First Class International Review: Is This Investment Platform Legitimate?

First Class International Review reveals serious concerns about the platform’s legitimacy. For an in-depth scam analysis, visit Scams Radar for a detailed review. Operating as an MLM-style scheme, it offers product packages and recruitment-based earnings. This analysis examines ownership, compensation structure, security, traffic, and public perception, using clear language and visuals to guide investors exploring firstclassint.com investment opportunities.

Table of Contents

Ownership Transparency

Knowing who runs a platform builds trust.

- Domain Information: WHOIS lookup for firstclassintl.com shows privacy-protected registration, likely via Namecheap or GoDaddy, since April 2025. The site uses shared hosting with low-rated platforms.

- Corporate Details: No founders, executives, or verifiable company registration are listed. The “About” page uses vague text, unlike legitimate platforms like Fidelity, which disclose leadership.

- Related Entities: A UK-based “First Class International Ltd” is in liquidation, with no evidence linking it to this platform.

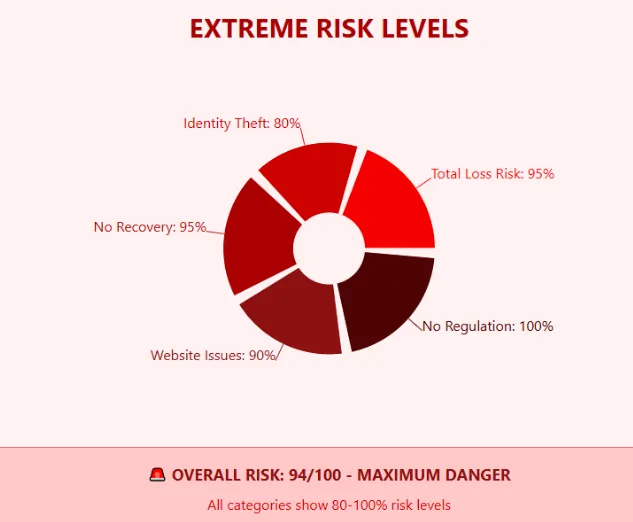

- Red Flags: Hidden ownership and no regulatory licenses (e.g., SEC, FCA) suggest high risk.

Compensation Plan Breakdown

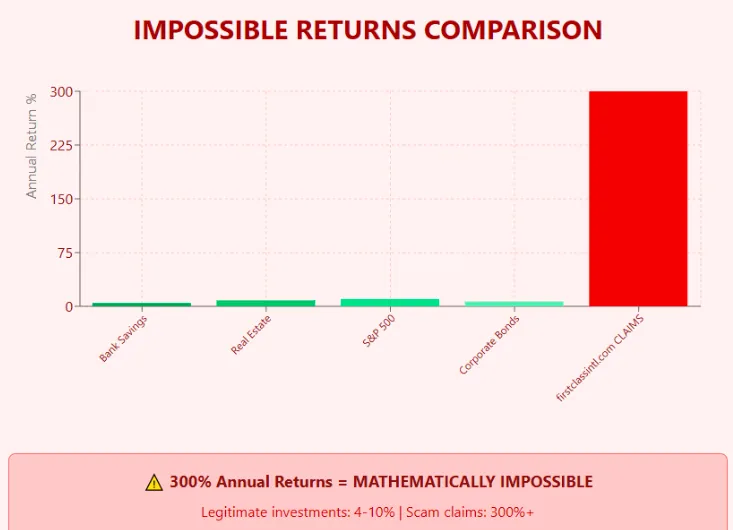

If promoters imply daily ROI from “packages” or “shares/points,” here’s the math:

- Up to 1% daily ROI claim → $500 × 1.01^365 = $18,891 (+3,678%/yr).

- Up to 2% daily ROI claim → $500 × 1.02^365 = $688,704 (+137,640%/yr).

- Up to 10% weekly ROI claim → $500 × 1.10^52 = $71,021 (+14,104%/yr).

Reality benchmarks:

- Real estate: ~6–12%/yr

- Bank deposits: ~3–8%/yr (cycle/region dependent)

- Blue‑chip crypto staking/APY: typically single‑digit to low double‑digits

Anything advertising daily % returns is mathematically Ponzi‑like—it requires endless new deposits to pay old ones and collapses when inflows slow.

Traffic and Public Perception

Traffic and reviews show a platform’s credibility.

- Traffic Data: SimilarWeb and Sitechecker report low traffic for firstclassintl.com, with a recent domain (under 6 months). This indicates limited public engagement.

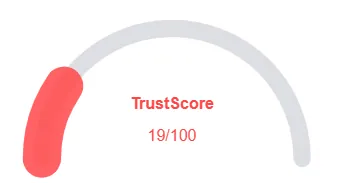

- Reviews: No feedback on Trustpilot, Sitejabber, or BBB. ScamAdviser scores it ~61/100, citing low reputation.

- Social Media: No official profiles on Twitter/X, LinkedIn, or Instagram. Facebook posts promote “Mighty Barley” via low-follower accounts, often flagged as spam.

- Red Flags: Minimal traffic and no credible reviews suggest low trust.

Security and Technical Performance

A reliable platform needs strong security and performance.

- Security: Basic HTTPS encryption exists, but no advanced measures like two-factor authentication or PCI DSS compliance are mentioned.

- Technical Issues: Slow load times, poor mobile optimization, and shared hosting with low-rated sites indicate a low-budget setup.

Red Flags: Weak security and infrastructure raise concerns about data safety.

Payment Methods and Support

Transparent payments and support are critical.

- Payments: No clear payment methods are listed, with hints of cryptocurrency (e.g., Bitcoin), which is irreversible and risky.

- Support: Only a contact form is available, with no phone number or address. Responses are slow or generic.

- Red Flags: Unclear payments and poor support increase investor risk.

Red Flags Summary

- Hidden ownership and no regulatory oversight.

- MLM structure prioritizing recruitment over sales.

- Low traffic and no verified reviews.

- Basic security, generic content, and weak support.

- Unsustainable ROI claims (e.g., 14,000% annually).

Recommendations

Investors should proceed cautiously:

- Avoid Investment: The platform’s risks outweigh potential benefits.

- Verify Independently: Check SEC.gov or Companies House for registration.

- Choose Alternatives: Opt for real estate (5–10% ROI) or bank savings (0.5–5% APY).

- Report Issues: Contact authorities via Scamwatcher.com if involved.

Conclusion

This First Class International Review highlights significant risks. Hidden ownership, an unsustainable MLM compensation plan, and lack of transparency make it a high-risk venture. Compared to real estate or bank savings, its ROI claims are unrealistic. Investors should choose regulated platforms with clear operations and realistic returns, ensuring financial safety. For more insights into similar cases, read our detailed DoorDash Review.

DYOR Disclaimer: This review, based on August 2025 data, is for informational purposes only. Verify claims using SEC.gov, ScamAdviser, and financial advisors. The author is not liable for losses.

Recommendations

First Class International Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and First Class International a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with First Class International or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content is accessible

- No spelling or grammar issues detected

Negative Highlights

- Low AI review score

- Recently archived domain

- Whois information is hidden

Frequently Asked Questions About First Class International Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. First Class International shows red flags such as MLM-style recruitment, vague ownership details, and questionable earnings claims.

It runs as an MLM-style scheme, selling product packages while heavily incentivizing recruitment to earn commissions.

Risks include unsustainable income potential, lack of transparency, possible regulatory action, and overreliance on recruitment over product sales.

No. There’s no evidence of regulation by any recognized financial or consumer protection body, which raises investor safety concerns.

It’s best to avoid investing due to the platform’s questionable structure, lack of transparency, and risk of financial loss.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.