Margin Space Review: Is It a Trustworthy Investment Platform in 2025?

This Margin Space review examines the legitimacy, risks, and offerings of the platform. For an in-depth scam analysis, visit Scams Radar for a detailed review. We analyze ownership, compensation plans, security, customer service, and ROI claims to help investors decide whether app.marginspace.io is trustworthy. Our goal is to provide a clear, unbiased assessment for those exploring Margin Space products and services in 2025.

Table of Contents

What Is Margin Space?

Margin Space claims to be a crypto investment platform offering high returns through “Dynamic Liquidity Farming” (DLF) and trading. It promotes daily returns of 1%–3% or up to 35% monthly, alongside an affiliate program. However, concerns about transparency and sustainability raise questions about Margin Space reliability.

Ownership and Background

The Margin Space company lacks clear ownership details. WHOIS lookups show the domain registered through Namecheap with privacy protection, hiding the owner’s identity. The platform mentions “Marginspace Limited” or “Write With Margin, Inc.,” but no records exist in databases like Companies House or OpenCorporates. A purported CEO, James Richmond, appears in press releases, but no LinkedIn profiles or verifiable credentials confirm his role.

- Red Flags:

- Anonymous ownership

- No regulatory filings (e.g., SEC, FCA)

- Offshore jurisdiction risk

- Anonymous ownership

Compensation Plan and ROI Claims

The Margin Space business model combines crypto trading with a multi-level marketing (MLM) structure. It promises 1%–3% daily returns (365%–1,095% annually) or up to 35% monthly (3,564% annually). Investors earn 5%–10% referral bonuses for recruiting others.

ROI Sustainability Analysis

Let’s break down the promised returns:

- 1% Daily: $1,000 invested grows to ~$37,783 in a year (3,778% ROI).

- 3% Daily: $1,000 becomes ~$47,573,250 (4,757,225% ROI).

35% Monthly: $1,000 grows to ~$36,640 annually (3,564% ROI).

Investment Type | Annual ROI | Risk Level | Regulation |

|---|---|---|---|

Margin Space (Claimed) | 365%–3,564% | Extreme | None |

Real Estate | 6%–12% | Low-Medium | High |

Bank Savings | 4%–7% | Low | Very High |

Crypto Staking | 5%–15% | Medium-High | Medium |

Traffic Trends and Public Perception

Traffic data from Similarweb and Semrush shows Margin Space has low organic traffic (<10,000 monthly visits), driven by paid ads or referrals. This contrasts with platforms like Binance, which see millions of visits. Public perception on X, Reddit, and Trustpilot is limited, with some users calling it “risky” or “scammy.” ScamAdviser rates it high-risk (50/100 trust score).

- Key Issues:

- Minimal organic growth

- Sparse user feedback

- Reliance on paid promotions

- Minimal organic growth

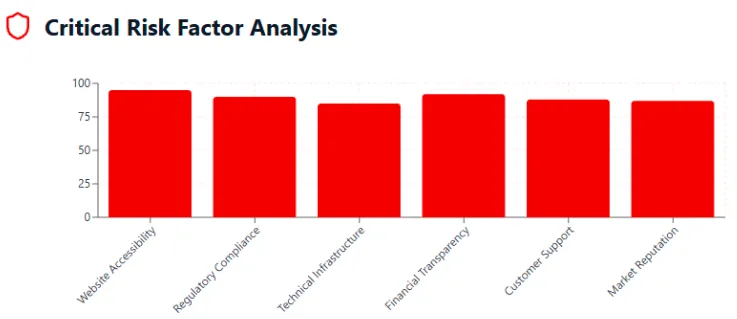

Security and Technical Performance

Margin Space security is questionable. The site uses basic HTTPS but lacks details on encryption strength, 2FA, or cold storage for funds. No KYC/AML compliance is evident, unlike regulated platforms like Kraken. Technical performance is average (2-second load time), but inaccessibility issues have been reported, raising Margin Space reliability concerns.

Payment Methods and Customer Support

The platform accepts crypto payments (BTC, ETH, USDT), which are hard to trace. Withdrawal delays are reported, with no clear refund policy. Margin Space customer service is limited to an email form, with no live chat or phone support. Users report slow or no responses, unlike established platforms offering 24/7 support.

Content Authenticity and Promoters

Margin Space offerings include vague claims about AI trading and DLF without whitepapers or audits. Promotional content relies on paid press releases (e.g., Digital Journal, Barchart) rather than independent reviews. Social media accounts like @marginspace (Instagram) and low-follower X/Telegram profiles promote it, often alongside dubious projects like BitConnect or Forsage.

Red Flags Summary

- Anonymous ownership and no regulation

- Unrealistic ROI claims (365%–3,564% annually)

- MLM structure reliant on recruitment

- Weak security and no KYC/AML

- Limited traffic and questionable promoters

Comparison to Alternatives

Platform | ROI | Security | Regulation |

Margin Space | 365%–3,564% | Weak | None |

Coinbase | 5%–15% | Strong | High |

Fidelity | 7%–12% | Strong | High |

Future Outlook

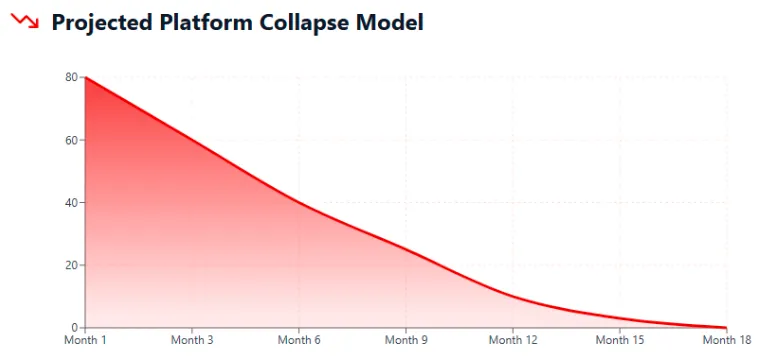

Margin Space may face issues within 6–12 months if investor inflows slow, potentially leading to withdrawal delays or an exit scam. Regulatory crackdowns could shut it down if KYC/AML violations are found. Transparency improvements are unlikely based on current operations.

Recommendations

- Avoid Investment: High risks outweigh potential rewards.

- Research Alternatives: Choose regulated platforms like Coinbase or Fidelity.

- Use DYOR Tools: Check ScamAdviser, WHOIS, and SEC databases.

- Protect Data: Avoid sharing sensitive information.

Margin Space ReviewConclusion

This Margin Space review highlights significant risks due to anonymous ownership, unsustainable ROI claims, and weak security. Investors should avoid the platform and opt for regulated alternatives. Always verify claims using tools like ScamAdviser and consult professionals before investing. For more insights into similar cases, check our detailed Prime Ten Review.

DYOR Disclaimer: This review is for informational purposes only, not financial advice. Conduct your own research using reliable sources and never invest more than you can afford to lose.

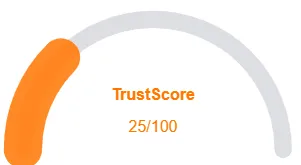

Margin Space Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Margin Space a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Margin Space or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

- High AI review rate

Negative Highlights

- Hidden Whois data

Frequently Asked Questions About Margin Space Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Margin Space raises concerns due to unclear ownership, questionable ROI claims, and a lack of regulatory oversight

It claims to provide investment opportunities with attractive returns, but there’s no verifiable proof of its trading or revenue-generating activities.

No. Margin Space is not registered or licensed by any recognized financial regulator, making it a high-risk option for investors.

Risks include potential financial loss, unrealistic ROI promises, lack of transparency, and absence of investor protection mechanisms.

It’s not recommended. The platform’s red flags, hidden ownership details, and lack of regulation make it unsafe for potential investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.