Crypque Review: Is This Crypto Platform Legitimate or Risky?

This Crypque review examines the legitimacy and risks of Crypque, a blockchain and Web3 platform based in India, with claimed operations in the UK and Dubai. We analyze ownership, compensation plans, ROI claims, security measures, and more, using clear data and charts to help beginners assess its potential. For more scam alerts and in-depth investigations into similar platforms, visit Scams Radar.

Table of Contents

What Is Crypque and How Does It Work?

Crypque Private Limited, launched in April 2022, markets itself as a Crypque cryptocurrency platform offering innovative solutions like the Cryp app, Cryp Labs (crypto mutual fund), and Tornado Token. The Cryp app supports crypto payments, UPI, and remittances, aiming to simplify crypto use for daily life. However, vague claims and limited transparency raise concerns.

Ownership and Transparency

Crypque’s leadership includes:

- Sidharth Shukla (CEO): A mechanical engineer with experience at Trade Turtles.

- Ankit Bhasin (COO): 21 years of corporate experience, including 18 years at Genpact as Vice President of Human Resources.

- Abhishek Bhandari and Anshit Bhandari: Limited public background details.

- Yugendra Kumar Sahu and Vikas Yadav: Listed as directors in Indian records.

The company is registered in Delhi, India, but claims offices in Dubai and the UK. No public records verify these international operations. The domain’s WHOIS data is hidden, reducing transparency and accountability.

Red Flags:

- Unverified international presence.

- Hidden domain ownership.

- Limited founder background details.

Compensation Plan and ROI Claims

Crypque promotes high ROI through:

- Cryp Labs: A crypto mutual fund-style investment.

- Tornado Token: Minted on Binance Smart Chain with a 24-year release and 20% burn mechanism.

- Mobicryp: Claims USDT minting, which is implausible as USDT is controlled by Tether.

- Cryp App: Supports crypto-to-fiat conversion, UPI, and merchant payments.

No clear payout structure or whitepaper exists. User reports suggest 0.5–3% daily ROI or 10% monthly returns, implying a multi-level marketing (MLM) model reliant on new deposits.

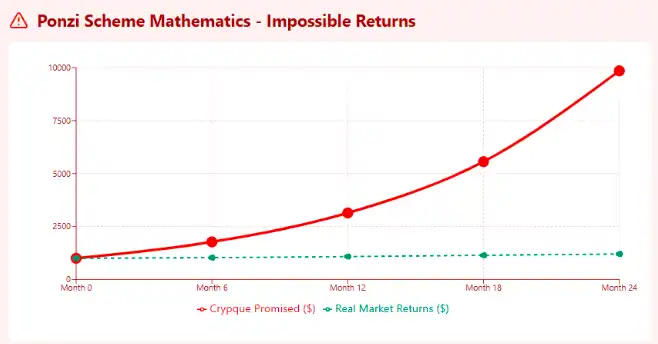

Mathematical Analysis of ROI

Assuming a 10% monthly ROI:

- Formula: A = P(1 + r)^n

- P = $1,000 (initial investment)

- r = 0.10 (monthly rate)

- n = 12 months

- Calculation: A = 1000 * (1.10)^12 ≈ $3,138 after 1 year

- Annualized ROI: 213.8%, far exceeding legitimate investments.

This suggests a Ponzi-like structure, as shown below:

Investment Type | Annual ROI | Risk Level |

Indian Bank FD | 6–8% | Very Low |

Real Estate (India) | 6–12% | Medium |

Crypto Staking (Binance) | 2–12% | High |

Crypque (Assumed) | 120–500% | Very High |

Red Flags:

- Unrealistic ROI promises.

- No audited financials or tokenomics.

- Implausible USDT minting claims.

Traffic and Public Perception

Crypque’s website has a low trust score (0/100 on ScamAdviser) due to hidden ownership and low traffic rank. It claims users in 25+ countries, but no third-party data (e.g., SimilarWeb) confirms this. Reddit users warn of Ponzi-like tactics, labeling Crypque, Mobicryp, and Tornado as scams. LinkedIn (571 followers) and Facebook (~387 likes) show limited engagement, with generic posts lacking product details.

Red Flags:

- Low trust score and traffic.

- Negative Reddit feedback.

- Limited social media engagement.

Security and Technical Performance

The Crypque secure wallet uses basic SSL encryption but lacks advanced security like 2FA or third-party audits. No KYC/AML enforcement is visible, despite claims. The website and Cryp app lack performance metrics or technical documentation.

Red Flags:

- Basic security measures.

- No audit or compliance proof.

- Offshore hosting risks.

Payment Methods and Customer Support

The Crypque crypto payment solution supports UPI, IMPS, P2P, and crypto transactions. However, no details on fees or supported blockchains are provided. Customer support is limited to a contact form and email (admin@crypqueitsolution.com), with user reports of unresponsive withdrawal support.

Red Flags:

- Unclear payment infrastructure.

- Poor customer support response.

Content Authenticity

Crypque’s website uses buzzwords like “coolest crypto tech” and generic visuals. Claims of awards (e.g., Dr. APJ Abdul Kalam Award) lack verification. No blockchain explorers or GitHub repositories support their products.

Red Flags:

- Vague, promotional content.

- Unverified award claims.

Social Media and Promotion

Crypque’s LinkedIn and Facebook pages focus on blockchain trends but lack product specifics. No verified Twitter or Telegram presence exists. Promoters may also push DreamNFTs.com and MineTXC.com, flagged as risky.

Red Flags:

- Generic social media content.

- Association with other high-risk platforms.

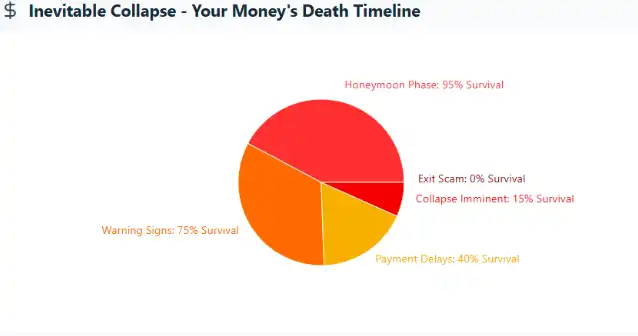

Future Predictions

- Short-Term: Early investors may see payouts, but delays are likely.

- Mid-Term: Regulatory scrutiny in India could force compliance or closure.

- Long-Term: Risk of collapse if reliant on new deposits, similar to Bitconnect.

Recommendations for Investors

- Avoid Investment: Wait for audited financials and regulatory proof.

- Use Regulated Platforms: Choose Binance or Coinbase for safer crypto investments.

- Secure Funds: Use non-custodial wallets for control.

- Research Thoroughly: Check ScamAdviser, Reddit, and regulatory bodies.

DYOR Disclaimer

This Crypque review is for educational purposes, not financial advice. Conduct your own research (DYOR) before investing in the Crypque cryptocurrency platform. Verify claims, consult advisors, and only invest what you can afford to lose. Crypto is volatile and risky.

Crypque review Conclusion

This Crypque review highlights serious concerns about legitimacy. Hidden ownership, unsustainable ROI, low trust scores, and poor transparency suggest a high-risk platform. Compared to bank FDs (6–8%), real estate (6–12%), or crypto staking (2–12%), Crypque’s claims are unrealistic. Investors should avoid Crypque, prioritize regulated platforms, and research thoroughly to protect their funds.

For further insights, check out our EZ777 Game Review to explore similar risks in other platforms.

Crypque Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Crypque shows a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Crypque or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website Content: Accessible and error-free.

- Services: Secure website design.

- Review Rate: High AI ratings.

- Whois Data: Accessible.

Negative Highlights

- Domain: Newly registered.

- Archive: Recently created.

Frequently Asked Questions About Crypque Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Crypque is a blockchain and Web3 platform claiming to offer decentralized services with operations in India, the UK, and Dubai. However, it lacks transparent information about its business model and financial operations.

Crypque’s claims of international operations and high returns lack credible verification. The platform's unclear ownership, absence of regulatory licenses, and unrealistic ROI claims raise significant concerns.

Yes, Crypque promotes high returns, but these claims are unverified and unsustainable, making them a red flag for investors looking for legitimate opportunities.

Currently, there are no independent reviews or third-party feedback available on trusted platforms, which makes it difficult to gauge the platform’s credibility and user satisfaction.

Crypque is flagged on Scams Radar due to its hidden ownership, unverifiable claims, and the potential risks associated with high-return promises, typical of many high-risk platforms.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.