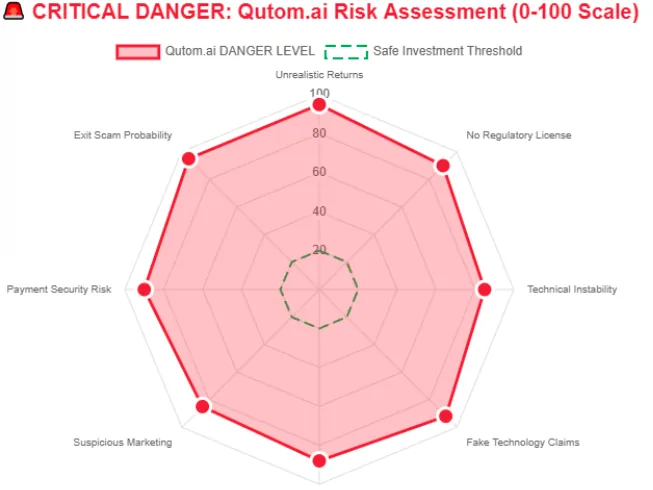

Qutom User Feedback and Public Perception

User feedback paints a troubling picture:

- Scamadviser: 0/100 trust score, flagged as suspicious.

- Scamdoc: 25% trust score, citing hidden ownership.

- Gridinsoft: 61/100, advising caution due to the young domain.

- User Complaints: Reports of lost funds ($98,456–$140,450 USDT) and withdrawal issues.

The platform’s low traffic (~5,000 visits/month) and high bounce rate (~80%) suggest poor user retention. Promotional posts on YouTube and X (e.g., @HelmyGraoul, @tsafeiali) push “guaranteed profits,” a tactic linked to scam networks like Quantum AI.

Payment Methods and Qutom Pricing

Qutom accepts crypto deposits (e.g., USDT, XRP, POWR) with a minimum of €250. Withdrawals reportedly take 30 minutes to 1 hour, but user complaints highlight delays and KYC demands. No fiat gateways or banking partnerships are mentioned, increasing the risk of irreversible transactions.

Qutom Customer Support Quality

Support is limited to emails (contactus@qutom.ai, team@qutom.ai). No phone support, live chat, or ticketing system exists. The lack of verified social media accounts and responsive support channels raises concerns about resolving issues, especially for fund recovery.

Qutom Performance and Technical Issues

Qutom claims to use AI and machine learning for energy trading, but no technical documentation or GitHub repository supports these claims. The website has faced accessibility issues, with “Unknown error” messages reported. Static .htm pages and reused imagery (e.g., awards from Devexperts) suggest a template-driven site, not a robust platform.

Qutom Pros and Cons

- Uses Solana blockchain for staking.

- Basic SSL and DDoS protection.

Cons

- Unrealistic ROI claims (2–5% daily).

- Hidden ownership and no regulatory licenses.

- Negative user reviews and scam allegations.

- Limited customer support and withdrawal issues.

- Misrepresented awards (e.g., TradingTech Insight 2024).

Qutom Alternatives

Consider safer options:

- Binance/Kraken: Regulated crypto exchanges with 5–10% APY staking.

- REITs: Real estate investments yielding 3–7% annually.

- High-Yield Savings: 4–5% APY with FDIC protection.

Qutom Scam or Legit?

Multiple red flags suggest Qutom is not legitimate:

- Hidden ownership and no regulatory oversight.

- Unrealistic returns and Ponzi-like structure.

- Misappropriated awards and promotional content.

- Negative user feedback and withdrawal complaints.

Recommendations for Investors

- Avoid Investing: Qutom’s high-risk profile makes it unsuitable for most investors.

- Use DYOR Tools: Check Scamadviser, WHOIS, and Trustpilot for updates.

- Choose Regulated Platforms: Opt for Binance, Kraken, or FDIC-insured banks.

- Report Issues: Contact financial regulators (e.g., SEC, FCA) if affected.

Qutom review Conclusion

This Qutom review highlights significant risks, including hidden ownership, unsustainable ROI claims, and poor user feedback. The platform’s lack of transparency, questionable awards, and crypto-only payments align with scam patterns. Investors should avoid Qutom and opt for regulated alternatives like Binance or REITs. Always verify claims independently and consult a financial advisor. For further insights into similar platforms, you can also read our detailed Tradyon Review.

DYOR Disclaimer

This analysis, based on public data as of August 18, 2025, is for informational purposes only. It is not financial advice. Conduct your own research, verify claims, and consult professionals before investing. Never risk funds you cannot afford to lose.

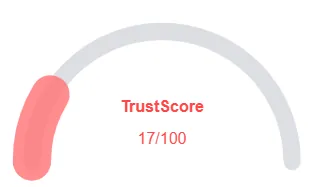

Qutom review Trust Score

A website’s trust score plays a vital role in determining its reliability, and Qutom currently shows an alarmingly low rating—raising major doubts about its legitimacy. Users are strongly advised to exercise caution.

The platform presents multiple warning signs, including low web traffic, poor user feedback, possible phishing threats, undisclosed ownership, unclear hosting details, and weak SSL protection.

With such a low trust score, the risks of fraud, data leaks, or other malicious activities increase significantly. It is crucial to carefully review these red flags before engaging with Qutom or any similar platforms.

Positive Highlights

- Website security service

Negative Highlights

- Content not accessible

- Low AI review rate

- New domain

- New archive

- Hidden WHOIS data

Frequently Asked Questions About This Qutom review

This section addresses important questions about Tradyon, aiming to clear any doubts, build trust, and highlight concerns about the platform’s legitimacy.

No. Qutom raises concerns due to a lack of transparency, unverified claims of high returns, and potential technical issues.

Qutom claims to offer profits through AI-driven renewable energy trading and hydrogen staking, but there is no verifiable evidence of consistent or sustainable returns.

No. Qutom is not licensed or registered with any recognized financial regulator, which increases the risk for investors.

Risks include potential financial loss, lack of investor protection, unclear ownership, and unverified compensation or ROI claims.

It is not recommended. The platform’s lack of regulation, transparency, and unverified ROI claims make it a risky investment opportunity.

Other Infromation:

WHOIS Last Update Date: 2025/04/26

Reviews:

There are no reviews yet. Be the first one to write one.