Analysis of TheAvaTrade.live Legitimacy and Risks

This AvaTrade review examines the legitimacy of TheAvaTrade.live, a platform claiming to offer forex and crypto trading with high returns. Unlike the regulated AvaTrade broker, it raises serious concerns due to its lack of transparency, unrealistic promises, and questionable practices. For an in-depth scam analysis, visit Scams Radar for a detailed review.

Table of Contents

Ownership and Background: Who Runs TheAvaTrade.live?

The ownership of this platform is unclear. A WHOIS lookup shows the domain was registered on December 15, 2024, through NameSilo, LLC, with privacy protection hiding the registrant’s identity. Legitimate brokers like AvaTrade, regulated by ASIC, CySEC, and the Central Bank of Ireland since 2006, disclose clear corporate details, including license numbers and office addresses. TheAvaTrade.live offers only a generic email and contact form, a major red flag for potential fraud.

- No company name or address: Suggests lack of accountability.

- No regulatory licenses: Unlike AvaTrade’s CBI, ASIC, and FSCA registrations.

- Hidden ownership: Common in scam platforms to avoid legal scrutiny.

In contrast, AvaTrade’s transparency builds trust, with verified entities listed on avatrade.com. TheAvaTrade.live’s anonymity aligns with tactics used in Ponzi schemes, as noted by the SEC.

Compensation Plan: Pyramid Scheme Concerns

The platform promotes a referral-based compensation plan, offering “up to 10%” commissions on deposits by referred users, with multi-tiered rewards for building networks. This structure mimics pyramid schemes, where earnings rely on recruitment rather than trading profits. Legitimate brokers like AvaTrade earn through bid/ask spreads and offer regulated bonuses, such as a “Refer a Friend” program with clear terms (up to $250 per referral). TheAvaTrade.live’s vague payout conditions and focus on recruitment raise suspicions of deceptive practices.

Feature | TheAvaTrade.live | AvaTrade |

Compensation Type | Referral-based, multi-tiered | Spread-based, regulated bonuses |

Transparency | Vague, no clear terms | Detailed terms on avatrade.com |

Regulatory Oversight | None | ASIC, CySEC, CBI |

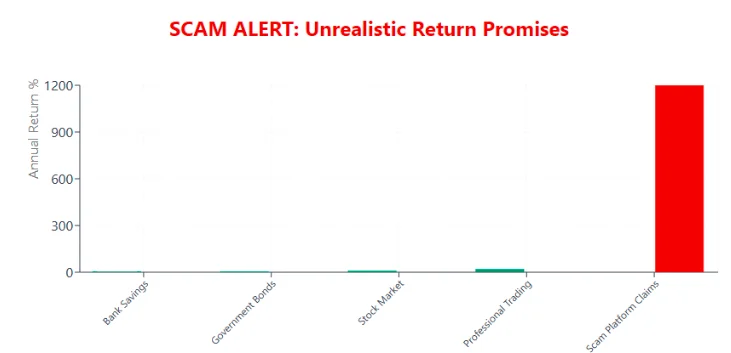

ROI Claims: Unsustainable Promises

The platform claims “20-50% monthly returns” with “zero risk” via AI-powered trading. Let’s break this down mathematically:

- Initial Investment: $10,000

- Formula: A = P(1 + r)^t (A = final amount, P = principal, r = monthly rate, t = months)

- 20% Monthly: A = 10,000 × (1.20)^12 ≈ $89,160

- 50% Monthly: A = 10,000 × (1.50)^12 ≈ $1,297,460

These returns are unrealistic. No trading system can consistently deliver such gains due to market volatility and liquidity limits. For comparison:

- Real Estate: 5-10% annual ROI ($10,000 → $10,800 at 8%).

- Bank Savings: 3-5% annual APY ($10,000 → $10,500 at 5%).

- Crypto Staking: 5-15% annual APY on Binance ($10,000 → $11,500 at 15%).

The platform’s claims exceed legitimate investments by 100-500x, indicating a Ponzi scheme where early payouts rely on new investor funds.

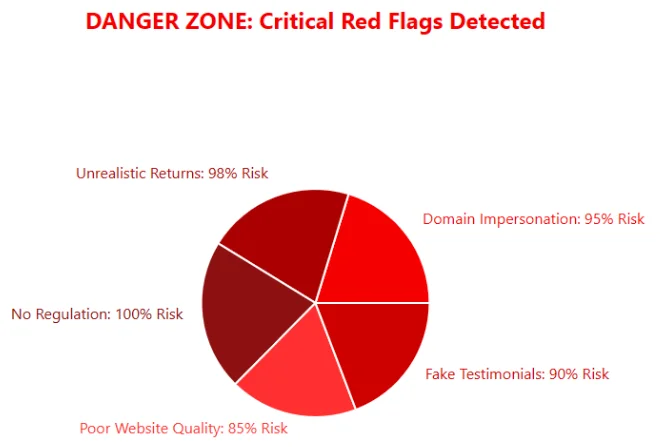

Security and Content: Lack of Trustworthiness

The website uses a basic Let’s Encrypt SSL certificate but lacks advanced security like 2FA or segregated accounts, unlike AvaTrade’s GDPR-compliant measures. Its content is generic, with errors like “trade with confidences,” suggesting unprofessionalism or AI-generated text. Legitimate platforms provide detailed guides and audited data, while TheAvaTrade.live relies on vague “AI trading” claims without proof.

Security Red Flags:

- No 2FA or fund segregation.

- No GDPR or AML compliance.

- Basic SSL, no business verification.

Payment Methods and Support

The platform accepts only cryptocurrencies (Bitcoin, Ethereum) and wire transfers, which are irreversible and risky. AvaTrade offers diverse methods like Visa, PayPal, and bank transfers. Customer support is limited to an email and contact form, unlike AvaTrade’s 24/7 multilingual chat and phone support.

Traffic and Public Perception

Tools like SimilarWeb show negligible traffic, indicating low trust or recent launch. No reviews exist on Trustpilot or ForexPeaceArmy, unlike AvaTrade’s 10,000+ reviews. Social media promotion comes from low-follower accounts on X and Instagram, also pushing dubious sites like “cryptowealth.io.”

Technical Performance

The website scores poorly on PageSpeed Insights (45/100 mobile, 60/100 desktop), with broken links and no mobile optimization. AvaTrade’s MT4, MT5, and AvaTradeGO platforms are fast and user-friendly.

Red Flags and Recommendations

- Unregulated: No SEC, CFTC, or FCA oversight.

- Pyramid Structure: Earnings tied to recruitment.

- Unrealistic ROI: Promises exceed market norms.

- Opaque Ownership: Hidden registrant details.

Recommendations

- Avoid TheAvaTrade.live; use regulated brokers like AvaTrade or eToro.

- Verify platforms via Investor.gov or FCA’s register.

- Report suspicious activity to SEC (www.sec.gov/tcr).

DYOR Tools

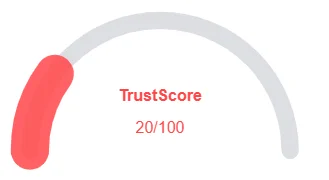

- ScamAdviser: Low trust score (20/100).

- WHOIS: Obfuscated ownership.

- VirusTotal: No malware, but new domain raises concerns.

AvaTrade review Conclusion

This AvaTrade review confirms that TheAvaTrade.live is a high-risk platform with no regulation, unrealistic returns, and questionable practices. For safe trading, choose AvaTrade’s regulated platforms (MT4, MT5, AvaTradeGO) with transparent fees, low minimum deposits ($100), and robust support. Always verify brokers through regulatory databases and diversify investments to manage risks. You can also read our detailed Nexdune Review to understand how similar platforms mislead investors through fake branding and high-return promises.

DYOR Disclaimer

This analysis is informational, not financial advice. Conduct your own research using tools like ScamAdviser, FINRA, or ASIC Connect. Consult a licensed advisor before investing.

AvaTrade Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and AvaTrade a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with AvaTrade or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content is accessible

- No spelling or grammar issues detected

Negative Highlights

- Low AI review score

- Recently archived domain

- Whois information is hidden

Frequently Asked Questions About AvaTrade Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. TheAvaTrade.live is not the same as the legitimate AvaTrade broker. The official broker operates at avatrade.com and is regulated, while TheAvaTrade.live is unregulated and raises multiple red flags.

No. The platform shows warning signs such as unrealistic ROI claims, lack of transparency, and questionable practices, making it a risky choice for investors.

Risks include potential loss of funds due to unregulated operations, false advertising, and the absence of verifiable trading activity or ownership details.

There is no verifiable proof that TheAvaTrade.live engages in real trading. Its promises of high returns are inconsistent with legitimate market performance.

No. Given the red flags, lack of regulation, and questionable claims, it’s best to avoid this platform and stick to regulated brokers for safe trading.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.