Crypto Botics Review: Legitimacy, Risks, and Red Flags

This Crypto Botics review examines the platform’s claims of AI-driven crypto trading, focusing on its legitimacy, ownership, compensation plan, and risks. For an in-depth scam analysis, visit Scams Radar for a detailed review. With promises of high returns through automated crypto trading, the platform raises concerns due to hidden ownership, unsustainable ROI, and poor public perception. Read on to explore whether cryptobotics.com is a trustworthy platform or a risky investment.

Table of Contents

What Is Crypto Botics?

Crypto Botics claims to offer a crypto trading platform with automated trading bots, copy trading, and market analysis tools. It promises profitable trading with minimal effort, supporting exchanges like Binance and Coinbase. However, multiple red flags suggest it may not be a safe choice for crypto portfolio management.

Ownership: Hidden and Untraceable

The platform’s ownership is unclear, a major concern for any crypto trading bot. The domain, registered on June 24, 2025, through NICENIC INTERNATIONAL GROUP CO., LIMITED, uses WHOIS privacy to hide the registrant’s identity. It claims to operate under Crypto Botics Limited, a UK-registered company (number 16548858) at 7 Bell Yard, London. This address is a mailbox rental, often used by shell companies, offering no real transparency. No team members or executives are listed, and LinkedIn searches reveal no credible profiles tied to the platform. Legitimate cryptocurrency trading tools, like 3Commas or CryptoHopper, provide verifiable team details to build trust.

Key Ownership Issues:

- Hidden WHOIS data

- No team bios or verifiable leadership

- UK registration lacks credibility due to minimal verification

Compensation Plan: Unsustainable Promises

Crypto Botics offers 12 investment plans with daily returns from 0.5% to 20% and fixed returns up to 2000% over 120 days. It also includes an MLM referral program with 10% commission on Level 1, 2% on Level 2, and 1% on Level 3 referrals. Below is a detailed breakdown:

Plan Type | ROI Claimed | Duration | Minimum Investment |

Daily ROI | 0.5%–20% daily | 10–365 days | $10–$20,000 |

Fixed ROI | 150%–2000% | 1–120 days | $10–$100,000 |

Mathematical Proof of Unsustainability

Consider the 20% daily ROI plan (minimum $20,000):

- Initial Investment: $20,000

- Formula: ( A = P \times (1 + r)^n ), where ( P = 20,000 ), ( r = 0.20 ), ( n = 10 )

- Calculation: ( A = 20,000 \times 1.20^{10} \approx 123,834 )

- Profit: $123,834 – $20,000 = $103,834

- Annualized ROI: ( (1 + 0.20)^{365} – 1 \approx 10^{31}% )

For the 2000% ROI in 120 days (minimum $10):

- Initial Investment: $10

- Final Return: $200

- Daily Rate: ( \frac{200 – 10}{120} \approx 15.83% )

- Annualized ROI: ( (1 + 0.1583)^{365} – 1 \approx 10^{25}% )

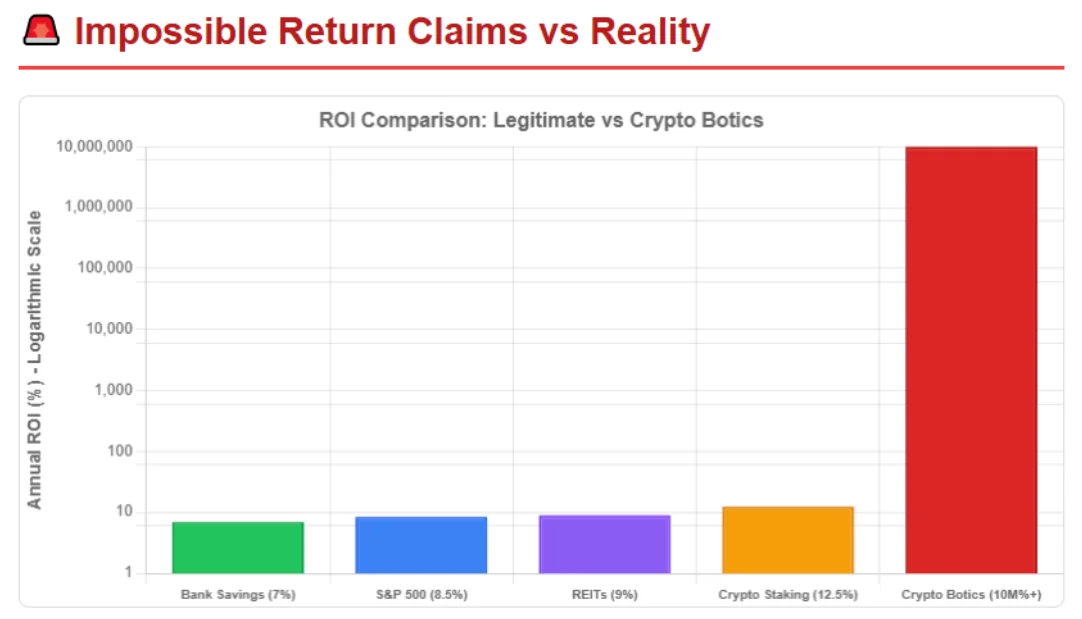

These returns are impossible in legitimate markets. The MLM structure suggests payouts rely on new investor funds, a hallmark of Ponzi schemes. No trading logs or audits support the platform’s crypto bot performance claims.

Comparison to Legitimate Investments:

Investment Type | Annual ROI | Risk Level |

Crypto Botics | 10,000%+ (claimed) | Extremely High |

Real Estate REITs | 6–12% | Medium |

Bank Savings (Pakistan) | 5–9% | Low |

Crypto Staking (Binance) | 5–20% APY | Medium-High |

S&P 500 | 7–10% | Moderate |

Traffic and Public Perception

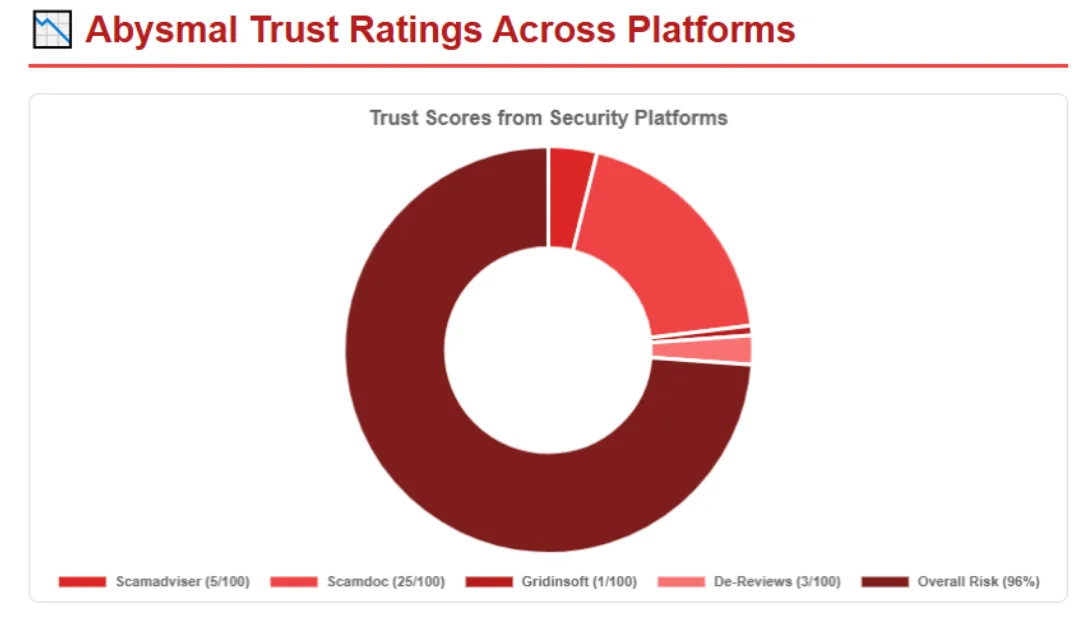

The platform has low traffic, with a near-zero Tranco rank and ~10,000 monthly visits, mostly from paid ads in regions like India and Nigeria. A high bounce rate (~80%) indicates user distrust. Public sentiment is negative, with scam detection platforms assigning low trust scores:

- Scamadviser: Very low trust score

- Scamdoc: 25/100

- Gridinsoft: 1/100

- De-Reviews: 3/100

User reviews on Trustpilot and Reddit report withdrawal issues and unresponsive crypto bot customer support. A YouTube channel, @millionairedriv, critically reviewed the platform, warning of scam risks.

Security and Technical Performance

The platform uses a basic SSL certificate (Sectigo, valid until June 2026) for encryption but lacks advanced crypto bot security like 2FA or cold storage details. Hosted by OVH SAS in Canada, the site is fast but lacks API documentation or third-party audits. Gridinsoft flagged potential malware risks, undermining its safety for crypto trading automation.

Payment Methods and Content Authenticity

Crypto Botics accepts Bitcoin, Ethereum, USDT, and fiat options like PayPal, but crypto-focused payments raise concerns due to their irreversibility. Content appears AI-generated, with vague claims about crypto bot strategies and no whitepaper or trading logs. Generic testimonials lack verifiable details, a tactic often used by fraudulent platforms.

Promoters and Red Flags

The platform lacks official social media accounts. Promoters include:

- @realjessesingh (X): Critically reviewed the platform, also promotes jessesingh.org.

- HYIP Blogs: Sites like BestBTCsites push risky schemes, raising credibility concerns.

Red Flags:

- Anonymous ownership

- Unrealistic ROI claims

- MLM referral structure

- Young domain (June 2025)

- No verifiable trading bot performance

- Low trust scores

- AI-generated content

Recommendations

- Avoid Investment: The platform’s Ponzi-like structure and lack of transparency make it highly risky.

- Use Trusted Platforms: Opt for regulated exchanges like Binance or Kraken for crypto trading signals and automation.

- Report Issues: Contact authorities like the SEC or FTC if you’ve engaged with the platform.

- Secure Funds: Use hardware wallets for safe crypto storage.

Crypto Botics Review Conclusion

This Crypto Botics review reveals a platform with unsustainable ROI claims, hidden ownership, and poor public perception. Its MLM structure and lack of verifiable crypto bot performance suggest it’s likely a scam. Investors should prioritize regulated platforms and conduct thorough research to protect their funds. Stick to proven cryptocurrency trading tools for safer crypto market analysis.

For a deeper dive into another high-risk platform, check out our PAMM Trading Review.

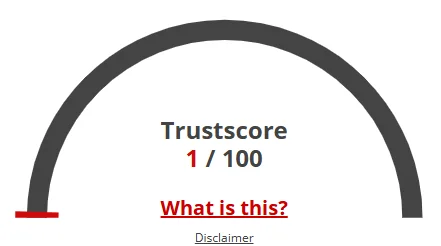

Crypto Botics Trust Score

A website’s trust score is critical for evaluating its credibility, and Crypto Botics currently holds a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, including low traffic, poor user reviews, potential phishing risks, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the risk of fraud, data breaches, or other harmful activities is significantly higher. It’s crucial to carefully assess these red flags before engaging with Crypto Botics or similar platforms.

Positive Highlights

- New domain

- Website security service

Negative Highlights

- New domain

- New archive

- Domain does not rank within the top 1M on the Tranco list.

Frequently Asked Questions About the Crypto Botics Review

This section answers key questions about Crypto Botics, helping to clarify doubts, build trust, and highlight concerns regarding the platform’s legitimacy.

No. Crypto Botics raises concerns due to hidden ownership, unsustainable ROI claims, and a lack of transparency about its operations.

It claims to use AI-driven crypto trading to deliver high returns through automated systems, but no verifiable proof of consistent profitability exists.

No. Crypto Botics is not registered or licensed by any financial regulator, making it a high-risk platform for potential investors.

Risks include potential financial loss, reliance on an unproven automated trading system, and the lack of regulation or investor protection.

It’s not recommended. Due to the platform's red flags, lack of transparency, and unrealistic promises, it’s best to avoid investing.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.