Nexdune Review: Is This Platform for Investing Genuine?

This Nexdune review examines the platform’s legitimacy, risks, and suitability for investors in 2025. For an in-depth scam analysis, visit Scams Radar for a detailed review. With promises of high returns through digital real estate and cryptocurrency, the platform raises concerns due to its lack of transparency and unrealistic claims. Below, we analyze its ownership, compensation plan, and key features to guide potential investors in understanding nexdune.com.

Table of Contents

What Is Nexdune?

Nexdune presents itself as an investment platform focusing on digital real estate and crypto opportunities. It claims to use AI-driven strategies to deliver high-yield returns. However, its lack of regulatory oversight and vague business model raise red flags. This Nexdune review dives into its operations to assess its reliability.

Ownership and Background

Nexdune Limited, registered in Scotland (Company No. SC845100, April 2025), lists Emre Yilmaz as its founder. The company is located at 93 George Street, Edinburgh, but this is a basic corporate registration, not a financial license. No Financial Conduct Authority (FCA) authorization exists, a critical requirement for investment firms in the UK. The website’s WHOIS data is privacy-protected, hiding ownership details. This lack of transparency is concerning, as legitimate platforms like Nexo disclose verifiable leadership and licensing information.

Owner Profile

- Name: Emre Yilmaz

- Role: Founder, Nexdune Limited

- Background: No public professional history or credentials are available. Legitimate platforms typically showcase founders’ expertise in finance or technology.

- Red Flag: Hidden ownership and lack of regulatory compliance suggest potential accountability issues.

Compensation Plan Explained

Nexdune’s compensation plan centers on a multi-level marketing (MLM) structure with high-yield investment packages. Investors deposit funds, primarily in cryptocurrencies like USDT, BTC, or ETH, to earn daily returns. The platform offers:

- AI Plans: 0.7%–0.9% daily for 260–300 days, starting at $50.

- Crypto Plans: 1.0%–1.2% daily for 220–260 days, starting at $2,000.

- Metaverse Plans: 9.1%–10.5% weekly for 210–250 days.

- Referral Program: 3% (Level 1), 2% (Level 2), 1% (Level 3) commissions, with career bonuses up to $10,000 for high recruitment.

- Deposit Terms: Minimum $50, 210–300 day lock-in, 25% penalty for early withdrawal in some cases.

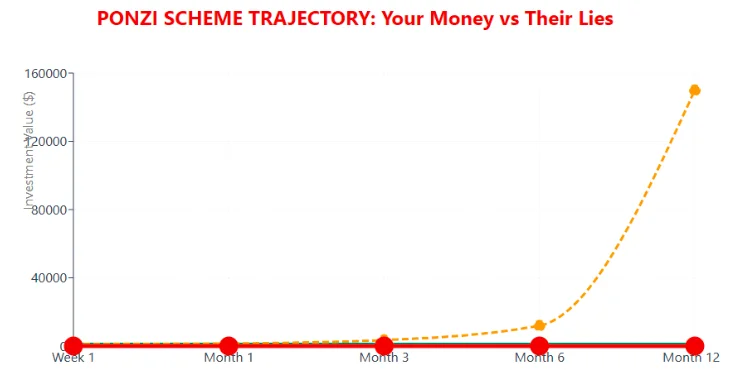

This MLM model relies heavily on recruiting new investors, resembling a Ponzi scheme. Returns are paid from new deposits, not sustainable business activities, increasing the risk of collapse when recruitment slows.

The XUEX trading platform promotes high returns, with some reports citing upto 2–5% daily profits or up to 300% in weeks. User reviews suggest a referral-based structure, resembling multi-level marketing (MLM) or Ponzi schemes, where payouts rely on new investor deposits. Such claims are unsustainable, as shown below.

ROI Sustainability Analysis

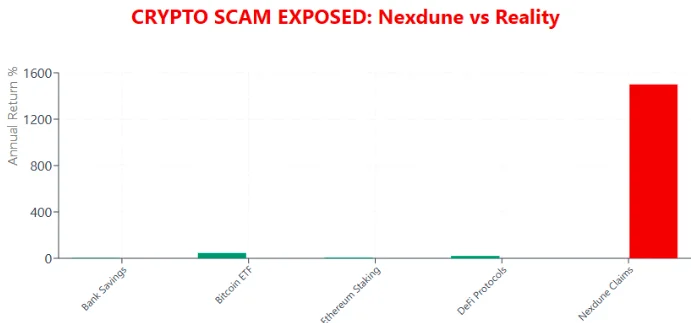

Nexdune’s promised returns are unrealistic. For example:

- 0.9% daily for 260 days: A $1,000 investment yields ~$8,273 (727% return).

- Formula: ( FV = 1000 \times (1.009)^{260} \approx 8273 )

- 1.2% daily for 220 days: A $1,000 investment yields ~$13,795 (1279% return).

- Formula: ( FV = 1000 \times (1.012)^{220} \approx 13795 )

Comparison to Benchmarks:

Investment Type | Annual ROI | Risk Level |

Real Estate | 6–10% | Medium |

Bank Savings | 4–5% | Low |

Crypto Staking | 5–12% | Medium-High |

Nexdune | 700–1200% | Extremely High |

These returns are 70–350 times higher than real estate or bank savings, and 20–100 times higher than crypto staking. Such yields are economically implausible without constant new investor funds, confirming a Ponzi-like structure.

Key Features and Concerns

Nexdune claims to use AI-powered market analysis and digital real estate investments. However, it provides no whitepapers or technical details, unlike regulated platforms. The vague use of buzzwords like “metaverse” and “AI” suggests a lack of substance.

Nexdune Deposits and Withdrawals

- Methods: Crypto-only (BTC, ETH, USDT, etc.), no fiat options.

- Process: Manual withdrawals (up to 48 hours), no fees claimed.

- Concern: Crypto-only payments are irreversible, increasing fraud risk.

Nexdune Customer Support

- Channels: Telegram (@nexdunesupport, @nexduneofficial), email (info@nexdune.com).

- Issue: No live chat or phone support, limiting accessibility. Legitimate platforms offer multiple channels.

Security Measures

- SSL Encryption: Basic (Let’s Encrypt, 3-month validity).

- Concerns: No mention of 2FA, cold storage, or insurance, unlike platforms like Kraken.

Technical Performance

- Website: Basic design, slow load times, Russian-language interface.

- Concern: No integration with trading APIs, suggesting limited functionality.

Public Perception and Traffic

- Traffic: Minimal organic traffic per SimilarWeb, driven by paid social media ads.

- Perception: No genuine reviews on Reddit or Trustpilot. ScamAdviser and Gridinsoft flag it as suspicious.

Social Media Promotions

Anonymous Telegram and Instagram accounts promote Nexdune alongside other dubious platforms like “xrpaibot.com.” These accounts use AI-generated content, a common scam tactic.

Red Flags Summary

- Unregulated: No FCA or SEC licensing.

- Unrealistic Returns: 700–1200% annual ROI is unsustainable.

- MLM Structure: Relies on recruitment, not profits.

- Crypto-Only Payments: High risk of untraceable funds.

- No Transparency: Hidden ownership, vague content.

- Poor Support: Telegram-only, no verified office.

ROI Comparison

Platform | Annual ROI | Sustainability |

Nexdune | 700–1200% | Unsustainable |

Real Estate | 6–10% | Stable |

Bank Savings | 4–5% | Secure |

Crypto Staking | 5–12% | Moderate Risk |

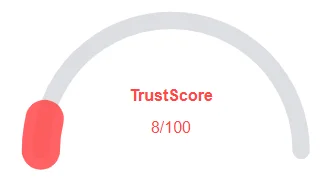

DYOR Tool Reports

- ScamAdviser: Low trust score, recent domain.

- Gridinsoft: Suspicious, potential malware risk.

- VirusTotal: Low reputation score.

- Companies House: Confirms Nexdune Limited (SC845100), but no financial license.

Future Outlook

Nexdune’s MLM model and high ROI claims suggest a 1–2 year lifespan before potential collapse. Regulatory scrutiny in 2025 may target such platforms, limiting operations. Investors risk losing funds if withdrawals are restricted.

Recommendations

- Avoid Investing: High risk of loss due to unsustainable returns.

- Research Thoroughly: Check FCA/SEC registers for licensing.

- Choose Regulated Platforms: Opt for Coinbase, Kraken, or Vanguard.

- Report Fraud: Contact authorities like Action Fraud if affected.

Nexdune Review Conclusion

This Nexdune review highlights significant risks, including unregulated operations, unrealistic returns, and lack of transparency. The platform’s MLM structure and crypto-only payments mirror Ponzi schemes, making it unsuitable for investors. For safer options, explore regulated platforms with modest, realistic returns. Always conduct independent research before investing. You can also read our detailed XUEX Review to see a similar case of high-risk patterns and deceptive ROI claims.

DYOR Disclaimer

This Nexdune review is for informational purposes only and not financial advice. Verify all claims through regulatory sources like the FCA or SEC. Consult a licensed financial advisor and only invest what you can afford to lose.

Nexdune Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Nexdune a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Nexdune or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content is accessible

- Domain ranks in Tranco top 1M

- Uses website security service

Negative Highlights

- Low AI review score

- Recently registered domain

- No archived history

- Whois details are hidden

Frequently Asked Questions About Nexdune Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Nexdune raises concerns due to its lack of transparency, unrealistic ROI claims, and absence of verifiable ownership details.

Risks include potential fund loss, no regulatory oversight, vague compensation plans, and exaggerated profit promises that are not sustainable.

Nexdune claims profits come from digital real estate and cryptocurrency trading, but there is no concrete proof these operations actually take place.

No. Nexdune is not licensed or regulated by any recognized financial body, which is a major red flag for investors.

It’s best to avoid investing in Nexdune due to the multiple red flags and lack of credible information about its operations and management.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.