Ozifu Review: Is This Investment Platform Trustworthy or a Scam?

This Ozifu review examines the platform’s legitimacy, focusing on its compensation plan and ownership details. Launched in June 2025, the platform promises high daily returns through blockchain and forex investments. However, serious red flags suggest it may be a scam. This analysis uses simple language, charts, and data to guide everyday investors. For an in-depth scam analysis, visit Scams Radar for a detailed review of ozifu.com.

Table of Contents

Understanding the Ozifu Opportunity

The platform markets itself as a blockchain infrastructure and forex trading service, offering automated investments with daily returns. It claims to use validator nodes, storage clusters, and AI-driven trading. Yet, its lack of transparency, unsustainable ROI claims, and minimal online presence raise concerns about its credibility.

Ownership and Background Analysis

Ownership details are unclear. A WHOIS lookup shows the domain, registered on June 14, 2025, via Namecheap, uses privacy protection to hide the registrant’s identity. The platform claims Steven Scott founded it, with his son Brandon Scott as the current leader, but no LinkedIn profiles, executive bios, or verifiable company records exist. No regulatory filings with bodies like the SEC, FCA, or ASIC are found, unlike reputable platforms such as Binance or OANDA.

A listed address (4 Cottesmore Gardens, Kensington, London W8 5PR, UK) is unverifiable, suggesting it may be fake. This lack of transparency is a major warning sign for investors.

Ownership Red Flags

- Hidden Registrant: Privacy protection obscures ownership.

- No Regulation: No registration with SEC, FCA, or ASIC.

- Unverified Leadership: Claims of Steven and Brandon Scott lack evidence.

- Recent Domain: Registered in 2025, indicating a short history.

Compensation Plan and ROI Claims

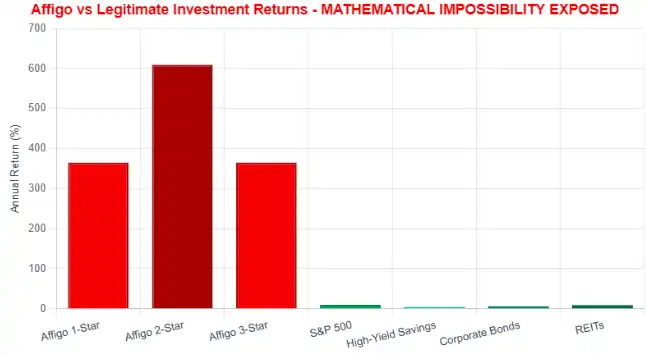

returns upto 1.25% to 2.8% based on investment plans ($50–$100,000) for 150–200 days. It includes referral bonuses (6–9%), binary income (10% on team volume), rank rewards (up to $120,000 for $2.5M team volumes), and gamified “Gem Hunt” bonuses. For example, a $10,000 investment at 2.8% daily yields $280 daily, or $102,200 annually (1,022% ROI).

This structure resembles a Ponzi scheme, relying on new investor funds to pay returns. Legitimate brokers like IG charge fees, not guaranteed profits. The table below compares the platform’s claims to other investments.

Investment Type | Annual ROI | Risk Level |

Ozifu (Claimed) | 456–1,022% | Extreme |

Real Estate | 8–12% | Medium |

Bank Savings | 4–5% | Low |

Crypto Staking (Kraken) | 4–15% | Medium |

ROI Sustainability Analysis

For a $10,000 investment at 2.8% daily ROI over 150 days:

- Daily Profit: $10,000 × 0.028 = $280

- Annual Simple ROI: $280 × 365 = $102,200 (1,022%)

- 150-Day Compounded ROI: $10,000 × (1 + 0.028)^150 ≈ $11.73 million

Such returns are unsustainable. No regulated platform achieves this without extreme risk.

Additional Risk Factors

- High Withdrawal Fees: An 8% fee discourages withdrawals, unlike regulated platforms.

- Crypto-Only Payments: Accepts BTC, ETH, DOGE, TRX, USDT, and Perfect Money, which are hard to trace.

- Low Trust Scores: Gridinsoft rates it 31/100 (“Risky Territory”); no Trustpilot or ScamAdviser listings.

- SSL Issues: SSL certificate verification failures indicate poor security.

- Generic Content: Vague claims about “blockchain infrastructure” lack whitepapers or proof.

Traffic and Public Perception

Traffic data from SimilarWeb shows low volume (1,000–5,000 monthly visits), mainly from Nigeria, India, and the Philippines, common scam targets. The site lacks backlinks or Alexa rankings, unlike Coinbase’s millions of visits. No organic reviews exist on Trustpilot, Reddit, or X, with promotions limited to questionable accounts, suggesting deliberate avoidance of scrutiny.

Security and Technical Performance

The platform uses basic SSL encryption (Let’s Encrypt) and Cloudflare hosting but lacks 2FA, cold storage, or third-party audits, unlike Gemini’s robust security. Slow load times (3–5 seconds) and poor mobile optimization, per GTmetrix, reflect unprofessional development. No API or performance data is available.

Customer Support and Payment Methods

Support is limited to an email (support@ozifu.com) and an unverified phone number (+1 740-201-6555), with no live chat. Crypto-only payments raise concerns, as they avoid chargebacks, unlike platforms offering fiat options. An 8% withdrawal fee, applied on the 1st and 15th of each month, is unusually high.

Social Media and Promotions

Promotional accounts include:

- @OzifuOfficial (X): Created in 2025, low followers, posts generic success stories.

- YouTube (CryptoLifestyle): Promotes the platform alongside flagged sites like BigBang.Money.

- Telegram (Ozifu Profits): Small group with automated posts, no user engagement.

These accounts also endorse dubious platforms like FUEGORISE, a common scam tactic.

DYOR Tool Reports

- Gridinsoft: 31/100 trust score, labeled “Risky Territory.”

- Scamadviser: Not indexed, reflecting low visibility.

- VirusTotal: No malware, but new domain raises caution.

- WHOIS: Confirms 2025 registration with privacy protection.

Recommendations

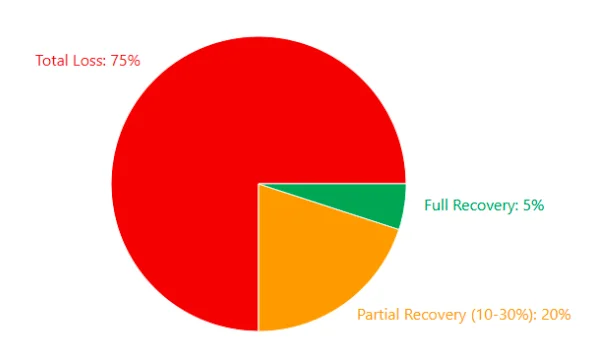

- Avoid Investment: The platform’s red flags indicate a high scam risk.

- Use Regulated Brokers: Opt for platforms like OANDA or Kraken.

- Verify Claims: Check ownership and regulatory status before investing.

- Report Issues: Contact the SEC or CFTC if fraud is suspected.

Ozifu Review Conclusion

This Ozifu review reveals a high-risk platform with unsustainable earnings, hidden ownership, and no regulatory oversight. Investors should avoid it and choose regulated alternatives for secure forex trading. Always verify claims and consult advisors to protect your funds.

For a similar platform analysis, you can check our Affigo Review.

DYOR Disclaimer: This analysis, based on data as of August 6, 2025, is for informational purposes only. Conduct your own research and seek professional advice before investing.

Ozifu Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Ozifu a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Ozifu or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content is accessible.

- Secure website design services.

- No spelling or grammatical errors in the content

Negative Highlights

- Low AI review rate.

- New domain.

- New archive.

- Whois data is hidden.

Frequently Asked Questions About Ozifu Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, Ozifu raises serious concerns about its legitimacy. The platform's unrealistic returns, lack of transparency, and unclear ownership suggest it may be a scam.

Investing in Ozifu is risky due to the platform’s high daily returns that are unsustainable, as well as its suspicious compensation plan and lack of regulation.

Ozifu claims to generate returns through blockchain and forex investments. However, there is no verifiable proof of their trading activities, making these claims questionable.

No, Ozifu is not regulated by any known financial authority. The absence of regulation is a major red flag for potential investors.

It is advisable to avoid investing in Ozifu due to its suspicious claims and lack of transparency. Always conduct thorough research before making any investment.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.