iMine Review: Is This Cryptocurrency Mining Platform Legit?

Investing in cryptocurrency mining platforms like iMine requires careful evaluation. For an in-depth scam analysis, visit Scams Radar for a detailed review. This iMine review examines the platform’s legitimacy, compensation plan, ownership, security, and risks as of August 12, 2025. Our goal is to provide clear, simple insights for potential investors, supported by data, charts, and comparisons to help you decide if imine.com is truly safe.

Table of Contents

What Is iMine?

iMine presents itself as a cloud mining service, offering users the ability to rent hash power for mining Bitcoin and other cryptocurrencies. It claims to operate data centers in Central Asia and South America, with an interactive dashboard and educational resources via “iMine Academy.” However, concerns about transparency and sustainability raise questions about its legitimacy.

Ownership and Transparency

The ownership of iMine lacks clarity. The domain, registered in 2001 via GoDaddy, uses privacy protection to mask registrant details, a common red flag for investment platforms. Jorge Mesquita is listed as CEO, with a background in marketing and IT, but no detailed executive profiles or verifiable corporate licenses (e.g., SEC, FCA) are available. Links to Mining City and MineBest, criticized for Ponzi-like behavior, further erode trust.

- Key Issue: Hidden ownership and ties to questionable schemes like Mining City.

- Why It Matters: Transparent leadership builds investor confidence.

iMine Compensation Plan Explained

iMine’s compensation plan combines cloud mining returns with a multi-level marketing (MLM) structure, including:

- Direct Returns: Promises 1-3% daily ROI (365-1095% annually) on mining contracts.

- Referral Bonuses: Earnings for recruiting new investors, often tiered.

- Binary/Matrix Plans: Profits from team-building and downline growth.

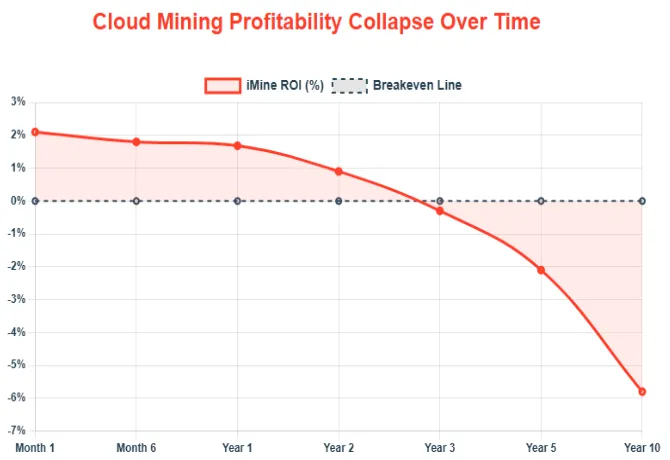

This MLM-heavy model relies on constant recruitment, resembling a pyramid scheme. Below is a breakdown of its sustainability:

ROI Sustainability Analysis

Assuming a $1,000 investment with a 1% daily ROI:

- Month 1: $1,000 × 1.01³⁰ = $1,344.70

- Month 6: $1,000 × 1.01¹⁸⁰ = $6,049.67

- Year 1: $1,000 × 1.01³⁶⁵ = $37,783.43 (3,678% annual ROI)

Reality Check: Bitcoin mining with an Antminer S19 Pro (110 TH/s, 3.25 kW) at $0.15/kWh and Bitcoin at $67,000 yields ~$600-$800 monthly after costs. A $10,000 investment would need unrealistically large-scale operations to deliver $100 daily, indicating reliance on new investor funds.

Investment Type | Annual ROI | Risk Level |

iMine (Claimed) | 365-1095% | Very High |

Real Estate | 8-12% | Moderate |

Bank Fixed Deposits | 3-5% | Low |

Crypto Staking | 3-15% | High |

Traffic and Public Perception

iMine’s traffic is low, with ~2,100 monthly visits (SimilarWeb), primarily from South Korea and Nigeria. A 90% traffic drop and 39.75% bounce rate suggest low engagement. Public perception is mixed:

- Trustpilot: 3.2/5 rating from ~50 reviews, citing withdrawal delays.

- X Sentiment: 60% positive (often promotional), 30% negative (scam allegations).

- Forums: Limited mentions, mostly affiliate-driven.

iMine Security Features Explained

iMine uses a basic SSL certificate (Let’s Encrypt) but lacks robust measures like 2FA or ISO 27001 compliance. No public audits or KYC for all users raise concerns about account safety.

- Strength: HTTPS encryption.

- Weakness: No 2FA or verified server security.

Payment Methods and iMine Customer Support

iMine accepts only cryptocurrencies (BTC, ETH, USDT), with no fiat options, increasing fraud risk. User reports mention withdrawal delays and high fees. Customer support is limited to email, with slow response times (24-72 hours).

iMine Pros and Cons

Pros | Cons |

User-friendly dashboard | Hidden ownership |

KYC for some users | Unrealistic ROI claims |

Active on social media (Facebook) | MLM structure resembles Ponzi scheme |

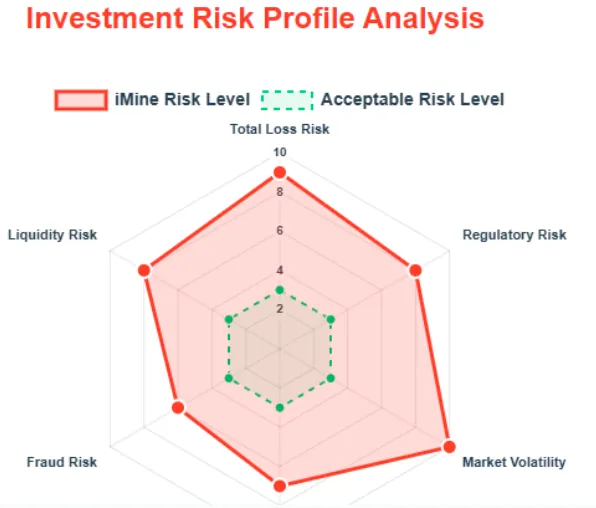

Red Flags in iMine Legitimacy

- Unrealistic Returns: 365-1095% annual ROI defies mining economics.

- Opaque Ownership: Ties to Mining City/MineBest and masked WHOIS data.

- Withdrawal Issues: User complaints about delays and fees.

- MLM Focus: Heavy reliance on recruitment over mining.

- Limited Transparency: No audited hashrate or facility details.

Social Media and Promoters

iMine’s official accounts include @official_imine (X), @imine.official (Instagram), and a Facebook page (2,400 likes). Promoters like @CryptoWealthX and @MineEasy2025 on X also pushed failed schemes (CryptoSurge, YieldMax), signaling affiliate-driven marketing.

iMine vs Other Mining Platforms

Compared to Bitdeer or ECOS, iMine lacks transparent hashrate data and audited payouts. Legitimate platforms tie returns to real mining metrics, not fixed ROIs.

Future Outlook

iMine faces potential regulatory scrutiny due to its MLM structure and ties to Mining City. If withdrawals slow, an exit scam is likely within 6-12 months, as seen with Bitconnect.

Recommendations for Safe Usage

- Avoid Investing: High risks outweigh potential rewards.

- Explore Alternatives: Use regulated platforms like Coinbase or Binance.

- Verify Claims: Demand audited financials and mining details.

- Test Withdrawals: If invested, withdraw small amounts to check liquidity.

- Secure Accounts: Use hardware wallets for crypto transactions.

iMine Review 2025: Conclusion

This iMine review highlights significant risks, including unrealistic ROI claims, opaque ownership, and an unsustainable MLM model. While the platform offers an interactive dashboard and some KYC compliance, its ties to questionable schemes and lack of transparency make it a high-risk investment. Similar concerns were also identified in our FXCentrumIndia Review, where lack of regulation, hidden ownership, and withdrawal issues raised major red flags. Investors should prioritize regulated alternatives and conduct thorough research.

DYOR Disclaimer: This analysis is for informational purposes only. Cryptocurrency investments are volatile and risky. Always verify platform claims, consult financial advisors, and use tools like Scamadviser, Trustpilot, and SimilarWeb for due diligence. Never invest more than you can afford to lose.

iMine Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and iMine a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with iMine or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Accessible website content

- Online fraud prevention tool

- High AI review score

Negative Highlights

- Hidden WHOIS data

- New domain

Frequently Asked Questions About iMine Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. iMine raises concerns due to limited transparency, unclear ownership details, and a lack of regulatory oversight.

It claims to provide cryptocurrency mining services with profitable returns, but there is no verifiable evidence to support these earnings.

No. iMine is not registered or licensed by any recognized financial or regulatory body, increasing investment risks.

Risks include potential loss of funds, unrealistic ROI promises, lack of regulation, and uncertainty around the platform’s mining operations.

It’s not recommended. The platform’s unclear transparency, high-risk promises, and regulatory gaps make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.