PhoenixFx AiWorld Review: Is This Trading Platform Legitimate or a Risky Scheme?

In this comprehensive PhoenixFx AiWorld review, we analyze the legitimacy of the PhoenixFx trading platform. For an in-depth scam analysis, visit Scams Radar for a detailed review. The site claims to offer AI-driven forex, stock, and crypto trading with monthly returns of 8-15%. With no verifiable ownership, questionable compensation plans, and unrealistic promises, we uncover red flags and compare it to safer investments. Read on to explore whether phoenixfxaiworld.com is truly safe, covering ownership, compensation, traffic, security, and more, supported by data and charts for clarity.

Table of Contents

What Is PhoenixFx AiWorld?

The PhoenixFx trading platform markets itself as a cutting-edge solution for forex trading, stock trading, and crypto investments. It claims to use automated algorithms and MetaTrader 4/5 for high returns. However, the site lacks transparency, raising concerns about its legitimacy for Asian bettors and global investors.

Ownership and Transparency Concerns

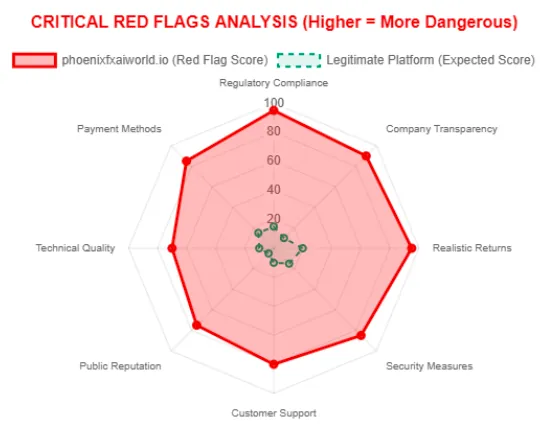

A legitimate trading platform must disclose its owners and registration details. Unfortunately, the PhoenixFx forex trading site provides no information about its founders, company address, or regulatory licenses. WHOIS data shows the domain, registered in March 2025 via Hostinger, uses privacy protection to hide ownership—a tactic often seen in high-risk schemes.

- No company registration: No SEC, FCA, or ASIC filings.

- No team credentials: No LinkedIn profiles or leadership bios.

- Red flag: Anonymous ownership risks investor funds with no accountability.

This lack of transparency contrasts with regulated platforms like eToro, which clearly list their licenses and offices.

Compensation Plan: MLM or Ponzi?

The PhoenixFx partnership program promotes a “Level Team Commission,” “Quick-Start Bonus,” and “Million Dollar Bonus,” suggesting a multi-level marketing (MLM) structure. However, no clear breakdown of commissions, fees, or caps is provided, making the plan opaque.

- Referral-driven model: Earnings likely depend on recruiting others.

- No audited strategy: Claims of AI-driven trading lack proof.

- Red flag: Vague plans often indicate Ponzi schemes, where payouts rely on new deposits.

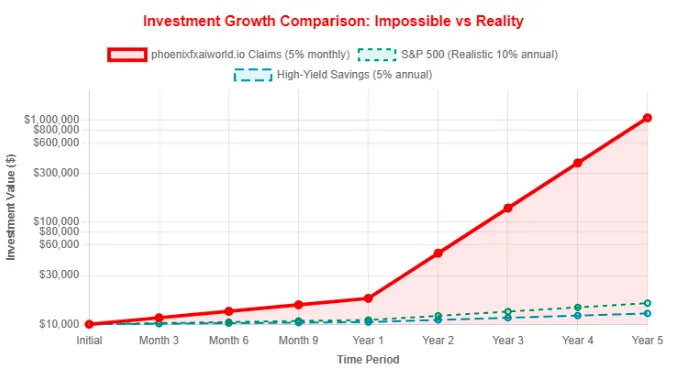

Mathematical Proof of Unsustainable Returns

The platform promises 8-15% monthly returns, which we analyze below:

Scenario | Monthly ROI | Annual ROI (Compounded) | $10,000 After 1 Year |

PhoenixFx | 8% | 151.8% | $25,180 |

PhoenixFx | 15% | 435.0% | $43,500 |

S&P 500 | 0.83% (10% yr) | 10% | $11,000 |

Crypto Staking | 0.5–1% | 6–12% | $10,600–$11,200 |

Formula: Future Value = Principal * (1 + rate)^n

For 8% monthly: $10,000 * (1.08)^12 ≈ $25,180

For 15% monthly: $10,000 * (1.15)^12 ≈ $43,500

These returns are unrealistic. Even top hedge funds average 10-15% annually, not monthly. To sustain 8% monthly payouts for 1,000 investors ($10M total), the platform needs $800,000/month in profits—impossible without new deposits, signaling a Ponzi collapse.

Traffic Trends and Public Perception

Using tools like SimilarWeb, the PhoenixFx stock trading platform shows negligible traffic, indicating low organic interest. No reviews exist on Trustpilot, Reddit, or ScamAdviser, and user testimonials on the site lack verifiable identities.

- Low visibility: Suggests a new or intentionally obscure site.

- No social proof: Absence of feedback raises doubts.

- Prediction: Complaints may emerge in 3-6 months if withdrawals fail.

Security and Technical Performance

The site uses basic HTTPS but lacks advanced security like two-factor authentication or KYC/AML protocols. It claims MetaTrader 4/5 integration but provides no proof. The site’s design is minimal, with template errors (e.g., “Baby Bottles” in navigation), suggesting a repurposed e-commerce template.

- No security certifications: Missing ISO/IEC 27001 or PCI compliance.

- Poor design: Includes off-topic casino/lottery pages.

- Red flag: Low engineering maturity risks crashes or scams.

Payment Methods and Customer Support

The PhoenixFx account login process requires USDT (crypto) deposits, with no fiat options like PayPal or bank transfers. This makes transactions untraceable, with no chargeback protection. Customer support is limited to a generic email, with no phone or live chat.

- Crypto-only payments: Risks fund recovery.

- No support channels: Investors may be ghosted post-deposit.

Social Media Promotion

Searches on Instagram and Facebook found promotional posts in groups like “Direct Selling FMCG,” linking to referral paths (e.g., /Register/PH3393). Accounts like @floating_phoenix_fx_bot_ claim 10-15% monthly returns, but these lack credibility and mirror past “Phoenix FX” scam promotions (e.g., FCA-warned Phoenix FX Trade).

Comparison to Legitimate Investments

Investment Type | Annual ROI | Risk Level | Regulation |

PhoenixFx AiWorld | 151-435% | Extreme | None |

Bank Savings | 4-5% | Low | FDIC |

Real Estate | 8-12% | Medium | Regulated |

Crypto Staking | 5-12% | High | Licensed |

The PhoenixFx market analysis claims far exceed realistic benchmarks, ignoring market volatility (e.g., 2022 crypto crashes).

Red Flags Summary

- Hidden ownership and no regulatory licenses.

- Unrealistic 8-15% monthly returns.

- MLM-style referral program with no transparency.

- No verifiable reviews or traffic data.

- Weak security and crypto-only payments.

Future Outlook

Short-term, the platform may attract investors via referrals. However, withdrawal issues are likely within 6 months, followed by a potential shutdown or rebrand, as seen with similar “Phoenix FX” scams. Regulatory scrutiny could accelerate its demise.

Recommendations for Safe Trading with PhoenixFx AiWorld

- Avoid investing: The risks outweigh any potential benefits.

- Choose regulated platforms: Opt for eToro, Binance, or Vanguard.

- Use DYOR tools: Check ScamAdviser, WHOIS, and ForexPeaceArmy.

- Protect funds: Use 2FA and hardware wallets.

PhoenixFx AiWorld Conclusion

This PhoenixFx AiWorld review reveals a platform with alarming red flags: hidden ownership, unsustainable returns, and a referral-driven model resembling a Ponzi scheme. Investors seeking safe trading should avoid this platform and choose regulated alternatives. For a similar case, see our detailed FXCentrumIndia Review. Always verify claims with tools like ScamAdviser and consult financial advisors before investing.

DYOR Disclaimer: This analysis, based on data as of August 11, 2025, is for informational purposes only, not financial advice. Conduct your own research, verify regulatory status, and never invest more than you can afford to lose.

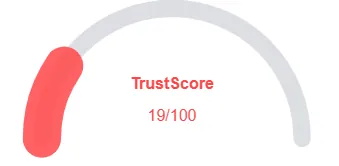

PhoenixFx AiWorld Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and PhoenixFx AiWorld a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with PhoenixFx AiWorld or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Content accessible

- No spelling/grammar errors

- Whois accessible

Negative Highlights

- Low AI review rate

- New domain

Frequently Asked Questions About Phoenix Fx AiWorld Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. PhoenixFx AiWorld raises concerns due to hidden ownership, unrealistic monthly ROI claims, and a questionable compensation plan.

It claims to provide AI-driven forex, stock, and cryptocurrency trading services with returns of 8-15% per month, which is highly unrealistic.

No. PhoenixFx AiWorld is not licensed or regulated by any recognized financial body, making it a high-risk option for investors.

Risks include potential loss of funds, unverified trading operations, unrealistic ROI promises, and lack of legal protection.

It’s not recommended. The platform’s red flags, absence of transparency, and unrealistic returns make it unsafe for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.